Michael M. Santiago/Getty Images News

The meme stock mania is back, and that too with a triumph. Yesterday (March 28), AMC Entertainment Holdings, Inc. (AMC) stock rallied 45%, while GameStop Corp. (GME) climbed 25% and Hycroft Mining Holding (HYMC) shares gained 81%. It’s too early to predict whether we will see 2021 all over again, but in any case, it would be rational to expect increased volatility in meme stocks in the coming weeks. This brings me to Bed Bath & Beyond Inc. (NASDAQ:BBBY) – a company that I thought was substantially undervalued back in 2018 and a company that I thought investors should run away from in January 2021. As meme stocks make a comeback, I thought it best to evaluate the prospects for Bed Bath & Beyond as the company seems to be forcing changes to remain relevant in the post-pandemic era. After evaluating a few interesting developments and the risks associated with investing in BBBY, I have decided to remain on the sidelines.

Ryan Cohen’s letter

RC Ventures’ Ryan Cohen sent a letter to the board of directors of Bed Bath on March 6, requesting the company to implement much-needed changes to steer the ship in the right direction. The market reacted positively to Ryan Cohen’s involvement with Bed Bath, which does not come as a surprise given his success with Chewy, Inc. (CHWY). Mr. Cohen also serves as the chairman of GameStop’s board of directors, which is probably another major reason for investors to get behind Bed Bath. In his letter, Ryan Cohen highlighted a few important flaws of Bed Bath, and below are some of these that I thought readers would find interesting.

- Bed Bath is continuing to lose market share in the home improvement industry in the United States.

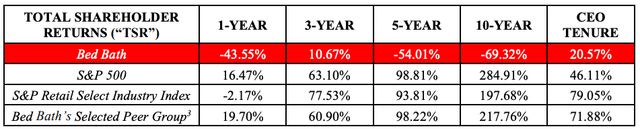

- Bed Bath has delivered lackluster total shareholder returns in both the short and long term (check exhibit 1).

- The executive compensation policy of the company does not seem to be aligned with the size of the company nor its profitability level.

- Bed Bath is struggling to improve sales while its competitors have almost fully recovered to the pre-pandemic level.

Exhibit 1: Total shareholder returns comparison

Ryan Cohen’s letter

As remedies to some of these flaws, Ryan Cohen suggests Bed Bath tie executive compensation to the financial performance of the company and seek to monetize its brands better. The entrepreneur goes on to point out that Bed Bath might need to find an acquirer who could pay a premium to buy the company outright as well.

These suggestions, if accepted, might help Bed Bath change its fortunes gradually in the coming years, but the question is, can the company survive for long?

Multiple risks are looming on the horizon

In case you read my previous articles on Bed Bath, you would know that I booked my profits early last year. Investing in Bed Bath a few years ago seemed a very risky choice, but as a risk-taking investor, I did not mind allocating a small space for Bed Bath in my portfolio given that I believed outsized returns were likely. When investing in a turnaround story, I believe the price is of utmost importance because a lot can still go wrong. I certainly thought the price was not right for me to continue holding on to Bed Bath just over a year ago, and today, I still believe it’s not the right time to get back on board because of a few risks that are looming on the horizon.

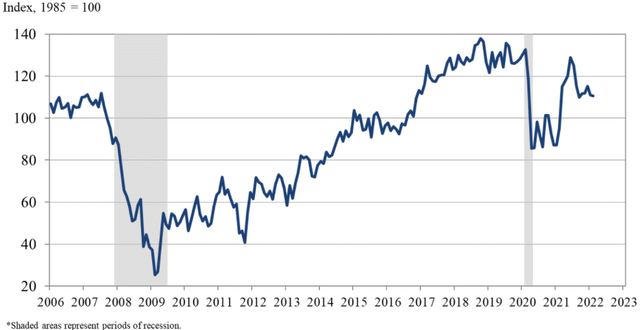

First, U.S. consumer spending might hit a wall in the latter part of this year as fiscal and monetary support fades away, while inflation continues to create headwinds for both businesses and consumers. As illustrated below, consumers are already beginning to be wary of what the future holds, which does not come as a surprise as recession fears have resurfaced.

Exhibit 2: U.S. Consumer Confidence Index

The Conference Board

Bed Bath is battling it out with both brick-and-mortar retailers and e-commerce behemoths such as Amazon.com, Inc. (AMZN) already, and an overall decline in consumer spending will hurt the company’s bottom line as price-based competition is likely to increase if consumer spending declines. This type of competition – which is already a feature of the home improvement market – will tilt the odds in favor of retailers or online-only players with efficient operating models, and Bed Bath is not one.

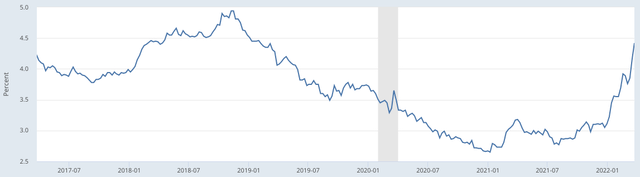

Second, the possibility of a slowdown in demand resulting from a buildup of home inventory. The prospects for the home improvement market are closely tied to spending on new homes and home upgrades. The strength of the property market, on the other hand, is tied to mortgage rates. After sitting on record lows for the better part of the last two years, mortgage rates in the U.S. have begun to ascend, which is not good news for the housing market.

Exhibit 3: 30-year fixed-rate mortgage average in the United States

Federal Reserve

Third, the stock buybacks might come back to haunt Bed Bath in the future. I am a fan of buybacks – make no mistake about that – but not every company is destined to see success with an aggressive buyback strategy. An undervalued company using excess cash to buy back shares after allocating sufficient cash for reinvestment is not the same as a company that is spending much-needed cash to buy back stock while also eyeing a turnaround. Bed Bath, in my opinion, should ideally maintain its liquidity levels at an above-average level until the turnaround is complete, and I would rather see the company invest money in the business before even remotely thinking about shareholder distributions. Using buybacks to purely boost the EPS (I’m not suggesting that this is happening at Bed Bath today) is not a formidable strategy to create long-term shareholder wealth, and companies like General Electric Company (GE), International Business Machines Corporation (IBM), and Citigroup Inc. (C) have spectacularly failed in the past because of poor capital allocation decisions involving ill-timed buybacks.

Takeaway: Avoiding BBBY Stock

Bed Bath & Beyond stock is likely to make headlines in the coming weeks if the meme stock mania continues to gain momentum. After evaluating the risks associated with the company and the possibility of further involvement by Ryan Cohen, I still cannot make a strong case as to why Bed Bath deserves a re-rating in the market. For this reason, I will avoid Bed Bath stock for the time being as I believe the risk-reward profile is not skewed in favor of investors at the moment.

Be the first to comment