Darren415

This article was first released to Systematic Income subscribers and free trials on July 16.

Welcome to another installment of our BDC Market Weekly Review, where we discuss market activity in the Business Development Company (“BDC”) sector from both the bottom-up – highlighting individual news and events – as well as the top-down – providing an overview of the broader market.

We also try to add some historical context as well as relevant themes that look to be driving the market or that investors ought to be mindful of. This update covers the period through the second week of July.

Be sure to check out our other Weeklies – covering the Closed-End Fund (“CEF”) as well as the preferreds/baby bond markets for perspectives across the broader income space. Also, have a look at our primer of the BDC sector, with a focus on how it compares to credit CEFs.

Market Action

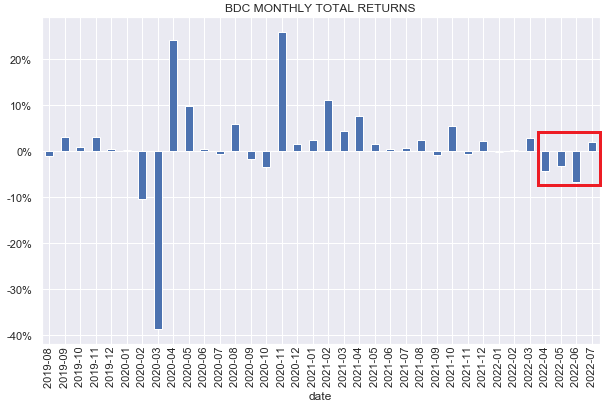

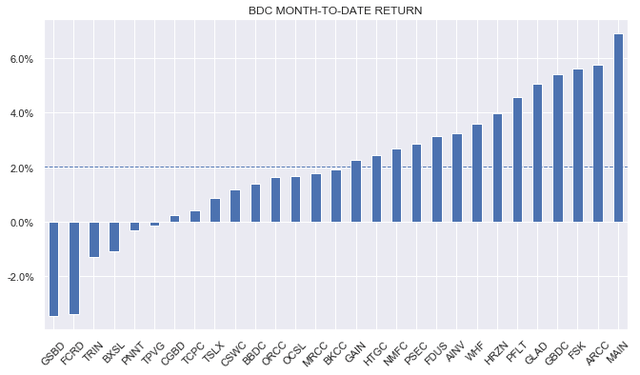

BDCs were down on the week with an average return of around -1.5%. Unlike floating-rate sectors like BDCs, fixed-income sectors outperformed with support from lower Treasury yields while lower stocks were a headwind for higher-beta income sectors.

Overall, BDCs are still up 2% for the month of July – a partial reversal of the steep June drop.

The July rally is a nice break from the previous three down months.

Systematic Income

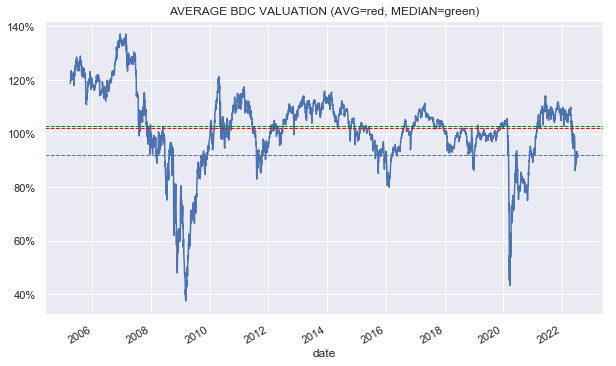

The rally has also pushed sector valuations higher and above a level of 90% based on Q1 NAVs.

Systematic Income

Market Themes

The upcoming Q2 results are highly anticipated by BDC investors given the swift change in both market pricing (impacting both NAVs via credit spreads and income streams via short-term rates) as well as changes in the corporate outlook (impacting loan valuations and changes in non-accruals).

We can get a feel for the upcoming numbers from a couple of different sources. First, as we discussed last week, from a company like the Saratoga Investment Corp (SAR) which reports a month earlier than nearly all other BDCs. SAR had a 2.5% drop in the NAV, an increase in non-accruals from zero to one and an associated increase in “underperforming” debt positions to 5% from 1.5%.

And second, it is common for BDCs to release preliminary and partial results ahead of full Q2 numbers. We got two snippets of information from BDCs that will be reporting full results in a couple of weeks.

Horizon Technology Finance Corporation (HRZN) published a portfolio update saying they funded $137m of new loans and received $57m of prepayments. Both numbers are on the higher end of the recent past. If there is carry over for the broader sector it suggests that prepayment income may end up being relatively strong. We don’t know at what yields the new loans were originated but as yields have risen, it could also marginally add to overall sector income levels, even outside of what’s happening to short-term rates.

Golub BDC (GBDC) had a press release where they said they originated $450m of new commitments. This is interesting, however, it doesn’t really tell us their net lending since we’d also need to know the amount of exits. All we can say is that the level of commitments in Q2 was not small – the Q1 number was $323m. Since Q2 was a bit messy we would expect the spread on the new loans to be quite a bit higher which is good for income. We would also expect exits to be relatively muted – the Q1 number was $120m since fewer companies would be keen to repay the loan in the current environment of lower liquidity and higher spreads. GBDC also said that the fair-value of investments rose by 3.5%. That sounds good however it doesn’t tell us what happened to the NAV. In Q1 the total FV of investments rose by 5% but the NAV only rose by 0.5%. It’s good that this number hasn’t collapsed, however, we’ll have to wait for the earnings release to know more.

Market Commentary

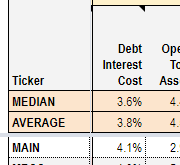

BDC MAIN got an investment-grade rating (BBB-) from Fitch. This may help it lower its funding costs going forward which are above average in the sector, particularly on its credit facility and unsecured debt though we wouldn’t expect big savings. Nearly 30% of its portfolio is in equity / warrants which is miles higher than the 6% median in the sector. You don’t see a lot of investment-grade ratings for BDCs with high equity allocation so this move by Fitch is surprising.

Systematic Income BDC Tool

Stance & Takeaways

Upcoming BDC earnings will be the next big potential driver of volatility in the sector. The key question will be whether valuations have adjusted not just for the likely portfolio deterioration in Q2 (which is likely to be modest) but through the likely recession over the coming quarters as well. Because the next recession, if it comes, is likely to be more prolonged due to inflation constraining the Fed’s hand in monetary policy stimulus, discounts to NAV will likely remain on the wider side of their historical average – a level which is, arguably, closer to fair-value than the optics imply. For this reason, we have not been swapping more into BDC positions during the recent stabilization in valuations but will consider adding to resilient companies on further falls, particularly, if they are technical, rather than fundamental, in nature.

Be the first to comment