Liudmila Chernetska/iStock via Getty Images

The Thesis

Many tout BCE (NYSE:BCE) for its oligopoly position in Canadian telecom, along with its enormous dividends. But, if you look under the surface, you’ll find deteriorating trends. We believe investors should revisit their thesis with an open mind, and we’ll outline why. In the decade ahead, we project returns of 1% per annum.

Secular Decline

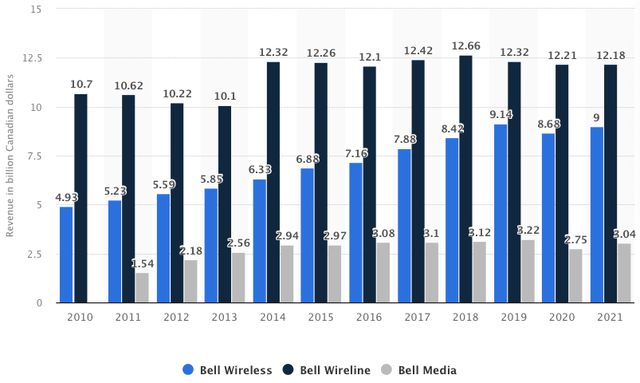

BCE makes its money from three big segments: Wireless, wireline, and media:

Bell’s Operating Revenue By Segment (Statista)

BCE’s involved in a number of businesses that are already in or near secular decline, such as land-line telephone, cable TV, and radio. As you can see above, this is affecting the company’s growth. Meanwhile, SpaceX’s Starlink is aiming to provide constellation satellite internet across the globe and has already expanded into Canada.

Once a near monopoly, BCE’s power is dwindling as Smart TVs change the landscape. The company has several media assets that now have to compete on third-party platforms like Roku (ROKU) and Apple TV (AAPL).

Bell’s Media Assets (Annual Report)

Although BCE owns great television assets, there’s no question the company was better positioned in the early 2000s. Since then, growth has stagnated and even declined in some segments. Even assets like Crave and iHeart Radio are subject to immense competition from applications like Netflix (NFLX), Spotify (SPOT), YouTube (GOOG) (GOOGL), Disney+ (DIS), and Amazon Prime Video (AMZN).

Then you have Meta’s (META) Messenger and WhatsApp, allowing us to receive instant text, calls, and video anywhere there’s an internet connection.

To remain relevant, many telecom companies are now pushing 5G technology. But is 5G internet really worth it? BCE is investing billions of dollars into this infrastructure, which is coming out of investors’ pockets. Nobody knows how long 5G will be relevant for.

A Look Under The Surface

Yes, BCE pays a huge dividend and has done so consistently. But, under the surface, there are serious issues.

The Dividend Cut

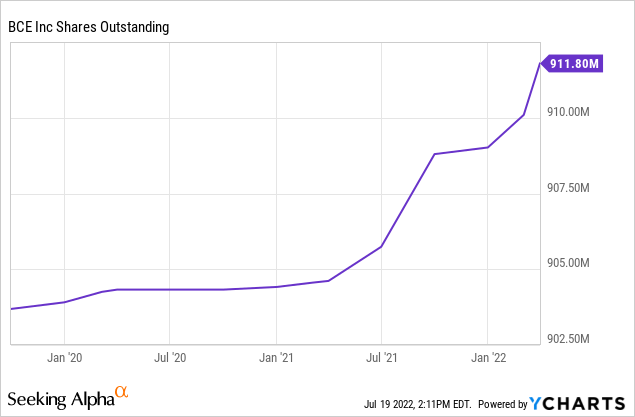

BCE is diluting shareholders, perhaps because it cannot afford to stay competitive and to pay an enormous dividend at the same time. Like we said, 5G is expensive. Over the past 12 months, BCE paid out 378% of its free cash flow and 112% of its net income as a dividend. It goes without saying that this is extremely unhealthy and comes with enormous risk of a dividend cut.

Diluting Shareholders

BCE’s Shares Outstanding:

Swimming In Debt

Meanwhile, BCE has racked up $24 billion USD of long-term debt and capital leases, which is 10x its net income. The company constantly carries a negative working capital. If BCE spirals into higher and higher debt as its core businesses decline, things could get ugly, especially as interest rates climb higher.

The Valuation

Bell’s EPS (Macrotrends)

BCE’s earnings have been in decline for a decade now, but the stock has been propped up on the back of low interest rates and limited investment alternatives for Canadians. At 3x book, with a forward P/E of 19, the stock is by no means cheap. In fact, it trades at a similar forward P/E to Google, a far superior business in nearly every regard.

All figures are in USD:

BCE is projected to earn $2.92 per share in 2024, barely enough to cover its dividend of $2.81 per share. We think a dividend cut is likely. BCE has said it wants a payout ratio of 65 to 75 percent of free cash flow. A $2.00 dividend is our base-case scenario, implying a 4% yield.

BCE’s earnings will fluctuate over time, but its pricing power is likely to be offset by secular decline in its other businesses. The company has tremendous debt and little capital to defend against technological change.

Our 2032 price target is $33 per share, implying a return of 1% per annum with dividends reinvested.

- We believe BCE’s earnings will plateau around $3.00 per share as it struggles to replace declining revenue streams and pay down debt. We’ve applied a terminal multiple of 11, which may seem low, but is still a premium to where Verizon (VZ) and AT&T (T) trade at the moment.

Risks To The Thesis

BCE has pricing power in its wireless service, as Canadians pay some of the highest mobile plan prices in the world. If Rogers (RCI) can successfully merge with Shaw (SJR), wireline consumers could get squeezed. 5G has not yet matured and could improve BCE’s financial position. If the oligopoly can weather the technological change that comes with Smart TVs, streaming, and Starlink’s satellite internet, it will benefit from inflation and pricing power. Any long-term growth would be a boon for BCE’s terminal multiple.

Conclusion

Given the financial and technological deterioration outlined above, we believe our “get out now” recommendation is warranted. Even with dividends reinvested, BCE could face a lost decade. The world is constantly changing. With competition from Roku, Apple, Netflix, Spotify, YouTube, Disney, Amazon, Meta, and SpaceX’s Starlink, BCE’s once powerful position is dwindling. If you look beyond the dividend, you’ll find enormous debts and share dilution. We hope this contrary analysis will be beneficial in navigating an uncertain future.

For investors looking to keep a telecom holding, we recommend Verizon. For more on this, check out my article:

Be the first to comment