bjdlzx

Baytex Energy (OTCPK:BTEGF) has spent years repairing its debt laden balance sheet. The CEO who nearly completed the task, Ed LaFehr, will retire. The new CEO Eric Greager will need to show some continuity of the policies that brought this company back from a zombie status due to all the debt. That appears to be the way that things will at least begin. Long term, the debt ratio needs to remain conservative so that the debt levels never become so threatening again in a downturn as was the case in the past.

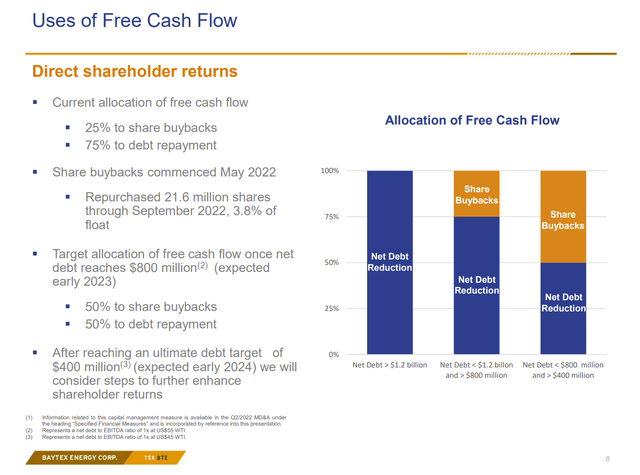

Baytex Energy Use Of Free Cash Flow (Baytex Energy October 2022, Investor Presentation)

Management is at the point where share buybacks have started in addition to debt repayments. The earnings report due in a few days will indicate how close the debt levels are to the next step in the diagram. Management wisely based the forecast upon debt levels because selling prices are so volatile that it is hard to forecast free cash flow for a timeline rather than debt level progress.

Growth

But the increasing flexibility allowed by lower debt levels has allowed various sorts of growth to creep into the future despite an initial guidance of maintenance.

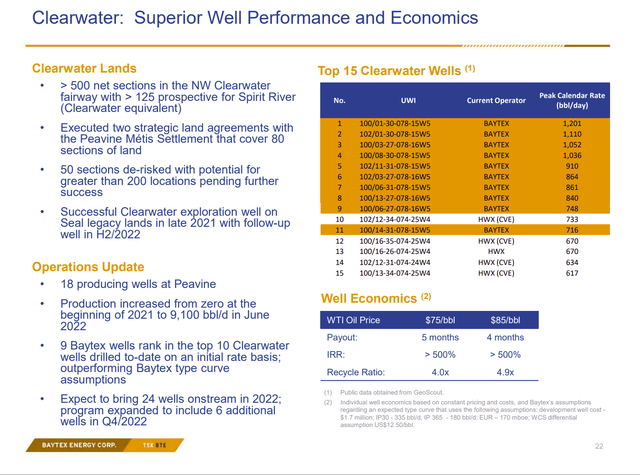

Baytex Energy Presentation Of Clearwater Play Advantages (Baytex Energy October 2022, Corporate Presentation)

The biggest source of profit growth in the near term will be the Clearwater Play. The returns listed above are the highest of all the basins in which the company operates. The only challenge is that heavy oil is a discounted product. Therefore, during periods of weak commodity prices, the discount can and usually does widen to the detriment of heavy oil producers.

The Clearwater Play has unusually low breakeven points. So, wells in this play should still cash flow during a cyclical downturn. However, there are times when heavy oil wells on legacy properties were shut-in until prices improved significantly so that the wells generated positive cash flow. Therefore, there will likely be both a lender demand and a shareholder demand to balance the heavy oil production with lighter oil production to assure a minimal amount of cash flow during a downturn.

But in the current environment, this project is the most profitable with the fastest paybacks. Replacing legacy cash flow with cash flow from these wells is likely to improve company profitability materially while lowering the corporate breakeven.

Lowering the corporate breakeven means more free cash flow at lower commodity prices than was the case in the past. There were years when the material amount of cash flow came from the Eagle Ford (before the Viking came to the company). Management now has the Viking, the Eagle Ford, and potentially Clearwater to assure cash flow during times of weak pricing. That assures a more comfortable passage during times of hostile industry conditions.

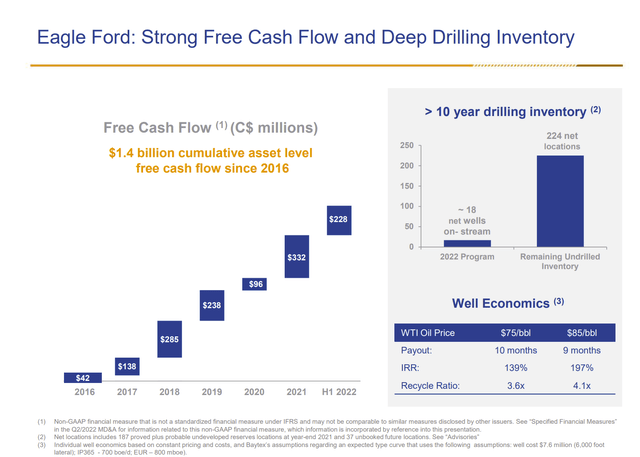

Baytex Summary Of Eagle Ford Characteristics And Cash Flow History (Baytex Energy October 2022, Corporate Presentation)

The Eagle Ford is not as profitable as heavy oil during times of robust commodity prices. But the light oil produced is a premium product with firmer pricing during commodity downturns. A reasonable cash flow from this acreage is assured during times of weak commodity prices due to the low breakeven point combined with better pricing for light oil.

This project has long been a material part of the company cash flow for some time. The Eagle Ford project generally has first call on capital dollars due to the relatively strong economics during commodity price weakness. These wells are not managed by the company. So, lease development is not in the control of management.

Other Projects

The company has operations in the Viking in Canada. This light oil project also cash flows relatively strongly during commodity price downturns. The breakeven point is a bit higher than the Eagle Ford, so the company often stops development during downturns. But the oil production continues to produce cash flow. Like the Eagle Ford the contribution to cash flow is material due to the stronger pricing of light oil products.

Legacy heavy oil projects are probably close to maintenance levels because the clearwater area has a big cost advantage. Currently the legacy projects produce quite a bit of cash flow. But Clearwater will rapidly overtake the cash flow of these projects. Because technology keeps advancing, most companies keep legacy acreage like this because a technology advance can make different acreage more profitable in the future. But for the time being, Clearwater development will be a relatively high priority over legacy heavy oil acreage.

The Future

The budget has been slightly modified over time to account for some strong operating results.

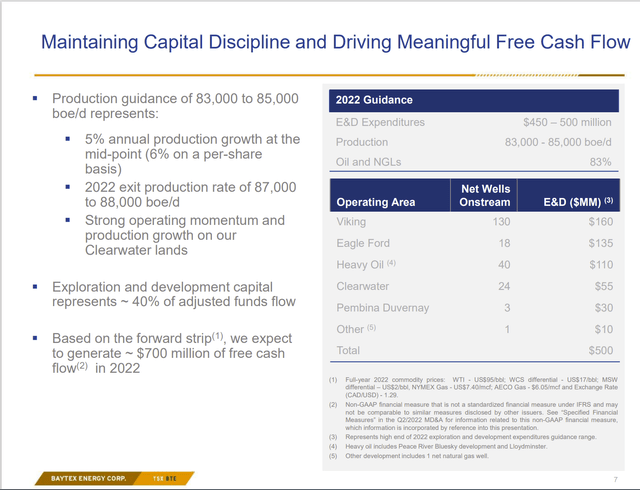

Baytex Energy Latest Budget Guidance (Baytex Energy October 2022, Corporate Presentation)

The company has upgraded the production from maintenance levels to a little bit of growth. Commodity prices have been so robust that management made unexpected progress in decreasing debt levels. That has allowed some budget flexibility and production growth to creep into the budget. Profit growth was already there the minute the Clearwater play become viable because Clearwater improves the profitability of the production as it gains in the production mix.

Generally, the Viking light oil projected is managed for cash flow. Growth of that production is not usually a high priority. The Eagle Ford production development is at the mercy of the operator. The Pembina Duvernay play is a light oil discovery that management is working on optimizing before developing. Development of the Pembina Duvernay is probably a few years away at least.

That leaves heavy oil. Heavy oil is the most profitable now. But profits are also the most volatile. The growth of the Clearwater play will be the priority. But the play is relatively new. So orderly development is called (as management started at zero basically). The remaining heavy oil money goes to legacy plays as they are profitable right now with generally fast paybacks.

Summary

Baytex has a new CEO that must assure the market that continuity will be a priority. He actually has some big shoes to fill because this company is in far better shape now than when his predecessor took over. Not many CEOs can accomplish that.

On the other hand, the Clearwater play offers a chance for significant profit improvements at various price levels along with some heavy oil cash flow during commodity price downturns. Therefore, it will be interesting to see what type of production balance is chosen by management.

The company has issued guidance to pay debt down to very low levels. That is probably very wise given the presence of a lot of heavy oil production. But for the first time in a long time, growth (profits and production) is in the future of the company. That is good news for the stock price going forward.

Be the first to comment