jetcityimage/iStock Editorial via Getty Images

Investment Thesis

Bath & Body Works (NYSE:BBWI) is a strong company trading at a heavily discounted valuation. Despite short term profit headwinds, the business is consistently growing its top line year over year. I believe that the business’s strong margins, brand loyalty and pricing power give it an edge in the long term.

Much of the retail sector has taken a hit due to macro factors, but I don’t believe Bath & Body Works is as vulnerable to inflation and supply chain risks as its valuation would imply. For these reasons, I’m extremely bullish on this company after the recent pullback.

Vertical Integration

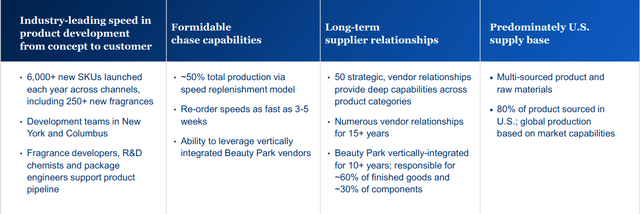

I believe the core competitive advantage of Bath & Body Works is its vertically integrated supply chain. The company has full control over its products and its products’ distribution. It sells its products through company owned stores, franchises, and digital channels. 85 percent of the company’s supply chain is located in North America. Most of its distribution is located in Columbus, Ohio.

We’re in an environment where global supply chain issues have been a consistent problem for many retailers. Bath & Body Works has mostly avoided them due to its decreased dependence on foreign suppliers and international shipping. Additionally, this streamlined production model allows the company to quickly react to sudden changes in the supply situation. This brings product turnaround time down to just a few weeks rather than a few months.

Rapid Iteration

A well designed supply chain lets Bath & Body Works rapidly iterate on its products. The business tests everything it does, from product launches to loyalty programs to store layouts. A good example of this is on the company’s latest earnings call. Management was able to present specific data for its ‘buy online, pick up in store’ service and its loyalty program, even before these programs were widely rolled out.

Examples of iteration this supply chain enables (Bath & Body Works Investor Handout)

New products are launched every four to six weeks, allowing the business to keep up with trends and gather information about its customers. This generates valuable data the company can leverage to consistently drive revenue increases to its business.

I believe this also increases the company’s operating efficiency. If all major projects are first tested out on a small scale, the company will be much less likely to waste money on bad ideas and failed products. Most retailers do this type of A/B testing on at least a limited scale, but I’m very impressed by how streamlined this company’s process is.

Great Financial Profile

Bath & Body Works has a very strong financial profile, especially for the retail industry. The company has consistently showed extremely strong margins. Gross margins are consistently just shy of 50%, even through the worst of the pandemic. EBIT margin is also high, coming in at an average of just over 25% for the past two years.

Even with the company’s increased resiliency to supply chain issues, I believe inflation and increased input costs will put some pressure on these margins in the short term. On its Q4 2021 earnings call, management noted that they benefited from decreased marketing spend during the pandemic, and that they expect this to normalize over the coming year. This may create a slight pressure on the margins the company has enjoyed for the past two years. Nevertheless the business still targets a long term EBIT margin in the low to mid twenties, which is great for this type of business.

Strong Conversion and Brand Loyalty

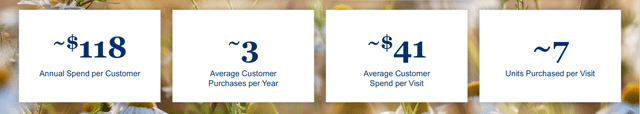

I consider the company’s strong brand loyalty another major strength. As reported on their last 10-K, their total customer base is around 60 million people. Retention rates for these customers are very high (at over 60%). According to their latest investor handout each customer visits an average of three times per year.

Bath & Body Works customer profile (Bath & Body Works Investor Handout)

The business is capitalizing on opportunities to further increase this already strong repeat business. During the summer it is rolling out a new customer loyalty program. This works on a points-based system where customers are rewarded for spending money. Early trials have showed an even further increase in customer retention rates, boosting retention to above 80%.

This also allows the company to collect more data on its customers’ spending habits. The extra data allows them to iterate faster, target products more effectively, and get more customers into its stores. This generates both more revenue and more data, and the process can be repeated.

Risks

On paper Bath & Body Works looks like an exceptionally strong performer. Yet it trades at a very low valuation, even among its peers. I think the main reason for this is the types of products the company sells. Fragrances, body care, and soaps are typically seen as discretionary purchases. This means that they’re easier to cut from household budgets if we fall into a recession.

But I think this is underestimating the strength of the core business. As I mentioned, the brand has very high customer loyalty and repeat business. Its primary products are lower cost consumables. I think these are less vulnerable than large one-time purchases during an economic pullback. Management hasn’t indicated that they’re seeing signs of a slowdown happening, although I’ll be watching their next investor meeting for updates.

An additional concern I’ve seen is that part of the company’s growth has been disproportionately due to sales of hand sanitizer. I don’t really see this as a factor. The business doesn’t break out its sanitizer sales directly, but I found one data point in the company’s most recent investor handout.

Product segment breakdown (Bath & Body Works Investor Handout)

According to this chart sanitizer sales make up at most 15% of the business’s revenue (and likely much less). This indicates to me that the company’s growth was much more broad. Even if a decline in this segment creates a slight headwind in the short term, I don’t see it as a major factor impacting the company’s long term growth.

Navigating Inflation Effectively

The key operating concern for companies in the current retail environment is inflation. Management most directly addressed this on their last earnings call. They guided for $225 million to $250 million in increased costs due to inflation. They further specified that about 50% of this is connected to input costs and 40% is connected to transportation.

Related to these headwinds, the company reduced its EPS guidance from a midpoint of $4.50 to $4.00. This is a significant decrease, but what I’m watching right now is the top line guidance. Management reiterated its revenue guidance calling for a slight increase in 2022. As the inflationary environment normalizes I believe the company’s profit margins will bounce back. There isn’t any reason to believe that these headwinds will last for more than a year or two.

Valuation

There are clearly some risks that could justify this business trading at a discount, but the valuation of this company is extremely cheap. I believe it has been oversold, trading downwards in sympathy with a broader group of retailers. But I think the business’s robust supply chain means it is not at as high of a risk as these other companies. While the company has reduced its earnings guidance it has kept its stable revenue guidance.

From a quantitative perspective, I see that the return on invested capital for this company is over 20%. Keep in mind, this is a company that is consistently growing its top line and making EBIT margins over 20%. I consider any company with this profile trading at an TTM EV/EBITDA of under 6 as a steal.

Final Verdict

I believe Bath & Body Works is a great company trading at a heavily discounted valuation. There is an elevated risk profile here, and if you have a lower risk tolerance I recommend waiting for some more clarity on the continuing product demand and the effects inflation is having on the company. More details should be provided at the company’s upcoming investor meeting and on their second quarter earnings call.

Overall, I don’t think short-term headwinds overshadow Bath & Body Works’ long-term upside. For investors willing to take on some risk, I think this is a great buying opportunity.

Be the first to comment