Brett_Hondow

Bath & Body Works (NYSE:BBWI) is one of the world’s leading companies specializing in body and home fragrance. BBW is one of the companies experiencing some boosts from the stay-at-home setup during the pandemic where, according to management, they experienced some growth in their customer base during the pandemic, increasing to ~60 million customers, up from ~53 million in 2019. However, the story is changing as a result of declining foot traffic and uncertainties from a high inflationary environment.

As the economy recovers from the pandemic, consumers continue to face rising prices for everything, affecting BBWI’s overall demand. Due to inflationary pressures, management ended its Q2 2022 with a disappointing top line outlook. This may ignite negative sentiment in an already bearish market, making BBWI a bit risky at today’s level.

Q2 2022 Overview

After the completion of its Victoria’s Secret & Co. (NYSE:VSCO) spinoff last Q4 2021, BBWI struggles to control their operating margins. Looking forward with its top line performance this Q2 2022, BBWI generated a total revenue amounting to $1,618 million, down 5.05% from $1,704 million in Q2 2021, due to declining store foot traffic according to the management.

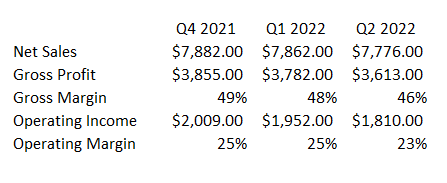

Looking at its trailing performance excluding Victoria’s Secret business as shown in the image below, it is visible how BBWI underperformed its past performance.

BBWI’s Continuing Operation Quarterly Trend (Source: Company Filings, Prepared by InvestOhTrader, Amounts are in millions )

The company’s TTM revenue has consistently been declining for the past two quarters. BBWI’s trailing total revenue of $7,776 million is down from $7,882 million in the fourth quarter of 2021. On top of its slowing foot traffic, BBWI is dealing with inflated input costs, which snowballed into its declining gross and operating margins, as shown in the image above.

Trimmed Outlook

Despite these positive catalysts, management reported a lower top line, down in the mid- to high-single digits from the $7,882 million reported in FY2021. Its continuing earnings per share outlook is also a bit disappointing, as it is expected to be around $2.70 and $3 or $2.85 on average in FY2022, down from the $3.94 recorded in FY2021, and down from the $3.07 recorded in FY2020.

According to the management, they accounted for an additional cost of $230 million to $240 million due to inflationary pressures in their outlook. Upon further investigation, this estimate is way higher than what they expect in Q4 2021, which amounts to $150 to $175 million only. With oil prices going up and OPEC+’s decision to reduce oil production putting more pressure on BBWI’s margin and its customers’ wallets, this stock looks risky in today’s high inflationary climate.

Overvalued BBWI

Looking at BBWI’s P/S ratio and leaving out its Victoria’s Secret business, the company seems to be overvalued right now, implying a decent 20% decline. As of this writing, BBWI is currently trading at a trailing P/S ratio of 1.19x, higher than its 3-year average of 0.92x (0.8x in FY2021, 0.8x in FY2020, and 1.15x in FY2019), and higher than its 2019 figure, where the company is just trading around ~$19 way back in 2019.

On the brighter side

Looking on the bright side, BBWI is actually increasing its scale, as evidenced by their growing company-operated stores of 1,773 stores, up from 1,755 in Q4 2021, and this may improve further as management plans to open and remodel new stores, as well as invest in technology and the supply chain, with a $400 million CAPEX budget for FY2022. Additionally, its current CAPEX budget will outgrow its FY2021 ($270 million) and FY2020 ($228 million) figures, which makes the company more interesting.

BBWI has an improving product pipeline, to name a few, with its men’s fragrance and deodorant products, where the management sees an $8 billion addressable market. Additionally, BBWI, as part of their cost reduction strategy, which eliminated 130 roles, as quoted below, and expects a savings of $30 million in the second half of FY2022.

We are committed to becoming a truly omni and customer-focused company. As part of these efforts, we are eliminating 130 roles from the organization. Some of those are open headcount, which we will not fill and some will be a reduction in force, primarily of leadership position.

…By shifting areas of responsibility and changing how our teams work together across the company, we will be operating like the truly global omni-brand that we are. Source: Q2 2022 Earnings Call Transcript

With a growing store count and a catalyst about the improvement in inflation pressures, consumers’ budgets may loosen up in order to splurge on the upcoming holiday, which may change the trajectory of the company’s top line. Hence, this temporary weakness can provide a potential opportunity to get BBWI at a better price.

Priced Bumps At Its Potential Resistance

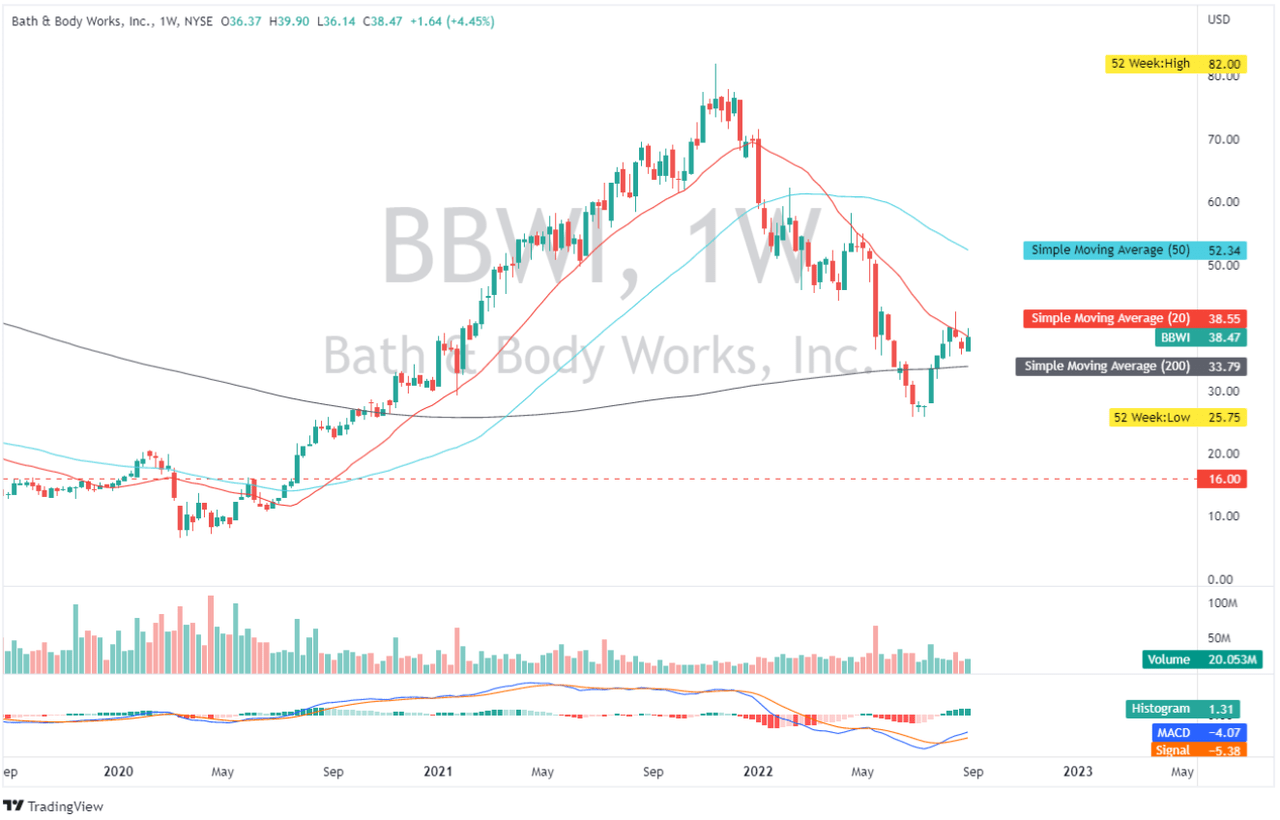

BBWI: Weekly Chart (Source: TradingView.com)

Looking at its weekly chart, BBWI seems to struggle when challenging its ~$40 level. Its 20-day simple moving average acts as another layer of resistance to monitor. If bearish pressure persists, BBWI may retest its ~$25 level before falling to ~$16, where a gap was created in July 2020.

Looking at its MACD indicator, a potential crossover in the next trading weeks may imply a bearish move to monitor. Currently, the stock is heavily shorted with 7.24% short interest, and 5.1 million shares available to be shorted at a 0.25% borrowing cost.

Final Key Takeaways

Another interesting catalyst, BBWI, has been successful in bringing down its total shares outstanding to 228 million, their all-time low. Thanks to its massive share buyback catalyst last February 2021, the company bought back $1 billion of its shares, and as of this writing, it has $188 million left of the $1.5 billion initial share repurchase authorization. Due to this massive repurchase and debt repayments, their cash and cash equivalent totaled $452 million this quarter, their lowest record. This snowballed to its declining current ratio of 1.39x, down from 2.33x recorded in FY2021. On the bright side, BBWI has no material debt obligation due for the next two fiscal years, and with its pressured operation declining in the mid-to-high single digits, it may be able to maintain its dividend payment and fund its $400 million CAPEX budget in FY2022.

To sum it up, I believe BBWI is still risky despite its improving dividend and share buyback catalyst. BBWI is trading at a premium on both a fundamental and technical perspective, making this stock a good short play.

Be the first to comment