artisteer

The price of gold shot up 4% over the past week following the Bank of England’s decision to “temporarily” restart quantitative easing. Gold has had a challenging year as rising real interest rates in the US, and falling foreign currency values, have weighed on the monetary value of gold. In my view, the “monetary value” of gold is a crucial concept today as fluctuations in gold’s price largely reflect changes in the value of money and not changes in gold’s supply-demand situation.

The recent decision by the BoE to abruptly restart fiat money creation has sent an overwhelming signal to the world: global central banks have little interest in protecting the value of fiat currency. Central banks, including the Federal Reserve, undoubtedly seek to lower inflation by raising interest rates. However, the Bank of England and the Bank of Japan’s recent decisions indicate the effort to tame inflation ends when financial market volatility rises, not necessarily when inflation is low. In my view, this situation could lead to a rapid decline in the value of many fiat currencies – particularly those countries with large and growing trade deficits. While the relative value of the US dollar is strong compared to other currencies, I believe it may soon peak, potentially causing gold’s price to rise dramatically.

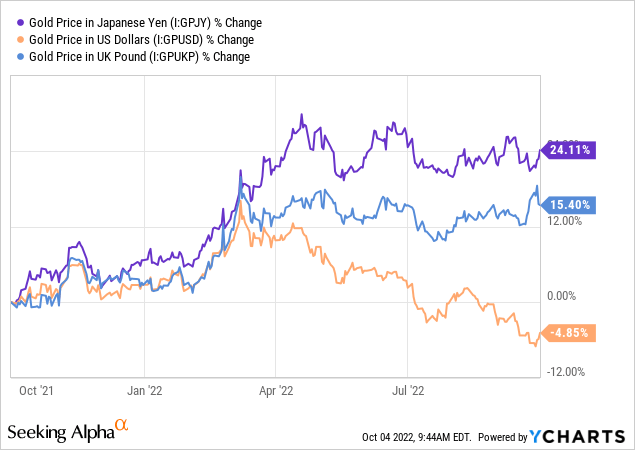

The price of gold in Japanese Yen and British Pounds is near an all-time high. Gold has maintained its value in much of the world but has declined primarily in the US due to FX market strength. See below:

In most of the world, gold investors have gained in 2022 as central banks’ unwillingness to pursue protective measures has led to record currency devaluation. The relative value of the British Pound and Japanese Yen are at the lowest levels in decades, while the Euro is at an over two-decade low. The United States is one of the few countries where the central bank is working to defend fiat currency; however, US rates remain well below the YoY inflation rate. In my view, as financial markets experience greater volatility, the Federal Reserve is likely to supply some level of QE to decrease turbulence. Given unemployment remains low and the US yield curve is extremely flat, I doubt we will see QE on the same level as in the 2020s anytime soon. However, I suspect the trend will begin to shift more favorably to gold, potentially leading to a giant upward swing.

Gold ETFs such as (GLD) offer a liquid means of gaining exposure to gold. However, GLD may struggle with counterparty risks in the case of a significant swing led by a rapid decline in fiat currency value. The fund “owns” physical gold legally, but there is far more “gold under contract” than physical gold in vault storage. This factor has led to a growing de-coupling between physical gold prices and the gold’s future market price. In this precarious situation, investors may be wise to look toward large and liquid gold miners such as Barrick Gold (NYSE:GOLD) as an indirect way to own physical gold. Barrick Gold also offers investors some leveraged exposure to the price of gold and, based on my assessment, is likely undervalued as its focuses on growing its dividend yield.

The Exchange Rate Case For Gold

In my view, the price of gold fluctuates primarily with the value of money. In fact, I believe gold is potentially the most simple asset in the world as its price has a robust inverse correlation to real interest rates. The fair value of gold could decline if the supply grows very quickly, but this risk is shallow, considering gold’s above-ground stock is many magnitudes larger than its annual production.

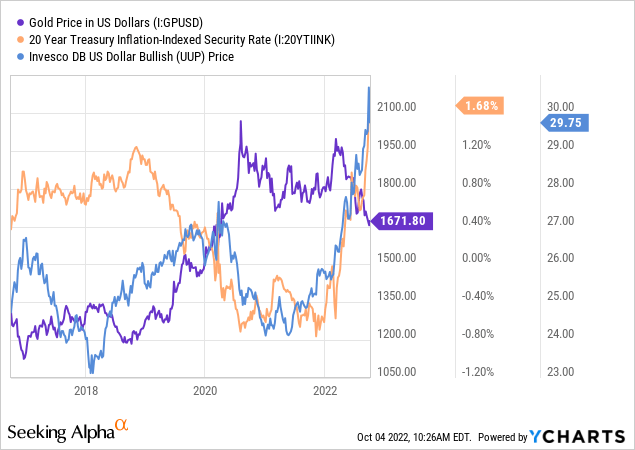

Real interest rates are interest rates after expected inflation. Since gold is expected to deliver a “real return” of zero, its monetary value fluctuates closely with inflation-indexed Treasury bonds (or inflation-protected bonds of virtually any currency). Exchange rates usually depend on the difference between real interest rates in countries. Since the central banks of most large economies have been slow to pursue hawkish monetary policies, US real interest rates are generally well-above foreign counterparts. As you can see below, this situation has led to a devaluation in gold:

The current 20-year US inflation-indexed interest rate is around 1.7%, while the five-year inflation-indexed rate is ~1.9%. Both are roughly decade-highs as real interest rates were generally below 1% during most of the 2010s but were over 2% for much of the 2000s. High real interest rates help to lower inflation and protect exchange rates, but if they’re too high, they can spur illiquidity in financial markets and worsen an economic recession. Today, US real interest rates are very high, given the negative GDP growth trend.

If either the Federal Reserve pursues a less hawkish tone or inflation surprises to the upside (without the Fed becoming more hawkish), real interest rates will likely decline. Today it may seem unlikely for the Federal Reserve to change its stance. Still, it may be necessary given the accelerating declines of most fiat currencies compared to the US dollar. The US dollar is essentially the strongest it has ever been compared to other fiat currencies. Some currency strength is good to help lower inflation, but at the dollar’s current level, it may spur a crisis in international FX derivatives markets. Indeed, this situation may already have begun as the rising “FRA-OIS” spread indicates a growing strain in global lending markets.

In my view, the case for gold does not depend on a “Fed pivot.” While a dovish shift is possible, it seems more likely that foreign central banks will begin to raise rates at a faster pace to combat runaway inflation. The UK currently has a PPI inflation rate of 17%, while Germany’s is a staggering 45%. With the US dollar rising against the Pound and Euro, more international goods are likely to flow into the US instead of Europe – worsening inflation in those regions unless protective efforts are made. In the short-run, the BoE’s decision to provide liquidity to its sovereign debt market may stop the liquidity crisis. Still, eventually, it will likely worsen the country’s inflation dynamic (through money supply expansion). As such, I expect gold to rise to 2021 levels or higher over the coming six months as global central banks seek to avoid further exchange rate collapse.

What Is Barrick Gold Worth?

Barrick Gold is the second largest gold miner in the world, with a $28B market capitalization. GOLD is highly liquid and has a “beta” to the price of gold of roughly 1.7X (measured using the “correlation method”). This means GOLD is expected to rise 1.7% for every 1% rise in the price of gold and vice versa. Of course, its relationship to gold will shift depending on the price of gold as earnings changes are more significant the lower gold is compared to its mining cost.

Barrick’s all-in-sustaining operating cost “AISC” for gold is ~$1,212 per oz. The company has mines in the US, Canada, South America, and Africa. As such, it has a slight hedge against the US dollar since its operating costs (in foreign currencies) decline in US dollar terms as the money strengthens. In other words, its “AISC” will tend to correlate to US dollar exchange rates inversely. Barrick has recently faced a rise in production costs due to higher energy prices and labor costs; however, I expect that trend to be offset by the dollar’s strength.

Barrick’s mid-range production target for gold is 4.4 million ounces. Its target for copper is 445 million pounds at an AISC of ~$2.85/lbs. With gold at $1724/oz, Barrick will likely generate around $512 in EBIT profits per ounce (using Q2 AISC) or ~$2.52B annually. With copper at $3.5/lbs, Barrick’s EBIT per pound is likely around $0.65, giving us a $290M EBIT estimate from copper. Combining the two, we estimate an expected forward EBIT of roughly $2.81B. The company’s effective tax rate is approximately 30%, and its TTM interest expense is $335M. Assuming these levels stay flat, we arrive at forecasted earnings of $1.74B.

The average large gold stock currently trades at a TTM “P/E” ratio of 15.7X. Over the long run, most stocks trade at a 16X “P/E” ratio – higher for growth stocks and lower for cyclical companies. Since large established gold miners are a healthy mix of the two, I believe a 16X “P/E” best estimates their long-term fair value. Multiplying Barrick’s forecasted earnings of $1.74B by 16X, we arrive at a fair value estimate of $27.8B, which is almost precisely its market capitalization today. Assuming gold and copper prices remain flat, GOLD appears to be at its fair value today.

As mentioned in a recent article regarding Freeport-McMoRan, I believe copper will likely slip toward $3/lbs due to adverse economic conditions. This change would lower Barrick’s copper EBIT per pound to $0.15, or a forecasted segment EBIT of only $67M. However, if the US dollar or US real interest rates reverse 2022’s gains, then gold would likely rise to a range of $1800 to $2100 per ounce. Assuming gold rises to the mid-range target of $1950/oz, Barrick’s EBIT per ounce would be ~$738, raising its gold segment EBIT to $3.25B and its total expected EBIT to $3.31B. After subtracting $335M in expected interest and accounting for a 30% tax rate, we arrive at expected annual earnings of $2.09B under these new assumptions. Multiplying that figure by 16X, we have a new estimated fair value of $33.4B. This valuation is 20% above Barrick’s market capitalization, giving us a share-price target of $19.70.

The Bottom line

Overall, I am bullish on Barrick for both quantitative and qualitative reasons. Quantitatively, using the company’s mid-range production and cost estimates and my mid-range price estimates for copper and gold ($3/lbs and $1950/oz, respectively), it appears GOLD has solid upside potential. Of course, if gold and copper remain where they are today, then there is little quantitative reason for GOLD to rise.

In reality, I believe gold will rise well above the $1950/oz target I used. Based on FX and interest rate dynamics, I think gold may reach that level quickly in the short run. However, a fundamental qualitative truth remains nearly impossible to account for: global central banks will likely protect financial markets at the expense of worsening inflation. This question is potentially the most critical today, and in the past, my views regarding the Fed’s “pivot potential” has fluctuated.

Fundamentally, commodity price shortages (particularly in oil) will continue to promote inflation until a significant economic slowdown causes demand to decline below supply. Despite the decline in crude oil prices, the total US oil inventories have fallen at a consistent pace throughout the year. Commercial oil inventories will likely collapse soon as the SPR release ends this month, particularly considering the recent decline in the US rig count and OPEC’s potentially significant production cut. Indeed, if it were not for the SPR release this year, I believe inflation and inflation expectations would be much higher in the US today. Since the core supply-side issues have not been solved, I do not think inflation has peaked.

That said, financial market volatility is undoubtedly rising. It may soon spur trouble in the interest rate and derivatives markets, potentially causing the Federal Reserve to mimic the BoE’s “mini QE” policy. Since the global banking system is highly levered, the Fed may perceive financial liquidity crisis risk as larger than inflation risk. In other words, it is worth exacerbating inflation to protect banking liquidity. Note protecting banking liquidity is different than protecting stock prices. At any rate, dovish monetary policies in the face of inflationary pressures are incredibly supportive of gold.

Honestly, I would be surprised if gold is below $2500/oz three years from today, in which case Barrick Gold’s fair value would likely be around $35 per share or higher. At this point, I am not confident that gold will rise that high in the next twelve months, but it may occur after a more oversized “Fed pivot.” Overall, I am moderately bullish on GOLD and have a target price of $19.70, with the primary catalyst being a moderate increase in gold’s value as the dollar declines. In my view, the BoE’s recent decision fortifies this outcome. Still, the US dollar may rise even higher on an international FX market “short-squeeze” to the detriment of gold, so speculators should exercise some caution.

Be the first to comment