brightstars/E+ via Getty Images

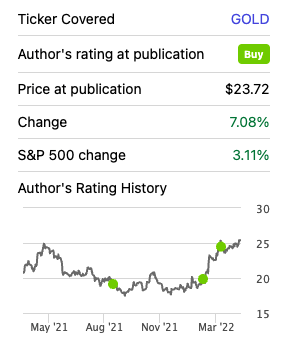

Since my latest article, Barrick Gold (NYSE:GOLD) share price has increased a further 7%, more than twice the gain of the S&P in the period. While gold prices retracted 2.2% from $1,996/oz to $1,951/oz in the period, the stock price increased due to the enhancement in the dividend policy and the expectation that the Fed is moving slower than needed to fight inflation.

Seeking Alpha

In this article, I will elaborate on the medium-term advantages of being upgraded to BBB+ by S&P, provide a preview of 1Q22 earnings and argue why I think GOLD’s discount to Agnico Eagle Mines (AEM) and Newmont (NEM) is not justified.

Barrick Gold Upgraded to BBB+ by S&P

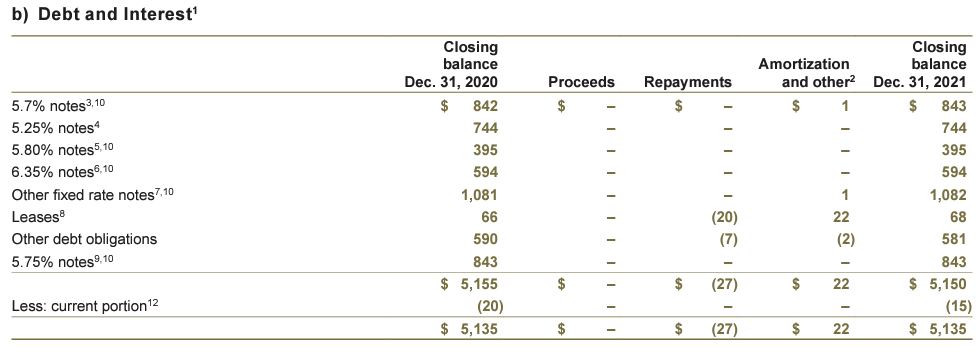

On March 29, S&P upgraded GOLD’s corporate debt to BBB+ due to its operational efficiency and credit profile. Even though GOLD’s net debt position is insignificant at 193M USD (0.4% of GOLD’s market cap), it has 5.1B USD in long-term debt that benefits from a better credit rating.

Barrick Gold Annual Report

GOLD’s long-term debt matures anywhere from 2039 to 2042 and it has an interest rate of 5.25% to 6.35%. I expect GOLD to refinance those higher-cost bonds in the medium term. GOLD could easily lower the cost of debt to ~4.5% saving ~50M USD in interest expense and lowering its cost of capital which would lead to an increase in the value of future cash flows.

While GOLD has significant reserves, it is continually expanding the life of current profitable partnerships as witnessed in the expansion of the Pueblo Viejo project beyond 2040 and the re-initiation of the Reko Diq project in Pakistan. This makes the decrease in the cost of capital more relevant.

Barrick Gold Q1 earnings preview

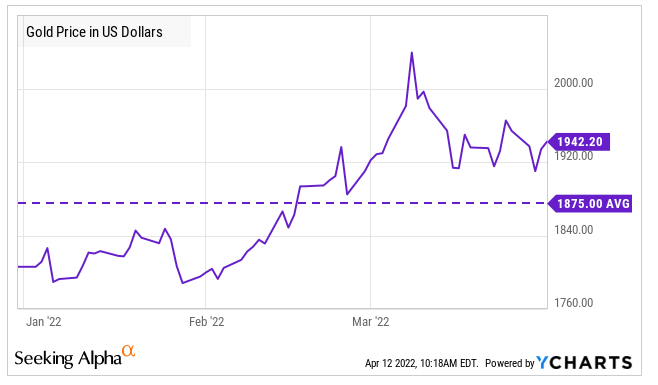

The average gold price for 1Q22 is $1,875/oz, which is $175 higher than the $1,700 assumed by GOLD in their guidance. As I expect volume to be +/-2%, revenue should grow 3% to 7% in the quarter to somewhere between 3.40B USD and 3.55B USD. The cost of production should increase slightly (~1-2%) driven by the increase in gold prices. As a result, free cash flow should increase to 780-930M USD.

YCharts

This free cash flow should be mostly available to shareholders via the performance-based dividend as it appears there were no share buybacks during the quarter.

The net cash position should be 590-740M USD leading to a dividend of $0.20 per share or a 3.1% dividend yield. As mentioned before, I expect that yield to compress to at least 2.25% leading to a fair share price of $35 per share.

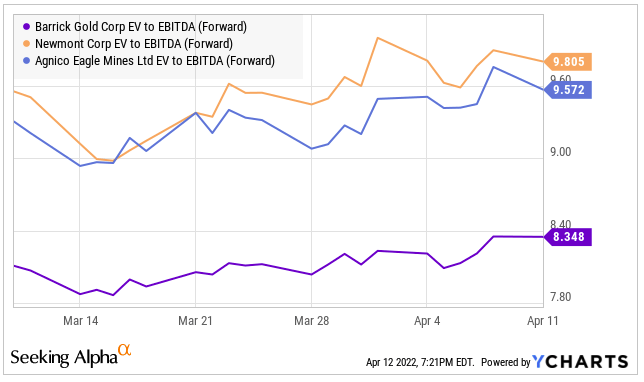

GOLD stock trading at a 13% discount to peers

GOLD is trading at 8.4x forward EBITDA, a ~13% discount to AEM’s 9.6x and NEW’s 9.8x multiples. I believe the market is assigning a lower multiple to GOLD due to its lower growth prospects and the location of its assets.

YCharts

A recent example is what is happening in Chile. Chile sues miners for their water use. Most of GOLD’s assets are in lower-grade countries such as Argentina, Pakistan and Congo.

However, I believe that the discount is not justified. Firstly, GOLD has demonstrated its ability to renew its reserves, secure key partnerships and is open to disciplined M&A. The CEO has openly mentioned (here and here) that capital allocation is his priority and he doesn’t discard M&A when it is the right asset at the right price.

As per the asset quality, the latest actions by GOLD management show their ability to manage assets in lower-grade countries and secure partnerships that the competition could not.

Conclusion

First-quarter earnings indicate that the quarterly dividend would be $0.20 per share, a 3.1% dividend yield. This alone should trigger the share price to increase to compress the dividend yield to at least 2.25%. Also, GOLD is trading at a discount to its peers for the wrong reasons as I believe GOLD has room to grow and its assets are wrongly being punished for their zip code.

Be the first to comment