Deejpilot/iStock Unreleased via Getty Images

Barclays (NYSE:BCS) (OTCPK:BCLYF) is a British multinational bank, operating as two divisions: Barclays UK and Barclays International. It has commercial and investment banking operations, alongside providing a host of other financial services globally. Barclays has a primary listing on the London Stock Exchange and is a constituent of the FTSE 100. Barclays also has a secondary listing on the NYSE.

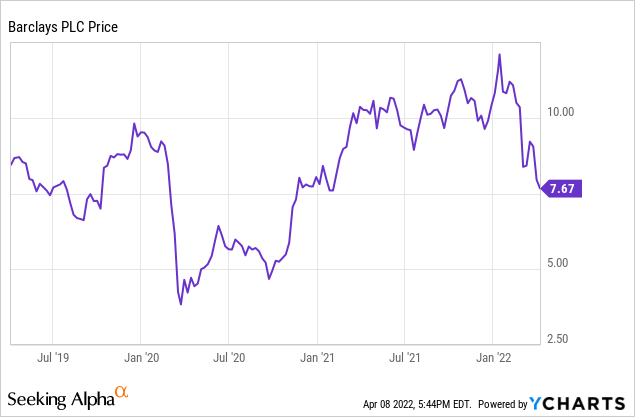

Barclays, in typical Barclays fashion, has been in the news of late due to several scandals. The stock is down 27.06% YTD, compared to the FTSE 100, which is up 0.62%.

Our view is that Barclays has quietly improved its fundamentals well in recent years and is primed to take advantage of economic tailwinds to outperform. The stock has been beaten down over the last one year for reasons outside of its continuing operation, which gives us a great entry point to achieve alpha. With steady net income, enterprising investors can earn a great dividend yield and benefit from buybacks until markets begin pricing Barclays correctly. We rate Barclays a cautious buy at its current price.

As such, we discuss the relative strength of Barclays going forward, and why investors should consider the stock at such depressed prices.

Recent update

Jes Staley stepped down as Barclays CEO in November 2021 following a UK regulator investigation into his relationship with Jeffery Epstein. The investigation found that most of the emails were sent before Staley moved to Barclays, and no evidence was found to suggest transgressions committed during his time at the British bank. Naturally, however, Barclays suffered reputational damage as a result of this.

Furthermore, at the end of March 2022, Barclays announced it had mistakenly issued $15.8bn more ETN than it had regulatory approval to do so (yes, that’s billion with a “b”). How on earth could this happen you ask? Well, it seems like a simple administrative mistake. Barclays previously had WKSI (well-known seasoned issuer) status, which meant it could issue over its allotted limit without manually filling an update. However, in 2017 Barclays settled with the SEC for overcharging its clients, which resulted in its WKSI status being rescinded. In 2019, Barclays agreed a new limit of $20.8bn, which it then exceeded.

Although Barclays have yet to disclose the reason, our belief is that Barclays assumed they had WKSI status again and so did not need to update their limit. The impact of this is that Barclays will now need to repurchase those ETN at the price they were issued, resulting in a post-tax hit of c.£450m. This represents 7% of 2021 attributable profits, and will be a serious drag on the profits in 2022. This is an outrageous error for an institution so large and seems to stem from control deficiencies. The only positive from this is that one can hope all other arrangements are double and triple checked, and the losses have been isolated. This will likely be the big investment impediment into 2022, investors will look for Barclays to make up for this error through improved performance.

With the bad out the way, we will now assess the fundamentals of Barclays to assess if the blue bird still has wings.

Investment Banking

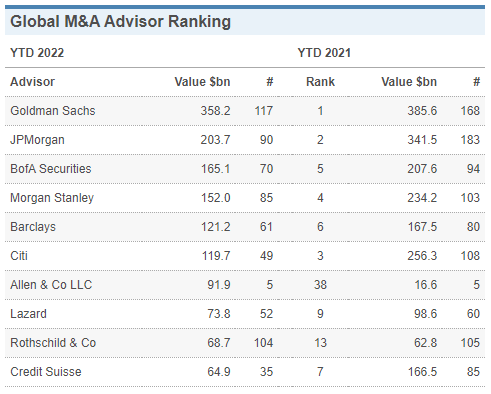

Investment banking is dominated by the Americans, if we look at the table below it paints a clear picture. Barclays is one of two non-U.S. banks and is among the few who can truly compete with the “bulge bracket.” Investment banking is an attractive operation due to the size of the fees and its impact on banks profits, if one can be competitive. Barclays has invested heavily to maintain and improve its investment banking division over the years, even while investors have called for it to be spun off. Commercial banking on the other hand has low growth and unattractive margins. As a result of this, the attractiveness of Barclays is tied to its investment bank’s ability to compete globally.

2021 Investment Banking ranking by value (Dealogic)

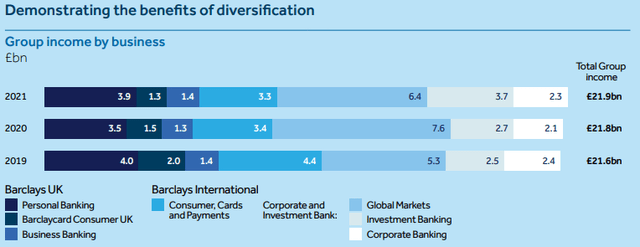

As per PwC, global M&A transactions reached record levels, up 24% from 2020. Many of these deals were driven by pent-up demand in 2020, but we feel is more so by the general strength of global economies during the pandemic. Consumer demand remained robust and financial markets grew rapidly post March 2020. Although this is in the context of M&A, we saw similar strong activity in the IPO market, and most facets of financial services. The impact of this was record fee paid to investment banks for services, much of which Barclays has benefited from. As per the below, investment banking operations have grown 37% in a single year, suggesting Barclays can compete with its U.S. peers and continue to be the premier European Investment Bank.

Barclays income by division (Barclays annual accounts 2021)

PwC are forecasting a “supercharged” year into 2022, which will mean continued strong performance for Barclays and potentially greater market share gained.

Commercial Banking

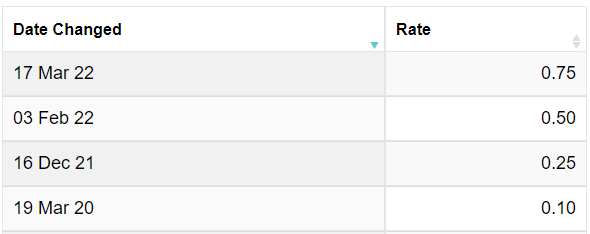

Commercial banking within the UK was historically a fruitful endeavor. However, the post financial crisis period has been nothing short of disappointing. After a long 12 years, there may be light at the end of the tunnel. The Bank of England has hiked interest rates multiple times, with it currently sitting at 0.75%.

Bank of England rate hikes since 2020 (Bank of England)

Not only this, but further increases are expected in the coming months. Economists and analysts are torn but the consensus seems to be that 1% is a minimum, but will not go beyond 1.5%.

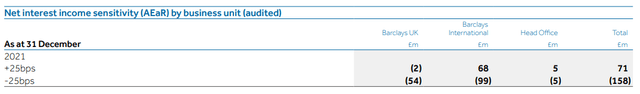

The impact of rate hikes on Barclays will be greater returns from its lending activities. The reason Barclays is an attractive proposition for this is due to its sensitivity to interest rate changes. As we can see from the below table, every 25bps increase results in a £71m increase in net profits. If we reach the higher end target of 1.5%, that would result in an increase of c.£355m, 5% of 2021 net income.

Impact on net profits of a change in interest rates (Barclays Annual Accounts 2021)

In recent weeks, there have been talks about a potential inversion of the yield curve. The yield curve is seen as a predictor of recessions as if the 20 year yield falls below the two year, the belief is that investors are seeking a safe haven in long dated bonds due to present market fears. In the context of banks, they borrow short and lend long, and so it is paramount that this does not happen. Currently, the 20Y UK gilt yields 1.892% with the two year at 1.46%.

Therefore, we believe Barclays commercial arm is in a good position to outperform in 2022 – rate hikes alone should drive growth.

Financial performance

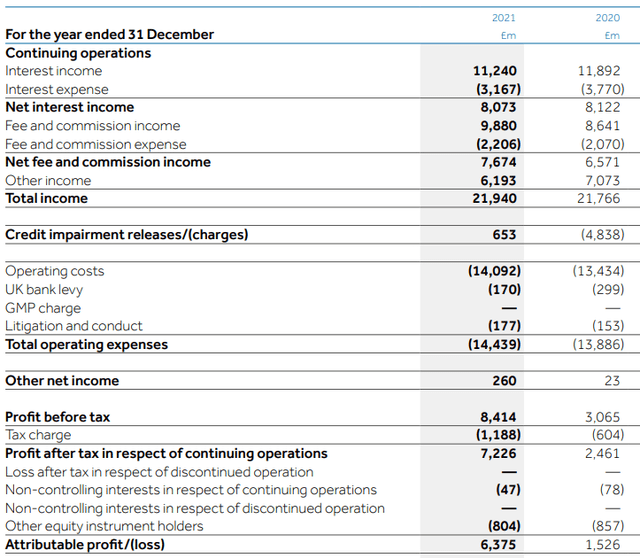

Barclays Income Statement (Barclays Annual Accounts)

Barclays has seen a huge increase in profit after tax during the year, which is predominantly driven by credit impairments. In 2020, in line with other banks, Barclays took a large impairment charge due to the COVID-19 pandemic. Some of this has been reversed in 2021 due to better than expected economic conditions.

The impact of this is a jump in return on tangible equity to 13.4%, which is noticeably higher than HSBC who achieved 8.3% and UBS with 11.9%. This suggests that Barclays year has been very good relative to its peers, not just as a result of the credit impairment.

Barclays have achieved these results with a CET1 ratio of 15%, which is above the required level. As a result of this, they are in a position to buyback shares and pay comfortable dividends. Given the level of excess, we are not concerned about the medium-term ability to maintain both.

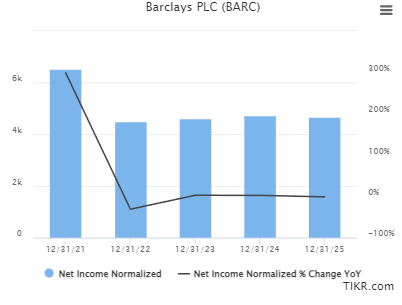

Moreover, as the below shows, analysts are estimating steady growth and strong net income going forward. At these levels, Barclays can easily continue to buyback shares and pay dividends. The current yield is 4.2%, with Barclays buying back another 3.62% of outstanding shares in 2021.

Barclays forecast net income into 2025 (Tikr Terminal)

Therefore, I think it is fair to say Barclays may have finally turned a corner performance wise. It may not grow at a considerable rate, but its current income levels are sufficient to generate a strong return for shareholders.

Peer comparison

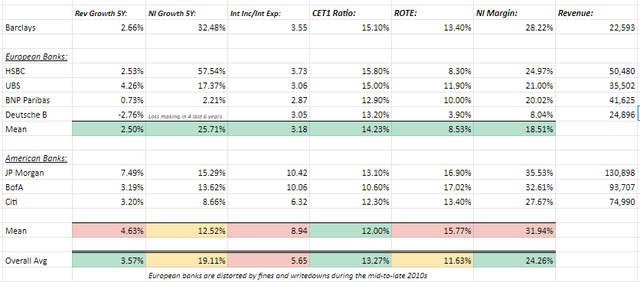

Barclays performance relative to other Banks (Tikr Terminal)

What immediately stands out is American banks compared to European banks. To compare the two directly would be a fool’s errand. The reason for this is due to the differing legislation post-crisis, and the different economic conditions.

When we look at Barclays compared to its European counterparts, it stands out among the pack. Barclays is growing revenues quicker, it is more profitable on every £1 it lends and it is doing so while maintaining a higher level of tier one capital. UBS is the closest competitor but it is clear Barclays are the leading global European bank.

What is most impressive is the ROTE, relative to the CET1 ratio. It suggests Barclays is leaner than its competitors. A contraction is inevitable for all in the coming 12 months, but Barclays is positioned well due to the reasons highlighted above.

As we move into the valuation, an issue presents itself. In the long term, Barclays should be valued above most European banks, but not to the level of U.S. banks.

Valuation

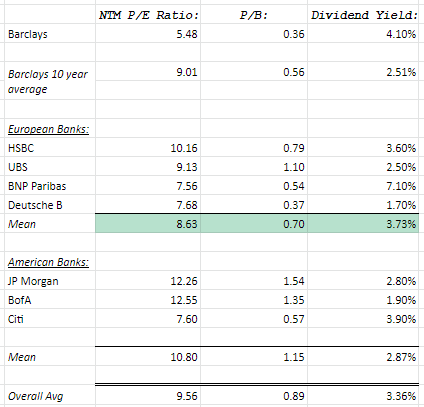

Barclays valuation relative to its peer (Tikr Terminal)

As Terry Smith likes to remind us, a high PE does not mean a stock is overvalued and a low PE does not mean it’s undervalued. We must consider the quality of the business. We note that Deutsche Bank (DB) has been loss making for 4 of the last 6 years, HSBC’s returns are poor compared to tangible equity, and BNP Paribas (BNPQF) has stagnated for 5 years. Barclays has not been amazing during this period, far from it, but the idea that it is trading below Deutsche Bank and half of HSBC is unreasonable.

Additionally, we have considered Barclays post-crisis valuation. We note similar amounts to the market comps which suggest even against its own history, Barclays is currently undervalued.

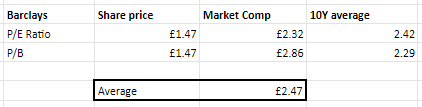

Barclays valuation (Tikr Terminal)

If we assume a multiple expansion towards its peers, and its historic average, we get to a share price of £2.47. This would suggest an upside of 72.7%.

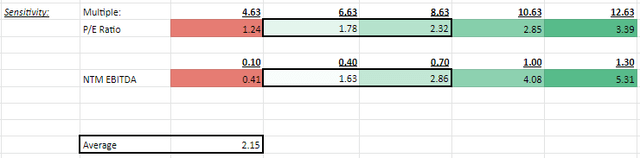

Sensitivity analysis on our valuation (Author’s own calculation)

If we assume a discount to our benchmarks, we still see an upside of 50%. In being prudent, I believe this is a more realistic valuation in the medium term. As we have established, Barclays will take a large right down in 2022 and so management are already on the back foot. Investors will have little patience for any other mishaps or missed targets.

For this reason, we believe Barclays is a fantastic investment opportunity. It is trading at a sharp discount to its peers while exceeding them in performance.

Final thoughts

Barclays is not our usual type of investment. It will not grow in the double digits, its profits fluctuate erratically, and it is involved in scandals regularly. However, when a business is trading below its intrinsic value, we are interested. Barclays has shown its investment bank is competitive, and the market is set to grow healthily. It has shown its commercial operations are sold, and tailwinds are ahead. Finally, it is trading at a discount to its peers, which it outperforms in many metrics. We are cautious investors, but the strong dividend yield and scope for buybacks give us some protection against downside movements. Therefore, we rate Barclays a buy.

Be the first to comment