AmandaLewis/iStock Editorial via Getty Images

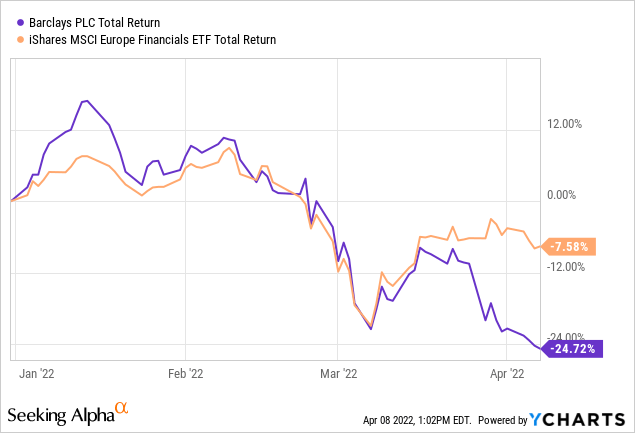

Shares in Barclays (NYSE:BCS) have fallen to less than half its tangible book value, after the lender admitted that it had sold $15.2 billion more structured notes and exchange traded notes than allowed under rules agreed with the Securities and Exchange Commission.

As a result, the bank has had to stop the sale of new retail structured products in the US, including not being able to issue any new shares in many of its iPath series exchange traded notes, such as the iPath Series B S&P 500 VIX Short-Term Futures ETN (VXX) and the iPath Pure Beta Crude Oil ETN (OIL) – two of its most popular ETNs.

And to bring itself back to its regulatory limit, Barclays is required to buy back the affected securities at their original price, in what is known as a rescission offer, at an expected net cost of £450 million (~$590 million) to itself.

Indirect Costs

The longer-term cost to the bank will likely be much higher, as indirect costs need to be considered too. We must take into account not only the impact of increased regulatory scrutiny on the bank, but additionally lost business opportunities and reputational damage caused by its latest scandal.

The risk of a lengthy regulatory investigation, including the possibility of regulatory fines and enforcement actions, will not bode well for investor sentiment either. Regulators could take a fresh look at the bank’s internal controls, and an investigation could cover a broader set of topics, including whether there had been sufficient oversight of all regulatory compliance risks and if management culture was to blame.

This latest compliance failure was significant enough to force management to delay the company’s planned £1 billion (~$1.30 billion) share buyback programme. The takeaway for shareholders is to underline that regulatory risks are not behind us, reminding investors of the volatility and the potential for unforeseen risks inherent in the bank’s operations.

Big Discount

Barclays’ stock now trades at a big discount to its peers, with a price-to-tangible book value of 0.49x and a forward P/E of 5.4. Of course, though, these valuation metrics do not yet take into account the expected cost of this latest compliance failure or any analysts revisions to earnings estimates.

Yet, as things stand, it would still be possible for Barclays to achieve its medium-term return on tangible equity target of more than 10%. After all, the net cost from buying back the affected securities at their original price would remove less than a full percentage point from its 2022 RoTE, and reduce its tangible book value by under 1%.

Rising Rates

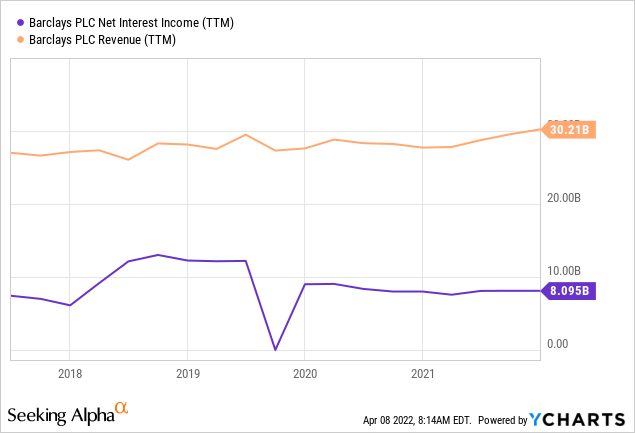

Against this, the rising rate environment will likely more than offset the impact of the loss, with Barclays’ balance sheet being well-positioned to benefit from higher interest rates. An upwards parallel shift of 25 basis points in the interest rate curve is expected to add around £275 million (~$360 million) in net interest income in the first year, with the benefit rising to £525 million (~$680 million) after three years.

Illustrative sensitivity of net interest income to parallel shifts in the interest rate curve (£ millions)

| Year 1 | Year 2 | Year 3 | |

| +25bps | +275 | +375 | +525 |

| -25bps | (450) | (575) | (700) |

Source: Barclays Full Year 2021 Results Presentation

Around two thirds of the NII benefit from the illustrative 25 basis points shift will be attributable to its UK retail bank, with the remaining coming from its consumer finance business and investment bank.

In its favor, Barclays is also well diversified, and earns a much bigger proportion of its revenues from fees and commissions than its peers – 63% in 2021. It has a lucrative credit card and payments business and the group is the sixth largest investment bank, as measured by global fee revenues in 2021.

Downside Risks

There are risks ahead too. Macroeconomic expectations have been lowered in recent months, and this has raised concerns about the financial health of companies and consumers going forwards. Inflationary pressures, particularly in the UK with regards to energy costs, could begin to dampen loan growth and asset quality expectations.

The risk of a recession sooner rather than later cannot be discounted, at a time when Barclays’ investment bank needs the current trading and deal-making frenzy to persist. Its investment bank reported a return on tangible equity of 14.9% in 2021 – the first time it achieved a RoTE of more than 10% since the 2008 financial crisis. It has not been that long ago from when the unit had been a drag on the group’s overall performance – its 5-year average RoTE was just 7.0% between 2015 and 2019.

With a cost to income ratio still stubbornly high, at 66%, there is a genuine risk of a slowdown in activity. That’s because it would not take much of a reduction to revenues to lower its profitability below the double-digit level that investors expect to see.

Final Thoughts

Barclays’ elevated earnings risk profile has meant investors demand a valuation discount against its rivals. That discount has widened considerably over the past two weeks, yet I see few reasons to justify the gap to close anytime soon. The bank needs to prove that it can sustainably generate a decent return year after year, and there are no shortcuts to this.

Be the first to comment