Editor’s note: Seeking Alpha is proud to welcome Jaime Wild as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Mlenny/iStock via Getty Images

Bannerman Energy (OTCQB:BNNLF) is a junior explorer that stands to benefit disproportionately from higher uranium spot prices. The size of the company’s asset, jurisdiction and management all appear to improve the probability of success of their proposed project. However, due to high estimated capex costs compared to its peers, Bannerman stock is highly leveraged to the average sale price of its extracted resources. Assuming the spot price of uranium reaches a minimum of $65 to justify the project and by weighting our valuation based on the probability of several average sale price scenarios we can get an expected fair value which is 129% higher than the current market price.

A development-ready, world-class asset

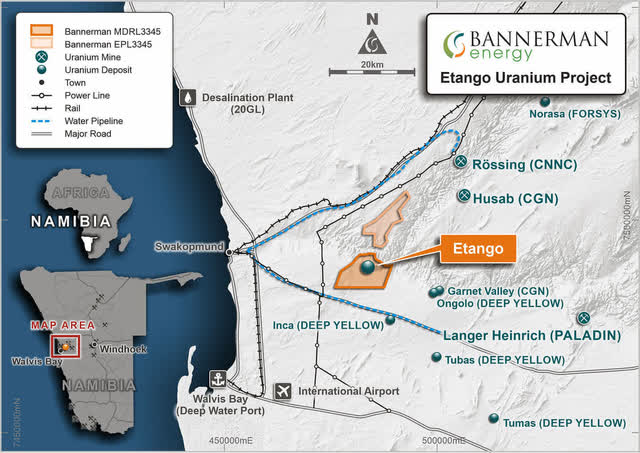

Bannerman’s flagship Etango Project is situated in the Erongo Region of Namibia and boasts one of the largest undeveloped assets in the space. The region is home other established U mining operations such as Paladin’s Langer Heinrich mine. As such, Namibia is a considered a favorable jurisdiction, with government support for the industry and excellent infrastructure already in place.

Etango Uranium Project (Bannerman Energy)

In terms of management, CEO Brandon Munro is well regarded in the industry and a member of the World Nuclear Association Advisory Panel with his finger on the pulse of the developing macroeconomic regime. He has familiarity with operations in the jurisdiction, previously working as the general manager at Bannerman from 2009-2011, he went on to co-found and act as the Managing Director of Kunene Resources, based in Namibia, before negotiating a reverse takeover, stepping down and returning to his former company as CEO. Whilst lacking in mine development experience, the CEO is very vocal in the space and active in terms of media and marketing efforts which will continue to make the company more visible to potential investors and assist with capital raising efforts.

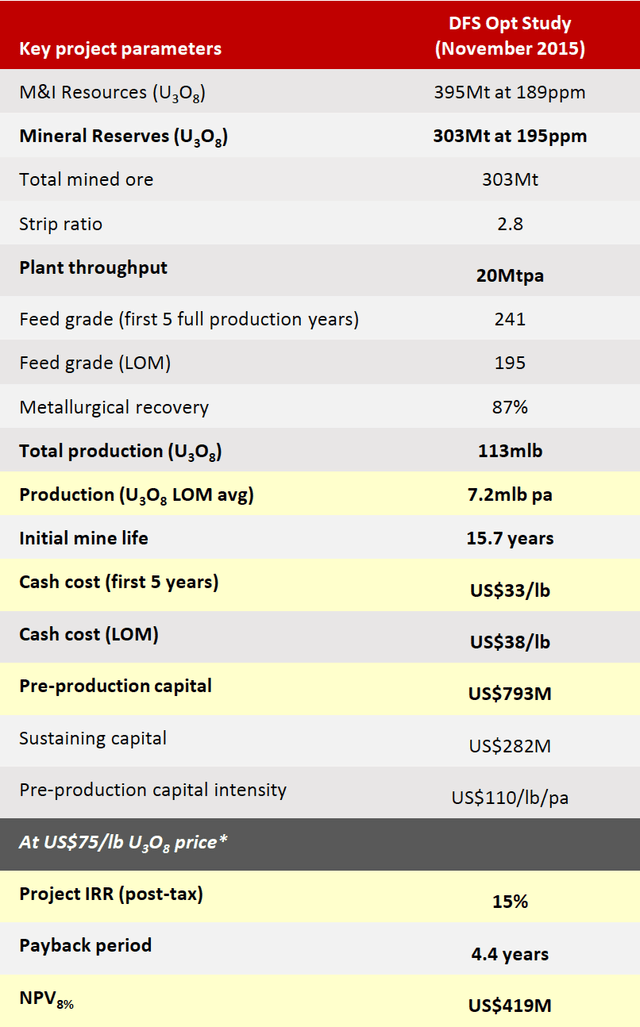

Extensive exploration activity over the past 15 years has uncovered an expected 395Mt of M&I U308 resources. In 2015, an optimized definitive feasibility study (DFS Opt) was completed for a 20Mtpa throughput mine fully exploiting the asset (Etango-20). However, with the project requiring significant capex, a reduced impact 8Mtpa mine (Etango-8) has been proposed. Most recently, a promising prefeasibility study (PFS) for Etango-8 was finished in August 2021, with a new DFS approved by the board for completion in September 2022, in order to further derisk the project. The forecast construction period is 24 months for an open pit mine with an initial operating life of approximately 15 years and a 3.5 Mlbs output per annum with further expansion scalability. This suggests a globally significant output, not only indicating economic viability, but also making the project attractive for potential acquisition.

Etango-20 DFS, 2015 (Bannerman Energy)

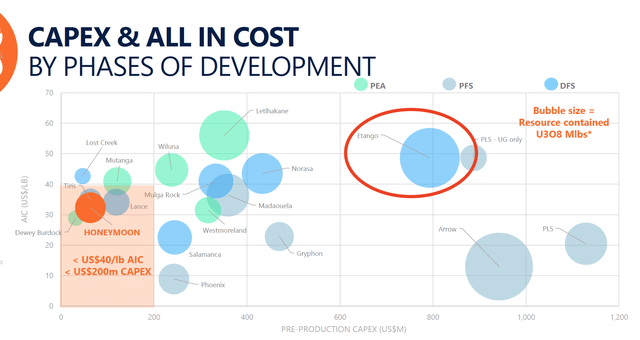

However, due to the significant capex requirements in comparison to its peers, the success of Bannerman Energy – in terms of a final investment decision (FID) and the magnitude of future cash flows – is highly leveraged to the price of uranium.

Estimated capex and AIC for several uranium projects (Boss Energy)

Below the breakeven $52 U3O8 price highlighted in the DFS, the Etango Project will not be feasible, however if prices do rise significantly and remain elevated, as suggested in the following section, Bannerman stands to benefit greatly. Therefore, future changes in uranium spot price are key to this investment thesis.

The uranium market is waking up

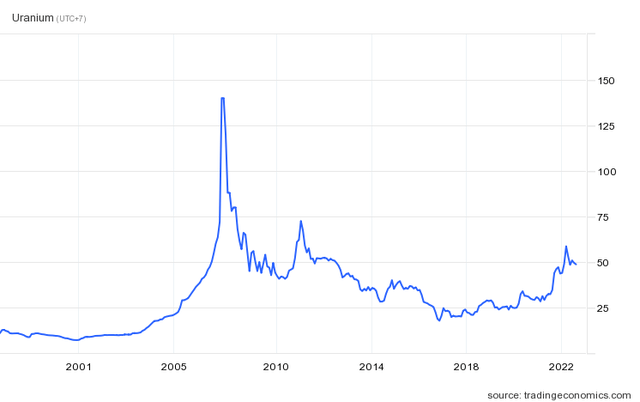

Many analysts are watching the uranium spot prices closely as we look to be entering the early stages of a new bull market.

Uranium spot price 25Y (Trading Economics)

Despite several failed runs over the last 10 years resulting from unfortunate setbacks, such as the Fukushima disaster, the spot price is starting to pick up once more. So why should we expect a continuation of the trend, as well as higher sustained long term spot prices in the future?

The push for global decarbonization and reduced reliance on fossil fuels, thus increasing the demand for clean and sustainable nuclear energy. There has been a massive shift in sentiment favoring nuclear energy in the past decade, with governments and environmental groups acknowledging nuclear as vital for a green future.

Due to a long drawn out bear market, supply has been tightening as many producers became unprofitable and shut down operations. There has been little incentive for explorers or developers to enter the space. In addition, renewable energy technology such as wind and solar are just not there yet. They cannot produce a reliable source of baseload power required to support the grid, a problem which will only get more important with the continued rise of electrification. It is becoming increasingly apparent that nuclear is the only viable solution to reach our emission goals.

55 new nuclear reactors are currently under construction globally, with 90 more on order or planned and 300 more proposed. China expects to complete 150 new reactors by 2035, investing heavily in a nuclear future and buying interests in existing producers and contracting supply from the world’s biggest uranium miner.

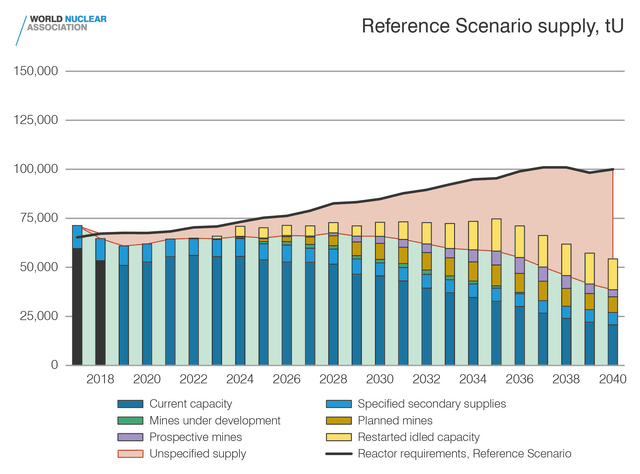

Developing a new mine is a long, slow process, with a lot of red tape. For many existing mines, production ground to a halt during the COVID-19 pandemic. Commonly cited estimations of global uranium supply and demand – such as that by the World Nuclear Association shown below – do not take these closures into account, indicating the supply shortage will only be exacerbated going forward.

Word Nuclear Association reference scenario uranium supply (World Nuclear Association)

This is far from an exhaustive list, but covers many of the core arguments for why the uranium spot market is ripe for a supply squeeze over the coming years. This supports the thesis for an investment in Bannerman with the stock price leveraged to uranium sale prices.

Recent events are intensifying the deficit

Since 2018 when annual production fell below annual consumption, the market has begun waking up and some recent unexpected developments have led investors to pull the thesis forward, as well as increasing the potential magnitude of elevated U prices.

Sprott Asset Management launched a new physical uranium investment trust (OTCPK:SRUUF), with the goal to buy up significant amounts of U3O8 from the open market, thereby giving investors an easier way to gain exposure to the commodity while simultaneously intensifying the supply deficit. Since Sprott entered the market in July 2021, they have already purchased 39.2 Mlbs of physical U from the open market and now hold 57.4 Mlbs, or the equivalent of around 45% of the total global 2021 uranium supply. This has led to an initial rapid price increase followed by volatility and what appears to be a new floor on the spot price.

In addition, sanctions related to the war in Ukraine have resulted in an ongoing energy crisis across Europe leading to renewed interest in nuclear, with Germany reconsidering power plant closures. Oil and gas price shocks across Europe and the world have forced many countries, such as South Korea, to switch their stance on nuclear as energy self-reliance becomes a focus going forward. In July this year, EU lawmakers agreed to label nuclear as “green,” setting a new precedent which will open the doors to ESG investment in the industry.

With these events in mind, an elevated and sustained U price is becoming the more likely scenario going forward and based on this we can assign probabilities to the various spot price scenarios outlined below.

A scenario-based P/NPV valuation

As stated, we should consider several scenarios for future uranium spot prices and evaluate the likelihood of each. It is then possible to calculate an expected stock price based on these probabilities. As noted in the PFS for Etango-8 and the DFS for Etango-20, the spot prices at which both projects are justified are fairly close so we can base our valuation on the assumption that Etango-8 expanded to Etango-20 will proceed or neither project.

A common method of valuing mining stocks is to calculate a price to net present value (P/NPV) multiple. By determining this multiple based on management forecast NPV at a specific spot price and current market cap, we can calculate an implied NPV at various spot prices.

Current MC ≈ $211M

Forecast NPV8% for Etango-20 (from DFS Opt) = $419M assuming an average spot price of $75.

If an NPV of $419M can be achieved at an average spot price of $75, current market cap would imply an expected average spot price of approximately 211/419 * 75 = $37.8 (current price is around $48).

If the current P/NPV holds, we can expect the following market caps at each spot price level:

$65 -> $363M

$85 -> $474M

$130 -> $726M

$200 -> $1,116M

It has been suggested by Namibia’s finance minister that miners in the region are waiting for a $65-70 U price to justify the marginal cost of new investments, while Bank of America is forecasting $70 spot prices by 2023. If the uranium bull thesis holds and there is to be constant or increasing future demand for the fuel, it is fair to expect spot prices will remain above the minimum sustainable price level of $65. Therefore, taking the conservative view that a future average sale price of around $85 is the most likely scenario, while a sustained overshoot to $200 is the least likely, we can weight the NPV for each scenario by the arbitrary probabilities assigned below

$363M*0.25 + $474M*0.63 + $726M*0.10 + $1,116M*0.02 = $511M

This gives us a final expected NPV of $484M equating to a 129% increase from the current market price.

In practical terms, an investment in Bannerman Energy is similar to a call option on the price of uranium, with elevated prices resulting in substantial returns. However, without first reaching the minimum U price of $65 it is unlikely that the project will go ahead at all. One could argue that after further discounting the risks associated with junior miners, the stock is fairly value at the current price.

Where the thesis breaks down

Obviously there is a lot of uncertainty baked into such a valuation and market prices will be affected by many more factors than those covered already in this article. This valuation is highly dependent on the accuracy of management NPV forecasts which already include many assumptions from future spot prices to capitals costs to FX rates, etc. The model also assumes no stock dilution, but this will likely be necessary to fund capital requirements as there are no current cash flows to act as collateral for a loan.

Volatility can be expected as we have seen recently with the broad market downturn and investment flows leaving risk assets. As with all micro-caps, large buys and sells can also move the stock price significantly.

Since the thesis hinges on uranium spot prices, not only to justify a FID but also to ensure a positive NPV, any shocks to the uranium market could prevent Bannerman from ever reaching the developer stage or cause cash flows to breakdown if it occurs later in the cycle. The market for uranium is relatively opaque and there is always a risk of unanticipated secondary supply coming online or current producers ramping up production early, stifling rising prices. In the near term, alternative energy solutions may also prove to be more favorable, in which case the demand for U will fall.

A worthy addition to the uranium portfolio

In conclusion, any valuation based on P/NPV for a junior mining stock such as Bannerman Energy is a difficult task and management will attempt to continue derisking the project going forward in order to justify a FID. Based on the valuation above, an argument can be made for a significantly higher stock price today and multibagger returns in the event that uranium spot price continues to rise and remains elevated. An investment in Bannerman is essentially a call option on the uranium bull market thesis that stands to be a key producer in the coming decade, and a great high-risk uranium exposure play.

Be the first to comment