miromiro

Earnings of Bankwell Financial Group, Inc. (NASDAQ:BWFG) will surge this year on the back of heightened loan growth and extraordinary prepayment fees. On the other hand, future margin compression and heightened provisioning will restrict earnings growth. Overall, I’m expecting Bankwell Financial to report earnings of $4.60 per share for 2022, up 37% year-over-year. For 2023, I’m expecting earnings to dip by just 1% to $4.57 per share. The December 2022 target price suggests a high upside from the current market price. Therefore, I’m maintaining a buy rating on Bankwell Financial Group.

Rising Interest Rates to Thrash the Margin

The ongoing rate up-cycle has been steeper and longer than previously anticipated. The Federal Reserve has already increased the fed funds rate by 300 basis points so far this year and is projecting a further around 150 basis points hike till the end of next year. Such large monetary tightening is going to hurt Bankwell Financial this year and the next. This is because the company’s balance sheet is currently in an unfavorable position. More liabilities than assets are subject to repricing as interest rates change, according to details given in the 10-Q filing. Negotiable order of withdrawal, money market, and savings accounts made up 58% of total deposits at the end of June 2022. These deposits will reprice soon after every rate hike. In comparison, only around 22% of the loan portfolio is either floating or set to reprice in the next twelve months, as mentioned in the earnings presentation.

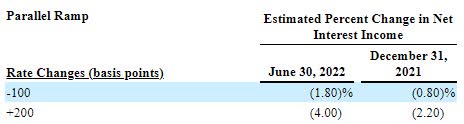

The results of the management’s interest-rate sensitivity analysis given in the 10-Q filing showed that a 200-basis points ramp in interest rates can decrease the net interest income by 4.0% over twelve months.

2Q 2022 10-Q Filing

Despite the liability sensitivity, the net interest margin actually increased during the second quarter to 4.01% from 3.30% in the first quarter of this year. This expansion was attributable to elevated loan prepayment fees, which the management doesn’t expect to recur, as mentioned in the earnings release. Further, strong loan growth during the quarter contributed to the margin expansion.

The effect of the loan growth gives me hope that Bankwell Financial will be able to ride out this up-rate cycle without too much damage. However, unlike most other banks, Bankwell Financial will most certainly not benefit from rising interest rates.

Considering these factors, I’m expecting the margin to plunge by 50 basis points in the second half of 2022 and then remain somewhat stable in 2023. Compared to my last report on Bankwell Financial Group, I’ve increased the margin estimate for 2022 because of the second quarter’s surprisingly good performance. Excluding the elevated prepayment fees, I’ve reduced my margin estimate.

Healthy Pipelines, Regional Economic Activity to Sustain Loan Growth

The strong loan growth trend that started last year continued in the second quarter of 2022, with the portfolio increasing by 3.7% during the quarter, or 14.7% annualized. Loan growth will likely remain elevated in the near term as the management mentioned in the earnings release that the third quarter’s loan pipeline is at record levels.

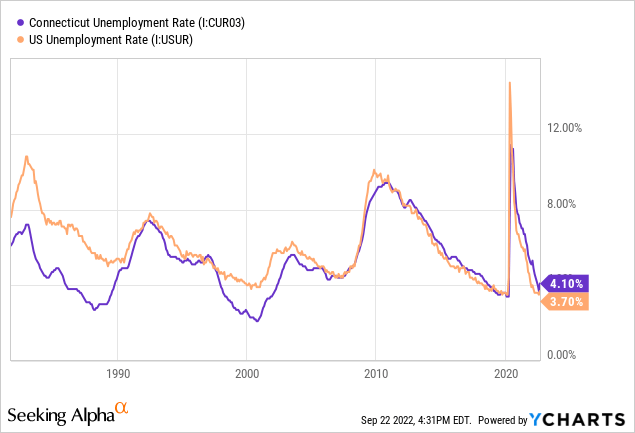

Further, economic activity will help with loan growth. Bankwell Financial serves businesses and residents of Connecticut. While the state’s unemployment rate is higher than the national average, it is still at a very good level from a historical perspective.

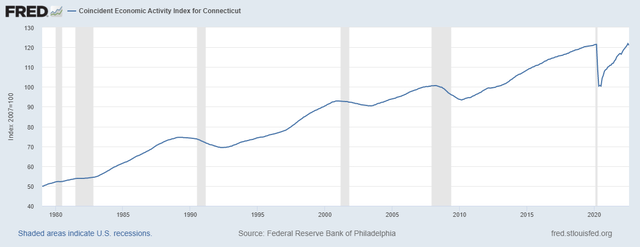

As more than 91% of total loans are to commercial borrowers (including commercial real estate), the coincident economic activity index is another good indicator of credit demand. This index includes the unemployment rate, average hours worked, and wages and salaries. As shown below, economic activity in Connecticut is back to the pre-pandemic level.

Federal Reserve Bank of Philadelphia

Bankwell Financial closed its Wilton branch in July, which leaves just nine branches in total. The branch closing could have a negative effect on loan growth. Further, high interest rates are likely to reduce the credit demand for projects that are not urgent.

Considering these factors, I’m expecting the loan portfolio to increase by 3% every quarter till the end of 2023. Meanwhile, I’m expecting other balance sheet items to grow somewhat in line with loans. The following table shows my balance sheet estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |

| Financial Position | ||||||

| Net Loans | 1,587 | 1,589 | 1,602 | 1,875 | 2,161 | 2,432 |

| Growth of Net Loans | 4.3% | 0.1% | 0.8% | 17.1% | 15.2% | 12.6% |

| Other Earning Assets | 119 | 101 | 111 | 161 | 140 | 151 |

| Deposits | 1,502 | 1,492 | 1,827 | 2,124 | 2,157 | 2,428 |

| Borrowings and Sub-Debt | 185 | 175 | 200 | 84 | 145 | 157 |

| Common equity | 174 | 182 | 177 | 202 | 218 | 246 |

| Book Value Per Share ($) | 22.4 | 23.4 | 22.8 | 26.0 | 28.6 | 32.3 |

| Tangible BVPS ($) | 22.1 | 23.1 | 22.5 | 25.7 | 28.2 | 31.9 |

|

Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) |

Higher than Average Provisioning Likely for the Second Half

Bankwell Financial surprised me in the second quarter by reporting a large reversal of the previous provisioning. Nonperforming loans were 0.74% of total loans, while allowances were 0.77% of total loans at the end of the last quarter. Bankwell Financial Group is not yet subject to the Current Expected Credit Losses accounting standard, CECL, and still provisions based on incurred losses. Therefore, such a tight allowance coverage is not too problematic.

Nevertheless, I’m expecting provisioning to be higher than the historical average in future quarters. Apart from the thin coverage, I’m expecting a worsening credit quality to keep provisioning elevated. The high-inflation environment will likely be one of the biggest contributors to financial stress for borrowers.

Further, according to management’s estimates, if the company had used the CECL method of accounting, then earnings would have been lower by $0.09 per share in the second quarter of 2022, as mentioned in the earnings release. This means that the company is currently facing greater risk than what’s incorporated in the existing allowances.

Overall, I’m expecting the net provision expense to be 0.23% of total loans (annualized) in the second half of 2022 and 0.16% of total loans in 2023. In comparison, the net provision expense averaged 0.16% in the last five years. In my last report on Bankwell Financial, I estimated a net provision expense of $2 million for 2022. Due to the second quarter’s surprise, I’ve now reduced my full-year estimate to $1 million.

Earnings to Surge by 37%

Robust loan growth will likely be the biggest driver of earnings growth this year. Further, the elevated prepayment fees booked in the second quarter will keep earnings elevated for this year. On the other hand, future margin compression and elevated provisioning will likely limit earnings growth. Overall, I’m expecting Bankwell Financial Group to report earnings of $4.60 per share for 2022, up 37% year-over-year. For 2023, I’m expecting earnings to be somewhat flattish at around $4.57 per share. The following table shows my income statement estimates.

| FY18 | FY19 | FY20 | FY21 | FY22E | FY23E | |||||

| Income Statement | ||||||||||

| Net interest income | 56 | 54 | 55 | 68 | 88 | 97 | ||||

| Provision for loan losses | 3 | 0 | 8 | (0) | 1 | 4 | ||||

| Non-interest income | 4 | 5 | 3 | 6 | 4 | 5 | ||||

| Non-interest expense | 36 | 36 | 43 | 40 | 45 | 52 | ||||

| Net income – Common Sh. | 17 | 18 | 6 | 26 | 35 | 35 | ||||

| EPS – Diluted ($) | 2.21 | 2.31 | 0.75 | 3.36 | 4.60 | 4.57 | ||||

|

Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) |

||||||||||

In my last report on Bankwell Financial, I estimated earnings of $4.07 per share for 2022. I’ve increased my earnings estimate because the margin increased by more than I expected in the second quarter of 2022. Further, I’ve reduced my provisioning estimate following the second quarter’s surprise.

Actual earnings may differ materially from estimates because of the risks and uncertainties related to inflation, and consequently the timing and magnitude of interest rate hikes. Further, a stronger or longer-than-anticipated recession can increase the provisioning for expected loan losses beyond my estimates.

High Price Upside Calls for a Buy Rating

Bankwell Financial usually increases its dividend every year. Given the earnings outlook, I’m expecting the company to increase its dividend by $0.02 per share to $0.22 per share in the first quarter of 2023. The earnings and dividend estimates suggest a payout ratio of 19% for 2023, which is close to the five-year average (ex-2020) of 20%. Based on my dividend estimate, Bankwell Financial is offering a forward dividend yield of 2.9%.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Bankwell Financial. The stock has traded at an average P/TB ratio of 1.14 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 22.1 | 23.1 | 22.5 | 25.7 | ||

| Average Market Price ($) | 31.5 | 28.6 | 18.2 | 27.8 | ||

| Historical P/TB | 1.43x | 1.24x | 0.81x | 1.08x | 1.14x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $28.2 gives a target price of $32.2 for the end of 2022. This price target implies a 6.5% upside from the September 22 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 0.94x | 1.04x | 1.14x | 1.24x | 1.34x |

| TBVPS – Dec 2022 ($) | 28.2 | 28.2 | 28.2 | 28.2 | 28.2 |

| Target Price ($) | 26.5 | 29.4 | 32.2 | 35.0 | 37.8 |

| Market Price ($) | 30.2 | 30.2 | 30.2 | 30.2 | 30.2 |

| Upside/(Downside) | (12.2)% | (2.9)% | 6.5% | 15.8% | 25.2% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 11.6x in the past, as shown below (the outlier in 2020 has been removed from the average).

| FY18 | FY19 | FY20 | FY21 | T. Average | ||

| Earnings per Share ($) | 2.21 | 2.31 | 0.75 | 3.36 | ||

| Average Market Price ($) | 31.5 | 28.6 | 18.2 | 27.8 | ||

| Historical P/E | 14.2x | 12.4x | 24.2x | 8.3x | 11.6x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the trimmed average P/E multiple with the forecast earnings per share of $4.60 gives a target price of $53.5 for the end of 2022. This price target implies a 77.1% upside from the September 22 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 9.6x | 10.6x | 11.6x | 12.6x | 13.6x |

| EPS 2022 ($) | 4.60 | 4.60 | 4.60 | 4.60 | 4.60 |

| Target Price ($) | 44.3 | 48.9 | 53.5 | 58.1 | 62.7 |

| Market Price ($) | 30.2 | 30.2 | 30.2 | 30.2 | 30.2 |

| Upside/(Downside) | 46.6% | 61.8% | 77.1% | 92.3% | 107.5% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $42.9, which implies a 41.8% upside from the current market price. Adding the forward dividend yield gives a total expected return of 44.7%. Hence, I’m maintaining a buy rating on Bankwell Financial Group.

Be the first to comment