Galeanu Mihai

Financial stocks have seen signs of stabilizing in recent weeks, but remain well below their near-term highs as the market continues to digest economic news and quarterly earnings. This can be a confusing time, as low unemployment rates are usually a sign of economic strength. But coupled with stubbornly high inflation rates and global uncertainty, these stocks mostly remain in value territory.

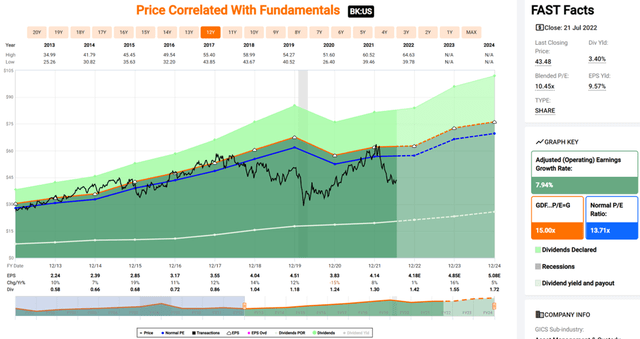

This brings me to Bank of New York Mellon (NYSE:BK) which, as seen below, currently sits well below its 52-week high of $64.63, and has seen a 27% plunge so far this year. In this article, I highlight why this financial giant is value buy at current prices, so let’s get started.

Why BK?

BNY Mellon is a global investments company that provides wealth management and investment services to clients across 35 countries and more than 100 markets. It’s the largest custody bank in the world, with $43 trillion in assets under custody and/or administration, and has $1.9 trillion in assets under management.

BNY’s wide-reaching scale enables it to offer a broader range of investment products. This reflected by the fact that it’s the largest provider of depositary receipts of international stocks. Having scale matters, as this enables it to spread costs over a wide asset base, thereby resulting in lower fees. This serves as a competitive advantage and economic moat, as noted by Morningstar in its recent analyst report:

We believe the custody business tends to be a wide-moat business built on cost advantages and switching costs. BNY Mellon edges out State Street as the number-one custodian based on assets under custody or administration. Given the low basis points paid for custody services, we believe this is a business where scale matters.

There are large up-front costs to developing software systems and processes to serve a high amount of assets. As an example, State Street and BNY Mellon each spent over $2 billion on technology in 2019, a level that smaller firms cannot match.

Clients of BNY Mellon’s investment servicing face switching costs due to process disruption, the interconnectedness of clients’ workflows, and the custodian’s infrastructure as well as onboarding costs. As a result, we believe BNY Mellon’s clients tend to be sticky.

Meanwhile, BNY has impressed with strong top-line results, growing revenue by 7% YoY, and earning a 9% ROE (19% ROTCE – return on tangible common equity) during the second quarter. It also maintains healthy leverage with a 10.0% common equity tier 1 ratio, sitting comfortably above the 6% regulatory limit. The higher revenue was driven in part by 4% increase in fee revenue, and primarily by a 28% increase in net interest revenue as interest rates have soared.

Notably, BNY is seeing some headwinds from market volatility, as its AUM dropped by 17% YoY to $1.9 trillion, primarily driven by market values. Looking forward, BNY may see continued earnings volatility as equity markets are still sorting out the effects of inflation and global unrest in eastern Europe.

Nonetheless, BNY remains a high quality and moat-worthy business that’s innovating in new areas, such as blockchain technology, which could prove to be a new growth opportunity. Given the recent fallout of big crypto players such as Celsius, 3AC, Terra, and Voyager, I believe this presents an opportunity for established players like BNY to step into the gap. The blockchain opportunity was highlighted by management during the recent conference call:

And now we’ve got a great new technology in the form of blockchain and that gives us the opportunity to do new things. And we’re excited about that. We think it’s going to bring great opportunity to our business. You’re right, there’s an element of potential disruption risk and so we’ve got to be ahead of that. But we also see a lot of opportunity in everything that this brings to bear.

And I’ll just note that the amount of interest that we have from our clients in us helping them to navigate this landscape is really remarkable. That’s demand from the institutional clients around looking after cryptos, which we view as interesting but not really the main core digital assets, to building various different capabilities across the digital asset life cycle, coins, tokenized assets and we’ve already cemented ourselves as a leader in the space, all the work that we’ve been doing for some of these stable coin providers, we’ve been doing our traditional business with them, looking after traditional assets as part of their stable coin portfolio.

But in doing so, we’ve really inserted ourselves into the ecosystem and that gives us a great landscape. So there’s a lot to do here. My view on this is it’s going to be years and potentially decades for the full effects to be known, but we’re in it and we’re excited about it.

Lastly, I see value in BNY at the current price of $42.72 with a forward PE of 9.96, sitting well below its normal PE of 13.7 over the past decade. It also pays a well-covered 3.4% dividend yield, which comes with a 5-year CAGR of 11.4%, a 32.6% payout ratio, and 12 years of consecutive growth.

Sell side analysts forecast 5-14% EPS growth over the next 4 quarters, and have a consensus Buy rating with an average price target of $48.74. Moreover, Morningstar has a fair value estimate of $56. Based on the lower of the 2 aforementioned estimates, BNY could give a potential one-year 17% total return including dividends.

Investor Takeaway

In summary, I believe BNY Mellon is a high quality and moat-worthy business that’s innovating in new areas, such as blockchain technology, which could prove to be a new growth opportunity. It benefits from a wide-reaching asset base, efficiencies, and sticky tenant relationships. BNY also pays a respectable and growing dividend that’s well covered by earnings, and appears to be attractively valued for long-term income and growth.

Be the first to comment