matt_benoit/iStock via Getty Images

Bank of America Could Reap the Rewards of Higher Interest Rates

Fed Chair, Jerome Powell, testified to Congress that the Federal Reserve is committed to fighting inflation with higher future interest rates. On the heels of a 75 basis point hike, the largest increase since 1994, Powell suggested that another 75-point hike is possible as soon as July. Banks tend to benefit from higher interest rates, and yet Bank of America (NYSE:BAC) looks like it’s trading at a discount at the moment. If you are looking to bring more balance to a pessimistic portfolio, and you can stomach the risk that a recession will force the Fed to lower rates, Bank of America might offer upside potential at a good price as a hedge to an otherwise defensive strategy.

Bank Stocks Are Cheap

Given that banks benefit from higher interest rates, something Powell has suggested is on the horizon and something that seems necessary to combat the current high inflation we are experiencing in the US, it would seem to follow that bank stocks could be headed into a favorable environment. According to an Andrew Bloomenthal article on Investopedia, higher interest rates mean “. . . banks can earn more from the spread between what they pay (to savers for savings accounts and certificates of deposit) and what they can earn (from highly-rated debt like Treasuries).” If rates are set to go higher in the near future, as Powell is guiding, banks could be especially well-positioned to benefit. Despite this, bank stocks have been beaten up recently.

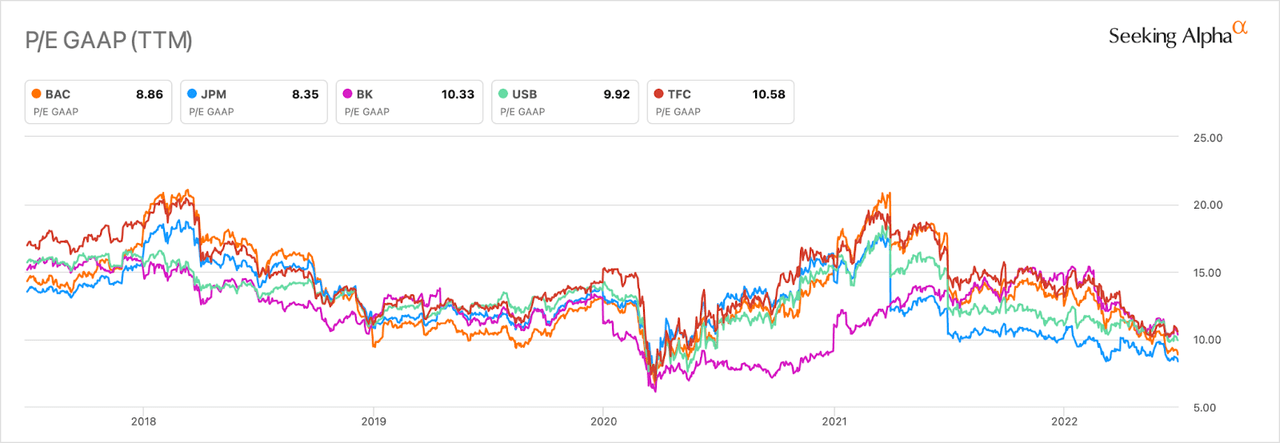

Bank stocks, as a group, have relatively low P/E GAAP ratios at current. Below is a chart that tracks this metric for five major US banks over the last five years. Among this group, Bank of America’s P/E GAAP reading is the second-lowest, and near JPMorgan’s (JPM) slightly lower number over the same timeframe.

Banks Comparison, P/E GAAP (Seeking Alpha)

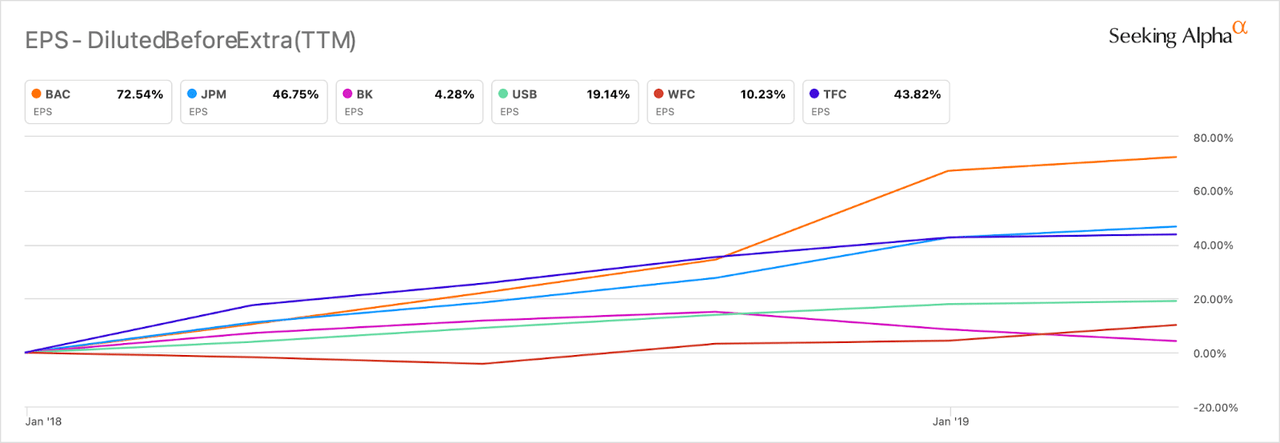

Recently, Bank of America has also demonstrated a superior ability to convert higher interest rates to earnings per share. The graph below shows the change in diluted EPS for Bank of America, JPMorgan, Bank of NY Mellon (BK), U.S. Bancorp (USB), Wells Fargo (WFC), and Truist Financial Corporation (TFC) from the start of 2018 to April 2019. The federal funds rate climbed steadily higher from 1.41 to 2.42 in that span of time. Bank of America expanded diluted EPS at a clip that was about 25% more than the next best performing bank in this group.

Diluted EPS, Comparison of Banks (Seeking Alpha)

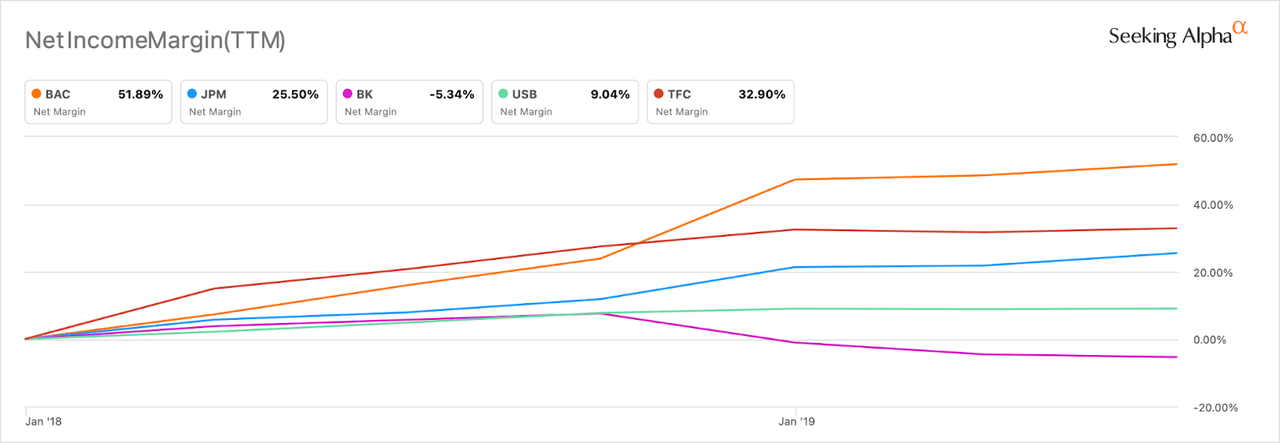

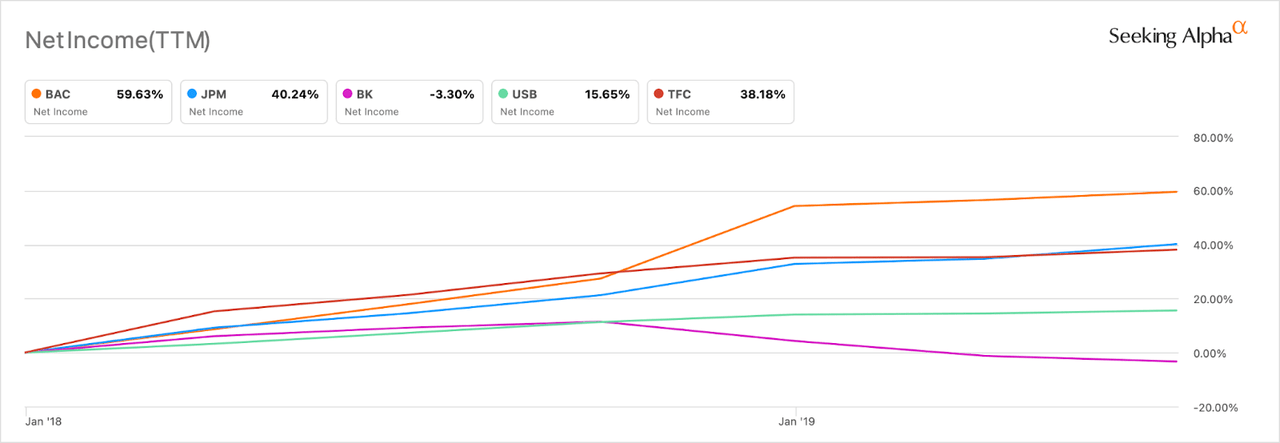

At the same time that Bank of America was growing their EPS numbers, something they and many of their peers achieved, in part, through significant stock buybacks, they were also expanding their net income and net profit margins at an impressive rate. The charts below compare the percent change in net income and net profit margins for the same six banks in the chart above during the same 17 months from the start of 2018. Bank of America was the best of the bunch by a sizable margin in both measures.

Net Income Margin Comparison, Banks (Seeking Alpha) Net Income Comparison, Banks (Seeking Alpha)

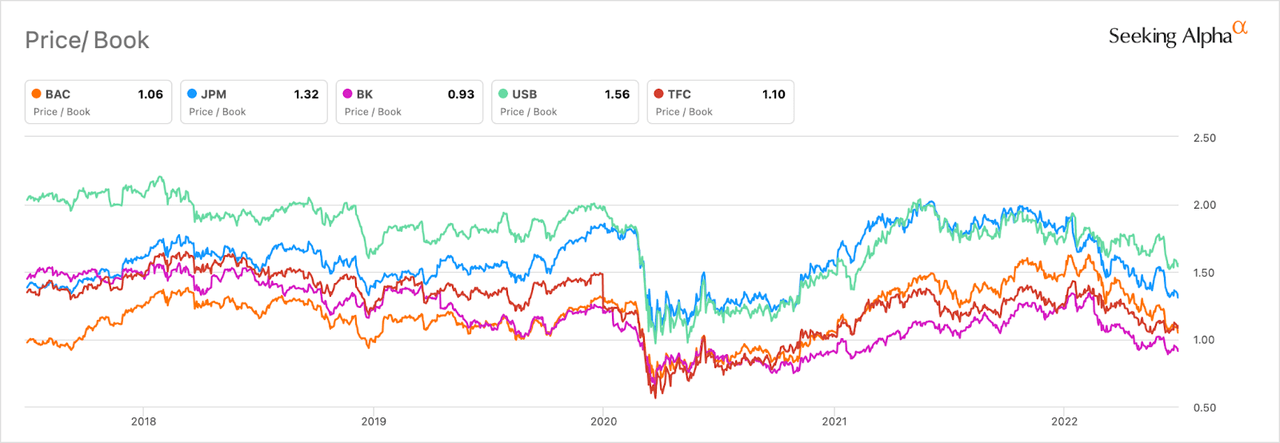

Bank of America’s current 1.06 price-to-book ratio is near the bottom of this peer group as well. At the onset of the pandemic, BAC’s P/B ratio fell to as low as .66, but looking past that unusual stretch of time, a P/B ratio near one is close to the low mark for Bank of America, at least over the last five years.

Price/Book Comparison, Banks (Seeking Alpha)

Since 2010, Bank of America’s price-to-book ratio has been on a general upward trend. For BAC stock to have a P/B ratio near the five-year low (after accounting for pandemic abnormalities) suggests to me that the stock is trading at a discount. If you believe that interest rates are headed higher, this seems like a reasonable entry price. Consider, too, that Bank of America’s dividend yield of 2.68% is close to as high as it’s been since September of 2009.

What’s The Catch?

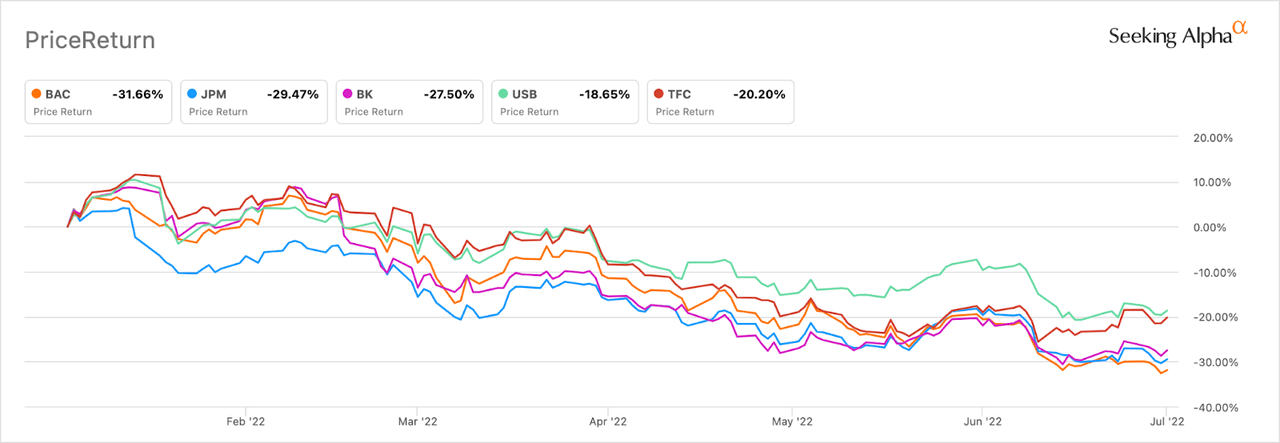

If higher interest rates are good for banks, and the Fed is rolling out steep rate hikes to combat high and sustained inflation, why are investors selling bank stocks? The chart below shows the percent change in stock prices over the last six months for the peer group inspected in the charts above. Bank of America has fallen by nearly 32%, the most of this comparison group.

Stock price change as a percent comparison, Banks (Seeking Alpha)

Based on data from Marketbeat.com, institutional investors are only known to have moved about 1.24 billion out of BAC over the last 12 months. Given Bank of America’s market cap of 254 billion, the fact that the last three months (for which there isn’t much information about institutional buying and selling yet available) resulted in steep declines for BAC’s stock price, and the fact that around 70% of Bank of America shares are held by institutional investors, it seems likely that larger investors dumped a lot of Bank of America stock in the current quarter. Some might view this as a bearish sign, but I think it might be bullish. If the large, skittish investors have already moved out of their BAC position, we’re likely closer to levels of support. Recent 13F filings suggest that Warren Buffett, who owns about 11.5% of outstanding Bank of America shares, hasn’t been selling.

I believe some investors have sold bank stocks because they don’t think the Fed will be able to raise rates much before they have to cut again. We already had a negative GDP reading for the first quarter of 2022, and the Atlanta Fed GDPNow forecasting tool recently dropped below zero, suggesting we’re in line for a negative GDP reading in the second quarter as well. The Federal Reserve has a long history of cutting rates during recessions. If we are already in a recession at the onset of the current rate hike cycle, it could be hard for the Fed to continue raising rates.

Risks

The most obvious risk to this trade idea is that the Fed may have to slash rates to zero again sooner than would be ideal for the banks. For what it’s worth, I think this is the most likely outcome. I’ll explain why I still like this trade in the conclusion section below. The Andrew Bloomenthal passage I quoted earlier in this article reminded us that when rates are high, “. . . banks can earn more from the spread between what they pay (to savers for savings accounts and certificates of deposit) and what they can earn (from highly-rated debt like Treasuries).” Falling rates would undermine this advantage for the banks. It’s also worth thinking about the second half of Bloomenthal’s quote, and whether or not US Treasuries will continue to be considered “highly-rated.” If the US dollar’s status as the world’s reserve currency begins to be questioned as we battle high inflation, Treasuries might be considered increasingly risky.

There is also something meaningfully different about the current rate rise cycle we find ourselves in: the Fed may have to fight high inflation at the continued cost of increasing unemployment. Jerome Powell has already forwarded this possibility. Rising unemployment and high inflation equate to fewer dollars that people can park at their bank. And even though interest rates could be higher in the future, it’s possible that fewer deposits would limit banks’ ability to capitalize on those higher rates. Note that after a big spike in 2020, the personal savings rate has started to inch lower.

Conclusion

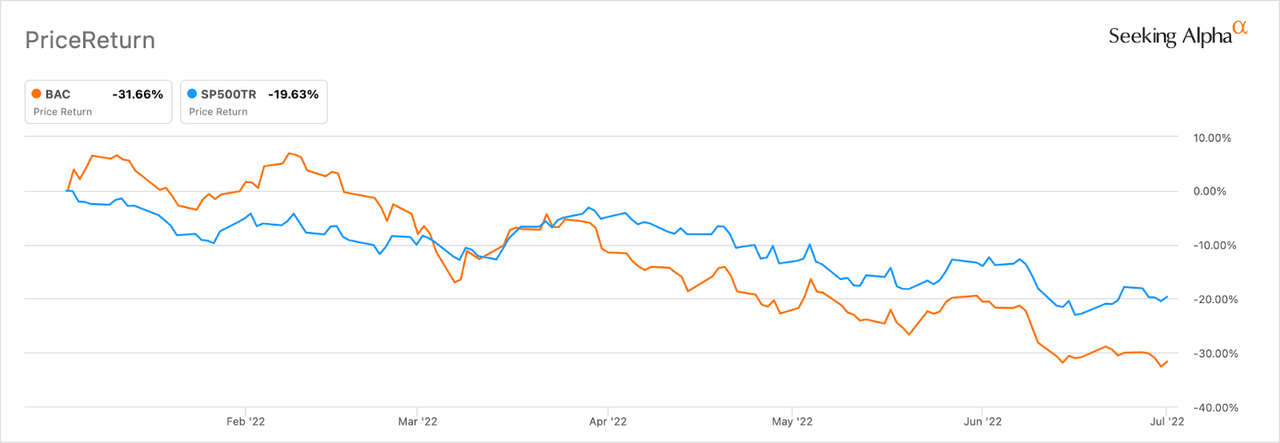

Okay, so if I believe the Fed could slash rates soon, and I’m worried about the impact that possible high inflation and rising unemployment might have on the banking sector over the coming years, why am I recommending Bank of America? It partly comes down to cost. Bank of America has fallen roughly 12% more than the S&P 500 over the last six months.

Stock change as a percent, BAC vs S&P 500 (Seeking Alpha)

Although it isn’t what I think is most likely, I have to acknowledge that there is some possibility the Fed keeps raising rates through a period of rising unemployment to fight persistently high inflation, as they are suggesting they will do. Because Bank of America stock seems, from my perspective, to be on sale at the moment, it offers an opportunity to inexpensively hedge my much more pessimistic portfolio of mostly gold royalty stocks. Bank of America could thrive under circumstances that I think have a low (but not zero) chance of happening. And while I still believe the pessimistic outlook better matches the current economic climate in the US, I don’t think it’s a terrible idea to hedge that thinking when the opportunity to do so looks relatively inexpensive.

Given a general concern I have about the future strength of the US dollar, I find it encouraging that Bank of America’s international exposure is robust. In the 4th quarter of 2021, 63% of Bank of America’s net income came from global banking, global wealth and investment management, and global markets. For reference, the vast majority of JPMorgan’s net income is derived from four main pursuits: consumer and community banking, corporate and investment bank, asset and wealth management, and commercial banking. Having a large international footprint, I believe, reduces Bank of America’s dependence on a US economy that looks somewhat risky from a macro perspective.

I’ve opened up a small position in Bank of America, but I want to stress that my larger bets are behind the thesis that the Fed will cut rates again soon and we will all have to deal with persistently high inflation for a while. My sense is that I am not alone in that thinking at the moment, which might explain why BAC shares have shed almost a third of their value in just six months.

Be the first to comment