Paul Morigi/Getty Images Entertainment

Bank of America (NYSE:BAC) is Warren Buffett’s favorite bank. Making up 12.7% of Berkshire Hathaway’s (BRK.B) portfolio, it’s Buffett’s second biggest position after Apple (AAPL).

Buffett’s Bank of America position doesn’t merely reflect overall bullishness on banks. The Oracle of Omaha famously sold Wells Fargo (WFC) stock in 2020 after a fake account scandal rocked the company. He trimmed other bank stocks the same year. So, it seems clear that Buffett likes BAC more than other banks. It’s obvious that he isn’t blindly buying the entire banking sector.

While Buffett hasn’t said much about his preference for BAC, there are many reasons for any value investor to like it. The stock trades at just 12 times earnings, which is quite low. Also, it has a 1.07% return on assets, which is relatively high, and has a 12% return on equity. JP Morgan (JPM) has somewhat stronger returns on assets and equity than BAC does, but it trades at a higher price/book multiple. So, from a value perspective, BAC wins.

For Warren Buffett, Bank of America’s overall cheapness, profitability and growth make it a long term buy and hold play. This year, the bank offers other characteristics that may make it a worthy play even for investors with a shorter time horizon. In 2022, interest rates are rising, and Bank of America is an extremely asset-sensitive bank. At the end of 2021, it predicted that a mere 1% move in short and long term interest rates would boost its interest income by $6.5 billion. That’s the kind of stock you want to own in a rising rate environment.

Do note, however, BAC specified short AND long term interest rates. If long term interest rates decline while short term rates rise, then Bank of America could see its margins get squeezed. And in fact, we are indeed starting to see short term rates rise compared to long term rates. That’s a risk factor investors need to keep an eye on. In this article I will nevertheless make the case that Bank of America is well positioned to thrive in the current macro environment, as the flattening of the yield curve is not at the level of full-on inversion.

Higher Interest Rates and Inverted Yield Curves: Mixed Signals

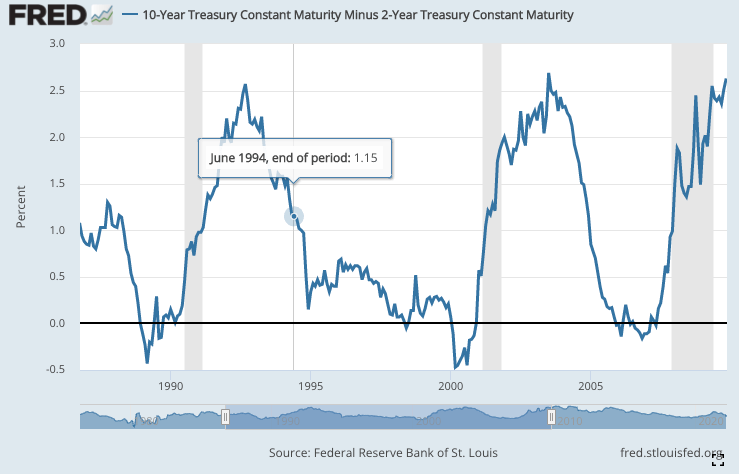

Today’s market environment is giving off mixed signals for bank profitability. On the one hand, interest rates on the whole are rising, which help banks because it increases their loan income. On the other hand, the yield curve is flattening-some say on the verge of inverting-which is generally a negative for banks. The interplay between these two factors is of crucial importance to anybody investing in Bank of America. Momentarily, I will demonstrate that BAC is uniquely well positioned to benefit from the current interest rate environment. First though, let’s take a look at the dynamics at play.

The effect of rising interest rates on banks is easy enough to explain. There is always some kind of spread between the interest banks pay on deposits, and the interest they charge on loans. The wider the spread, the bigger their profit margins. That is, assuming the yields on short term and long term securities are simultaneously rising. If the Fed is selling short term bonds so aggressively that their yields fall below those of the long term bonds, the margin-expanding quality of rate hikes does not materialize.

This leads into the second of our “mixed signals”: the flattening yield curve. Today, the 10 year to 2 year yield spread is just 18 basis points. This means that there isn’t much of a difference between the short term bond yield and the long term bond yield. This sort of thing can get banks into trouble. When the cost of funds (i.e. deposit interest) rises above the interest on long term loans, banks end up paying more on deposits than they are collecting on loans. The end result is negative profit margins.

This is far from academic. It has actually happened in the past. There was a period between 1980 and 1995 when nearly 33% of U.S. Savings & Loan associations failed. That was largely due to the Fed’s interest rates rising above the rates they were earning on mortgage loans. The Savings & Loans companies hadn’t securitized their mortgages before the rate hikes kicked in. As a result, they began losing money.

So, higher interest rates in themselves improve bank margins, but inverted yield curves do just the opposite. This helps explain a 2016 observation by David Wheelock of The Federal Reserve of St. Louis, who noted that empirically, bank margins don’t always go up when rates rise. Specifically, Wheelock observed that bank margins moved in the opposite direction from interest rates in 1990, and in the 2007-2009 period. Both of these periods saw yield curves invert early on. The banks likely issued low-interest loans early in these periods that held back profits for a few years, until the spread increased later on.

Federal Reserve of St. Louis

Bank of America is Highly Interest Rate Sensitive

Bank of America is uniquely well positioned to thrive in the year ahead because it is an asset sensitive bank whose margins increase when interest rates rise. In many of its recent earnings releases, BAC explicitly attributed its net interest income (“NII”) performance to the prevailing interest rates at the time. The first was in the first quarter of 2019, when it said higher increased rates caused NII to surge. The second was in the second quarter of 2021, when it said that NII declined due to lower interest rates.

So, we are seeing clear indications that BAC’s profitability-or at least its NII-rises and falls with interest rates. Overall earnings are impacted by results in other business units, like wealth management and capital markets. But the core consumer bank stands to benefit from interest rate hikes.

What About the Flattening Yield Curve?

As we’ve seen, Bank of America stands to benefit enormously in a scenario where both short and long term interest rates rise. If interest rates at all maturities were guaranteed to move in the same direction, the stock would be a surefire buy this year. But, as we’ve seen, the yield curve is flattening. That is to say, short term rates are gaining on long term rates. As of this writing the 10 year to 2 year spread was a mere 18 basis points. That’s extremely low. For comparison, the spread at the end of April 2020, when most of the world was in COVID-19 lockdown mode, the spread was 44 basis points. So we are now at a smaller spread than we were at in one of the riskiest recent moments in human history.

If this continues then Bank of America may not realize a massive increase in net interest income. However, it needn’t necessarily see its interest income decline. If the yield curve actually inverts, then we may eventually get to a point where Bank of America is paying more on financing than it is collecting on loans. Mortgage rates went well below 3% in 2020. Today, the Federal Reserve is reportedly eying a long term funds rate near 2.75%. So, some of BAC’s mortgages issued in 2020 may squeeze BAC’s margins if they aren’t securitized. However, what we are seeing so far this year is merely a flattening yield curve, not an inverted one. It isn’t an “ideal” scenario for BAC, but it’s not a disaster either.

Financials

Having looked at the macro environment BAC is facing today, we can turn to its financials.

BAC’s most recent quarter was a significant beat, featuring strong growth and profitability. In the quarter, the bank reported:

-

$22 billion in revenue, up 10%.

-

$7 billion in net income, up 28%.

-

$1.2 billion in net interest income, up 11%.

-

$280 billion in average deposits, up 16%.

-

A 10.6% CET1 ratio.

-

$851 million in net reserve release.

Pretty solid results for the quarter. It was also a strong year. In fiscal 2021, Bank of America delivered:

-

$89.1 billion in revenue, up 4.7%.

-

$32 billion in net income, up 78%.

-

$3.57 in diluted EPS, up 90%.

Not only was the growth solid, but we also got an off-the charts 36% net margin. Partially, the strong growth was due to weakness in the base period. The COVID-19 pandemic increased the perceived risk of many banks’ loans. For example, the rise in unemployment made it appear that people would default on their mortgages. Some defaults did occur. But as the year went on, the economy improved, and eventually BAC was able to lower its PCL. Over $851 million in reserves had been released by the end of the fourth quarter; PCL stood at a $489 million benefit.

What all of this adds up to is that BAC is both highly profitable, and relatively fast-growing by bank standards. To be sure, the flattening yield curve could slow things down in the year ahead. But the yield curve has not actually inverted. Overall, the bank should continue to prosper in the near-term.

Risks and Challenges

As you can tell, I’m pretty enthusiastic about Bank of America stock. It’s a solidly profitable business that is uniquely well adapted to today’s macro environment. However, I don’t actually own this stock directly. I have indirect exposure through BRK.B and the Vanguard Financials ETF (VFH), but no individual shares. The reason is that the stock faces enough risks that I’d rather hold it in a diversified package of financials, rather than through an outsized direct share holding. These risks include:

-

Yield curve inversion. Bank of America’s asset sensitivity means it makes more money if yields rise all along the yield curve. A flattening or inverted yield curve does the opposite. If financing costs rise above the interest BAC is collecting then its margins will get squeezed. Even if rates in general are rising.

-

Not the best capitalized U.S. bank. In the fourth quarter, BAC had a 10.6% CET1 ratio. JP Morgan in the same period had a 13% ratio. BAC’s lower ratio indicate that it is less able to absorb losses compared to JP Morgan. It is well above the minimum amount required by law, but still low compared to some of its competitors.

-

The housing market. The U.S. housing market is showing signs of getting overheated. This is part of the reason why the Fed is raising interest rates. If housing remains strong despite the higher rates, then BAC should keep issuing plenty of loans, but at higher interest. That would be a good thing. If, however, consumers found themselves unable to pay their large, high-interest loans, then BAC could face higher defaults. Likewise, if the higher interest rates deterred people from buying homes, then house prices would go down, and BAC would simply be collecting higher interest on smaller loans. So, there are many housing-related risks facing BAC.

All of these risk factors are worth bearing in mind. But on the whole, BAC looks like a worthy value play. The stock is super cheap, while also offering decent growth and big profit margins. It’s not surprising at all that Warren Buffett likes it. If you’re looking to piggyback the Oracle of Omaha in 2022, BAC would be one vehicle through which to do it.

Be the first to comment