visualspace/E+ via Getty Images

Industrias Bachoco (NYSE:IBA) has a fair bit going for it in the inflation regime as well as in the current monetary regime. With quite limited risks in our opinion, we see a late cycle multiple that is difficult to reconcile. With favourable exposures and with geopolitical forces supporting the current pricing environment, the 8x PE multiple LTM seems low. With a nice dividend yield of 2.4%, the company seems like a smart place to park money as the various macroeconomic forces battle with each other for supremacy.

Bachoco Updates

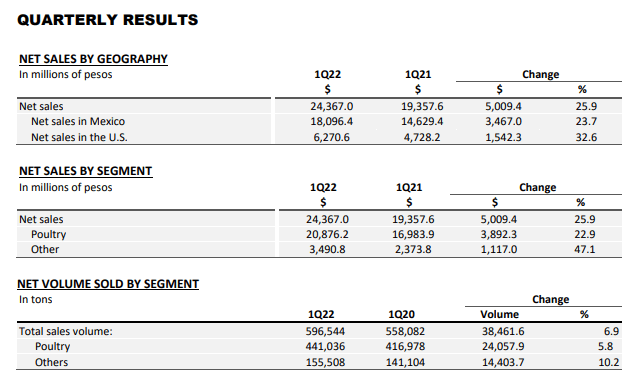

The major forces to discuss for the Q1 2022 call is firstly the geopolitical situation in Ukraine, a major grain producer, causing large amounts of supply to be removed from western markets. Bachoco sells chicken, and therefore, meal prices matter for gross margins. COGS has risen by 27%, with sales rising 25% on pricing translations. While gross margins were slightly compressed from 21.8% to 21%, volumes grew along with unit margins and this profitable throughput caused a 22% increase in operating income.

Income Data (Q1 2022 Pres)

Considerations for Investment Case

The Ukraine situation is unlikely to be resolved soon, so we should expect the current pricing regime to be relatively resilient on sharp supply side upside as the company passes on cost increases for meal proportionately onto the price of the final products. What distinguishes Bachoco in our eyes is how it might be able to deal with the next wave of macro headwinds, the higher interest rates. Food products are attractive because their volumes are more likely to be resilient to crimping of disposable incomes than other products. With a necessity status for the Bachoco proteins, the ability to maintain margins on pretty consistent volume needs remains present, especially as high meal prices, which will persist, should keep players disciplined as limits on imports from the eastern bloc could become even more serious as the years go by, with further sanctions on Russian products, which also includes large amounts of grain. This is our thesis with one of our major holding, Aker BioMarine, which is a feed producer for the aquaculture industry. In fact, the company sees the current EBITDA levels as being representative of normalisable conditions, indicating that the new economic regime which threatens supply volumes of key commodities should keep unit margins elevated for poultry and many other industrial farmers in the future.

This is in stark contrast to the 8x PE multiple, which reflects a quite hefty 12.5% earnings yield that is not consistent with a company that has seen secular and durable improvements in its standing. With end-markets that are resilient on the basis of them being a necessity, we question the need for applying a rather late-stage multiple onto the company. One of the reasons there might be concern reflected in the multiple is perhaps intervention by Mexico in order to establish price controls to protect poorer and more vulnerable families in the country. While price controls and the threat of socialist interventions should always be seriously assessed when present, it appears the government is making a sage move by targeting other avenues for reducing effective prices, including reducing direct taxes on diesel and gasoline as well as on logistics. Moreover, there are longer-term plans to increase local agriculture and land-use, but these do not present an immediate vector of effect.

Conclusions

Another final factor that investors should consider is that the family of Robinson Bours that owns the majority of the shares in the company is preparing a voluntary tender offer for the 30% of the shares not currently owned by them. This is going to be set at the price of 81 Mexican pesos which is a 15% premium from current prices. This would result in the company being taken private if successful. The board will have to either recommend that shareholders accept the tender offer or not, which is below book value but still at a premium to current prices. Since the family is in the process of formally making the offer, authorities will have to authorise it, which could take some time, after which there will be 10 days to turn around a fairness opinion. A 15% premium if achieved in a short amount of time would of course be welcome for a new shareholder. However, with a long-languishing price and the fact that the company would be acquired by the controlling family at below book value, we would prefer that the stock could run free. We think it is likely that the tender offer will succeed since shareholder ownership is so scattered, so investors should be aware that while quite a likely mode of exit, returns are capped.

Overall, a low multiple with good pricing power and resilient economics in a macroeconomic downturn is to the benefit of investors considering investing in Bachoco. With a tender offer quite likely to succeed and offer current investors a nice 15% premium, and if not leave stock in your account that should be relatively well-positioned for the macro environment, the story here is quite interesting. While returns are capped, the possibility of a quick turnaround on the investment with capital appreciation is attractive for investors, but the turnaround is pending legal authorisation which could take some time and drive down IRR. Nonetheless, as a safe investment, we think it warrants investor consideration.

Be the first to comment