PonyWang

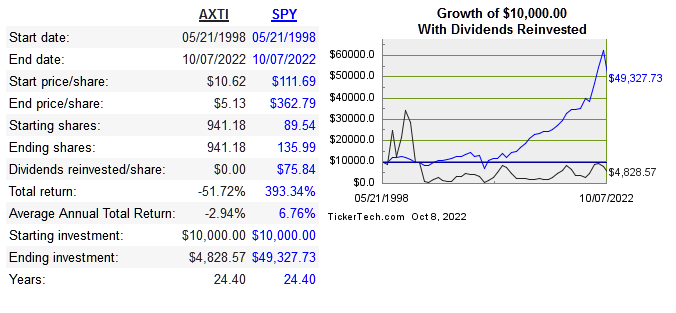

The focus of this article is on AXT, Inc. (NASDAQ:AXTI) versus its peers, not on arbitrage with the recent approval of IPO for their largest subsidiary, Tongmei, on the Shanghai exchange. AXTI was founded in 1986 and went public in 1998, in the midst of the tech bubble. Below is the share price performance since IPO:

dividend channel

Semiconductor companies have become some of the most important to the modern world. The leaders in the space especially have some of the widest moats you can find, and have the stock returns to prove it. AXTI has always been a micro-cap in its tenure as a public company, but this shouldn’t diminish the importance of what they do.

Headquartered in California, all production is done in three different facilities in China. They specialize in developing and producing high-performance compound and single element semiconductor substrates. The global market for semiconductor substrates, also known as wafers, market is estimated to grow at 26% till 2026.

Below are the return on capital metrics compared with peers:

|

Company |

Median 10-Year ROE |

Median 10-Year ROIC |

EPS 10-Year CAGR |

FCF 10-Year CAGR |

Revenue 10-Year CAGR |

|

AXTI |

1.8% |

1.6% |

13.6% |

n/a |

2.8% |

|

-11.2% |

-11.3% |

-26.3% |

n/a |

-10.1% |

|

|

4.3% |

3.3% |

12.3% |

-2.6% |

2.6% |

Capital Allocation

A small dividend has been paid only three times in the company’s history and there are no plans to make this a regular thing. They have diluted share continually, share count grew at 3.8% CAGR over 16 years. They intend to raise capital from the Tongmei IPO when it finally happens. So far capital intensity has been high, assets have grown at 7.4% while revenue only grew 2.8% over the past decade.

Long term debt is at very small levels, only around $2 million. With $45.5 million in cash on the balance sheet, there is no risk as far as leverage. They have no intentions of reducing share count currently.

Risk

A major risk is political since the company is fairly entrenched in the Chinese financial and government system. They have 10 different joint ventures with raw material companies in China. This IPO has been planned since 2020 and they had to raise funds from Chinese investors in order to be listed on the STAR market.

Semiconductor manufacturers use some of the most complicated processes in the world. Any established company inherently has somewhat of a moat due to the cost and complexity of this kind of manufacturing. As for AXTI, there isn’t a strong case for them having a strong moat, because the returns on capital have been very low. This is in addition to inconsistent earnings and free cash flow. I can forgive them for not always having positive accounting earnings, but inconsistent free cash flow, meaning not always positive, is a big red flag for me qualitatively.

Valuation

Share prices peaked last February and came down along with most other stocks. In July however, shares rallied on beating EPS, followed by a 44% decline since then. Below is the comparison of multiples:

|

Company |

EV/Sales |

EV/EBITDA |

EV/FCF |

P/B |

|

AXTI |

1.2 |

7.9 |

-7.4 |

0.8 |

|

ASYS |

0.8 |

21.1 |

-128.4 |

1.4 |

|

PLAB |

0.8 |

2.2 |

3.5 |

0.9 |

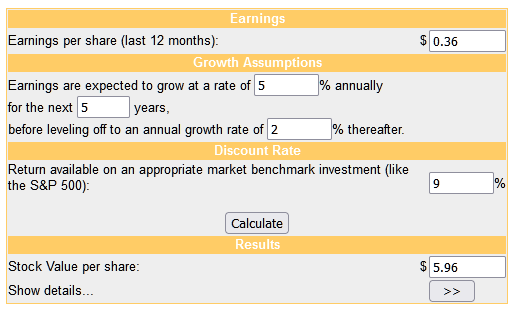

The DCF model below is admittedly very conservative in the earnings growth:

Moneychimp

According to this the stock is close to fair value now. I don’t have the conviction that the IPO on the STAR market will boost share price as the bulls hope it will.

Conclusion

Overall the company has inconsistent free cash flow and profits, and I don’t see this changing anytime soon. The Tongmei IPO could lead to a jump in share price, but there is too much complexity with the foreign listing for me to get excited about. The business quality isn’t high enough to consider as a long-term growth investment. A shorter-term opportunity does exist, but I won’t be participating.

Be the first to comment