ipopba Axsome

Price is what you pay. Value is what you get. – Warren Buffett.

In biotech investing, certain special stocks can continue to rally despite operating in a bear market environment. Such companies tend to have a flurry of catalysts stacked on top of one another. That way, when one catalyst is exhausted, there are other developments that would give the shares another boost.

That being said, Axsome Therapeutics, Inc. (NASDAQ:AXSM), which I have written about before, enjoyed significant rallies from two recent events: the Auvelity approval and the ACCORD data results. Nevertheless, there are much more catalysts going into next year to galvanize more runs. In this research, I’ll feature a fundamental analysis of Axsome while focusing on the next important corporate development. Moreover, I’ll share with you my expectations of this intriguing grower.

Figure 1: Axsome chart.

About The Company

As usual, I’ll present a brief corporate overview for new investors. If you are familiar with the firm, I recommend that you skip to the next section. I noted in the prior research,

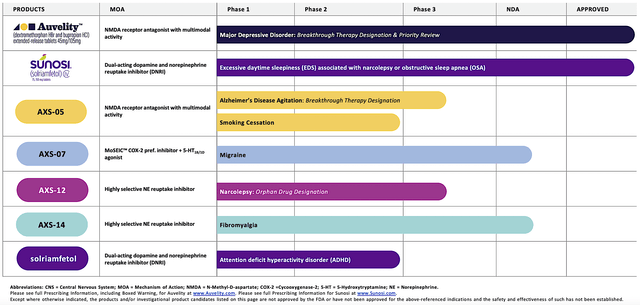

Operating out of New York, Axsome dedicates its efforts to the innovation and commercialization of novel medicines to fulfill the unmet needs in psychiatry. Powering the pipeline are four promising molecules in development, including AXS05, AXS07, AXS12, and AXS14. As the crown jewel of this pipeline, AXS05 is either being assessed or approved for various disorders such as major depressive disorder (“MDD”), agitation associated with Alzheimer’s disease (“AD”), and smoking cessation. By experimenting with multiple uses for a single drug, Axsome can maximize the value of its innovation. That is to say, it increases the chances at least one indication would become a bonanza. That aside, there is another new and commercialized drug (i.e., the Sunosi acquisition).

Figure 2: Therapeutic pipeline.

Early Auvelity Launch Results

Accordingly, let us analyze the latest Auvelity commercialization progress. On that note, most drugs launched in-house tend to take roughly two to three years to see significant sales traction. After all, it takes time for a small company like Axsome to build its in-house sales/marketing team. The professional reps also need to build a meaningful relationship with the clinicians to generate prescriptions.

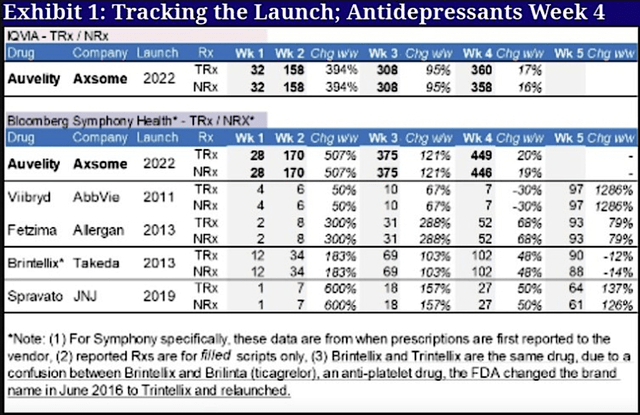

Despite facing launch obstacles, you can see from the figure below that Auvelity is generating significant sales traction. Symphony data showed that the total prescription for Week 4 is already sitting at 360 scripts with a 17% week/week growth rate. Hence, Auvelity trumped even Brintellis of Takeda which garnered a total of 102 prescriptions in Week 4.

Figure 3: Early launch data.

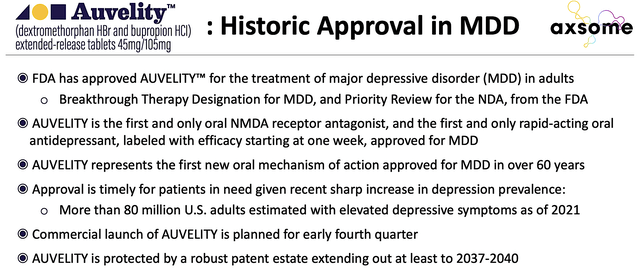

As you can imagine, the significant sales momentum is likely due to Auvelity’s therapeutic profiles for MDD. Precisely speaking, Auvelity delivers a response as soon as Week 1 while demonstrating excellent safety outcomes. Interestingly, the drug is the first novel therapeutic approved for MDD in the past 60 years. That aside, early launch success is likely due to the management’s prudent marketing approach as noted by the CEO (Dr. Herriot Tabuteau):

While it is still extremely early days in the Auvelity launch, we are very encouraged by the interest and reception from the prescriber community thus far. Our first-in-class DCC, or digital centric commercialization, platform is already demonstrating the effectiveness and efficiency of a contemporary, integrated, omni-channel approach to meaningful customer engagements.

Figure 4: Auvelity making history in psychiatric medicine.

Robust Alzheimer’s Results

Shifting gears, you can see that Axsome was heading toward a powerful catalyst that significantly moved the needle on this stock. I previously elucidated:

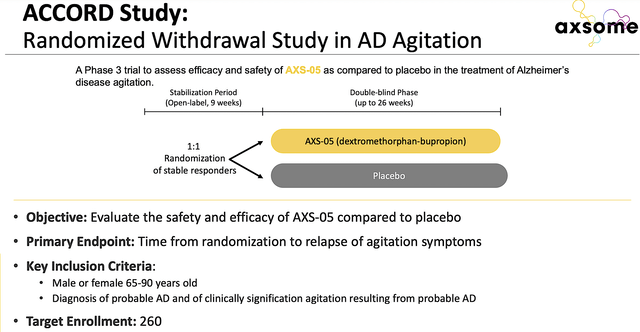

Beyond MDD, you can appreciate that Axsome is positioning Auvelity to become a mega blockbuster with additional label expansions (i.e., for Alzheimer’s agitation and smoking cessation). Of Alzheimer’s, Axsome already finished the Phase 3 (ACCORD) trial. Therefore, you can expect topline results to be reported very soon. If positive, that’ll spark another huge rally.

Figure 5: ACCORD study design.

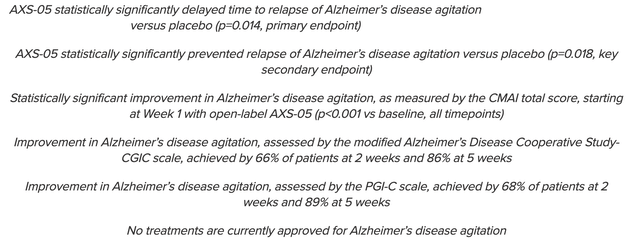

As I forecasted back in September, Auvelity indeed cleared the ACCORD trial with flying colors. That is to say, Auvelity treatment significantly improved the delayed time to AD agitation relapse. Specifically, there was a 3.6-fold lower risk of relapse for Auvelity compared to the placebo. As shown below, the key secondary endpoints were also positive. Since the p-values were all less than 0.05, you know that this is due to Auvelity efficacy rather than random occurrences.

Figure 6: Stellar ACCORD outcomes.

Robust Demands In A Lucrative Market

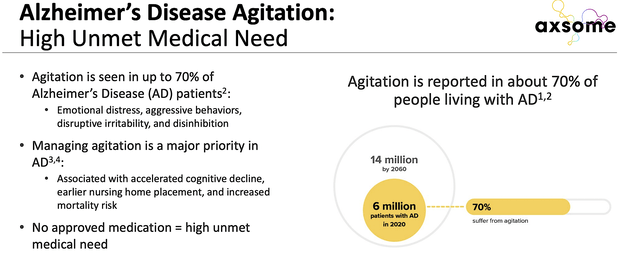

Riding the stellar ACCORD data, you can imagine that Axsome is now in a great position with or without a buyout. That is to say, there is currently no efficacious treatment for Alzheimer’s asides beyond cognitive-enhancing drugs like memantine or Namenda. Novel therapeutics like Aduhelm have yet to deliver convincing efficacy. As such, I strongly believe that the validated ACCORD data positioned Auvelity to capture a lucrative Alzheimer’s market that is in dire need of innovation.

To temper your optimism, Auvelity doesn’t reverse or delay Alzheimer’s disease. Nevertheless, the drug treats the crucial symptom associated with Alzheimer’s (i.e., agitation). Given that 70% of adults living with AD suffered from agitation, there is a heightened demand for Auvelity. You can see that such a demand is as strong as the demand for novel therapeutics to reverse Alzheimer’s. After all, agitation is associated with accelerated cognitive decline, earlier nursing home placement, and increase risk of death.

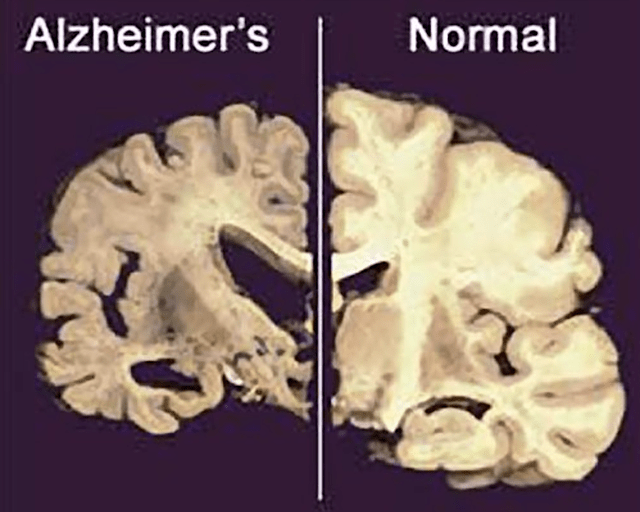

Realistically, I doubt you’ll ever see a drug that can reverse Alzheimer’s due to the “disease context.” The best and most realistic you can see is a novel molecule like Auvelity. That is to say, by the time AD is diagnosed, it already caused permanent/irreversible damage to the brain itself. Though there is “neuronal plasticity,” once the brain structure is dead like how you lost an arm, it’s forever gone. According to the National Institute of Health (i.e., NIH):

In Alzheimer’s disease, as neurons are injured and die throughout the brain, connections between networks of neurons may break down, and many brain regions begin to shrink. By the final stages of Alzheimer’s, this process-called brain atrophy-is widespread, causing significant loss of brain volume.

Figure 7: Alzheimer’s causing brain structure atrophy.

As there is no approved drug for managing agitation, you can bet that Auvelity would capture a monopoly. With 6 million patients suffering from AD agitation, this can translate into billions of dollars in profits. More importantly, Auvelity delivers hope in seemingly hopeless situations. Commenting on the data development, the Director Emeritus of the Cleveland Clinic (Dr. Jeffery Cummings) remarked,

… The results of the ACCORD trial demonstrate convincing clinical activity for AXS05 on agitation associated with AD based on both a significant delay in symptom relapse as well as a reduction of relapse compared to placebo. Treatment with AXS05 during the open-label period in a large cohort of patients resulted in rapid and clinically meaningful improvements in AD agitation. The improvements were especially notable since they were seen on the aggressive symptom subscales of the agitation measures. Agitation occurs in the majority of patients with Alzheimer’s disease and there are currently no treatments approved for this condition. AXS-05 could potentially fill this high unmet medical need for patients and their caregivers, if approved, based on the observed positive efficacy and favorable safety and tolerability results.

Figure 8: Alzheimer’s disease market.

Catalysts Stacking – AXS12 & AXS14

As you’re probably thinking that Axsome already exhausted all its growth catalysts. Notwithstanding, Axsome is a special company with catalysts stacked on top of one another. As soon as the Auvelity approval is achieved, you had your positive ACCORD data catalyst.

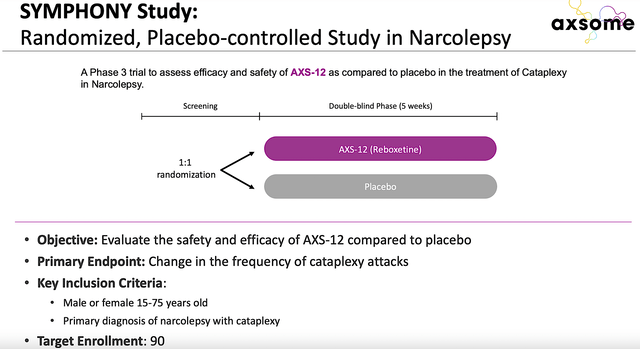

Next in line is the AXS12 SYMPHONY topline results that will be published as soon as 1H next year. That aside, Axsome is poised to submit a New Drug Application (NDA) for AXS14 as a treatment for fibromyalgia in 2023. Additionally, the company will resubmit AXS07’s NDA in 3Q203 with anticipated approval in 2024. Hence, you can see that Axsome would have a quite busy year, just a few months from now.

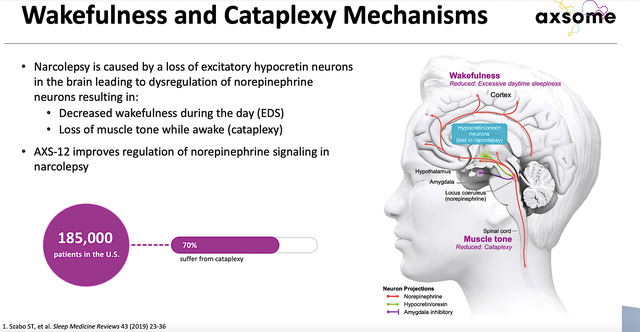

AXS12 for Cataplexy

Given that AXS12 (i.e., reboxetine) is the next big catalyst, you should analyze its upcoming advancement. As you can see, this drug is designed to treat the condition known as cataplexy. As a disorder due to the brain deregulation of norepinephrine (i.e., NE) neurons, patients having cataplexy would develop sudden loss of muscle tone while awake. Additionally, the patient would suffer from decreased daytime wakefulness.

Figure 9: Narcolepsy disease context and AXS12 mechanism of action.

As a highly selective and potent NE reuptake inhibitor, AXS12 plays a crucial role in promoting wakefulness and muscle tone. Already granted the orphan drug designation, AXS12 is being assessed in a Phase 3 (SYMPHONY) trial against a placebo. As you know, the company is set to release data for SYMPHONY in a couple of months from now. A positive data report could rally the shares much higher.

Figure 10: SYMPHONY study.

Financial Assessment

Given that I previously featured great details about the 3Q2022 earnings report, I’ll briefly mention the pertinent metrics in this article. As follows, Axsome procured $16.8M in revenue compared to none for the same period a year prior. That aside, the research and development (R&D) for the respective periods registered $14.8M and $13.1M. Additionally, there were $44.8M ($1.07 per share) net losses compared to $34.8M ($0.93 per share) net declines for the same comparison.

Of the balance sheet, there were $227.5M cash and equivalents. Against the $59.2M quarterly OpEx and on top of the $16.8M quarterly sales, there should be adequate capital to fund operations into 4Q2023 prior to the need for additional financing.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the main concern for Axsome is whether the company can quickly ramp up sales growth for its lead medicine, Auvelity.

Despite signs of strong sales traction, it’s difficult to fully unlock Auvelity value with a small in-house sales force. Moreover, the other significant risk is if Axsome can deliver positive SYMPHONY data in H1 next year. I ascribed a 35% risk of negative data results.

Concluding Remarks

In all, I raised my recommendation on Axsome from a buy to a strong buy with a 4.8 out of five stars rating. After the robust recent runup from the ACCORD data catalyst, Axsome has proven itself as a bear-deterrent stock. The company is now a commercialized-stage operator with highly promising medicines. Though I don’t expect Sunosi to become a blockbuster, Auvelity is on its way to proving itself as one. Early in the launch, Auvelity garnered strong prescription growth. Going into next year, the stock can enjoy another huge rally with the upcoming data release for SYMPHONY. If you are patient with Axsome, this stock should handsomely reward you with multiple-fold upsides.

Be the first to comment