Cindy Ord

The AXS 2X Innovation ETF (NASDAQ:TARK) provides 2x leverage to the ARKK ETF through total return swaps. A levered exchange-traded fund (“ETF”) on a highly volatile asset like ARKK is a recipe for disaster, as returns will be eaten away by volatility decay.

Fund Overview

The AXS 2X Innovation ETF provides 2x daily levered exposure to the ARK Innovation ETF (ARKK).

Strategy

The AXS 2X Innovation ETF aims to magnify the daily returns of the ARK Innovation ETF through the use of total return swaps with investment banks.

Investors are encouraged to read some of my previous articles detailing the mechanics of levered ETFs. The key concepts to understand are that levered ETFs have “positive convexity” (exposure grows as the investment trades in one’s favor) and “negative decay” from volatility and daily rebalancing.

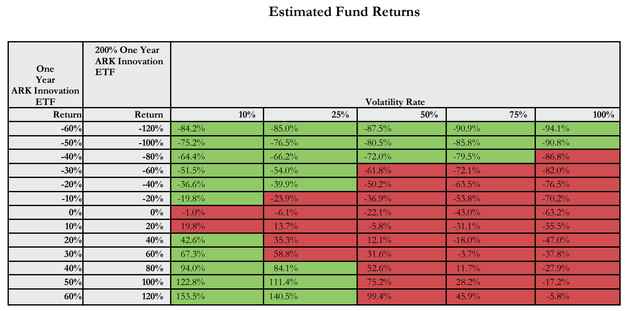

Figure 1 shows estimated returns of TARK depending on the returns of ARKK and the underlying volatility. From AXS’s estimates, TARK’s return can be significantly better than twice the ARKK ETF’s return, if returns are positive and volatility is low. However, when volatility is high, TARK can perform significantly worse than expected.

Figure 1 – TARK estimated fund returns depending on underlying returns and volatility (TARK prospectus)

Returns

TARK was only launched on May 2, 2022, so it has very limited operating history. However, in that short period of time, TARK has been able to lose an incredible 65% of its value to November 28, 2022 (Figure 2). This is more than twice the loss of the underlying ARKK ETF.

Figure 2 – TARK vs. ARKK total returns (Seeking Alpha)

Distribution & Yield

The TARK ETF does not pay a distribution.

Fees

TARK charges a 1.15% net expense ratio after fee waivers.

Is There A Point To TARK?

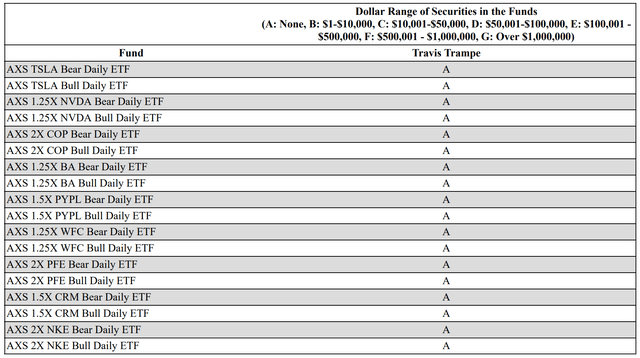

Basically, any asset class can be placed into a levered ETF product, provided there is investor demand and the investment banks are willing to trade total return swaps with the fund sponsor. For example, AXS, the sponsor of TARK, have also launched levered ETFs on single stocks like Tesla and NVIDIA (Figure 3).

Figure 3 – Single stock levered ETF sponsored by AXS (TARK prospectus)

The question is, is there a point to all these levered bets? Investors need to realize that making levered bets on highly volatile assets like the ARKK ETF is a recipe for disaster.

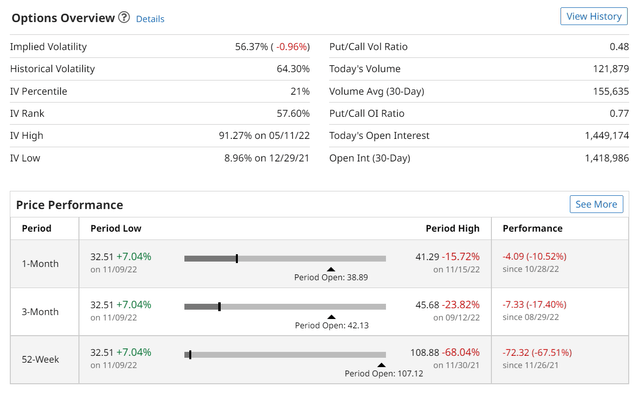

ARKK currently has option implied volatility (“IV”) of 56% and a 20-day realized volatility of 64% (Figure 4). ARKK’s current level of volatility is actually on the low side of recent history, as its current IV is only in the 21st percentile of the past year.

Figure 4 – ARKK IV and realized volatility (barcharts.com)

From figure 1 above, we can see that in almost all scenarios, when the underlying asset class’s volatility is as high as ARKK’s, investors are going to underperform with the levered ETF due to volatility decay.

If investors truly want levered returns on volatile assets like ARKK, they may want to consider using alternative investment strategies such as buying the asset on margin (avoids volatility decay at the expense of potentially losing 200% of one’s capital) or buying long-dated options (the most one can lose on options is the premium, but the premium will have theta decay). Please note I am not advocating for either strategy. As Warren Buffett once said, “there’s only three ways that a smart person can go broke…liquor, ladies, and leverage.” I try not to go broke through leverage.

Conclusion

The TARK ETF provides 2x leverage to the ARKK ETF through total return swaps. A levered ETF like TARK on a highly volatile asset like ARKK is a recipe for disaster, as returns will be eaten away by volatility decay. I fail to see the reason for TARK’s existence except for short-term gambling.

Be the first to comment