Marti157900/iStock Editorial via Getty Images

One of my ex-girlfriends once characterised me as “disagreeable to the point of extreme curmudgeonliness.” When she said that, I was a bit offended by the understatement, but I agreed with her general point. I often seek out opportunities where I can disagree with the majority opinion. With that as background, I thought I’d have a look at AMC Entertainment Holdings Inc. (NYSE:AMC). The shares have dropped in price, and that sort of thing draws my attention. I’ll determine whether or not it makes sense to buy this name in a few ways. First, I want to examine whether or not theatres are recession resistant or not. I’ll then look at the financial history here, and will conclude by looking at the stock as a thing distinct from the underlying business.

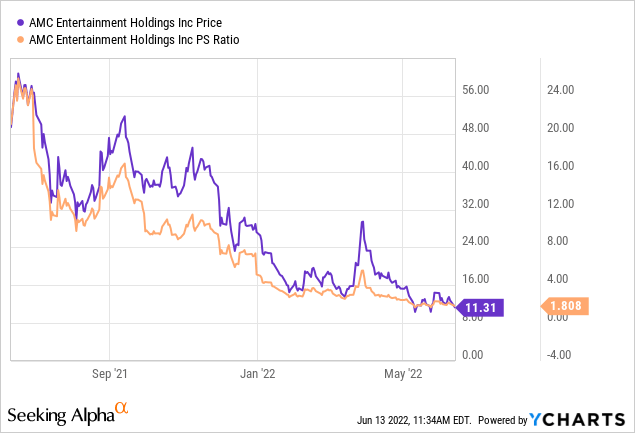

Welcome to my perennial “thesis statement” paragraph. I put these in every article to help investors avoid as much of my tedious writing as possible. I have been known to get a bit long winded with my prose, and so I put this paragraph at the front so you can get most of the ideas “flavour” at a fraction of the ponderous read “calories.” You’re welcome. I’m of the view that the old adage that theatres are recession proof is out of date. In general, theatres are negatively impacted by competition from alternative sources of entertainment (streaming) and the fact that “Hollywood” seems to have alienated a substantial portion of its audience, at least for the immediate term. In spite of this, AMC has held up rather well until Covid struck. I was impressed to learn that. I’d also say that they’re making great strides at returning to normal. The problem for me is that the market seems to agree with this assessment, and has bid shares up as a result. I think 1.8 times sales is too high a price for a business of this nature, and for that reason I would recommend that investors eschew the shares. If you own it, I think the best course of action for you would be to sell it. If you were considering buying it, I think you would be wise to hold off until the price drops to the $6 per share territory.

Theatres Becoming Less Recession Resistant

I was always of the view that movies were recession proof, or at least strongly recession resistant, because, in times of economic stress, people take refuge in pyrotechnic extravaganza starring artists like Dwayne “The Rock” Johnson, Steven Seagal, Mel Gibson, and many other “A listers.” As this writer describes it, “in tough economic times, Hollywood really does offer escapism (not just in an interior sense, but in a physical sense – the theater is an escape from work and home) for a relatively small price.” In the past, the only issue I would have taken with the above quotation is the fact that the writer misspelled “theatre.” Everything else seemed reasonable to me.

It turns out though that this may not be true, and that theatre chains may actually be more susceptible to recessions than once believed. Exacerbating this problem is the fact that companies like Netflix (NFLX), Amazon (AMZN), Hulu, and others didn’t offer entertainment delivered to the home in the past. This obviously calls into question any comparisons to prior periods. Even the most ardent critics of streaming services must concede that they offer entertainment without the need to face traffic, pay for parking, get in line, and sit in a crowded theatre. Also relevant in times of economic stress is the fact that a streaming subscription is extremely cheap on a per movie basis.

This is likely one of the reasons why the theatre business was in decline before Covid. To give you a sense of the rate of decline, in the United States, total theatre admissions were ~1.36 billion in 2012, and were ~1.244 billion by 2019. That is a decline at a CAGR of 1.1%. For context, over the same time period, the population of the United States grew at a CAGR of ~0.6%. .

I’ve seen two movies over the past three weeks. They were “The Unbearable Weight of Massive Talent” and “Everything Everywhere All At Once.” I recommend both films very highly. More interesting for our purposes was the fact that I had an opportunity to talk to the theatre managers for about 10 minutes during the commercial messages that pass for trailers these days. Both agreed that theatre attendance was down massively from the same period in 2019 (one said “about 70%” the other “about 50%”). Both were optimistic that things would pick up again after we get a few more blockbusters.

This is troublesome in my view. If there were about 116 million fewer tickets sold in 2019 than there were in 2012, and the current year is down “massively” from the anemic 2019, that’s a spicy meatball. So, in my estimation, Covid exacerbated and very dramatically accelerated a trend that was underway for years.

I see nothing on the horizon that leads me to believe this trend won’t continue. Using myself as an example, if I could have watched “The Unbearable Weight of Massive Talent”, for instance, in my residence, surrounded by my favourite self-destructive hobbies, I would have done so. I’m not that much different from any other consumer who likes watching movies.

In addition, we can’t ignore the obvious shift in the culture. If you read the comments section from this post, for instance, and track the upvotes of the same, you’ll get the sense that, rightly or wrongly, a large number of people believe that most of modern media is produced by censorious elitists who hold views that are anathema to the American movie going public. It seems that said movie going public doesn’t adore it when “Hollywood” lectures them about their apparently long and varied list of moral failings. Tell your audience their “bad” and they abandon you. Who could have foreseen that one?

I’ll end this rant with a personal story. Given that I spell words like “favourite” and “theatre” properly, you may have inferred that I’m a non-American. Add to that the fact that I had a large number of film and television professionals as clients when I worked on Bay Street (Canada’s deeply insecure baby brother to Wall Street), and I think I’m uniquely qualified to make this observation. These professionals worked on both sides of the Canada-U.S. border. It was frequently the case that whenever the subject came up, the imminent and inevitable failure of the American system was right around the corner for various reasons, but chief among these is the notion that it’s apparently a “racist country in massive decline.” When I would ask something awkward like “if it’s so hellish there, why the massive line ups I see at the U.S. embassies in Toronto and Dublin? Or the even greater numbers flowing in from other places? Is it the case that the legions of people trying to get in are just ignorant, or do you not know what you’re talking about?” Such questions give you another insight into why my social life is in its current state. That aside, when I asked such uncomfortable questions, I was typically greeted with the silence of the ignorant or angry sputtering. I regale you with this tale to point out that in my experience, there’s some truth to the idea that filmmakers are uncomfortable with many aspects of the American experiment, and they are very comfortable offering those critiques in their work. Anyway, unless and until the “Hollywood hates me” perception goes away, this problem will linger for the likes of AMC in my view.

AMC Financial Snapshot

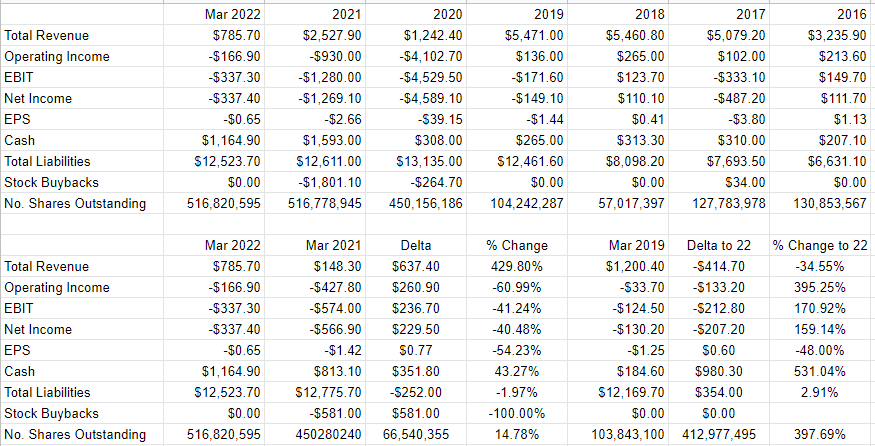

A review of the financial performance here revealed to me some surprising positives. First, the long run financial picture is not nearly as bad as that presented by the data above. In fact, prior to Covid there was some reason to be cautiously optimistic. For instance, between 2016 and 2019 revenue was actually up by about $2.2 billion, or just over 69%. While fewer tickets may have been sold in aggregate over this time, between 2016 and 2019, admission revenue was up just over $1.25 billion, or 61%. At the same time, food and beverage revenue was up $700.5 million, or 68.75%, and “other theatre” was up $282.7 million or just under 169%. Note that “other theatre” means things like advertising, gift cards, theatre rentals and the like. It seems that AMC was able to grow in the teeth of an industry in decline.

Second, the company seems to be recovering very nicely from the pandemic period. Specifically, revenue during the first quarter of this year was about $637.4 million higher than the same period a year ago, and net income is better by about $229.5 million, up from a loss of $566.9 million last year to $337.4 million this year. Additionally, the capital structure has improved from last year to this, with cash up over 43% to $1.164 billion, and total liabilities down by ~$252 million.

Unfortunately, 2021 offers an artificially easy comparison period for obvious reasons. When we compare the first quarter of this year to the same period in 2019, things look less good as we’d expect. Revenue was still $414.7 million lower during the first three months of 2022 relative to the Q1 of 2019. At the same time, net income was $207 million lower. Additionally, share count has exploded nearly 400% from 2019 to now. On the bright side, though, total liabilities are up by only 2.9% from 2019 to 2022.

All of this suggests to me that this company seems to have managed to navigate the many headwinds this industry has faced over the years reasonably well. I don’t expect much in terms of profits anytime soon, but I’d be willing to pick up a few shares if the price is right.

AMC Financial History (AMC Entertainment Holdings Inc. investor relations)

The Stock

I’ve written more than once on this forum that I consider the stock and the business to be very different things. Specifically, every business buys a number of inputs, performs value-adding activities to those, and sells the results at a profit. In the final analysis, that’s what every business is. The stock, on the other hand, is an ownership stake in the business that gets passed around in a market that aggregates the crowd’s rapidly changing views about the future health of the business. There’s often a very strong disconnect between the price of the stock and what’s going on at the business. We all believe this, otherwise, we wouldn’t be on this platform. Compounding the quickly moving views about the crowd’s views about a given company is the fact that a stock can be buffeted by the crowd’s view about “the market” in general, and have very little to do with what’s going on at the company. This is troublesome, but I think we can take advantage of this tedious phenomenon. We take advantage of it by acknowledging that the only way to make money in stocks is to spot the difference in expectations embedded in the current price, and subsequent reality. Put another way, I think that a great, profitable business can be a terrible investment if you overpay for the stock. I’m also of the view that a terrible business has the potential to be a great investment if you can get it at a sufficiently great discount to intrinsic value. If the assumptions embedded in the price of the profitable business are too rosy, the stock will likely disappoint. If the assumptions embedded in the price of the struggling business are too pessimistic, the stock may eventually flourish. I should also point out that it’s typically the case that the lower the price paid for a given stock, the greater the investor’s returns over time. This idea shouldn’t need any explanation or elaboration.

I measure the relative cheapness of a stock in a few ways ranging from the simple to the more complex. On the simple side, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. I like to see a company trading at a discount to both the overall market, and to its own history.

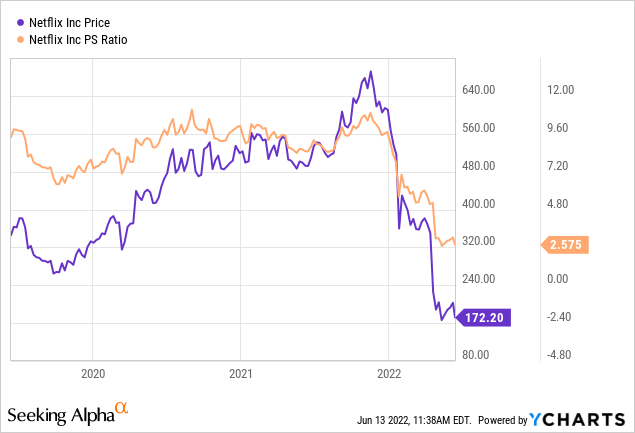

Although this stock is cheaper on a price to sales basis than any time over the past year, they’re still changing hands at 1.8 times, which I consider to be fairly optimistic for a business that’s declined this dramatically. To put this 1.8 figure in context, the market is paying only 29% less for this stock on a price to sales basis than it is for mighty Netflix, per the following. In a world where every investment is equally available to us, I would expect these shares to be much cheaper on that basis.

In my view, the stock has much more downside than upside from here, specifically I think the shares may represent value when they’re trading for ~1 times sales. This implies further downside from here. The overall market seems to be heading lower. Additionally, the yield on the risk free 10-year note is now at 3.334%.

I don’t think AMC is compelling enough to buck the overall downtrend in the market. Additionally, I don’t think AMC’s future is sufficiently compelling to make it much more enticing than a 10-year note where the future is certain. Thus, I think it would be wise to avoid this stock for the moment. I think if you’re invested in AMC already, you should take your lumps and get out. If you’re considering buying AMC, hold off until the price becomes much, much more attractive. If anyone asked me, I’d be comfortable buying at the $6 per share level, assuming no major changes from here.

Conclusion

In a world where an investor can put their capital to work in a 3.3% 10-year Treasury note, I think there’s no reason to buy AMC Entertainment Holdings Inc. In a world where the overall market seems to be heading lower, I think there’s no reason to buy AMC Entertainment Holdings Inc. In a world where much more powerful peers that represent the future are trading at a very slight premium to it, I think there’s no reason to buy AMC Entertainment Holdings Inc. If you own this, I think the best course of action would be to salvage the capital you can. If you were considering buying, I would recommend hold off until the market gets to ~$6 per share.

Be the first to comment