Roger Utting Photography/iStock Editorial via Getty Images

Leading global rental car company Avis Budget Group Inc. (NASDAQ:CAR) has been plagued by short-sellers through the pandemic, and justifiably so, but the fundamentals are shifting. CAR is now leaner and better positioned to leverage a cyclical rebound as economies reopen post-COVID and travel restrictions are lifted.

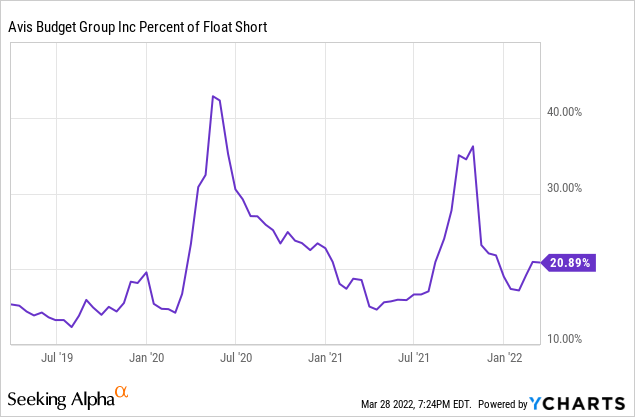

Net, increased leisure demand for rental cars and a leaner, more flexible cost structure should allow CAR to sustain structurally higher margins and steady earnings growth going forward. Plus, the balance sheet is the strongest it’s been for years – the cost of fleet financing is on the decline, and leverage levels are very manageable with no near-term maturities, creating ample flexibility for more shareholder-friendly capital allocation decisions. The latest buyback authorization is a key catalyst as short interest remains elevated, creating a compelling setup for another short squeeze scenario to play out this year.

Upsizing the Buyback

Buybacks have been top of mind for CAR in recent months – the company repurchased $1.4bn in stock in the back half of last year (equivalent to ~14.2m shares or >20% of shares outstanding pre-authorization). Most of the buybacks were done in 3Q, with CAR repurchasing ~$463m in 4Q at a decelerating pace. Per company disclosures, CAR only repurchased ~$136m through November/December following the short squeeze, likely reflecting management’s opportunism.

Since then, however, the stock has normalized lower, and although management sent out mixed signals on the 4Q call, leverage levels of 1.5x at year-end (almost two turns below the 3-4x target) meant the company was always likely to reconsider buying back shares opportunistically. So, it came as little surprise that Avis announced another $1bn in share buyback authorization this month – clearly, management still believes the stock is undervalued and, in my view, has turned to the additional buyback as a means of catalyzing a higher pro forma valuation.

Sizing the Potential Buyback Impact

If we account for the additional $1bn authorized by the Board, CAR now has $1.16bn to deploy for the year. Reconciling this with the $959m remaining in authorization as of 2021 and the $160m in excess of the latest authorization, this implies ~$800m of buybacks through Mar 16th (the date of the $1bn buyback announcement). Thus, depending on how much of the $800m was deployed after Feb 11th (the release of its 10-K filing) when CAR disclosed 53.8m shares outstanding, the share count could now be closer toward the ~50m mark (assuming a $200/share average).

So how much further could CAR shrink the float? Assuming a ~$250 share price sustains into the end of the year, CAR would have enough to buyback ~4.6m shares based on the $1.16bn authorization. This would also mean CAR likely ends the year with 45.4m shares outstanding if Avis utilizes its entire buyback authorization (or a ~10% tailwind to EPS). The more interesting angle to this play, in my view, is the implication for the shorts – given >20% of the float (>7m shares) is currently sold short, this would imply Avis has the firepower to squeeze a significant amount of the short interest over the course of the year.

Robust Balance Sheet Creates Optionality

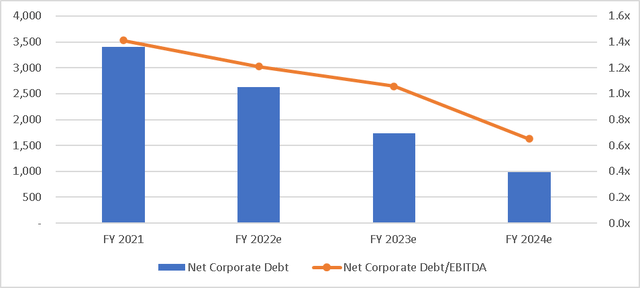

Fundamentally, buybacks are a good signal – CAR’s additional buyback authorizations indicate management and the Board see value in the stock, and thus, buybacks have been the go-to capital deployment strategy thus far. More importantly, though, CAR has the balance sheet to support its buyback plans – even with the additional buyback, Avis is on track to generate $1-1.5bn of FCF this year, which should result in ~$2.5bn of net corporate debt (i.e., excluding fleet debt) in 2022.

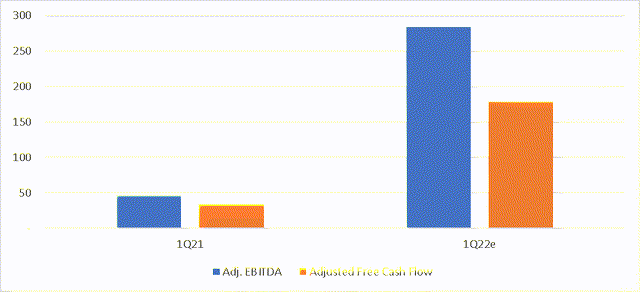

Assuming the 1Q momentum sustains, there could be upside to this figure – while management refrained from providing forward guidance this time around, the 4Q commentary indicated cost and revenue optimization efforts are taking hold and should drive CAR’s best 1Q adj EBITDA outcome in years (1Q tends to be a seasonally weak quarter). This outlook also accounts for the seasonal weakness in volumes coming off the Omicron variant impact, so a post-pandemic rebound in the coming quarters should support 2022 outperformance, in my view.

The company already had a comfortable liquidity position of ~$757m at end-2021, with an additional $2.6bn of fleet funding capacity and net leverage of ~1.4x – the lowest ever reported by the company. With FCF also set to inflect higher, I see limited risk to credit ratings from the upsized buyback. Even if management allocates some funds for a partial redemption of EUR900m of callable EUR bonds, the FCF alone should more than cover the funding requirement. Given the ample headroom, I think more agencies could follow S&P’s recent upgrade to BB/stable (from B+), providing another potential balance sheet catalyst for the year.

A Cyclical Rebounder with a Short Squeeze Catalyst

CAR benefited from a significant short squeeze last year, and management appears to be reusing the playbook again with $1bn of additional buybacks authorized for the year. Clearly, the Board sees value here, and with the improved balance sheet flexibility, buybacks should set a floor on the stock price going forward.

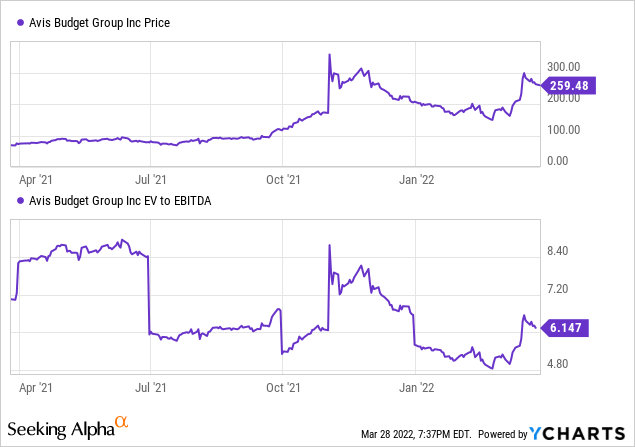

To be clear, the CAR story isn’t all about the short squeeze potential – fundamentally, the outlook is as strong as it’s ever been, with post-pandemic margins structurally higher and disciplined industry-wide supply/demand trends also driving pricing sustainability. Beyond the current buyback authorization, the rising cash generation should provide further balance sheet catalysts going forward, not only from buybacks (likely to be the priority unless the stock price pops) but also from further deleveraging (and potentially rating upgrades) as well as growth-driven M&A. At ~6x EV/EBITDA, the YTD stock price rally still has legs.

Be the first to comment