Vertigo3d

Overview

I believe AvePoint (NASDAQ:AVPT) is undervalued by 15%. The company is well-positioned to capitalize on the long-term trend of digital transformation, as it offers scalable solutions that can be easily adapted to the needs of businesses of various sizes. Additionally, AvePoint has strong relationships with key industry stakeholders, which gives it an edge over its competitors.

Business description

AvePoint operates as a software company. The business develops cloud-based software for transferring data, controlling IT operations, and protecting sensitive information.

Digital transformation is a long-term secular trend

First of all, in my opinion, digital transformation will soon be the top priority for IT spending by businesses. Priorities in IT have typically been set by the IT department of a company, however, decisions about how much money should be spent on digital transformation are increasingly falling under the purview of business unit executives. Business unit leaders want to put their money into projects that will increase their company’s profits, streamline its operations, and give them an edge over the competition. The good news is that spending on technology is rising, but IT departments have less say over the money spent on productivity solutions than other parts of the business, such as marketing and sales. However, most IT professionals are still tasked with the duty to keep these systems running, secure the data they generate, and help businesses integrate them. Worse yet, COVID has accelerated the imperative for transition and adaptation to ad hoc, distributed teams.

Secondly, tech giants like Microsoft (MSFT) are making waves by laying the groundwork for the new modern workplace with Microsoft Teams, an expansion of the company’s popular Microsoft 365 suite of services. My guess is that the ultimate aim is to create a unified platform that facilitates all kinds of people-centered collaboration across all kinds of features and applications. From what I’ve seen in my workplace and heard from people in other industries, or even the news, it is apparent that companies are implementing more cutting-edge technological solutions to boost the employee workplace experience.

The question is why IT is not centralizing collaboration services as quickly as end users would like. I think the solution lies in increasing the level of complexity. Organizations that are considering making the move from on-premises to the cloud, or consolidating cloud platforms, do so at their own risk and in the face of heightened security and privacy concerns as well as regulatory oversight. Cutting costs and doing more with less is still a top priority in today’s competitive business environment, where operations and markets are threatened by factors like COVID-19. To me, this indicates a growing need for tools that enhance digital teams’ capacity for productive cooperation.

Solutions serve the needs of all business sizes and have a global reach

I think AVTP has been successful because it can meet the needs of SMBs, multinational corporations, and even companies that have specific cloud-related needs despite being part of a larger industry. This success stems from AVPT’s capacity to automatically scale up its solutions to meet the needs of businesses of varying sizes. Additionally, these solutions are scalable across both various cloud architectures, even those employed to ensure data sovereignty or obtain Federal Risk and Authorization Management Program certification. In my opinion, this makes things easier for customers because they can work with a single provider who can adapt to their changing needs as their business expands.

In addition, AvePoint’s products are available in over 100 global marketplaces, allowing managed service providers to launch products quickly and enjoy flexible monthly billing options. This, in my opinion, simplifies implementation and increases AvePoint’s exposure to the SMB market. AvePoint’s ability to serve clients from all over the world gives it a competitive advantage over local players as the world becomes more interconnected.

Strong industry relationships with stakeholders

AVPT, in my opinion, has a leg up on the competition thanks to its early access into technology adoption programs. Several AVPT staff members who have been promoted to Most Valuable Professionals or Regional Directors at MSFT, according to the S-1. In addition to their close ties with Microsoft, AVPT could also call upon staff of former records managers and members of the International Association of Privacy Professionals, according to the S-1, to provide insight and advice as they work with clients to find effective solutions.

This access is crucial because it gives AVPT a direct line to the ground and the ability to learn about current trends and the requirements of their clients. As a result, AVPT may have a significant first-mover advantage over competitors who lack such access and miss out on capitalizing on the coming demand surge.

Adopting AVPT would lower the total cost of ownership

In contrast to custom software development, cobbled-together point solutions, and non-SaaS enabled solutions, adopting AvePoint Cloud does not necessitate any investment in hardware on the part of the customer and imposes no additional burden on the operations team in terms of installation, maintenance, or the automatic rollout of upgrades and enhancements. To put things into context, a cloud backup customer with 5000 users can save up to $2 for every $1 they would have spent on a self-hosted backup solution, according to the S-1. In addition to being immediately cloud-testable, AVPT’s solutions also allow IT teams to scale to meet the growing technological demands of businesses.

Various growth strategies available to extend the growth runway

There are more than 300 million Microsoft 365 users globally. As MSFT converts and captures more users, I expect the number of people using Microsoft 365 to continue to rise. In my opinion, this is a huge opportunity for AVPT to expand into, especially considering the prevalence of Microsoft 365 and the need for SaaS data management solutions. In my opinion, there are two main growth drivers for AVPT.

First, incorporate complementary offerings to enhance its cloud data management narrative, drive growth within existing accounts, and ultimately raise the lifetime value of each customer. AVPT technology will benefit both businesses and individuals if it is designed with the customer in mind. AVPT could also expand its total addressable market by spending money on multi-cloud development in addition to Microsoft’s cloud services.

Second, utilize a channel-distribution strategy to expand into the SMB market. I believe that AVPT will be able to expand into new markets by forging strategic alliances and enlisting the help of channel partners in these endeavors. It’s noteworthy because SMBs employ 60% of the world’s labor force, and AVPT estimates that SMBs could make up as much as 50% of the number of seats for Microsoft 365 (according to AVPT filings). In my opinion, SMBs represent AVPT’s fastest-growing segment of revenue and seat acquisition; consequently, AVPT should focus their efforts on this customer base by increasing their investment in channels distribution. I also expect AVT’s Channel business to expand significantly because of their leadership position as a SaaS data management provider with enterprise-grade features.

Forecast

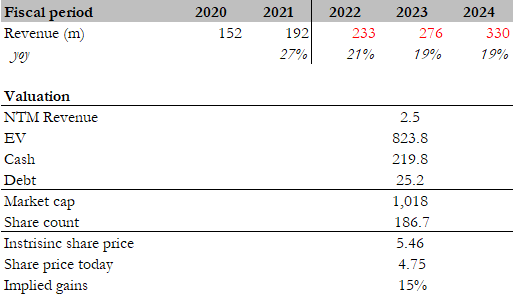

According to my investment thesis, I expect AVPT to grow as guided in FY22, reaching $233 million in revenue. Given the above-mentioned strong secular trend, I believe AVPT can continue to grow along with the industry and sustain its growth moving forward in the ~20% range. The business is not generating any profits today due to reinvestment into the business – a right move in my opinion – as such it should be valued on a forward revenue basis.

Overall, I anticipate $330 million in revenue for AVPT in FY24.

If AVPT does this and trades at the same forward revenue multiple as it does now, it should be worth $5.46 in FY23. This is about 15% higher than the current share price.

Author’s estimates

Key risks

Partnership with MSFT

Most AVPT clients opt to work with third-party solutions, like Microsoft’s infrastructure, platforms, and applications, to supplement or improve the quality of their products and services. If Microsoft buys competitors with features that are very similar to AVPT’s or makes features that compete with AVPT’s, AVPT could lose its key method of attracting customers.

Reliant of developers

The truth is that the AVPT industry is dependent on the number of developers it has. If AVPT is unable to retain developers or hire more talent, especially given the rise in developer wages and importance, it could have a significant impact on growth and profitability.

Conclusion

I believe AVPT is undervalued. Digital transformation is a key trend in the industry, and AvePoint’s solutions aim to support the shift to cloud-based technologies and modern collaboration tools.

Be the first to comment