MoMo Productions/DigitalVision via Getty Images

A Quick Take On Aveanna Healthcare Holdings

Aveanna Healthcare Holdings (NASDAQ:AVAH) went public in April 2021, raising approximately $458 million in gross proceeds in an IPO that was priced at $12.00 per share.

The firm provides healthcare to high-cost patients in the United States.

AVAH is facing labor shortages, supply chain challenges while seeking to increase reimbursement rates at the state level.

I’m on Hold for AVAH until these conditions improve and filter through to its operating results.

Aveanna Healthcare Overview

Atlanta, Georgia-based Aveanna was founded to develop a home care delivery platform to provide care to medically complex, high-cost patients across all patient populations, from newborns to seniors.

Management is headed by Chief Executive Officer, Tony Strange, who has been with the firm since 2017 and was previously President and CEO of PSA and CEO of Gentiva.

The company’s primary offerings include:

-

Personal Care

-

Physical Therapy

-

Private Duty Nursing

-

Home Health & Hospice

-

Enteral Nutrition

The firm receives payment from Medicare for its senior patients and from 20+ states and Medicaid for its pediatric and young adult patients.

Additionally, the U.S. Medicare system is focused on transitioning to a value-based healthcare payment model, which increases the incentive for in-home care at a lower cost.

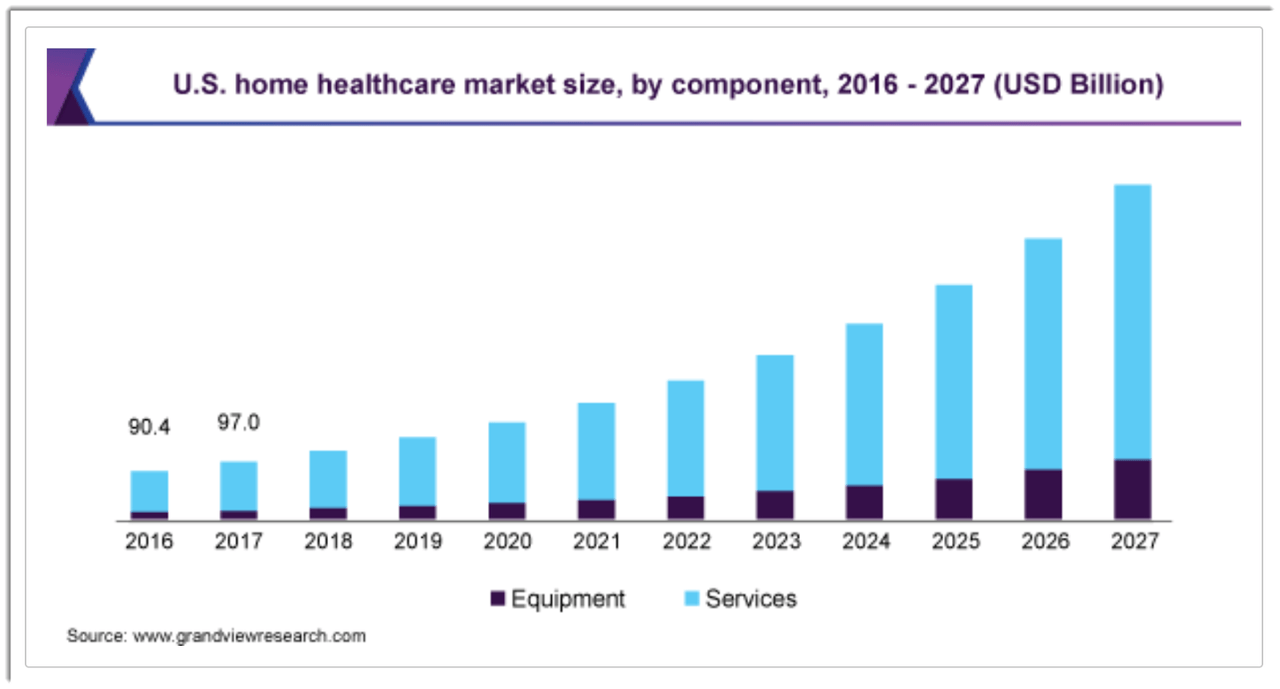

Below is a chart showing the historical and projected U.S. home healthcare market growth by category:

U.S Home Healthcare Market (Grand View Research)

Major competitive or other industry participants include:

-

Kindred At Home

-

Amedisys (AMED)

-

LHC Group (LHCG)

-

Encompass Health (EHC)

-

AccentCare

-

Brookdale Senior Living Solutions

-

Bayada Home Health Care

-

Trinity Health At Home

-

Elara Caring

-

Interim Healthcare

-

Other providers in a still fragmented industry

AVAH’s Recent Financial Performance

-

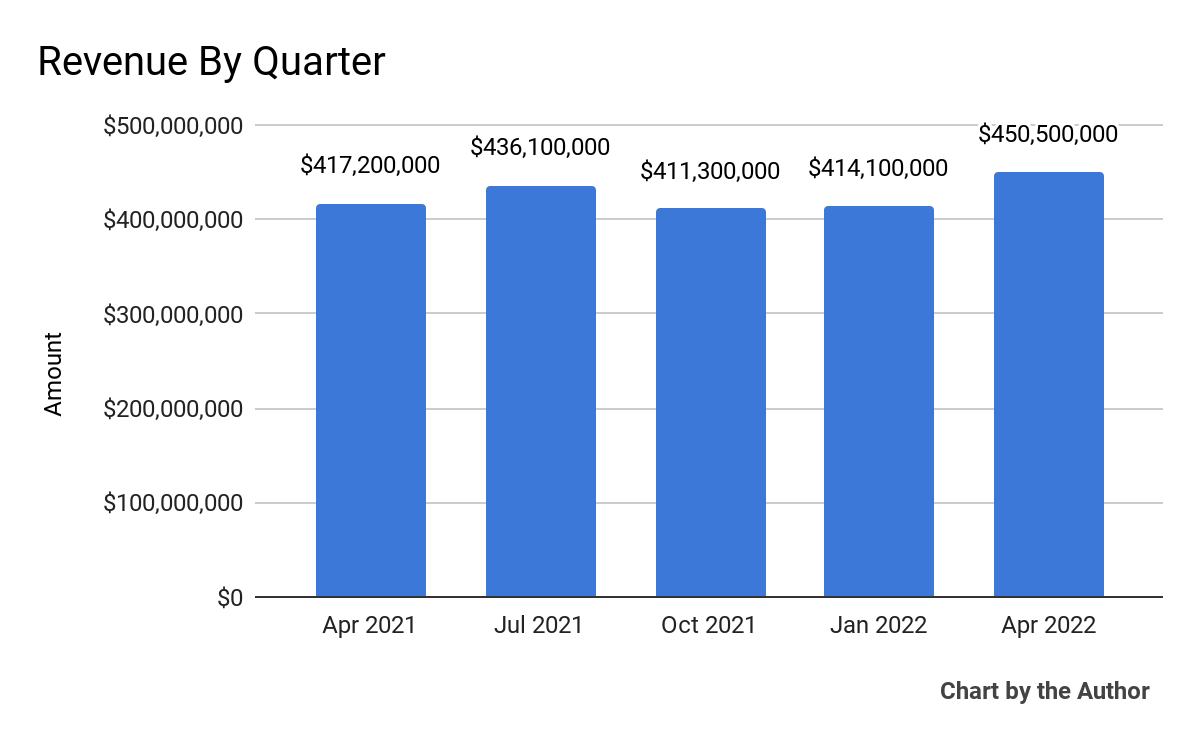

Total revenue by quarter has risen unevenly over the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha and The Author)

-

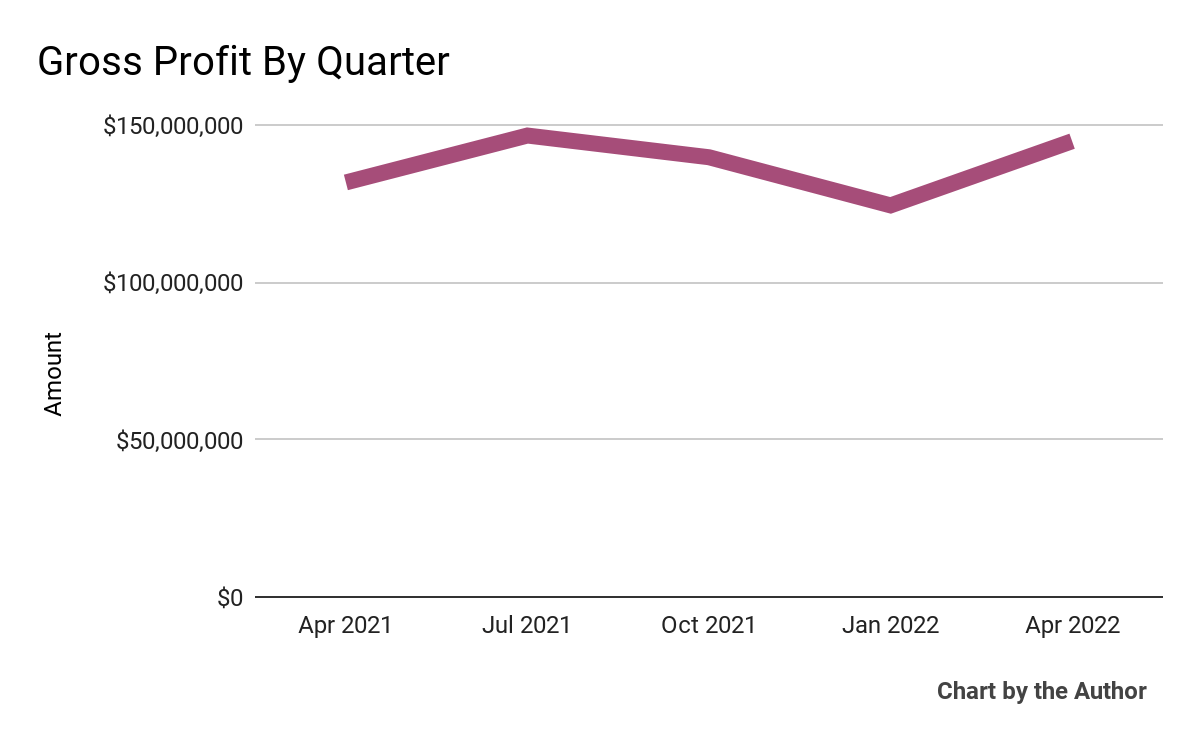

Gross profit by quarter has followed approximately the same trajectory as total revenue:

5 Quarter Gross Profit (Seeking Alpha and The Author)

-

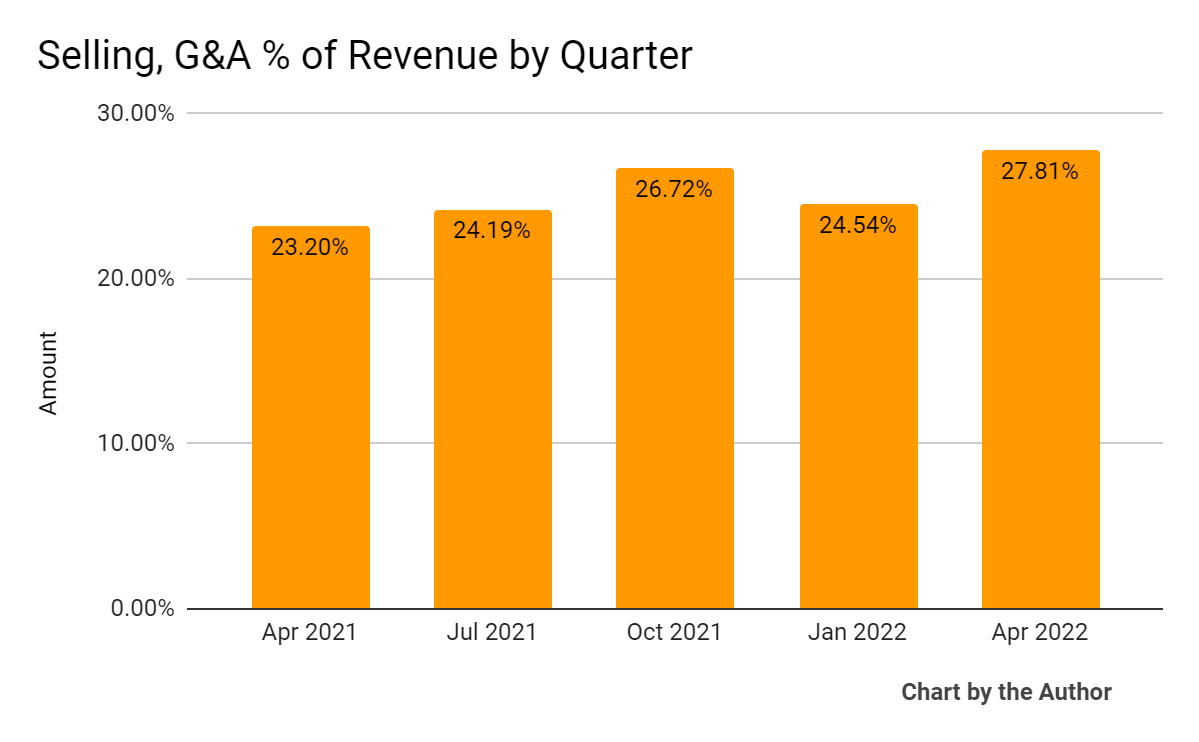

Selling, G&A expenses as a percentage of total revenue by quarter have been trending higher in recent quarters:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha and The Author)

-

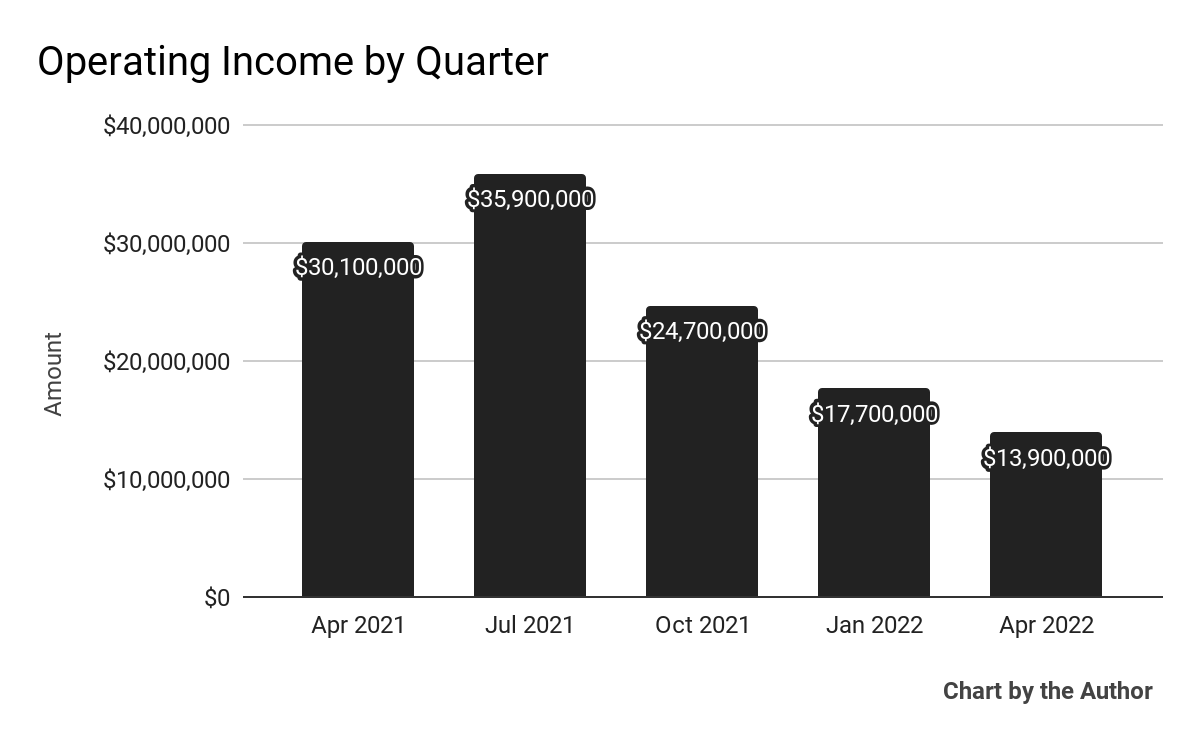

Operating income by quarter has dropped markedly as the chart shows below:

5 Quarter Operating Income (Seeking Alpha and The Author)

-

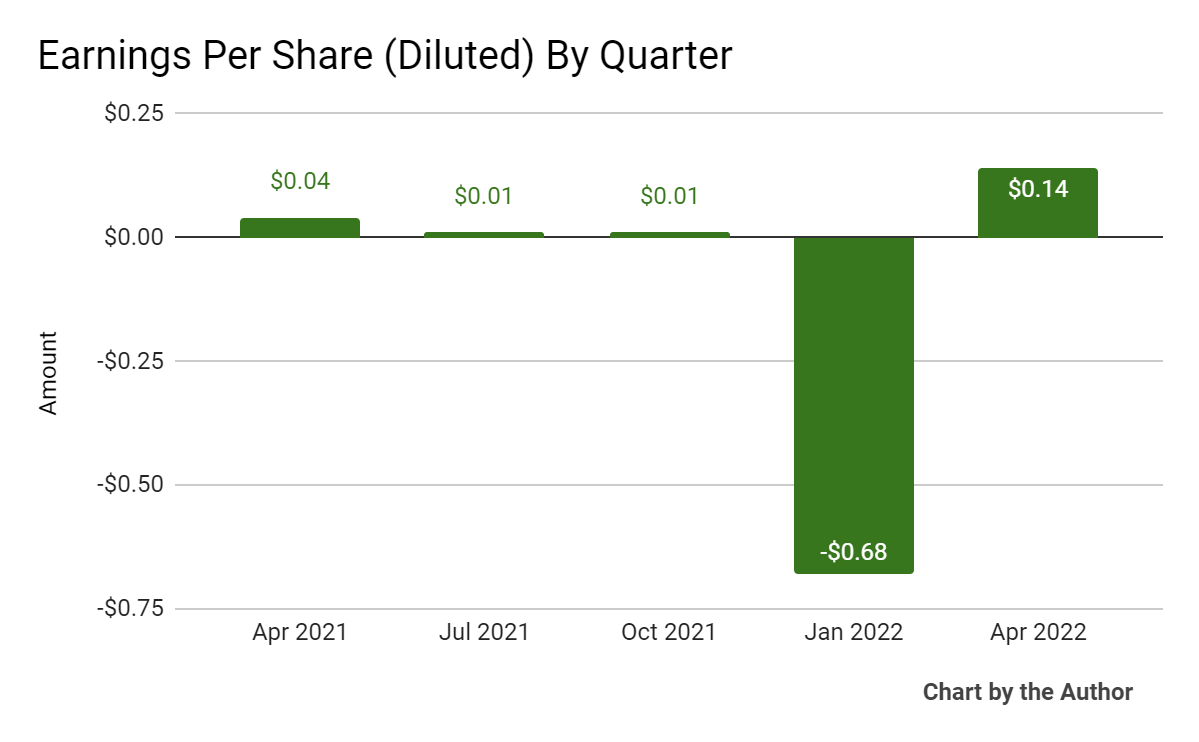

Earnings per share (Diluted) have been highly uneven over the past 5-quarter period:

5 Quarter Earnings Per Share (Seeking Alpha and The Author)

(Source data for above GAAP financial charts)

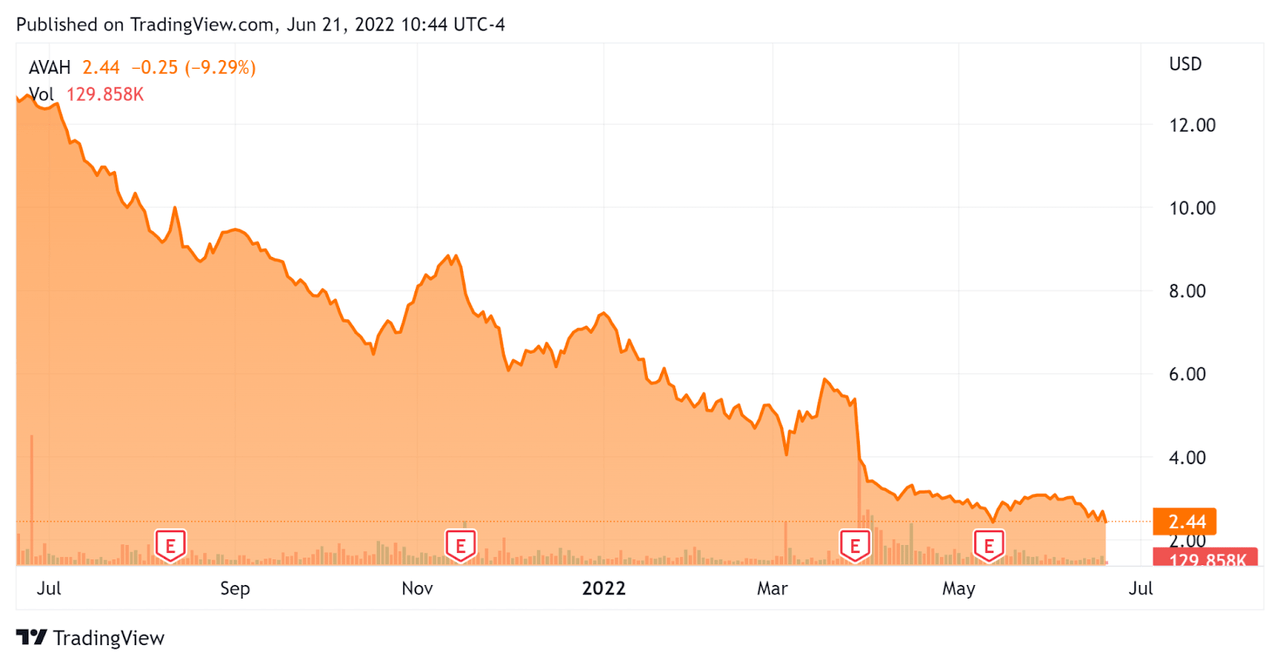

In the past 12 months, AVAH’s stock price has fallen 80.7 percent vs. the U.S. S&P 500 Index’s fall of around 10.7 percent, as the chart below indicates:

52 Week Stock Chart (Seeking Alpha)

Valuation Metrics For Aveanna

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Market Capitalization |

$496,930,000 |

|

Enterprise Value |

$1,910,000,000 |

|

Price/Sales (TTM) |

0.28 |

|

Enterprise Value/Sales (TTM) |

1.12 |

|

Operating Cash Flow (TTM) |

$12,090,000 |

|

Revenue Growth Rate (TTM) |

9.95% |

|

CapEx Ratio |

-0.70 |

|

Earnings Per Share |

-$0.52 |

(Source)

As a reference, a relevant partial public comparable would be Encompass Health (EHC); shown below is a comparison of their primary valuation metrics:

|

Metric |

Encompass Health |

Aveanna Healthcare |

Variance |

|

Price/Sales (TTM) |

1.07 |

0.28 |

-73.8% |

|

Enterprise Value/Sales (TTM) |

1.83 |

1.12 |

-38.8% |

|

Operating Cash Flow (TTM) |

$776,200,000 |

$12,090,000 |

-98.4% |

|

Revenue Growth Rate |

11.3% |

10.0% |

-12.3% |

(Source)

Commentary On Aveanna

In its last earnings call (transcript), covering Q1 2022’s results, management highlighted the ongoing labor challenges due to strong demand for its services.

A related challenge is finding enough employees to service demand. With a significant rise in employee costs, firms such as Aveanna have faced deteriorating economics against reimbursement rates that may not keep up with wage inflation.

In response, the firm is ‘aggressively lobbying’ in those states where reimbursement rates have not adjusted.

As to its financial results, total revenue grew 8% and was primarily driven by inorganic growth from the recent acquisitions of Accredited and Comfort Care. Volume was reduced due to a spike in cases from the Omicron variant.

A spike in cases means that a higher number of employees are affected and revenue is reduced accordingly.

Gross margin for Q1 grew by 50 basis points year-over-year while CEO Tony Strange said that the company’s SG&A expenses will be ‘right in line with our expectations’ once the cost savings for the Accredited and Comfort Care acquisitions are fully integrated.

Looking ahead, management said its M&A pipeline ‘remains robust’ and there are numerous opportunities to consider.

Regarding valuation, the market has punished AVAH with a nearly 81% drop in stock price over the past 12 months. The trailing twelve-month Enterprise Value/Revenue multiple is now at 1.12x, far below that of partial comparable Encompass Health.

The primary risk to the company’s outlook would be a rise in COVID-19 variant cases in its areas of operation, which would reduce its employee pool and revenue accordingly.

A second risk would be if the firm fails to obtain more favorable reimbursement rates in the states that have not yet increased rates to keep up with the inflationary environment.

A potential upside catalyst is as supply chain and labor challenges reduce over time, combined with improved state reimbursement rates, AVAH’s business fundamentals could improve markedly due to a strong demand environment.

But, until we see those realities start to show up in its financial results, I’m on Hold for AVAH.

Be the first to comment