Sundry Photography

Overview

The once high-flying telecommunications company Avaya (NYSE:AVYA) appears to be in trouble once again. The Silicon Valley company, which spun off from Lucent Technologies in 2000, filed for bankruptcy in 2016 after being unable to serve its debt. A year later, the company emerged from debt restructuring after slashing its debt load by nearly $3 billion.

Fast forward, the company listed on the New York Stock Exchange just 12 months after filing for bankruptcy. Now, the company which competes with heavy-weights including Microsoft (MSFT) and Cisco (CSCO) by offering unified communications and collaboration, has dropped over 90% year-over-year as rising interest rates put pressure on Avaya’s high debt load and increases the risk of bankruptcy. Nevertheless, Avaya is working relentlessly on restructuring its business model toward a recurring Cloud-based model, which is growing at a tremendous rate. More importantly, at current levels, shares are priced for a bankruptcy scenario, although Avaya has minimum liquidity to serve debt for at least 2 more years, regardless of having to raise more debt in the future. Therefore, Avaya currently represents an enormous asymmetrical opportunity, with a favorable risk/reward profile. The downside is capped at 100% in the case of bankruptcy, while shares could easily multiply many times in the case of a successful business transition and positive free cash flow generation.

Q2 Earnings

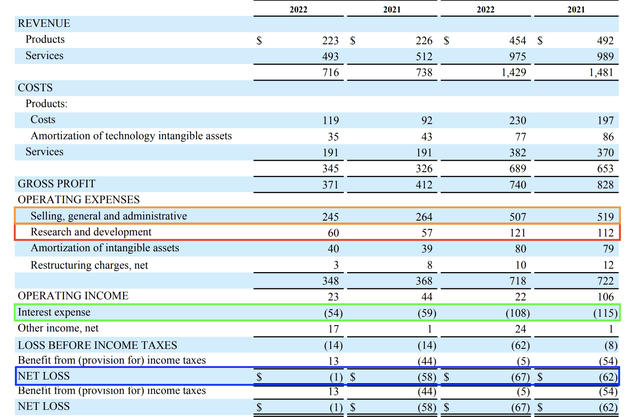

Avaya shares are down over 60% since reporting its Q2 earnings, despite demonstrating a successful and accelerating transition towards its Cloud business. Overall, Avaya posted revenues of $716 million for the quarter, down by 2% on a constant currency basis, missing estimates by roughly 3%. The company reported earnings per share of $0.53, compared to estimates of $0.61 per share. However, this was expected as an outcome of the company’s accelerated success in moving to a recurring revenue model which is resulting in higher working capital requirements.

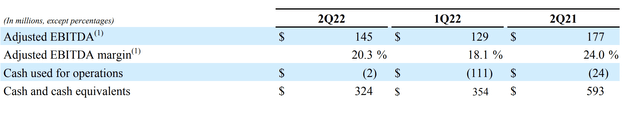

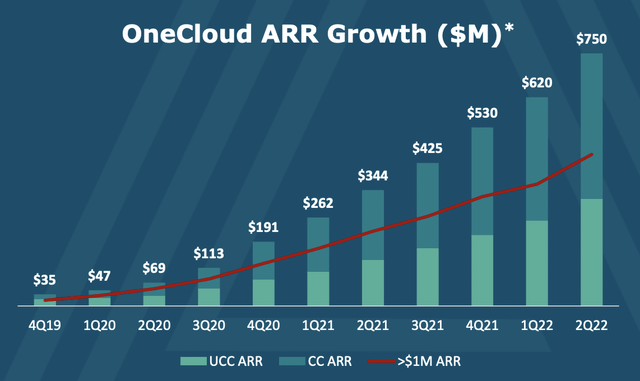

Here, OneCloud ARR was $750 million, up 21% sequentially and 118% year-over-year. As part of OneCloud, CAPS (Cloud, Alliance, Partner and Subscription) was 54% of revenue, up from 40% a year ago. Overall recurring revenue was 69% of revenue, up from 66% last year. Adjusted EBITDA was $145 million, 20% of revenue, while cash from operations was $(2) million, an improvement from Q2 2021, when cash from operations was $(24) million. Overall, Avaya posted $1 million net loss and Non-GAPP Net Income of $51 million.

We drove record growth for Avaya OneCloud ARR with a $130 million quarter over quarter increase and an over $400 million year over year increase, to $750 million. The path to hit the $1 billion ARR mark by the end of calendar year 2022 is well paved. We are successfully repositioning the company from our historic one-time revenue model to a recurring one, in fact 75% of our new bookings were Avaya OneCloud. Our strategy is clearly taking hold faster than we anticipated leading to a significant and fundamental shift in our business. – Jim Chrico, CEO Avaya

The company ended the quarter with $2.3 billion in remaining performance obligations and added over 1400 new customers. Over 95% of OneCloud ARR came from customers generating $100,000 or more, demonstrating a highly diversified client base. For the full year, Avaya expects revenue between $2.8-$2.85 billion and OneCloud ARR in the range of $940 million to $960 million. GAAP-Operating Income is expected to be between $80 million to $100 million with adjusted EBITDA in the range of $580 million to $600 million, representing a 21% margin.

Business Transition

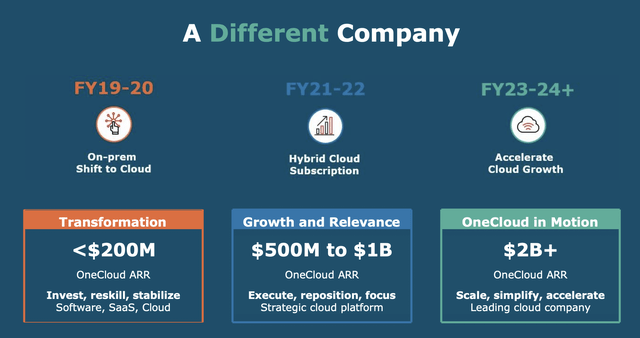

After exiting bankruptcy and listing on the New York Stock Exchange, CEO Jim Chirico noted that the IPO would free up to $300 million to spend on R&D to drive future growth. However, he also noted that Avaya has to act differently by investing in the future of the cloud era. By doing so, it introduced its OneCloud product in 2020, talking up the company’s vision for artificial intelligence, IoT, and blockchain through which the company hopes to make a mark. Recently, it launched its public cloud offering outside of the US, bringing its Pure Cloud product to Europe.

What Is Avaya OneCloud?

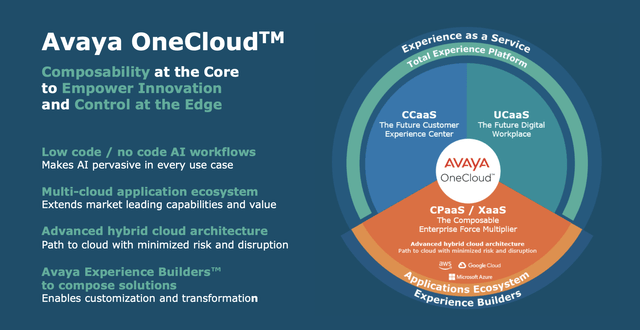

As Avaya is shifting its business model from a perpetual revenue model to a subscription business, it’s transforming from a legacy hardware business to a software as a service vendor. This transformation is built upon its experience platform Avaya OneCloud which incorporates three main segments including Contact Center as a Service (CCaaS), Unified Communications as a service (UCaaS) and Communications Platform as a Service (CPaaS) or Anything as a service (XaaS) to deliver cloud architecture.

Through these segments, Avaya offers a unified communications platform that brings voice, video and data together into a single, unified platform. It allows businesses to scale up or down their UCaaS and CCaaS solutions as needed through a Pay-As-You-Go Model, similar to AWS, Microsoft Azure and Google Cloud (GOOG) (GOOGL). Since, pay-as-you-go models are extremely powerful for both companies and customers, they require a certain scale to be profitable and might initially drag on profitability as seen with Avaya in past quarters. Furthermore, Avaya has partnered with leading cloud platforms including Microsoft Azure, AWS, Google Cloud and IBM (IBM) to offer organizations more flexibility in increasing their productivity and customer engagement trough additional scale.

Our strategic partnership with Microsoft is an important milestone in our continued transformation to a cloud business model. The global scale of Microsoft helps ensure that our joint customers rapidly deploy Avaya OneCloud solutions in any cloud environment of their choice with speed, agility and cost competitiveness. This represents a tremendous opportunity for customers to accelerate their journey to the cloud, and a tremendous opportunity for Avaya to expand our go-to-market reach through the co-selling efforts we have identified with our trusted partner –David Austin, Senior Vice President Avaya.

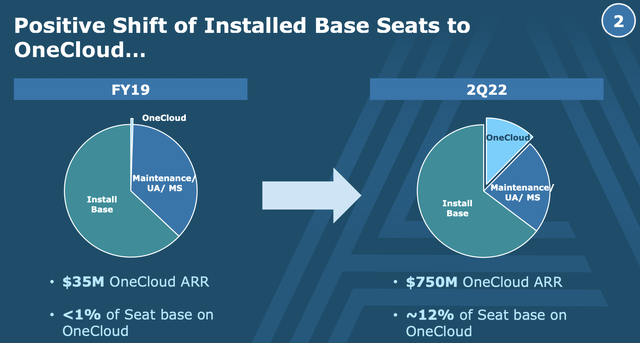

Within just under two years, Avaya has grown its OneCloud subscription platform from just $35 million to $750 million in ARR and expects to hit the $1 billion mark in early 2023. It expects to hit $2 billion by 2024, which would be roughly 70% of its current total revenue. In the past, bears have noted that the stellar growth in subscription revenue has come from simply flipping the install base from perpetual to subscription, which means the growth trajectory could soon come to an end.

However, Avaya’s subscription model is growing exponentially as seen in its sequential quarter-to-quarter growth. Before Q2 2022, its highest sequential growth was $105 million from Q3 21′ to Q4 21′. This quarter OneCloud grew by a staggering $130 million, demonstrating a steep exponential curve. If it was true that the growth really only came from switching existing seats to its subscription model, the growth curve would already be flattening, considering that $750 million would come close to 50% of its current total revenues. Moreover, as noted before, Avaya added over 1400 new customer last quarter alone, meaning it’s still growing its existing seats.

Even if OneCloud would stop growing at $2 billion in ARR, I would not be too concerned as switching existing customers to a subscription-based model would result in higher long-term margins due to lower fixed costs. For instance, Adobe (ADBE) transitioned its business model to a subscription-based service in 2012, by releasing its Creative Cloud. Within years of launch it hit over $4 billion in ARR and is has now grown to over $10 billion. As a result of significantly lower fixed costs, Adobe’s net profit margins swelled from just 5% in 2014 to nearly 40% in 2021. It is unrealistic to assume Avaya will achieve anywhere near those profit margins in the future, simply due to its heavy indebtedness, but it is certainly the right strategy to increase free cash flow over the long-term.

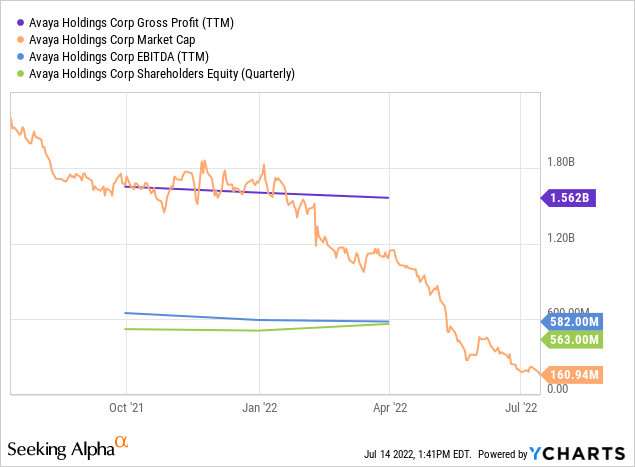

Asymmetrical Risk/Reward Valuation

What’s most intriguing about Avaya as an investment opportunity is not the fact that the business is transforming towards a software subscription model, but rather just about how cheap shares are trading at the moment. At its current market cap of around $160 million, Avaya is priced for immediate bankruptcy, although this is simply not the case. When subtracting all liabilities (including its debt) from Avaya’s Assets, its current shareholder’s equity stands at $563M. This translates to a book value of less than 0.3; in other words, Avaya’s book value per share should be at least $5-$6, based on its assets alone, regardless of its transitioning core business.

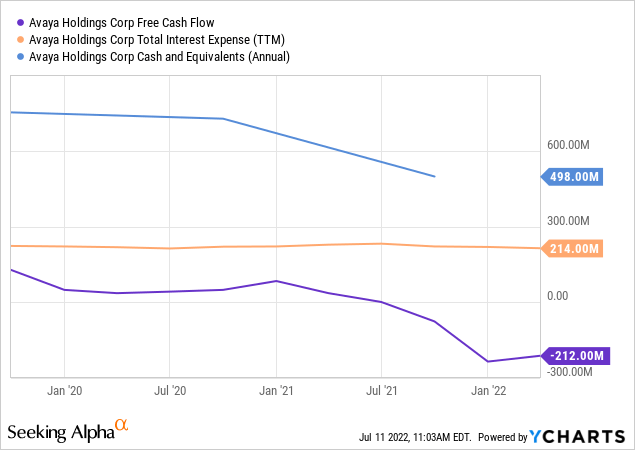

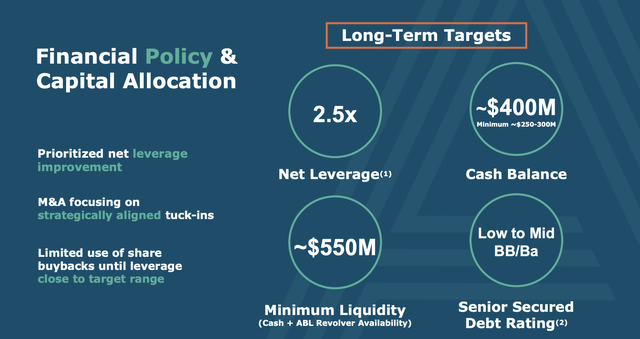

Certainly, Avaya’s current free cash flow appears frightening considering its heavy indebtedness. However, Avaya still has around $320 million in Cash & Equivalents on hand and just secured $600 million in new financing which will significantly increase its short term liquidity (more on that later). Currently, Avaya’s total interest expenses amount to $214 million per year. Thus, even at the current cash burn rate, Avaya has the required liquidity to serve its interest expenses for at least two more years. However, its cash burn will likely improve as a result of its subscription business reaching scale. However, the market is currently pricing in a doomsday scenario.

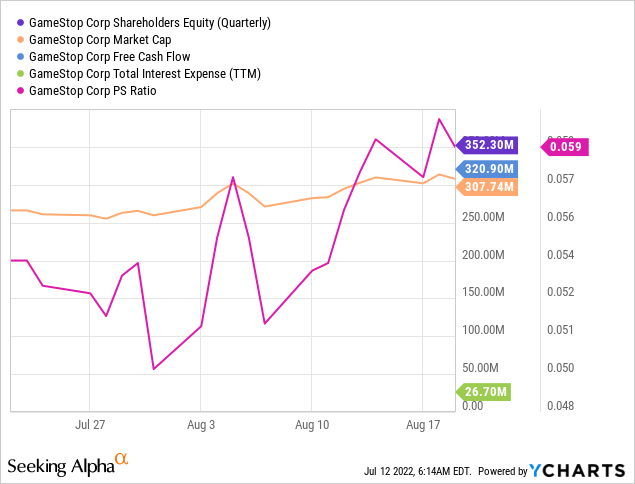

Avaya’s current situation may draw some similarities to GameStop’s (GME) short squeeze in early 2021. While the situation was different due to GameStop’s heavy short interest and positive free cash flow generation, they do also share striking similarities. For one, GameStop was also a struggling company that failed to adjust its business model, which caused revenues and profits to drop. Second, the company was restructuring its business to stay competitive, by shifting its business towards digital sales. Third, GameStop also had heavy indebtedness and bears warned from potential bankruptcy. Finally, GameStop also appeared severely undervalued based on its past valuation metrics. For instance, the company traded at a book value of less than 1x and less than its annual free cash flow. It also traded at just 0.06 times Sales, compared to its long-time average of 0.25-0.35x. In comparison, Avaya traded at 0.6x Price to Sales one year ago and now trades at only 0.05 times Price to Sales. In comparison, this is the same as Bed Bath & Beyond (BBBY), a struggling retailer with just half of Avaya’s gross margins.

Chirico and his team sound like they’ve learned from previous mistakes, but the proof of that will be in the company’s balance sheets in the years ahead. What looks interesting is the fact that Avaya increases its R&D spend compared to last year, despite being in a troublesome financial situation. It also barely cut back on S&G expenses, which makes sense considering it’s trying to grow its subscription business by winning new logos. As OneCloud reaches a certain scale, it is plausible to expect S&G expenses to drop slightly, say roughly 10%. Without the $108 million in annual interest expenses, Avaya would actually be profitable as shown by its Operating Income of $22 million. If Avaya cuts $50 million in S&G expenses, its annual cash burn would narrow significantly. However, the fact that Avaya has actual increased expenses, points to high management optimism regarding its available liquidity.

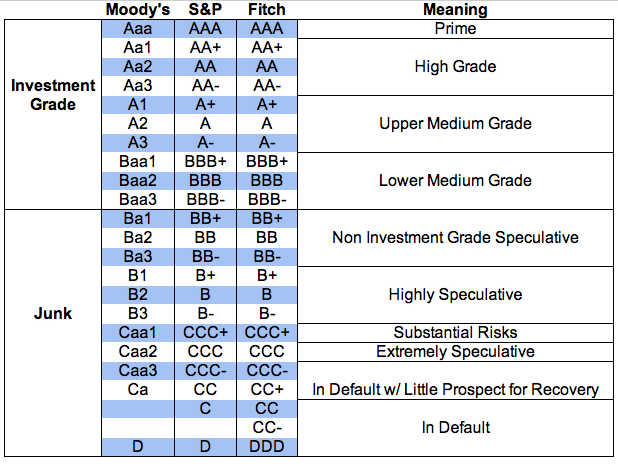

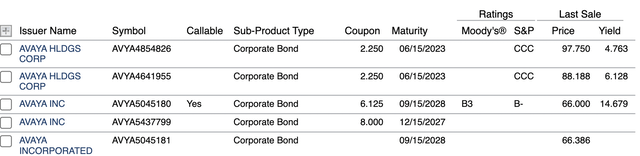

Now, the company has just priced $600 million in aggregate principal amount of new Senior Secured Term Loans, all due in 2027. These funds will provide fresh liquidity to fund June 2023 maturities, which are all triple C rated, which means they fall in the category junk bonds.

Colorado Financial Management

Avaya’s credit rating remained unaffected by its upsized financing, but downgraded Avaya’s senior secured first-lien issue ratings to BB- from BB as Avaya is ‘experiencing near-term effects on revenue and cash generation due to a faster-than expected shift to a cloud/subscription-based model’. However, while the near-term impacts of the shift to subscription pressure the credit profile, Fitch ‘views the momentum in subscription, cloud-based offerings, and OneCloud’s annual recurring revenues (ARR) as a longer term positive, provided the company successfully navigates the transition.’ (Fitch Ratings)

We are pleased with the successful execution of this financing. This funding supports and accelerates our business model transformation and addresses our convertible notes maturing in June of next year – Kieran McGrath, Chief Financial Officer, Avaya.

Avaya Debt Structure (Avaya IR)

So overall, the vast majority of Avaya’s debt doesn’t come due until 2028 and its 2023 triple C bonds have been refinanced. Its 2028 bonds are triple B rated, yet Avaya trades like its bonds are CC or even DDD rated and are already in default.

Conclusion

Avaya is a speculative bet – there is no arguing about that. However, with higher risk and volatility comes higher potential reward. For a speculative bet, the risk/reward profile appears attractive. And sure, the principles also works the other way around, meaning the chances for a loss are much higher than on average. Certainly, the same can be said about every ‘penny stock’ out there with enormous potential upside. The difference is, however, that Avaya is an established IT provider with thousands of employees, customers and a proven business model that is transitioning quickly towards a more sustainable and competitive one.

At current prices, Investors have the opportunity buying into shares trading at a >150% discount in book value. The stock trades at levels as Chapter 11 is imminent and inevitable. The truth is, however, that Avaya has just successfully refinanced its soon-maturing debt and has until 2028 to repay its remaining debt. At the same time, management is expecting OneCloud to reach $2 Billion in ARR, which should soon reflect in improving cash flows. Even if the company was to default on its debt, competitors such as Twilio (TWLO), RingCentral (RNG), Cisco, or even Microsoft would likely agree to pay more than $160 million for Avaya’s existing communication infrastructure, and large customer base to expand competitive advantages.

Regardless of that, Avaya is still a speculative bet and I would personally not allocate more than 1%-5% of my portfolio in a position, so that in case of bankruptcy the overall portfolio would not suffer too much. Another strategy could be using call options, for instance through Out of the Money (OTM) options to take advantage of the high upside potential, without risking too much capital.

Be the first to comment