AutoZone (AZO) is a name that has always been a very reliable trade as it ebbs and flows. Obviously, with the COVID-19 market crisis, AutoZone stock has not been spared. It is our opinion that this company will thrive moving forward. While the current quarter is definitely going to experience pain as people try to stay home, we know auto parts are essential services. We believe that when the peak passes in North America in a month or so, the lasting economic consequences will linger, and it is likely that many will try and extend the life of their cars. Under these assumptions, AutoZone, as a company should reap rewards. This is a winning company and it is offering a great opportunity to come back into the name, especially if you can get the stock under $800. If it falls again, we believe the stock is a strong buy. It is at present a buy, but we think you may get a better price once again. While we do not know that the earnings will be this year, where we thought they would be the stock is 13X forward EPS, a level unheard of for this stock for years. Even with some erosion this quarter, we think future quarters help offset the pain. In this column, we will touch on Q2 performance, and it is our opinion that with the stock down 30%, this is one to consider.

While the world has changed temporarily in the last month, AutoZone reported earnings earlier this month at the beginning of the pain we are seeing in North America from the virus. We think the future is bright. We see a potential entry point to get in the name at $700-800, levels that would be exceptional. While the stock touched these levels at market lows, we think you will get the chance to scale in once again. There is lots of room for growth, and the company’s products will always be in demand, since we all rely on motor vehicle transportation. We believe that if the stock retraces, you should still be acquiring shares of this quality company. You have not missed the boat for the long term.

What we thought of fiscal Q2 performance

In our opinion, fears over gross margin compression and competition has been pretty much allayed, long term, with the present Q3 excluded. We are very bullish. Ignoring the temporary setback in operations which is priced in after a 30% decline, we will say that Q2 was strong in many aspects once again. The company is crushing sales expectations and still exceeding our bullish same-store sales expectations. It remains a stock for winners. We want you in this name. In Q2, AutoZone registered sales of $2.51 billion, which was a 2.6% year-over-year increase, but was a very slight miss versus consensus analyst estimates of $56 million. Sales growth is evident each year:

Source: SEC filings, graphics by BAD BEAT Investing

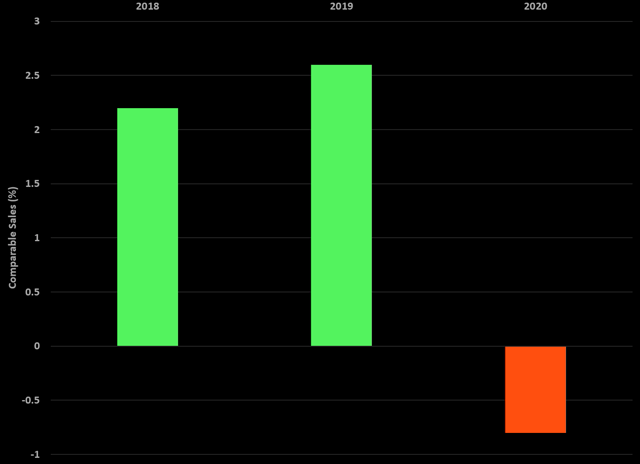

Now, as sales continue to grow, we need to, of course, understand what is driving these sales. The measure you should care about is comparable sales, which have been on the mend since bottoming out in 2017. This is a critical metric, and we were bullish on comps. We expected at least 1%, but comps declined:

Source: SEC filings, graphics by BAD BEAT Investing

This comparable sales figure was worrisome, to be honest, as the virus issue really had not begun. This was a big change from last year’s Q2, which saw an increase of 2.6% in same-store sales. After these results, we are still projecting for the entire year 2020 ahead comparable sales of 1-2%, even if the virus issue destroys Q3. We think that is priced in. We are excited about Q4 2020 and beyond, when things subside and people need to keep cars going. That is the thesis here.

It is worth noting that further boosting the top line is the fact that AutoZone also continues to strategically open new shops to fuel future growth. The company opened 25 net new stores in the U.S. and added another 3 internationally. With these new store openings, and those opened in the last three quarters, sales should see continued low-single digit growth overall, though again, Q3 is likely to suffer for obvious reason. Long term, continued sales growth is bullish.

We still expect a very strong 2020, barring the Q3 COVID-19 impacts

As shareholders in the long term of AutoZone, our firm is looking to see the company continue to focus on increasing sales while controlling expenses, particularly those impacting gross margins. However, we expect margins to remain strong and not fluctuate greatly. If it can do this, earnings will not only rise even more, but the stock should react more positively. Make no mistake, the company continues to have a stellar buyback. This buyback has helped increase shareholder value quarter after quarter. The bottom line is that earnings per share continue to grow nicely, yes, excluding what is about to happen in Q3.

We saw higher sales. We saw decent margins. Operating margin remains solid. Yes, Q3 is questionable. No one really knows. We expect whatever damage is expected is priced in. The stellar buyback program continues to help earnings per share. Here in Q2, AutoZone invested another $315 million into new purchases at an average price of $1,180 per share. This helped drive EPS to $12.39, smashing estimates by $0.65. As we look ahead to the rest of 2020, we no longer see the stock earning over $70 per share in fiscal 2020. Assuming the company sees EPS cut in half in Q3, that would mean $8 per share in EPS. Let us also assume Q4 is not as strong as we expect and there is no growth. No, let’s actually factor in a 25% reduction. That would mean about $17 per share in earnings. So, $25 in EPS in H2 2020 is expected, combined with $26.69 in actual EPS.

That would be a $51.59 EPS result for the year 2020. If you get shares at $800, that would suggest a 15.5X forward EPS, which is still below the historical forward EPS of 18-20. Now factor in that we are projecting huge EPS cuts to get these figures. Worst case? You might be paying for only above-average value. We like shares. Start buying from $800 down if you can.

If you like the work of Quad 7 Capital, scroll to the top of the article and click the orange “Follow” button.

Let us help you navigate this awful market. Get a 50% off discount now

Like our thought process? Stop wasting time and join the community of 100’s of traders at BAD BEAT Investing at an annual 50% discount.

It is simple. We turn losers into winners for rapid-return gains

- You get access to a dedicated team, available all day during market hours.

- Rapid-return trade ideas each week, including shorts

- Target entries, profit taking, and stops rooted in technical and fundamental analysis

- Deep value situations identified through proprietary analysis

- Stocks, options, trades, dividends, and one-on-one portfolio reviews

Disclosure: I am/we are long AZO. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment