deepblue4you/iStock via Getty Images

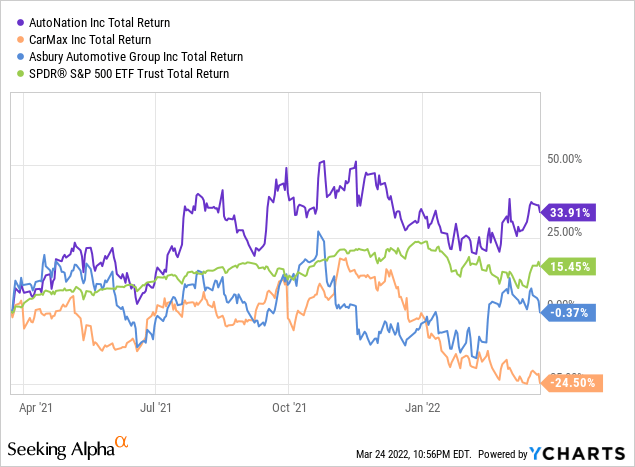

Over the last twelve months, AutoNation (NYSE:AN) has trounced its competition and the broader market. It delivered a total return, dividends reinvested of ~34% vs. ~16% for the S&P 500, ~0% for Asbury Automotive Group (ABG), and -25% for CarMax (KMX). Talk about a divergence. Part of the strong returns are borne from the company’s superior ability to capitalize on a hot car market – AutoNation has a leading footprint and a massive growth opportunity in recurring aftermarket and used vehicle business. After a period of dedicated investment in technology, AutoNation is planning to grow from 10 AutoNation USA used vehicle stores to 130 by the end of 2026, warranting a leading growth trajectory. Currently, the stock looks compelling at first blush at an attractive forward PE multiple of 5.9x vs. 5.6x for Asbury and 13.7x for CarMax. At the same time, owing to its leadership position, AutoNation has superior gross margins at 19.2% compared to 19.3% and 11.0% for Asbury and CarMax, respectively.

According to Seeking Alpha data, the Street, however, is not so hot on the stock. Nearly three-quarters of the 13 analysts with ratings out rate the stock a “hold”. This sentiment has been the case going back over the last three years and, since then, AutoNation has returned 250% to shareholders. While AutoNation is still vulnerable to the cyclical new car sales market, where half of its revenue comes from, I don’t believe the market is giving them enough credit for their exposure in parts & services, which actually contributes almost 50% more in gross profit than the new vehicles segment. Also seemingly missing from the equation is the ramp up in AutoNation USA stores and integration of the Priority 1 acquisition that added $420 million in annual revenue.

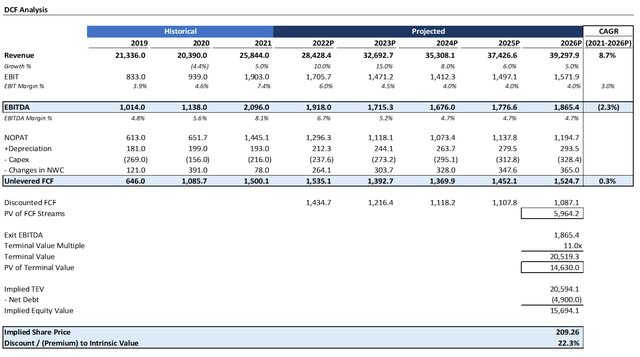

DCF Analysis Indicates Significant Upside

To get a sense of the company’s intrinsic value, I ran a DCF analysis. No DCF analysis can provide a perfect picture of future returns for shareholders; however, they can provide an illustrative “story” of the likelihood of different scenarios. In my DCF analysis, I assumed 10% revenue growth in 2022 staggering, climbing to 15% in 2023, and then staggering down to 5% by 2026. I also assumed EBIT margins contracting by almost 50% to 4%, a more normalized level on par with 2019 levels. Capex, increase in net working capital, depreciation, and taxes were flat-lined for simplicity.

Created by author using data from Yahoo! Finance

Assuming a terminal EBITDA multiple of 11x and a 7% discount rate, the stock has ~22% upside. This is especially significant, because the company’s multiple has generally trended in the 10-13x range and thus has further upside. CarMax is currently at 16x. In a stock market that is so lofty, AutoNation is one of those steals that provides stable free cash flow, a generous share repurchase program that bought back $382 million of shares last year, and impressive actionable growth opportunities in parts & services.

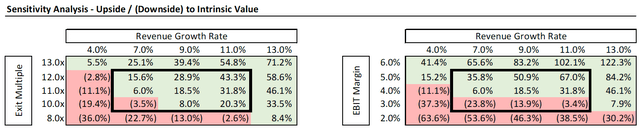

Created by author using data from Yahoo! Finance

Looking at the sensitivity analysis, things become even more rosy for investors. At a 13x multiple, a mere 7% growth rate would deliver a 25% return on top of the 7% annual returns implicit in the discount rate. Should margins hold steady at 6% and the company grow at a 10% rate, this stock may have room to almost double to approach its fair value. It would take the multiple contracting to 8x at the current growth trajectory to argue it is overvalued.

Upside Catalysts

There are several catalysts that could get AutoNation to close its discount to intrinsic value. I have already mentioned the major opportunity in used vehicles and parts & service. Used rental units increased a staggering 21% y-o-y in the fourth quarter. At the same time, the company is positioned to realize meaningful operating leverage through scale and capitalize on its improved digital capitabilities, pushing SG&A/Gross Profit % to be in the mid-60% range, well below pre-pandemic levels consistently above 70%. With $1.5 billion of liquidity and authorization for another $776 million in share repurchases, the stock also has meaningful downside protection against a cyclical swing in the car market.

Again, as much as the bears are making AutoNation out as if it’s a new-vehicle business, they are fundamentally missing that the Used and Parts & Service segment contribute 48% of the gross profit vs. just 24% for the New segment. These businesses, particularly, Parts & Service are particularly resilient to macro economic cycles, as they are lifecycle consumables that owners will continue to need. Finally, the rollout of 130 AutoNation USA stores will reinvent how investors think about the stock and thereby make the upside story more apparent.

Why I Could Be Wrong

As bullish as I am on the stock, it’s important to consider factors that could lead AutoNation to underperform. The supply chain continues to be hampered and labor remains hard to come by. So, while the company is aggressive on trimming costs, growth is constrained by a growing shortage of workers. During the earnings call, management made a case that the shift towards e-commerce and the virtues of its single pricing model for used vehicles was enough to justify an aggressive improvement in SG&A, but the car market is undergoing upheaval through autonomous & electric vehicles, so I don’t see how a more polished salesforce won’t become necessary at some point. Lastly, while I’m bullish on AutoNation USA, I believe the stock will be highly sensitive towards underperformance. Investors are looking for a new avenue to offset challenges in new & used vehicles, so any failed execution on a key growth catalyst will stymie investor interest.

Conclusion

AutoNation is a strong undervalued stock with a history of exceeding expectations. It has an A- in terms of earnings revisions on Seeking Alpha and beat expectations by $0.80 in the most recent quarter at EPS of $5.76, following a quarter where it posted a beat of $0.91. With a strong management team and numerous growth opportunities in Parts & Services and Used Vehicles, I believe the stock is highly undervalued at a forward PE multiple. Although it is fairly volatile at a beta of 1.4, the share repurchase program is robust enough to insulate much of the downside. Accordingly, I strongly recommend investing in AutoNation.

Be the first to comment