Blue Planet Studio/iStock via Getty Images

Let’s start with where exactly are we placed with respect to economic cycle. We are right now in a situation where inflation growth is much higher than the GDP growth. This is causing the central banks to increase interest rates at a much faster pace to cool down inflation. This move was very much required and is actually good for the economy in the long term. It has already started to pay off in bits and pieces as we see commodity and oil prices cooling off from recent highs. However, the pace of future rate hikes should be in tandem with growth and inflation plotting, else situation can blow off.

IMF’s views validates this too ” The US economy is likely to slow in 2022 and 2023 but will “narrowly avoid a recession” as the Federal Reserve implements its rate-tightening plan to curb inflation.”

So actually these rate hikes are good for the economy, and recent correction has also removed the frothiness in terms of market valuations. We had been experiencing a one way rally since 2020.

Economical Tailwind: In volatility and rising rate scenario, cyclical stocks have historically performed better with auto, banks and real estate generally outperforming the broader index, while businesses that have their demand and input costs sensitive to inflation and rising rates have done poorly. So, auto stocks should definitely be in one’s portfolio as it might outperform the broader index.

Fundamental Tailwind

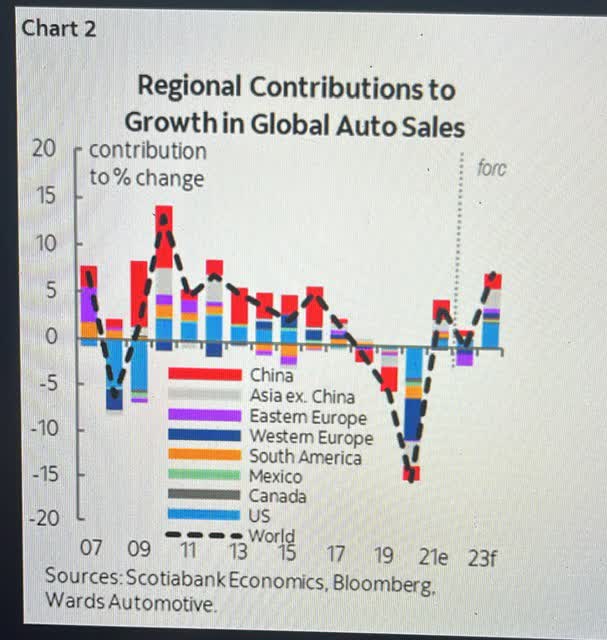

Global Auto sector sales to experience an uptick (scotia bank)

Oil prices increase is getting balanced by rise in OECD and US supply. Eventually, the pumped up demand would fall in line as the structural shift to EV would also reduce the overall demand of oil in the long term as auto forms >40% of oil demand.

According to BCG, Battery Electric vehicle sales would account for 59% of global light vehicle sales by 2035. EVs accounted for just under 10% of global sales in Q12022.

- However, there will be a major shift in market share of EV makers, and Tesla’s (TSLA) market share is expected to decline on the back of new entrants – Ford, GM, KIA, NIO etc

- During 2023-26, various companies will be launching EV models in the US: GM – 17, Ford – 6, Volkswagen – 11, Korean duo of Hyundai and Kia – 13 (BofA)

- Chinese maker NIO (NIO) has delivered total of 50,827 units YTD (until June 2022) and has been recording >50% YoY growth each month

- Other companies like Lucid (LCID) in the US and CATL in China are also coming up with competitive EV cars that can cover grater driving range of 520 and 620 miles, respectively

- India’s largest electric carmaker, Tata Motors, recently partnered with Japanese chip manufacturer, Renesas Electronics (OTCPK:RNECF) to design and develop semiconductor solutions in order to address the global auto chip shortage crunch

Chip shortage issues are also being partially resolved after two years of pain with “Mercedes Benz, Daimler Truck Holding, and BMW are among carmakers now getting enough of the high-tech components to produce at full capacity after experiencing crippling outages for months.”

Structural Tailwind especially for countries like China and India where car sales are at record high every month due to the pent up demand from delay in replacement cycle on the back of covid scenario and chip shortage. In addition, both countries are also receiving a push from the government to expand the current market size. India’s transport minister aims to double the size of auto industry to 15 lakh crore from current 6.5 lakh crore. China also decided to “slash the purchase tax by half for passenger cars under 300,000 yuan (about 44,709 U.S. dollars) with engine displacements within 2 liters purchased between June 1 and Dec. 31 this year.”

So, with all factors favoring the underperforming auto sector now, I believe it is a good investment bet for generating alpha for the next five years, keeping the changing landscape in mind.

Be the first to comment