gorodenkoff

Summary

I recommend a buy rating on Aurora Innovation (NASDAQ:AUR). AUR is an industry leader that seeks to invent the most sophisticated self-driving vehicles. Their automation seeks to deliver benefits like improved safety for drivers. They have innovative minds on their team that constantly help them look for ways to be at the top of their game. Also, they have built strategic, mutually beneficial relationships with top brands, which helps them stay on top of the industry.

Company overview

AUR is building the Aurora driver with a team that has profound understanding and experience. They are building the Aurora driver on the basis of what they believe to be the most cutting-edge and climbable suite of self-driving hardware, software, and data services available globally, to revamp the global transportation market. Essentially, the Aurora driver is a platform that was created to adapt to and work in synergy with a lot of vehicle types and applications.

Autonomous driving industry is a new and growing industry

For almost a century, humans have fantasized about the concept of self-driving vehicles. Over time, industry experts and academicians have given a ray of hope for this fantasy becoming a reality. However, although it is not impossible, the process will be hard. Their dispersed efforts began around the early 2000s, when a number of open contests were bolstered by the Defense Advanced Research Projects Agency (DARPA) to encourage and boost the efforts of different research groups. Chris Urmson, AUR’s Founder and Chief Executive Officer, was the specialist and expert director of the Carnegie Mellon University team that moved ahead the most in the first edition of the DARPA competition in 2004, and they won the final 60-mile urban driving challenge in 2007.

Companies at the forefront of the automotive and tech industries, as well as up-and-coming businesses, have all poured resources into this field since then. As a result, significant strides have been made in areas such as sensor range and accuracy, processing capacity, and vehicle integration.

There are multiple benefits that automation brings

In my opinion, the most pivotal advantage is improved safety. Statistics show that, globally, about 1.3 million people lose their lives yearly to vehicle accidents. The United States truck transportation sector experienced the highest number of casualties. A lot of human factors like distraction, exhaustion, and negligence all add up to 94% of crashes. Independent cars and trucks can reduce these factors by constantly paying attention to the driving environment with the help of advanced sensing and perception technology.

Improved safety will only result in a reduction in insurance expenses. According to AUR, on average, a large truck crash that involves casualties costs $3.6 million. One of the major concerns of truck carriers is the cost of insurance. Invariably, improved safety for these autonomous vehicles will prove to be cost-effective in the long-run.

Also, productivity will get better with automation. E-commerce is a rapidly growing sector, and hopes for fast or same-day delivery are continually increasing. Presently, because of the Hours of Service, truck drivers are limited to eleven hours per day of driving. It is worthy to note that independent trucks will not be prone to these limitations, as they are expected to be on the go for more than 20 hours daily. Because their movement time is extended, they will be able to move more goods faster and more adroitly. All of this will make sure that supply chains run more smoothly and can be trusted. It will also help manufacturers and retailers grow their markets.

Furthermore, the issue of freight supply will be solved by automation. Currently, the trucking industry is experiencing a driver shortage, which was estimated to be around 60,000. A forecast predicts that it will rise to 160,000 by 2028. I strongly believe that autonomous trucks can prove to be cost-effective and also deal with the problem of a shortage of drivers.

Bespoke go-to-market strategy and deep strategic partnership

AUR’s technology allows them to first target trucking, which they believe is the best way to enter the market and scale self-driving technology. The expandability of the Aurora driver across vehicle types and use cases enables AUR to fully optimize the capability overlap across use cases and minimize cost in their self-driving system. As such, the capabilities and increase they get from their development in trucking will increase their expansion into passenger mobility and local goods delivery, and vice versa.

Additionally, AUR also has strategic relationships and partnerships with industry leaders like PACCAR, Volvo, Toyota, and Uber. All of these affiliations will help grow and develop Aurora driver-empowered trucks and self-driving passenger vehicles. AUR’s partners are leading their industries in the fields they find themselves in. As such, AUR is able to leverage each of their strengths as they commercialize. They are able to grow faster and more efficiently because of this.

AUR uses next-generation technology to compete

Without the constraints of legacy technologies, AUR is able to design a self-driving system that is both reliable and extensible. AUR has focused on key areas of differentiation that will yield long-term benefits, including:

- Their perception and motion planning systems have been carefully integrated with machine learning and engineering methods.

- A simulated testing environment that facilitates quick and effective creation.

- A long-range, high-resolution, multi-modal sensor suite powered by FirstLight Lidar technology, which has many advantages over traditional lidar, makes it possible to drive safely at highway speeds.

- The importance of scalable maps for the future challenges of autonomous vehicles

3Q22 results review

The company expects to have completed development of all of its features by the end of the first quarter of 2023, and the release of Aurora Driver Beta 4.0 during the quarter will assist them in meeting that goal.

Importantly, Aurora has confirmed that its commercial offering will be available soon. The Aurora Driver platform is scheduled to be finished by the end of 2023, with a full commercial launch in 2024. Aurora, on the other hand, is adamant that its Aurora Horizon project will be completed by the end of the year. Management also revealed that testing on a fleet of vehicles provided by OEM partners has begun in preparation for the truck platform’s launch in 2019. Furthermore, during the quarter, the company made significant progress toward its stated goal of expanding its fleet by purchasing 21 new Peterbilt 579 trucks outfitted with Aurora’s latest generation of commercial hardware.

Overall, Aurora achieved a number of technical milestones in the development of its autonomous solutions during the last quarter, including the detection of lane markings that have shifted due to construction and the response to road debris. Aurora’s ability to meet its 3Q targets is a plus in my opinion, even though it still has a few technical capabilities to develop before reaching its feature complete target.

Valuation

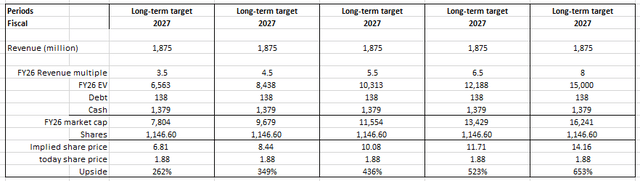

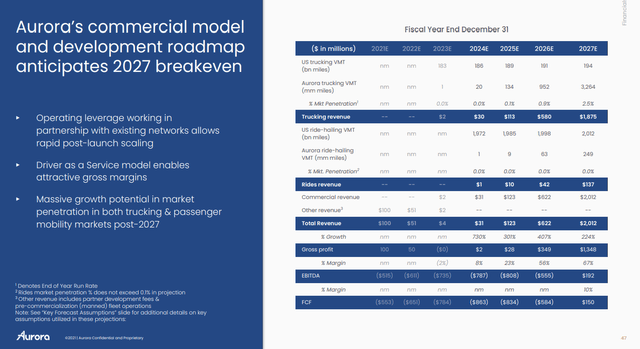

I believe the current valuation does not reflect AUR’s potential value. I expect AUR to make $1.8 billion in sales in FY27, giving it a market cap range of $7.8 billion to $16 billion and a stock price range of $6.81 to $14.16 in FY26, assuming AUR trades within a range from 3.5x revenue to 8x revenue.

Assumptions:

- Sales will meet management’s projections in FY27.

- AUR to trade within a valuation range between 3.5x to 8x, using TuSimple (TSP) and Lucid (LCID) as comp.

The key thing to highlight here is that I assumed management could hit their guidance, and this is akin to investing in a start-up from a venture capitalist point of view. The basis for assuming management can hit its guidance is trusting the management, which I believe is good.

Risk

Emerging technology that has not seen widespread adoption yet

This is perhaps the major concern presently. The task of creating self-driving vehicles is not exactly the easiest. The industry has a number of technical and commercial challenges. If AUR is not able to scale through these challenges, their business will be adversely affected, and their goals may never materialize.

Very competitive market with plenty of players with good tech

This market is a highly competitive one as it is characterized by rapid technological improvement. AUR’s success will depend on their ability to always be one step ahead of their competitors. If their competitors commercialize before they do, develop higher technologies, or are believed to have better technologies, they may grab market opportunities and create relationships for partners that would have been meant for AUR.

Conclusion

This piece has given a level of insight into what AUR is all about. A number of features, like automation, strategic partnerships, etcetera, differentiate them from the crowd of other competitors in the market. Their ultimate goal is to make the most advanced self-driving cars the world has ever seen.

Be the first to comment