hobo_018/iStock via Getty Images

Thesis

With the recent acquisition, Aurora Cannabis (NASDAQ:ACB) is even more of a stock for investors to avoid. The company has historically reported poor financial results despite major acquisitions, and the company is burning through cash rapidly as loan commitments are coming due. We believe that liquidity issues and an unfavorable political environment in the United States will continue to drive this stock price lower over the coming years.

Company Overview

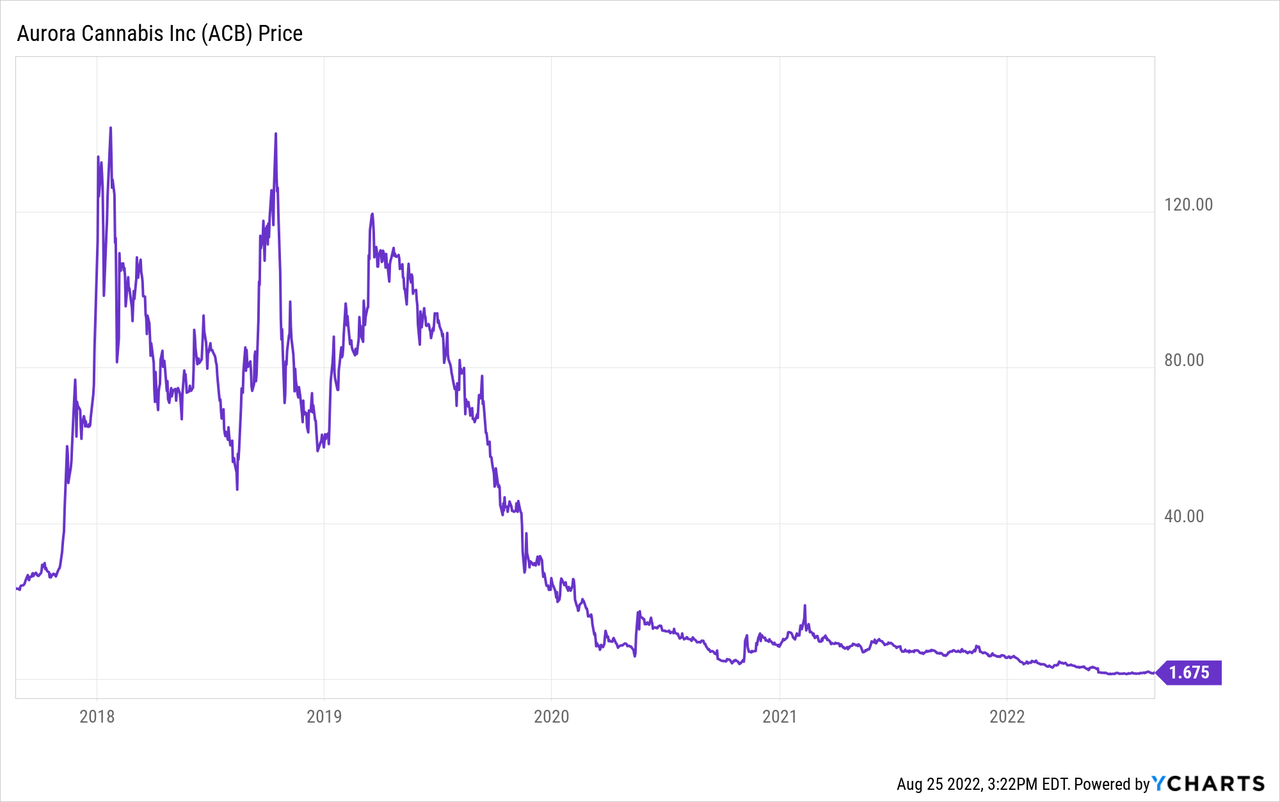

Aurora Cannabis is a cannabis growing company based in Edmonton, Canada. Aurora operates a network of subsidiaries related to the cannabis industry, and the company owns numerous brands, such as San Rafael ’71, Daily Special, CanniMed, Whistler Cannabis Co., and more. These brands create cannabis products for consumer and medical consumption. The stock has had abysmal return for investors, and the stock trades at around $1.675 compared to its historic high above $120 per share only a few years ago. The company now has a valuation of less than $500 million CAD.

Abysmal Performance and Returns

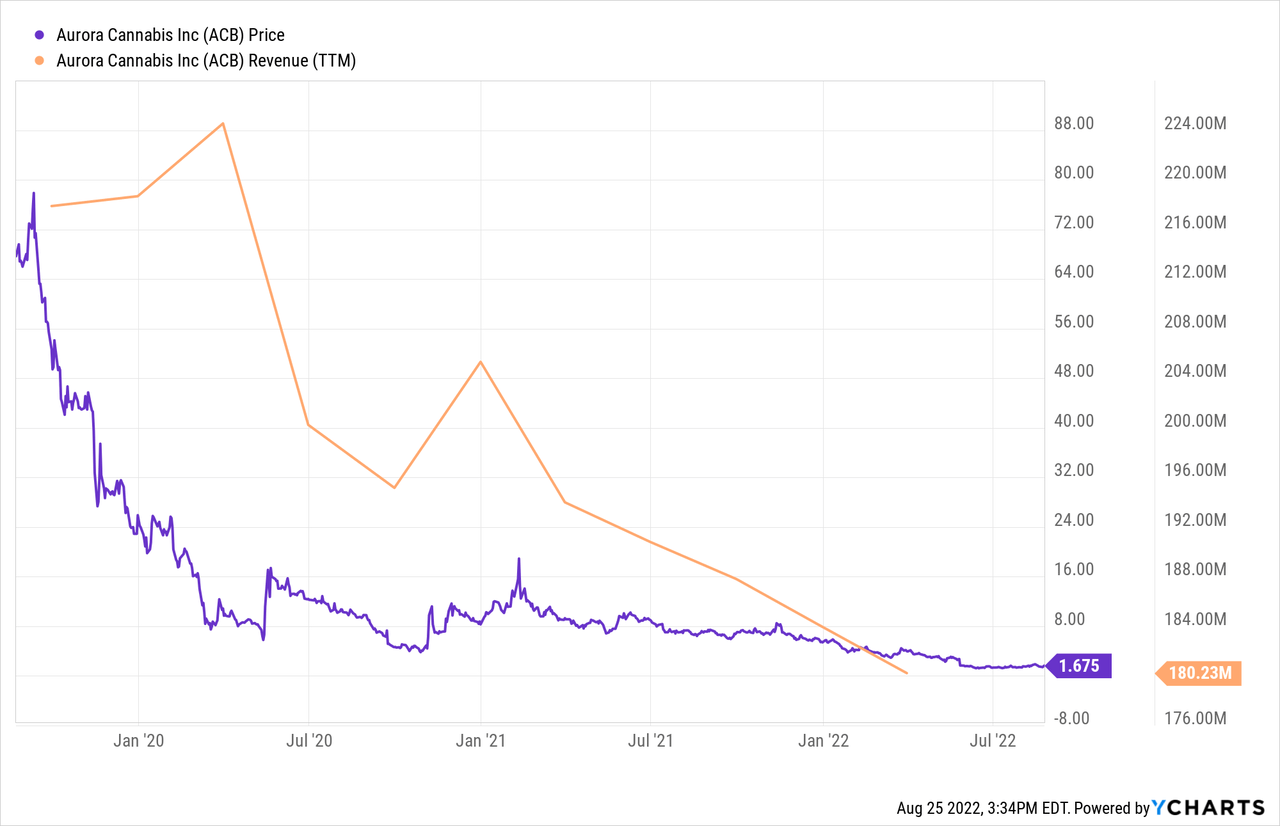

Aurora Cannabis has had poor financial performance in line with the poor stock price performance in the same time frame. The company is still down ~80% from its 52-week high of $8.69 and the stock price is correlated with the revenue decline. For a growth stock name, the company has actually seen its revenue decline over the past few years, even as the company aggressively acquired competitors. For the recent quarter, revenue has declined 9% YoY and has declined 17% QoQ. In addition, the company has reported a loss of $1 billion CAD in the recent quarter, and according to a report, the recent quarter increased the cumulative net losses of the company to roughly $5.3 billion CAD since 2015. These losses are astronomical, given that the cumulative losses are now 10x the current market capitalization of the company. The poor financial performance should immediately be a red flag to investors, and we believe that there is no immediate catalyst to turn this stock around anytime soon.

Liquidity Issues

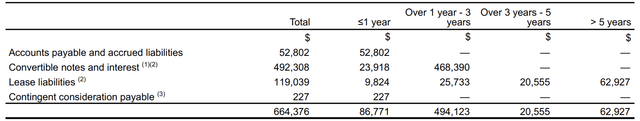

For a company with such large losses, it is not hard to find that the company is exposed to major liquidity issues. In the most recent FY 2021 financial report, the company outlines that ~$494 million CAD are liabilities that are payable between one and three years. In that same time frame, the company reported that there’s $332.4 million CAD in cash and cash equivalents, which is substantially below the pending commitments in the next few years. Given the liabilities and the negative earnings, liquidity is risk of the utmost issue, and it is unclear how management plans to navigate through this problem.

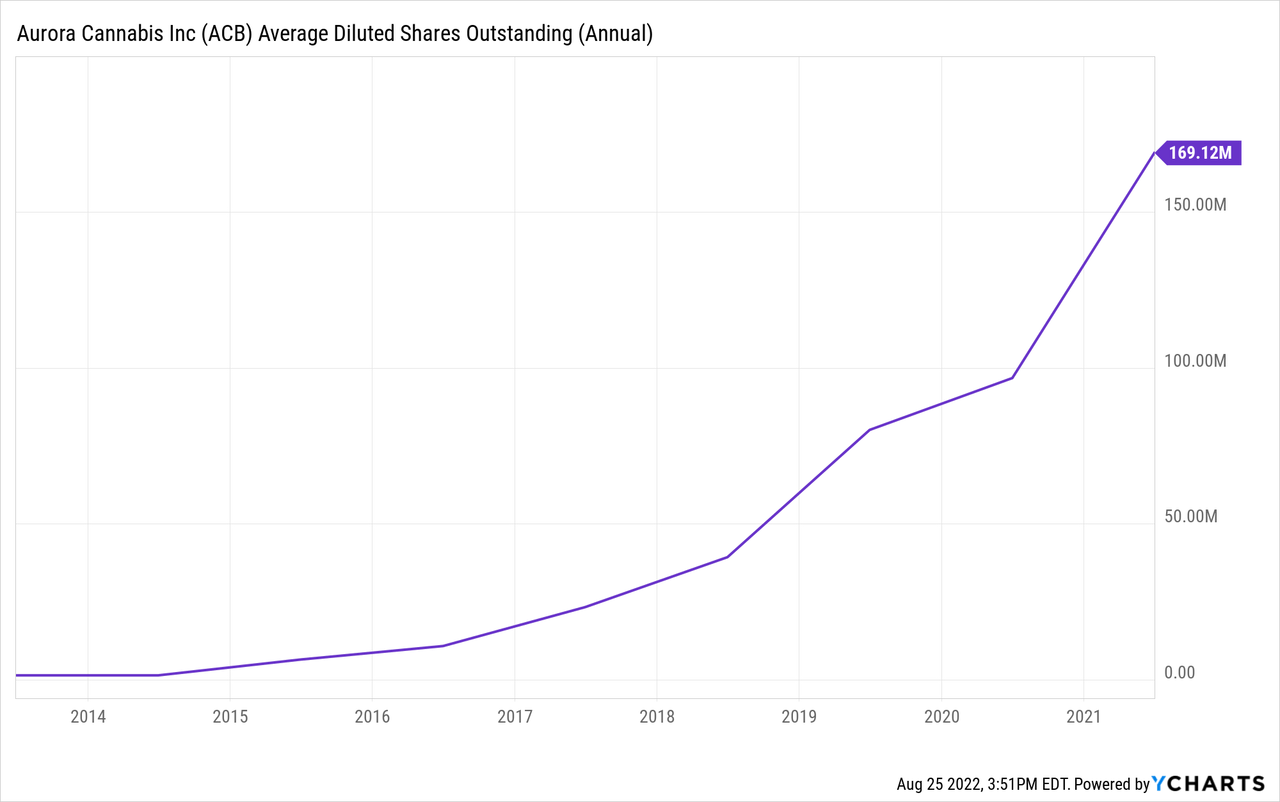

We believe given management’s history, we find it likely that the management will continue to keep the business afloat through dilutive actions and tapping into the debt markets, which will only further add debt to the unprofitable business. As seen below, the diluted shares outstanding for ACB has soared as a result of various acquisitions and financing needs. Just recently, the company announced a major acquisition at a price tag of ~$45 million CAD in cash. Regardless of the potential synergies through the acquisition, we find that the cash burn in addition to constant acquisitions are not recipes for success when the company’s fundamentals continue to decline. We don’t see that this trend will stop any time soon, and we believe that the company should be avoided at all costs as a result of its frivolous spend and impending liquidity crunch.

Upcoming Political Headwinds

Aurora Cannabis was one of the beneficiaries of the change in political climate in 2020. However, in the past couple of years, it appears that Aurora Cannabis has not been able to capitalize on these changes as the company’s financial performance has actually worsened since the 2020 general election. Now, the political climate has changed, and it appears increasingly likely of a gridlocked Congress and an uncertain political climate in the 2024 general election. We have seen no serious movement by the Biden administration to change federal laws with regard to marijuana, and given the political climate and the upcoming mid-term election, we find that the hope of a widespread de-criminalization and adoption of marijuana is highly unlikely in the near future. As a result, we believe the changes in the U.S. politics will now be secular headwinds for a troubled company with increasingly worse prospects.

Conclusion

We believe that Aurora Cannabis should be a stock that is avoided at all costs. The company has seen substantial deterioration in its financial performance, and there are many risks facing the company, namely liquidity risk. With the upcoming mid-term election and other uncertainties facing the business, we would highly recommend investors to find other areas to invest.

Be the first to comment