Australian Dollar Talking Points

AUD/USD trades in a narrow range ahead of the Reserve Bank of Australia (RBA) Minutes, but the policy statement may spark a bullish reaction in the exchange rate if the central bank tames speculation for additional monetary support.

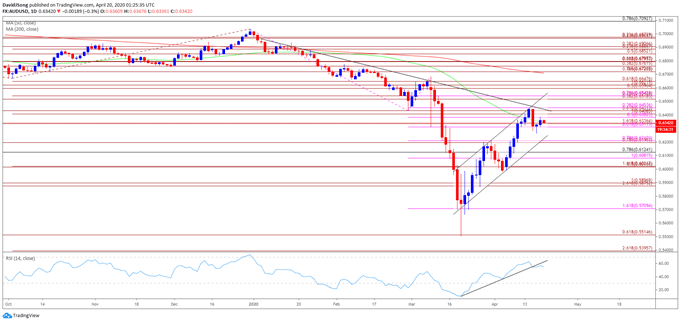

AUD/USD Rate Retains Ascending Channel Formation Ahead of RBA Minutes

AUD/USD continues to track the upward trending channel carried over from the previous month as the Reserve Bank of Australia (RBA) abandons the dovish forward guidance for monetary policy, and the minutes from the April meeting may heighten the appeal of the Australian Dollar if the central bank tames speculation for additional monetary support.

The update to Australia’s Employment report may encourage the RBA to adopt an improved outlook as the economy unexpectedly adds 5.9K jobs in March, and Governor Philip Lowe and Co. may continue to change their tune over the coming months as officials insist that “smaller and less frequent purchases of government bonds will be required” if market conditions continue to improve.

The unprecedented efforts taken by monetary and well as fiscal authorities should help to curb the slowdown in economic activity, but the RBA may come under pressure to further support the economy as the International Monetary Fund (IMF) sees global growth contracting 3.0% in 2020.

Source: IMF

At the same time, the IMF projects Australia to contract 6.7% this year, and the RBA may continue to deploy unconventional tools to combat the economic shock from COVID-19 as “it was likely that Australia would experience a very material contraction in economic activity, which would spread across the March and June quarters and potentially longer,”

In turn, it remains to be seen if the RBA will continue to adjust the forward guidance at the next meeting on May 5 especially as Standard and Poor’s cuts Australia’s credit rating outlook to ‘negative’ from ‘stable,’ but the central bank may merely attempt to buy time as the “coordinated monetary and fiscal response, together with complementary measures taken by Australia’s banks, will soften the expected contraction.”

With that said, the RBA Minutes may trigger a bullish reaction in AUD/USD if the central bank tames speculation for additional monetary support, but the Relative Strength Index (RSI) offers a mixed signal as the oscillator snaps the bullish formation carried over from the previous month.

Recommended by David Song

Forex for Beginners

Sign up and join DailyFX Currency Strategist David Song LIVE for an opportunity to discuss potential trade setups.

AUD/USD Rate Daily Chart

Source: Trading View

- Keep in mind, the monthly opening range has been a key dynamic for AUD/USD in the fourth quarter of 2019 as the exchange rate carved a major low on October 2, with the high for November occurring during the first full week of the month, while the low for December materialized on the first day of the month.

- The opening range for 2020 showed a similar scenario as AUD/USD marked the high of the month on January 2, with the exchange rate carving the February high during the first week of the month.

- However, the opening range for March was less relevant, with the high of the month occurring on the 9th, the same day as the flash crash.

- With that said, the rebound from the yearly low (0.5506) may continue to evolve as AUD/USD continues to track the ascending channel from March, but the bullish momentum appears to be abating as the Relative Strength Index (RSI) reverses course ahead of overbought territory and snaps the upward trend carried over from the previous month.

- The failed attempt to break/close above the Fibonacci overlap around 0.6380 (50% expansion) to 0.6450 (38.2% expansion) may generate range bound conditions as AUD/USD holds above the 0.6310 (61.8% expansion) to 0.6340 (161.8% expansion) region, but a break of channel support along with a move below the 0.6200 (78.6% expansion) to 0.6210 (78.6% expansion) area may bring the downside targets back on the radar.

- Next area of interest comes in around 0.6080 (100% expansion) to 0.6120 (78.6% retracement) followed by the 0.6020 (50% expansion) region.

Recommended by David Song

Traits of Successful Traders

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

Be the first to comment