AUDUSD, AUD/JPY, AUD/CHF Analysis & News

On Friday, we discussed the potential for the Australian Dollar to break out and now that pivotal resistance (0.7300-20) has been broken, AUD bulls can take some comfort. Overnight, sizeable gains in iron ore underpinned the gains in Aussie, while Sydney emerging from a near four-month lockdown has helped improve the mood music. To add to this, given that speculators continue to hold a large short position in Aussie, risks are geared towards a short squeeze. On the tech side, having broken above resistance, a close above 0.7320 will be key.

AUD/USD Chart: Daily Time Frame

Source: Refinitv

The Swiss Franc Remains Resilient

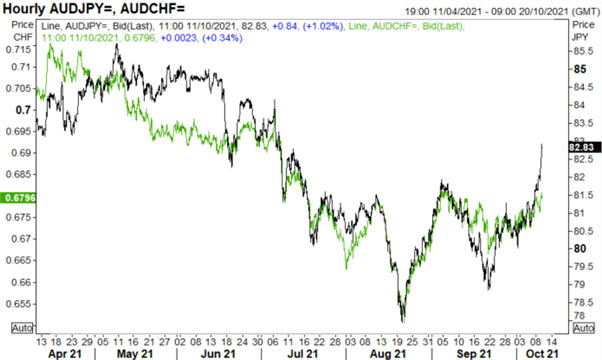

Elsewhere, as global bond yields continue to tick higher, AUD/JPY soared to a three month high, however, what is slightly bemusing is the more muted gains in AUD/CHF. Resistance at 0.6800 continues to hold for now, although, as risks remain tilted to the upside on global bond yields, I favour further upside in AUD/CHF. That said, the concern for the cross would be a deterioration across equity markets.

AUD/JPY vs AUD/CHF

Source: Refinitiv

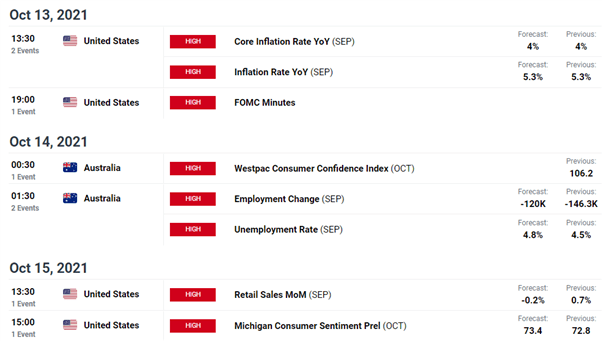

Looking ahead, domestic data in the form of the Australian jobs reports will be in focus for Aussie traders, while the main highlight will be the US CPI report. In turn, given the markets increasing concern over stagflation risks a softer report will see the USD underperform across the board.

Source: DailyFX

IG Client Sentiment Shifts Signal Mixed AUD/USD Outlook

Data shows 52.36% of traders are net-long with the ratio of traders long to short at 1.10 to 1. The number of traders net-long is 2.93% higher than yesterday and 0.08% higher from last week, while the number of traders net-short is 2.45% higher than yesterday and 0.09% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests AUD/USD prices may continue to fall.

Positioning is more net-long than yesterday but less net-long from last week. The combination of current sentiment and recent changes gives us a further mixed AUD/USD trading bias.

Be the first to comment