The AUD/CHF currency pair, which expresses the value of the Australian dollar in terms of the Swiss franc, is conventionally and strongly associated with risk sentiment in global markets.

The reason is two-fold: the Australian dollar (or AUD) is considered a commodity currency, particularly due to Australia’s significant exports of commodity products. Meanwhile, the Swiss franc is considered a safe haven in the FX world, owing to its positive current account surpluses and relative political stability.

In my last article covering AUD/CHF, dated January 27, 2020, I outlined strong potential for AUD/CHF to fall in light of the Australian bush fires and the emergence of the coronavirus threat to business and markets, among other factors. The chart below, which uses daily candlesticks to illustrate recent price action, also includes a vertical line to mark the date of my prior article.

(Chart created by the author using TradingView. The same applies to all subsequent candlestick charts presented hereafter.)

Subsequent to the publication of my article, volatility evidently increased dramatically, sending the pair from above the 0.66 handle to hit levels as low as 0.5350 (March 19, 2020). While there was some delay prior to the fall, markets ultimately caved to the growing risks surrounding coronavirus, as well as subsequent lockdown measures (per government interventions) to combat the spread of the COVID-19 pandemic.

However, we can also see that AUD/CHF has clearly retraced a significant portion of this move. In my recent articles covering the Australian dollar, including AUD/JPY (another traditional risk-on FX pair), I have taken a bearish view on AUD versus both JPY and USD. However, there are different reasons here.

JPY and USD are both safe havens, while USD demand is likely to remain high and JPY outflows are likely to remain low (lower risk-taking, less incentive to export capital owing to risk and very low global interest rate differentials, etc.). There are other reasons for why JPY and USD are likely to “remain bid”, but these are some important reasons. Meanwhile, my bearish view on AUD is based on markets likely under-pricing the second and third-order effects of the recent lockdowns. The economic effects are likely to be negative and multiplicative, and ‘actual output’ (economically speaking) is likely to fall behind ‘potential output‘ for a while.

This is likely to increase the demand for safe havens, and reduce the demand for commodity currencies. The recent upside is strongly correlated with recent upside retracements in other pro-risk instruments (e.g. U.S. equities). However, once again, I maintain that these seemingly risk-on moves are likely to return to the downside. The market may remain irrational for longer than we can remain solvent, but I believe the downside risk nevertheless remains.

In spite of this view, while CHF is typically considered a safe haven, AUD/CHF may in fact rise going forward. Given my thoughts on AUD, logical consistency would indicate this owing to a broadly weaker CHF, rather than a broadly stronger AUD. Both AUD and CHF are likely to remain weak going forward, but a potential weakening of CHF could make AUD/CHF an interesting long trade.

The reason is because AUD/CHF offers potential to rise in both a risk-on and risk-off environment. If we cannot accurately guess where risk sentiment is going, we can attempt to exploit a directional trade that is likely to succeed independent of risk sentiment.

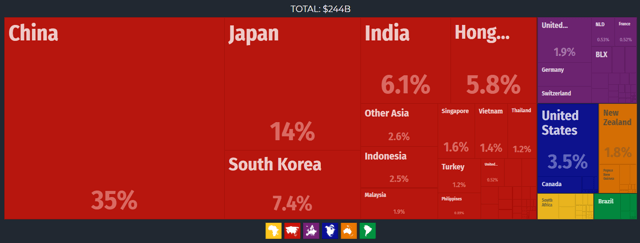

Why could CHF weaken more than AUD? It is probable that while AUD could fall based on lower risk sentiment and/or international trade, the currency is still going to find some degree of demand owing to its significant export exposure to China. China is perhaps better positioned to rebound economically moving forward, as the country now returns to work, as the country appears to have passed the worst of the recent pandemic domestically.

(Source: Observatory of Economic Complexity. Key export destinations for Australia include China, Japan, South Korea and India.)

(Source: Observatory of Economic Complexity. Key export destinations for Australia include China, Japan, South Korea and India.)

AUD is likely to remain liquid, and interest rates are unlikely to rise any time soon. Nevertheless, if it were not for the COVID-19 shock, arguably the country’s short-term interest rate (as set by the Reserve Bank of Australia) would still be positive at +0.75% (it has since been cut to +0.25%; still above the zero bound). Going into this crisis, the comparable Swiss rate (the SNB policy rate) was already negative at -0.75%.

Therefore, while AUD and CHF are both likely to maintain expansionary monetary policies, Switzerland is far more incentivized to increase CHF liquidity than Australia is to increase AUD liquidity. Liquidity can be increased through various measures, but ultimately the common denominator tends to be to increase the money supply.

I hold to my opinion that currencies do not depreciate in the long term based on money supply increases (except versus goods and services, over longer durations of time, in line with inflation); FX demand and geopolitical confidence is what usually drives FX prices. Yet the Swiss National Bank is well-positioned to continue to intervene in markets, especially as EUR/CHF continues to fall (putting pressure on Swiss export competitiveness; see chart below).

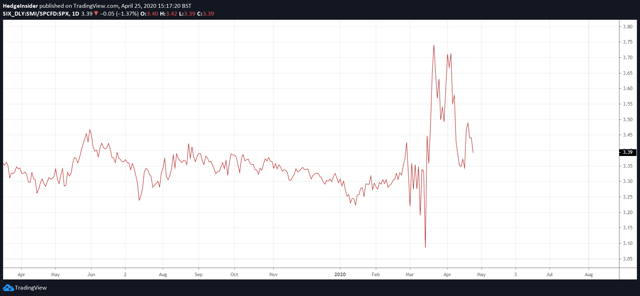

Investors also appeared to favor Swiss equities going into this crisis, yet confidence now appears to be falling. The chart below shows the ratio between the value of the Swiss Market Index (an index used as a proxy for Swiss equity performance) and SPX (i.e., the S&P 500, a proxy for U.S. equity performance).

It appears that Switzerland, and Swiss equities, were used as a sort of “reactionary safe haven”, as investors had little idea where to park capital in light of this unprecedented crisis. The spike in Swiss equity outperformance has alas not managed to sustain itself. A further drop in relative confidence is likely to continue to put pressure on CHF through further international capital outflows.

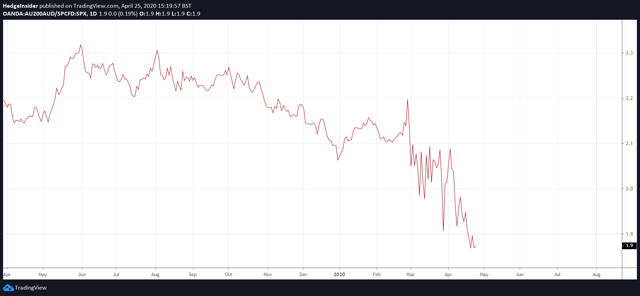

To compare the ratio with above, the chart below illustrates the ratio between S&P/ASX 200 (an Australian equity index) and SPX.

Clearly, Australia has not (and continues to not) be attractive to international investors. While we could start to build a contrarian case for a reversal here, we do not need to do this to make the case that CHF outflows could (continue to) be sharper, going forward.

AUD is still unlikely to be attractive on the long side (most AUD FX crosses will probably retrace to the downside). However, AUD/CHF appears to offer an interesting long trade potential, given that it stands a good chance of appreciating regardless of risk sentiment. Since risk sentiment has been challenging to predict recently, this makes AUD/CHF appealing.

While AUD/CHF could find itself dipping in the short term from the current market price of around 0.6220 to possibly as low as the 0.60 handle, this author does not believe AUD/CHF will attempt new lows.

Instead, we should set our eyes on new targets to the upside (as shown in the chart above): 0.6435 and 0.6615 (which incidentally align with levels seen as at the publication date of my prior article in January).

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment