PeopleImages/iStock via Getty Images

Is AT&T Or Verizon Stock The Better Buy?

In this article we explain why we prefer Verizon Communications Inc. (NYSE:VZ) over AT&T Inc. (NYSE:T) as an investment.

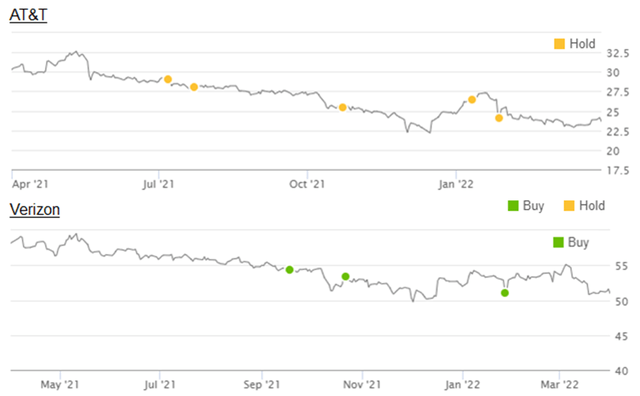

We initiated a Hold rating on AT&T (meaning we would avoid the stock) in July 2021 and a Buy rating on Verizon in September. Verizon has outperformed AT&T, losing 4.0% since our initiation compared to AT&T’s loss of 10.6% over the same period (AT&T has lost 13.8% since its initiation):

|

Librarian Capital Rating History vs. Share Price – AT&T & Verizon  Source: Seeking Alpha (31-Mar-21). |

We like Verizon for a number of qualitative reasons; AT&T falls short when assessed on the same areas. Both have low valuation multiples and good Dividend Yields (6.3% for AT&T and 5.0% for Verizon). We expect Verizon shares to deliver a total return of 79% (18.4% annualized) by 2025 year-end. AT&T shares look superficially even “cheaper”, but AT&T’s business weaknesses mean that we do not view the stock as a good investment.

AT&T Vs. VZ Company Overviews

Both AT&T and Verizon are driven by their wireless businesses.

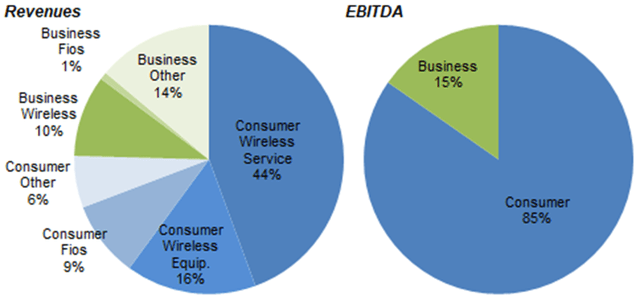

Verizon reports in two segments, Consumer and Business, with Consumer generating 85% of its segmental EBITDA. Across the two segments, Wireless (including both Service and Equipment) contributes 70% of revenues, Fios (i.e. Wireline) contributes 10% and Other contributes 20%:

|

Verizon Revenues & EBITDA by Segment (2021)  Source: Verizon 10-K filing (2021). NB: Reportable segments only; not pro forma Tracfone acquisition. |

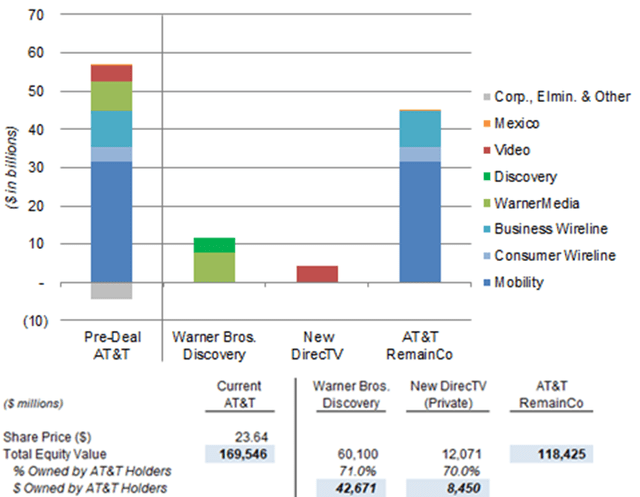

AT&T is in the process of spinning out WarnerMedia; RemainCo will have three main segments: Mobility (70% of segmental EBITDA), Business Wireline (21%) and Consumer Wireline (9%):

|

AT&T EBITDA & Valuation by Segment (2021)  Source: AT&T company filings. NB. DirecTV EBITDA based on last 12 months to Jun-21. |

WarnerMedia is merging with Discovery (DISCK). AT&T shareholders will receive 0.24 shares in the new Warner Bros. Discovery (WBD) for every AT&T share held. The record date for the distribution is April 5, after which buyers of AT&T shares will not receive WBD shares.

AT&T also holds a 70% stake in DirecTV after spinning it off to private equity firm TPG in August 2021.

Based on Discovery’s current share price and the DirecTV deal value, the value of each AT&T share is 70% in RemainCo, 25% in WBD and 5% in DirecTV.

This article focuses on comparing AT&T RemainCo with Verizon.

AT&T Vs. VZ Financial Outlooks

AT&T and Verizon share some similarities in their financial outlooks, including low-single-digit revenue growth, EBITDA margin expansion, and a normalization in CapEx. However, AT&T’s growth is much more wireline-focused, and its CapEx will also peak later than Verizon’s.

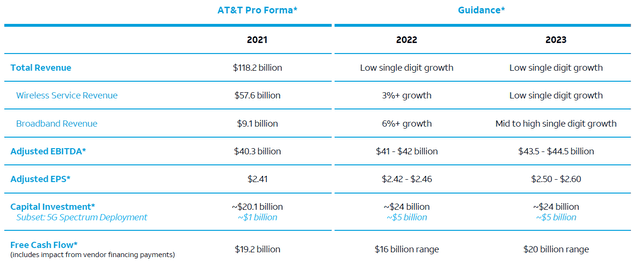

AT&T expects a low-single-digit growth in overall revenues in 2022-23, including low-single-digit growth in Wireless Service and mid-to-high single-digit growth in Broadband. EBITDA is expected to be $43.5-$44.5bn in 2023, or 8-10% higher than 2021, implying margin expansion. CapEx is expected to be $24bn in both 2022 and 2023, from $20.1bn in 2021, before normalizing to a $20bn run-rate in 2024:

|

AT&T Outlook (2022-23)  Source: AT&T investor day (Mar-22). |

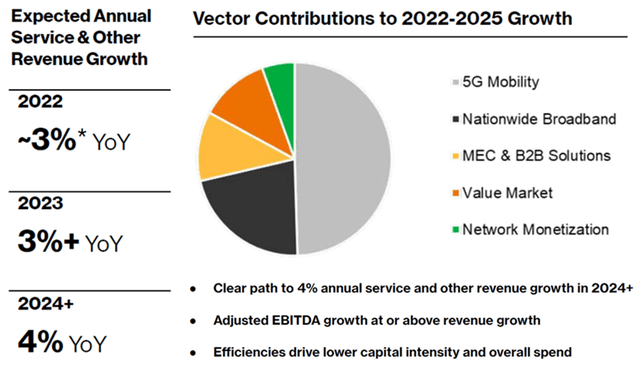

Verizon expects an approx. 3% growth in its Service & Other revenues in 2022, followed by 3%+ in 2023, then 4% for 2024 and beyond. Approximately half of the 2022-25 revenue growth is expected from 5G Mobility, another 10% from pre-paid wireless (“Value Market”). EBITDA margin expansion is expected, but actual EBITDA expectations are not specified:

|

Verizon Selected Outlook (2022-25)  Source: Verizon investor day (Mar-22). NB. Nationwide Broadband includes Fixed Wireless. |

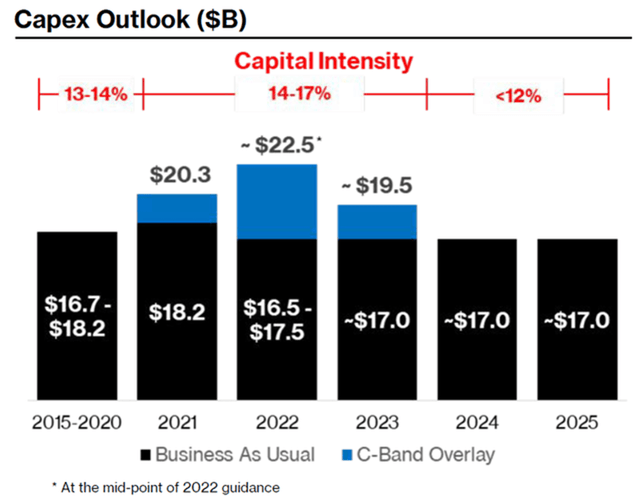

Verizon expects its CapEx to peak at $22.5bn in 2022, compared to $20.3bn in 2021, and to normalize down to $17.0bn by 2024:

|

Verizon CapEx Outlook (2022-25)  Source: Verizon investor day (Mar-22). |

We prefer Verizon’s outlook for its greater clarity. In addition, the differences in the two companies’ outlooks stem from fundamental differences in their strategies, and we believe Verizon’s strategy is more likely to succeed.

Wireless: Verizon’s More Disciplined Growth

In wireless, Verizon has targeted a more disciplined form of growth that is driven by Average Revenue Per User (“ARPU”) instead of user numbers.

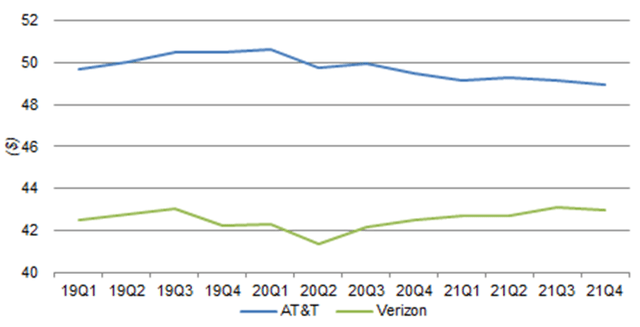

Verizon’s ARPU has continued to grow since early 2020, while AT&T has intentionally sacrificed ARPU to gain volume:

|

Average Revenue Per User – AT&T vs. Verizon  Source: Company filings. |

Verizon achieved a higher growth rate in its Wireless Service revenues in 2021, at 4.8% compared to AT&T’s 3.7%.

Verizon expects its ARPU growth to continue, targeting a 2.5%+ ARPA (Average Revenue Per Account) growth through 2025 in Consumer. AT&T expects its Mobility Service revenues to be “driven by subscriber growth”, with ARPU only “to stabilize in the latter part” of 2022.

Wireless: Verizon Expanding In Value Market

Verizon is also expanding in the “value” part of the wireless market with Tracfone, a Prepaid mobile provider acquired for $6.25bn in November.

The acquisition of Tracfone brings a leading “value” brand, 20m customers and $8.1bn of revenues (2019 figure) to Verizon. Management expects to generate $1bn+ in incremental revenues, as well as approx. $1bn in cost synergies, from Tracfone and the “value” market by 2025.

We believe Tracfone will give Verizon an advantage in Prepaid growth.

Wireless: Verizon’s Hedge with U.S. Cable

Verizon has hedged its downside in the wireless market with Mobile Virtual Network Operator (“MVNO”) relationships with U.S. Cable.

U.S. Cable is a key threat to incumbent Wireless operators in the new era of fixed-mobile convergence, as they already have existing customer relationships, and can have a lower cost-to-serve by including Wireless products in their bundles (reducing sales and marketing costs) and by using WiFi offload for data consumption at home (reducing network costs).

Verizon has longstanding (and perpetual) MVNO agreements with Charter (CHTR) and Comcast (CMCSA), the two main U.S. Cable operators with nearly 30m residential broadband customers each. By contrast, AT&T’s biggest MVNO relationship is with DISH Network (DISH), which serves 10.7m Pay TV subscribers using mainly satellites, in a deal signed only in July 2021. DISH has 8.5m wireless subscribers after acquisitions such as Boost Mobile, but the bulk of these are currently served by a T-Mobile (TMUS) MVNO.

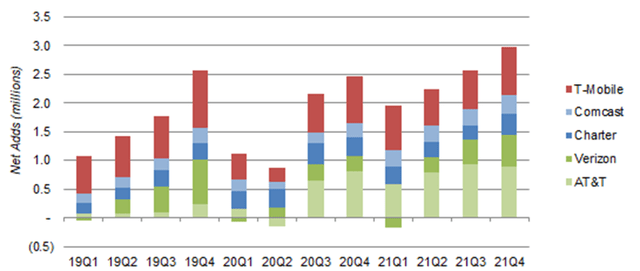

Since 2019, the combined Wireless Postpaid Phone net add at Verizon, Charter and Comcast have exceeded that at AT&T in 10 out of 12 quarters; Wireless net adds at Charter and Comcast have been accelerating during 2021:

|

Wireless Postpaid Phone Net Adds – Key Players (Since 2019)  Source: Company filings. |

We believe Verizon’s Cable MVNOs advantage it over AT&T.

Mobility: Verizon Ahead with New Spectrum

Verizon is ahead in deploying new spectrum, which means it has improved its capacity faster than AT&T and its CapEx will normalize down sooner.

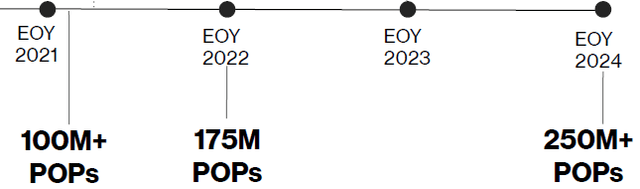

Verizon is currently deploying its newly-acquired C-band spectrum, having already reached a coverage of 100m+ POPS, and is targeting 175m for 2022 and 250m+ for 2024:

|

Verizon C-Band Deployment Schedule  Source: Verizon investor day presentation (Mar-21). |

AT&T’s C-band deployment is more gradual, only expected to cover 75m POPS by 2022 year-end, somewhat catching up with 200m by 2023 year-end. This is in part due to AT&T having acquired spectrum more slowly.

Verizon’s faster deployment represents a competitive advantage over AT&T.

Wireline: AT&T Spending Far More on Fiber

AT&T’s strategy is more focused on fiber, involving much larger CapEx over the next few years, partly because its present fiber coverage is low.

AT&T’s wireline network is currently 20% served by fiber. It intends to double its fiber coverage to 30m+ locations (including 25m residential locations) by 2025, by adding 3.5-4.0m locations annually (compared to 2.6m in 2021). This means that 75% of its locations will be covered by fiber or Fixed Wireless by 2025, and AT&T will evaluate whether to build more fiber then.

Verizon’s wireline network is currently 40% served by fiber. It intends to expand its fiber coverage from 16.5m locations to 18m by 2025 year-end. This means 50% of its locations will be covered by fiber. Further expansions are likely limited, as Verizon regards its fiber roll-out as largely complete:

“Our core OneFiber build is winding down as we have completed a majority of the markets and more than 75% of the overall ramp miles with the expectation that the core build will be completed by the end of 2023.”

Matt Ellis, Verizon CFO (March 2022 investor day)

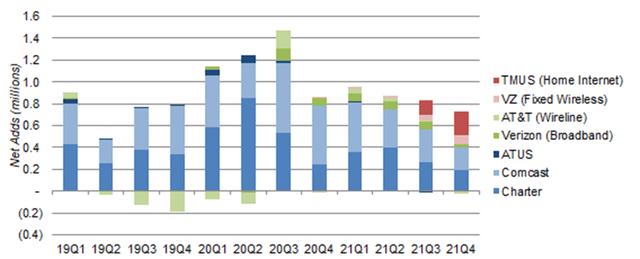

Despite their fiber overbuild, AT&T’s and Verizon’s overall broadband net adds remained marginal and far smaller than U.S. Cable net adds in 2021:

|

Wireline & Fixed Wireless Broadband Net Adds – Key Players (Since 2019)  Source: Company filings. NB. TMUS figures only disclosed from Q3 2021. |

We believe telco fiber overbuild may help stem their non-fiber broadband losses, but will not result in material subscriber gains from U.S. Cable due to the latter’s entrenched position and competitive offerings.

We view AT&T’s more aggressive fiber CapEx as a sign of weakness, with uncertain returns, and prefer Verizon’s more settled wireline footprint.

Fixed Wireless: Focus For VZ, But Not AT&T

Verizon sees Fixed Wireless as a key focus area, whereas AT&T sees it as an inferior product more suitable for filling gaps in its fiber network.

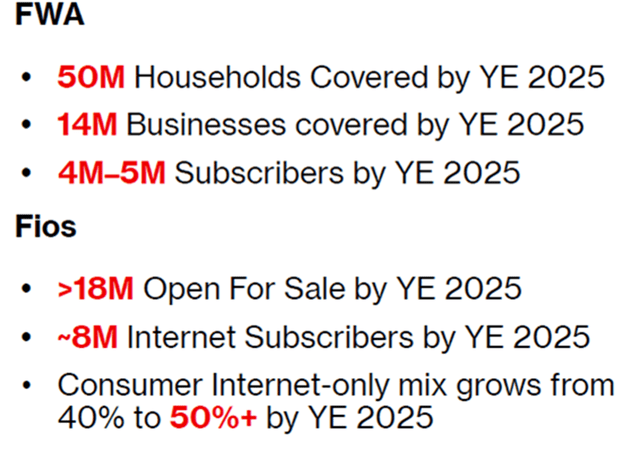

Verizon’s “National Broadband” growth vector target involves having 11m residential broadband customers by 2025 year-end, including 8m in Fios (fiber) and 4-5m in Fixed Wireless (“FWA”):

|

Verizon “National Broadband” Targets  Source: Verizon investor day presentation (Mar-21). |

The targets compare with existing residential subscriber counts of 6.5m in Fios and 189k in Fixed Wireless (with a 150k net add guided for Q1 2022), which means the bulk of new broadband subscribers in 2022-25 will come from Fixed Wireless. To facilitate this, Verizon will be expanding its Fixed Wireless coverage to 50m households by 2025 year-end (from 20m at 2021 year-end).

AT&T sees Fixed Wireless as an inferior product for households, for both quality and cost reasons, and prefers to build fiber instead:

“Fixed wireless is a tool that we have available to us. And it’s one that, in certain instances, it is the right solution … But in densely populated areas, like long term, first, it’s not as good of a product. Two, it costs us more long term to maintain it. So why not just simply go and do it right the first time … Build fiber and bet on the long term that the trends are in your favor.”

Pascal Desroches, AT&T CFO (Deutsche conference, March 14, 2022)

We believe Fixed Wireless can gain significant share in areas historically poorly served by U.S. Cable (with Altice USA’s (ATUS) Suddenlink footprint particularly vulnerable), and prefer Verizon’s focus here.

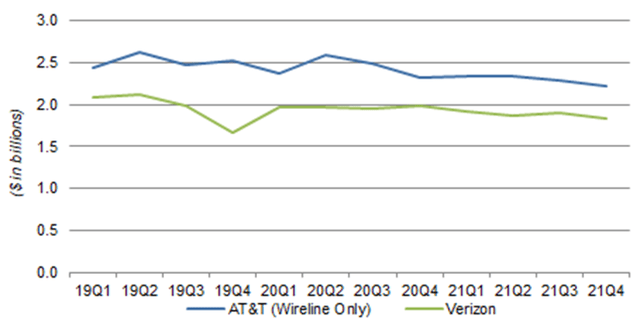

Business EBITDA: T AND VZ Both Shrinking

Both AT&T and Verizon have seen EBITDA in their business segment shrink, due to decline in legacy solutions and competition from U.S. Cable:

|

Business EBITDA – AT&T vs. Verizon  Source: Company filings. |

Both companies are targeting new verticals like B2B solutions and Mobile Edge Computing (“MEC”), and both have partnered with cloud platforms such as Microsoft’s (MSFT) Azure. AT&T also sees its fiber roll-out (from 3m business locations in 2021 to 5m in 2025) as key to gain share among SMBs.

Verizon targets $2bn+ of new revenues from Internet of Things and public MEC by 2025, while AT&T expects its Business Wireline EBITDA “to stabilize as we exit 2023” (after falling low-single-digits in 2022).

AT&T’s exposure to business customers is marginally higher – its Business Wireline segment (which excludes Wireless) was 21% of RemainCo EBITDA, while Verizon’s Business segment was 15% of its segmental EBITDA.

We prefer Verizon’s approach, as it is less dependent on a fiber roll-out and competes less with U.S. Cable operators.

Restructuring: AT&T Still Work In Progress

AT&T is still undergoing significant restructuring, while Verizon has substantially completed its and is more efficient.

AT&T has been executing a three-year, $6bn cost savings program since 2020. This is more than half completed, but most of the savings to date were “reinvested”:

“We achieved more than half of our $6 billion cost savings run-rate target, which we’ve reinvested into operations”

John Stankey, AT&T CEO (Q4 2021 earnings call)

Management now “expects incremental transformation savings of $1bn in 2022 and $1.5bn in 2023”. The remaining savings are to come “primarily” from field dispatch and customer service; other sources include energy, real estate, shutting down legacy copper networks, back-end platforms and general & administration. There were also $700m of restructuring expenses in 2021 that will “taper off” over 2022 and 2023.

Verizon has completed a $10bn cost savings program in 2021. Management expects incremental savings in the future, but margin expansion is expected to be also driven by revenue growth and operational leverage. We think this implies Verizon’s operations are already more efficient. (Verizon’s EBIT margin is also several points higher than AT&T RemainCo’s, at 24.3% compared to 19.1% in 2021, though the mix may not be comparable.)

We are cautious of AT&T’s claims, as savings that are “reinvested” are impossible for investors to verify, and also see a risk in cost cuts negatively impacting customer experience. We prefer Verizon here.

Valuation: T And VZ Stock Key Metrics

We calculate AT&T valuation metrics with an adjusted share price that excludes the value of WBD shares that will be distributed to AT&T shareholders. Each AT&T share is set to be given 0.24 WBD shares so that AT&T shareholders end up owning 71% of the WBD equity. Each existing Discovery common share will be converted to 1 WBD share, so their current price allows us to value WBD.

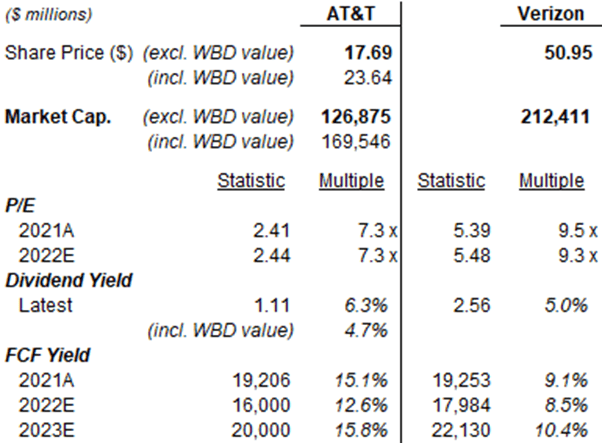

Based on actual financials, management guidance and our own estimates, key valuation metrics for AT&T and Verizon are below:

|

Key Valuation Metrics – AT&T vs. Verizon  Source: Company filings, Librarian Capital estimates. |

AT&T appears to be “cheaper” than Verizon. Excluding WarnerMedia, AT&T’s Free Cash Flow in 2021 was almost identical to Verizon’s (at $19bn), yet AT&T’s adjusted market capitalization (excluding WBD) was 40% below Verizon’s (and would still be 20% below if unadjusted). AT&T’s P/E is about 2x lower than Verizon’s, and its Dividend Yield is 1.3% higher.

However, with the various issues in AT&T’s businesses listed above, we do not believe AT&T shares will be a good investment, even at this lower valuation.

Verizon Stock Forecasts

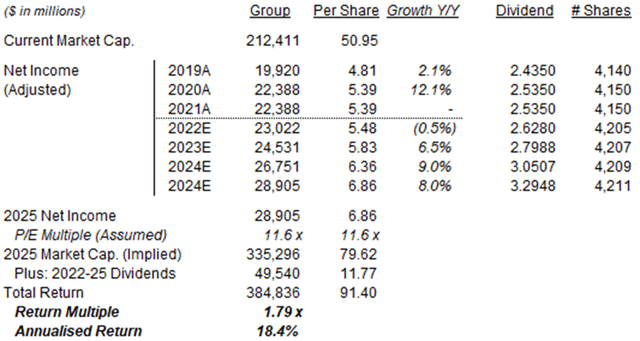

Our forecasts (unchanged from January) are as follows:

- Our updated 2022 EPS to be $5.48, mid-point of the guidance

- 2023 EPS growth of 6.5%

- 2024 EPS growth of 9.0%

- 2025 EPS growth of 8.0%

- Share count to increase by 2m annually

- P/E of 11.6x at exit

|

Illustrative Verizon Return Forecasts  Source: Librarian Capital estimates. NB. EPS adjusted to exclude amortization of acquired intangibles from 2022. |

With shares at $50.95, we expect an exit price of $80 and a total return of 79% (18.4% annualized) by 2025 year-end.

Are T and VZ Good Long-Term Stocks?

In summary, we believe Verizon is a good long-term stock but AT&T is not.

Verizon has a track record of disciplined growth in Wireless. It has a history of growing ARPU, and can now also target the “value” market after acquiring leading Prepaid provider Tracfone. It has hedged its downside with MVNO partnerships with the two main U.S. Cable players. Its fiber roll-out is substantially complete, and it is ahead in deploying new spectrum. Fixed Wireless can provide further upside in some markets. Its operations appear more efficient, having completed a major savings program.

We reiterate our Buy rating on Verizon Communications Inc.

AT&T has prioritized volume growth over ARPU. Its Wireless business is under threat from U.S. Cable players adding mobile offerings into their bundles. Only 20% of its wireline network is served by fiber, and it will be spending major CapEx over the next few years to catch up. It is behind in deploying new spectrum and does not see Fixed Wireless as a focus area. It is in the middle of a major restructuring, which carries significant operational risks.

We reiterate our Hold rating on AT&T Inc., meaning we believe the stock should be avoided by active investors.

Be the first to comment