Erik Khalitov/iStock Unreleased via Getty Images

With the WarnerMedia spinoff fast approaching, AT&T (NYSE:T) has uploaded a series of press releases last week detailing how the transaction will take place. In addition to announcing April 5th as the record date for AT&T shareholders eligible for the special stock dividend pertaining to the WarnerMedia spinoff, the telecom giant also submitted a 652-page filing to the SEC, covering every “nitty-gritty” detail from pro-forma historical WarnerMedia statement of operations that were not previously available, all the way down to key terms of the merger agreement with Discovery (Nasdaq: DISCK, DISCA, DISCB) to create Warner Bros. Discovery (“WBD”).

In our last coverage on the upcoming WBD transaction and its implications for AT&T post-close, we had provided a detailed estimate on WBD’s upside potential attributable to AT&T shareholders post-close. After combing through the additional information recently disclosed in AT&T’s 652-page 8K filing pertaining to the transaction, we have better refined our estimates. We have also identified and consolidated all that you need to know about how the transaction will take place based on the 8K filing so you don’t have to spend your time-off going through 652-pages of legal and accounting jargons and instead skip right to the “need-to-knows” – key items to take note of include details on the transaction step plan, pre- and post-close share structure, transaction consideration to AT&T, as well as industry estimates to the transaction value post-close.

What Happens on April 5th?

Last week, AT&T confirmed April 5th at market close as the record date for the stock dividend related to the WarnerMedia spinoff. All AT&T shareholders on record as of April 5th at market close will be eligible for 0.24 WBD shares for each share of AT&T share owned.

Now, the record date is not the same as the transaction completion date. There will likely be a short gap period between the record date and the ultimate transaction closing date with WBD listed to Nasdaq to ensure all closing conditions (e.g. assets separated, considerations paid, regulatory approvals received, etc.) are met. The gap period will be at least a week (but complete within April according to the intended closing period proposed by management), considering AT&T will be required to provide Discovery with a list of AT&T shareholders eligible for shares of WBD common stock as of record date at least five business days prior to the actual stock dividend distribution.

Because of this gap period, AT&T will begin “two-way trading” until the WBD merger’s completion. Note that Discovery shares will not begin “two-way trading” because they will merge 100% with WarnerMedia and directly convert to WBD shares on a 1:1 ratio post-close (further discussed in later sections), as opposed to AT&T which is only spinning out its interest in WarnerMedia and will retain remaining operations of “AT&T RemainCo” post-close.

There will be three trading options available for AT&T shareholders beginning April 4th (or technically, post April 5th market close when an existing AT&T shareholder on record date is marked eligible for the right to shares of WBD common stock post-close):

- AT&T Regular Way Trading – AT&T shareholders can engage in “Regular Way Trading” during the two-way trading period if they wish to sell “both the share of AT&T common stock and the right to receive shares of WBD common stock in the transaction”. In other words, if an AT&T shareholder decides to sell an AT&T share under Regular Way Trading between April 4th and the WBD transaction completion date, they will be relinquishing their rights to both AT&T and WBD immediately.

- AT&T Ex-Distribution Trading – AT&T shareholders can engage in “Ex-Distribution Trading” during the two-way trading period if they wish to only sell their right to AT&T RemainCo and retain their stock dividend pertaining to the WBD transaction. In other words, if an AT&T shareholder decides to sell an AT&T share under Ex-Distribution Trading between April 4th and the WBD transaction completion date, they will only be retaining rights to the WBD shares distributed to them as a result of their AT&T share ownership as of the record date (April 5th market close). Ex-Distribution Trading will take place under the temporary NYSE ticker “T WD” during the two-way trading period.

- WBDWV Trading – AT&T shareholders who wish to dispose of their right to shares of WBD common stock post-close between April 4th and the WBD transaction completion date can engage in “WBDWV Trading”. Under WBDWV Trading, AT&T shareholders will be able to sell their right to WBD shares distributed to them as a result of their AT&T share ownership as of the record date through the temporary Nasdaq ticker “WBDWV” beginning April 4th.

All transactions taken place during the two-way trading period under “T WD” and “WBDWV” “will settle after the closing date of the [WBD] transaction”.

WarnerMedia Spinoff Share Structure

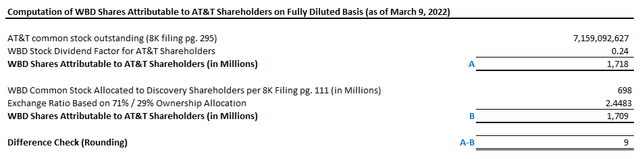

As discussed in detail in our last coverage, AT&T will spinoff 100% of its current interest in WarnerMedia post-close. Upon completion of the transaction, AT&T shareholders will, together, own 71% equity interest in WBD, with Discovery shareholders owning the remainder 29%. We had previously estimated about 2.4 billion WBD shares outstanding post-close according to AT&T’s stock dividend structure of 0.24 WBD shares for each AT&T share. According to the company’s latest 8K filing, it estimates 2,406,906,476 actual shares of WBD common stock to be issued upon completion of the transaction, derived as follows:

- AT&T has applied an exchange ratio of 2.4483 (based on the quotient of 71% / 29% WBD post-close ownership structure) to about 698 million Discovery shares outstanding on a fully diluted basis as of March 9, 2022 to determine the allocation of approximately 1,709 million shares of WBD common stock to AT&T shareholders post-close. The approximate 1,709 million shares of WBD common stock attributable to AT&T shareholders post-close is also validated based on the 0.24-to-1 WBD share distribution ratio for each AT&T share outstanding computed as follows:

WBD Shares Attributable to AT&T Shareholders (Author)

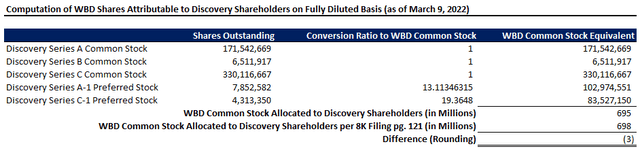

- The 698 million Discovery shares outstanding on a fully diluted basis is computed as follows:

WBD Shares Attributable to Discovery Shareholders (Author)

- Together, shares of WBD common stock allocated to AT&T and Discovery shareholders will total approximately 2,407 billion units as disclosed per AT&T’s latest 8K filling.

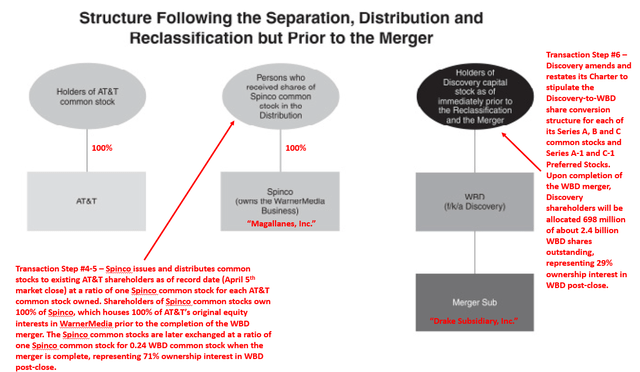

WarnerMedia Spinoff Transaction Structure and Step Plan

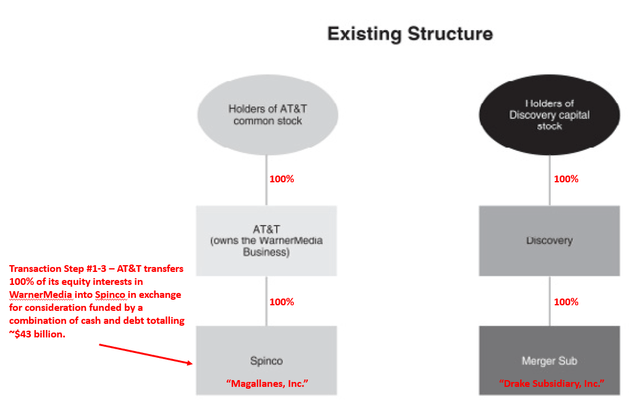

If you have taken a look at AT&T’s latest 8K filling dated March 28th, you would notice that the filing registrant is “Magallanes, Inc.”. Magallane, Inc. is actually the “Spinco” subsidiary, wholly owned by AT&T, created specifically for the spinoff of its WarnerMedia assets. Essentially, AT&T will transfer 100% of its owned WarnerMedia assets into the Magallane, Inc. Spinco prior to the completion of the transaction. Upon closing, Magallane, Inc. Spinco will merge with “Drake Subsidiary, Inc.”, the wholly owned “merger subsidiary” of Discovery’s to create WBD. The specific transaction structure will be executed in the seven steps as follows:

Step 1 The Separation – Prior to AT&T’s distribution of rights to shares of WBD common stock to existing AT&T shareholders as of record date and the final merger completion, AT&T will have to transfer all of its equity interests in the assets and liabilities attributable to its WarnerMedia business to the Magallanes, Inc. Spinco.

Step 2 Issuance of Spinco Debt Securities – Prior to AT&T’s distribution of rights to shares of WBD common stock to existing AT&T shareholders as of record date and the final merger completion, the Magallanes, Inc. Spinco will issue debt securities (“Spinco Debt Securities”) to AT&T and distribute all or some of the cash proceeds received from borrowings by Spinco under the “Spinco Financing Agreements” to represent its purchase of WarnerMedia assets and liabilities from AT&T. The Spinco Financing Agreements allude to debt totaling approximately $42 billion received from a combination of bridge loans, term loan credit agreements, note issuances, and revolving credit agreements obtained or completed through commitments with JPMorgan Chase Bank, Goldman Sachs Bank, Goldman Sachs Lending Partners LLC, and “certain other financial institutions”. The combination of issued Spinco Debt Securities and cash proceeds from Spinco Financing Agreements provided to AT&T as part of transaction step #2 must total $43 billion, which represents the total consideration paid by Spinco to AT&T in exchange for its equity interests in the assets and liabilities of WarnerMedia (i.e. net asset value under U.S. federal income tax purposes $33 billion + $10 billion additional amount) transferred into the Spinco in transaction step #1:

Estimated Consideration to AT&T for WarnerMedia Assets (AT&T Form 8K filing dated March 28, 2022, pg. 111)

Step 3 Special Cash Payment – Prior to AT&T’s distribution of rights to shares of WBD common stock to existing AT&T shareholders as of record date and the final merger completion, the Magallanes, Inc. Spinco will make a “Special Cash Payment” to AT&T totaling $33 billion, which represents the estimated fair value of AT&T’s equity interest in total WarnerMedia assets and liabilities to be transferred to Spinco as discussed in transaction step #2.

Step 4 Issuance of Spinco Common Stock – Prior to AT&T’s distribution of rights to shares of WBD common stock to existing AT&T shareholders as of record date, the Magallanes, Inc. Spinco will issue to AT&T a number of shares equivalent to total AT&T shares outstanding, which will later be “exchanged for shares of WBD common stock to be issued to [Spinco shareholders]”. Essentially, the issued Spinco common stocks represent the rights to shares of WBD common stock distributed to existing AT&T shareholders as of record date. These issued Spinco common stocks can be exchanged for 0.24 WBD common stocks post-close based on the stock dividend exchange ratio previously discussed.

Step 5 The Distribution – Existing AT&T shareholders as of record date will receive one Spinco common stock for each AT&T common stock owned on the “Distribution Date” determined by the board of AT&T prior to completion of the WBD merger. The distributed Spinco common stocks can be exchanged for 0.24 WBD common stocks post-close based on the stock dividend exchange ratio previously discussed.

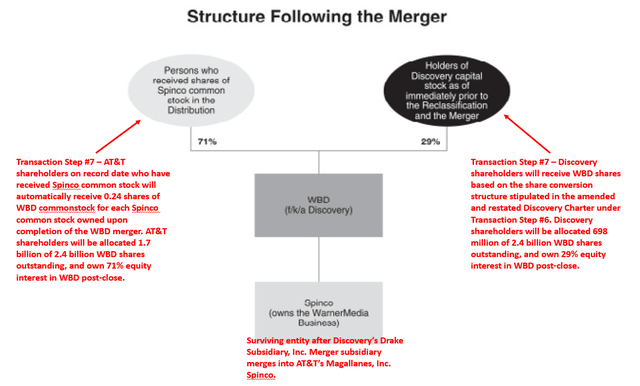

Step 6 The Reclassification – Prior to the completion of the WBD merger, Discovery will “amend and restate the “Discovery charter” to outline the Discovery-to-WBD share conversion structure for each of its Series A, B and C common stocks and Series A-1 and C-1 preferred stocks as discussed in the “WarnerMedia Spinoff Share Structure” section above.

Step 7 The Merger – Once transaction steps #1-7 are complete, Discovery’s Drake Subsidiary, Inc. merger subsidiary will merge into Magallanes, Inc. Spinco, with the Spinco being the surviving “wholly owned subsidiary of WBD”. Upon completion of the merger, each Spinco common stock issued under transaction step #4 and distributed to existing AT&T shareholders as of record date under transaction step #5 will automatically convert into 0.24 shares of WBD common stock. The conversion will ultimately result in 71% AT&T shareholder ownership in WBD, with the remaining 29% ownership in WBD attributable to Discovery shareholders.

WBD Transaction Structure (AT&T 8K filing, with annotations by Author.) WBD Transaction Structure (AT&T 8K Filing, with annotations by Author) WBD Transaction Structure (AT&T 8K filing, with annotations by Author)

Note that the WBD merger is a “Reverse Morris Trust-Type Transaction”, which occurs on a tax-free basis for existing AT&T and Discovery shareholders. Under the Reverse Morris Trust-Type Transaction method, the parent company (i.e. AT&T) wishing to divest a subsidiary (i.e. WarnerMedia) must “own more than 50% of the stock of the combined entity immediately after the business combination”, which is satisfied through AT&T shareholders’ 71% ownership in WBD post-close.

The Million Dollar Question: When Will the WBD Merger Close and What is Its Post-Close Value?

There is currently no definitive answer to when the WBD merger will close or what its post-close value will be. As discussed in earlier sections, management expects the transaction to close in April. Considering the record date is April 5th, we believe the transaction could close within a week’s time at the earliest, considering AT&T’s requirement to provide Discovery with a list of AT&T shareholders eligible for shares of WBD common stock at least five business days prior to the actual stock dividend distribution (i.e. distribution of Spinco common stock to eligible AT&T shareholders as of record date), which occurs prior to completion of the WBD merger.

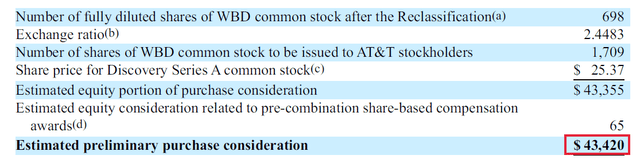

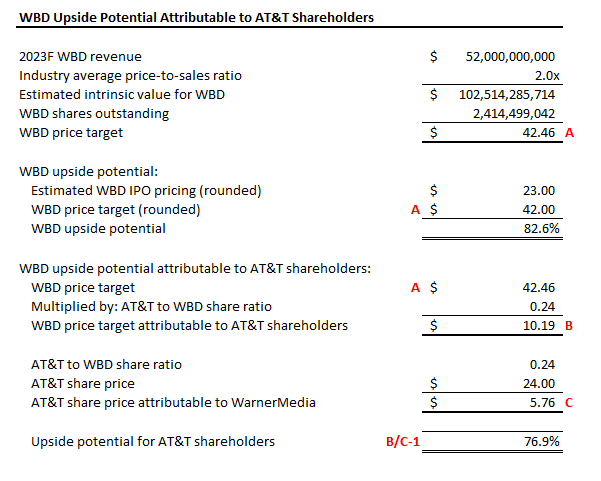

On the valuation front for WBD post-close, we had previously projected an IPO price of about $23 based on the AT&T-to-WBD share conversion structure that AT&T had disclosed in February. Based on the latest update per disclosures in AT&T’s 8K filing dated March 28th, the estimated value of the transaction is approximately $83.4 billion. The estimated transaction value takes into consideration the closing price of $25.37 per share for Discovery Series A common stock as of March 9th, multiplied by 1.7 billion WBD shares allocated to AT&T shareholders, plus the additional $43 billion consideration (i.e. $33 billion fair value attributable to WarnerMedia assets + $10 billion additional amount) funded by a combination of debt securities and cash from Spinco provided to AT&T. Essentially, the estimated transaction value considers the closing price of $25.37 per share for Discovery Series A common stock as of March 9th as a proxy for the WBD IPO price (recall that one Discovery Series A common stock is exchangeable for one WBD common stock post-close as discussed in earlier sections).

In our previous coverage, we had determined the potential upside potential in WBD attributable to AT&T shareholders to be about 77% considering (i) AT&T’s share price of about $24 at the time (late March), (ii) management’s projected 2024 WBD revenues and EBITDA, as well as (iii) comparable peer valuation multiples:

WBD Upside Potential Attributable to AT&T Shareholders (Author)

Considering the latest disclosure of WBD transaction details (e.g. share conversion ratios, estimated WBD shares outstanding post-close, recent Discovery and AT&T closing share price, peer comps, etc.) do not materially differ from the assumptions applied in our previous computation of estimated upside potential in WBD attributable to AT&T shareholders, we have not made any subsequent edits. However, we have taken additional consideration of the valuation sensitivity analysis performed by the WBD transaction advisors, Allen & Company and J.P. Morgan, as disclosed in AT&T’s most recent 8K filing dated March 28th to further gauge the upside potential in WBD post-close.

Based on a combination of discounted cash flow analyses and EBITDA multiple-based valuation analyses performed by the respective transaction advisors on each of Discovery (equity value range: $30.6 billion to $43.1 billion) and WarnerMedia (equity value range: $55.9 billion to $94.3 billion without synergies; $87.3 billion to $127.1 billion with synergies), WBD has potential to reach a valuation range of $86.5 billion to $137.4 billon without synergies, and $117.9 billion to $170.2 billion with synergies post-close. The blended average of the combined WBD valuation range with and without synergies is about $102.2 billion to $153.8 billion. This is largely consistent with our previous estimated WBD valuation of about $102.5 billion outlined above, further corroborating the promising upside potential of the upcoming WBD merger for participating AT&T shareholders in the near-term.

Conclusion

Echoing our thoughts from the previous coverage, we believe the fast-approaching WBD spinoff will be a promising play for participating AT&T investors. While most AT&T shareholders are income-focused, the WBD transaction could make an attractive one-time trade to capitalize on promising near-term upside potential resulting from a valuation re-rate event.

Be the first to comment