jetcityimage/iStock Editorial via Getty Images

AT&T (NYSE:T) beat Q2 earnings on both the top and bottom line but dropped -$1.56 per share (-7.62%) due to its Free Cash Flow (FCF) outlook. T expects its full-year FCF to be $14B, down from a prior outlook of $16B. T just sold off because it’s going to generate $14 billion instead of $16 billion in FCF, and while $2 billion of FCF is a large reduction, this reaction is perplexing. T has a market cap of $146.61 billion, and at $14 billion FCF it trades at less than 10x FCF. The valuation is incredibly cheap, and I believe the market is once again incorrectly valuing shares of T. Make no mistake, T has been one of the most hated stocks in the market, and there is no evidence this will change. The investment community has a horrible perception of T in their minds, and many believe it’s dead money. The facts are that T is growing its subscriber base in postpaid phone and AT&T fiber subs; they increased guidance in their wireless service revenue for 2022 and maintained all their previous 2022 guidance except FCF.

Businesses are supposed to make money and AT&T doesn’t fall short in this category

No matter what the critique has been, anything T has done hasn’t been enough to change the market’s opinion or spark excitement among the investment community. Businesses are in the business of making money, and $1 of revenue is $1 of revenue, and $1 of FCF is $1 of FCF regardless if you’re an auto manufacturer, a consumer staple company, big tech, or a telecommunications company.

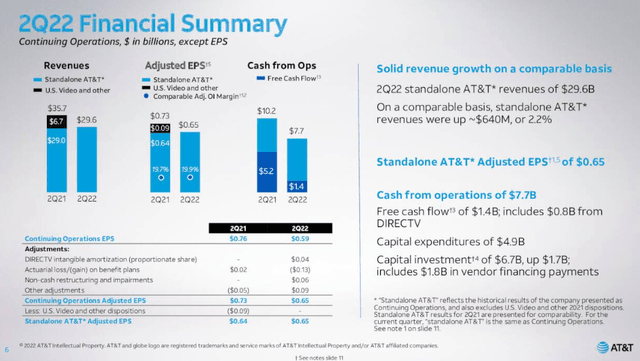

T’s revenue grew from $29 billion to $29.6 billion YoY, while its adjusted EPS grew from $0.64 to $0.65 in this period. T generated $7.7 billion of cash from operations, and its FCF came in low at $1.4 billion. T explained exactly why this occurred. The $2 billion less in FCF was due to longer collection times for customers, higher costs of adding subscribers, and continued pressure on its business services unit. In the 2nd half of 2022, T has forecasted for $10 billion of FCF, placing its full-year guidance at $14 billion FCF rather than $16 billion. The market is acting as if T is in danger, and that’s simply not the case.

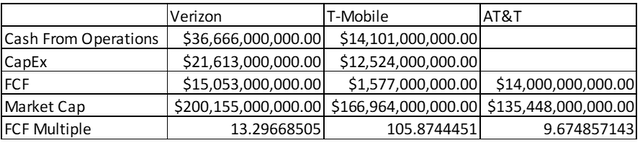

Verizon (VZ) and T-Mobile (TMUS) are T’s competitors in the U.S. So I wanted to show how T compares to them on a FCF multiple. VZ and TMUS haven’t reported yet, so I will be using TTM numbers for them. VZ has generated $15.05 billion in FCF, while TMUS has generated $1.58 billion of FCF in the TTM. VZ has a market cap of $200.15 billion and trades at a 13.3x FCF multiple, while TMUS has a market cap of $166.96 billion and trades at a 105.87x FCF multiple. T just reported and has lowered its forecast to $14 billion of FCF and is a different company than it was at the beginning of the year since WarnerMedia was spun off. Using the $14 billion forward FCF projection, T trades at a 9.68x FCF multiple as its market cap is $135.45 billion. This valuation doesn’t make sense. While I think VZ’s valuation is low, TMUS is ridiculous. T is generating 8.88x the amount of FCF than TMUS, yet TMUS has a market cap that’s $31.52 billion larger. The market absolutely hates T, and no matter what type of numbers T produces, it can’t get rid of the dark cloud hanging above it.

Steven Fiorillo, Seeking Alpha

What’s not to like about T from an income perspective? I think the market is so jaded by T that it doesn’t even know why it’s been so bearish. T is projecting low-single-digit revenue growth in 2022. Their adjusted EBITDA is expected to come in between $41-$42 billion with a per share adjusted EPS of $2.42 – $2.46. T is still on track to deploy $24 billion in capital investments throughout 2022. The only thing that has changed is its FCF projection has declined by $2 billion to $14 billion. I think the market is overreacting as T is a cash cow and the overall story hasn’t changed. T is going to be a slow grower that prints money hand over fist. With an FCF multiple just under 10x, T is a steal.

AT&T isn’t a dead company as it’s still making progress

T continues to see record levels of customer additions, including the best Q2 postpaid phone net adds in over a decade, coming in at 813,000 postpaid phone net adds. In the previous 2 years, T has added more than 6.1 million postpaid phone net adds. At the end of the 1st half of 2022, T has already achieved its end-of-year target of covering 70 million people with mid-band 5G spectrum and is on track to approach 100 million people with mid-band 5G spectrum by the end of the year. Postpaid phones aren’t the only area that T is delivering on, T added 316,000 Fiber net adds. This brings the total net additions over the past two years to nearly 2.3 million, including 10 straight quarters of more than 200,000 net adds.

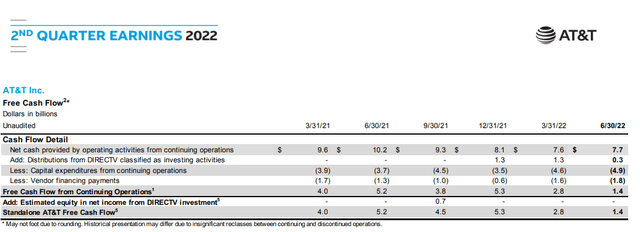

In the supplemental Q2 earnings documents, T broke out how much FCF standalone it generated over the most recent 6 quarters. Throughout 2021, standalone T’s FCF range was $4 billion – $5.3 billion quarterly. With $10 billion of FCF expected in the back half of 2022, T will come in at the upper range of its previous quarterly FCF level in 2021. T’s Q1 and Q2 2022 FCF was impacted by front-loading capital investment plans in order to kick-start its growth initiatives. T is not having an issue generating cash from operations or FCF, and 2023 should be a much different year than 2022.

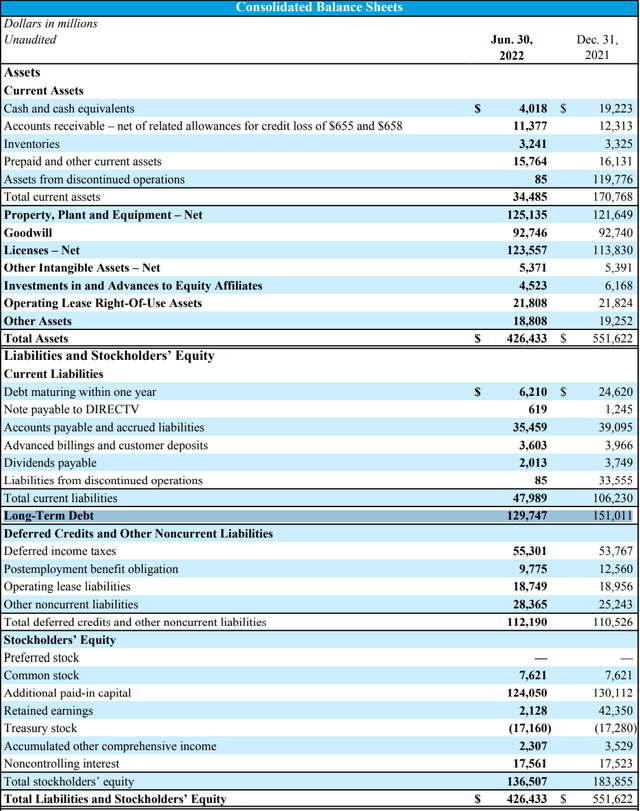

The common negative theme for T has been its debt. T has utilized a portion of its proceeds to reduce its debt load in 2022. There are two line items to look at, debt maturing within one year under current liabilities and long-term debt. Between these two line items, T had $175.63 billion in debt starting out in 2022. T eliminated $18.41 billion of debt maturing in one year (74.78%) and $21.26 billion (14.08%) of its long-term debt in the 1st half of 2022. T’s debt load has decreased by $39.67 billion (22.59%), going from $175.63 billion to $135.96 billion.

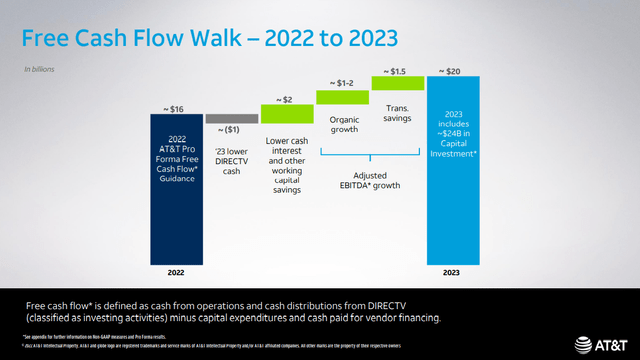

For me, the question becomes what will the bears say when the debt load is eventually under $100 billion? Debt is only a problem when it can’t be serviced and T generates more than enough FCF to service its debt obligations. Originally, T had projected $16 billion of FCF in 2022 and $20 billion in 2023. The $2 billion impact has been indicated as a 1-time occurrence. Hypothetically, let’s underestimate and speculate that T generates $18 billion of FCF in 2023 and gets to $20 billion in 2024. T is allocating 40% of its FCF toward the dividend, which would leave $10.8 billion and $12 billion of remaining FCF in 2023 and 2024. If T were to allocate $8 billion of its FCF toward its debt, every penny would be eliminated in 17 years. By allocating $8 billion a year toward its debt, T would eliminate an additional $40 billion over the next 5 years, bringing its debt load to $95.96 billion. Eventually, the debt story will no longer have the same impact that it has had in recent years. We don’t know if T will put an accelerated repayment plan on the table, but debt is not an issue. T has a large pile of debt, but it’s manageable due to T’s ability to generate large sums of cash from operations and FCF.

The Dividend

T’s dividend is once again exceeding 6% due to its declining share price. I wouldn’t expect T to embark on a dividend growth program any time soon. Management was clear on the Q2 call that the board feels the current yield is very attractive compared to other equities. Their main priority is deleveraging the balance sheet. A 2.5x level is the threshold that T wants to achieve before having discussions about the dividend policy but investing more in the business and buybacks are also options. Once the 2.5x level is reached, T could reallocate some of its FCF, but if the share price hasn’t appreciated to where the dividend is less than a 5% yield, I would speculate that dividend increases would be a low percentage chance. The current dividend is safe as there is more than enough FCF being generated, but we will have to wait and see what T wants to do after their deleveraging efforts are achieved.

Conclusion

T continues to be the same old story about the same debt-ridden company that can’t generate excitement in the investing community. Instead of the story being that T generates a large amount of FCF, is growing its top line in the low-single-digits, and has a plan to further deleverage its balance sheet, the market is focused on a decrease in its 2022 FCF. There was a perfectly good rationale for why FCF came in short in the 1st half of 2022, and it’s not creating headwinds for T. This is a company that is trading at less than 10x its projected FCF for 2022, generating a large yield, and is reducing its debt load. T has never been given the credit it has deserved for being a cash cow, and no matter what they do, the market focuses on the negatives. In an environment where cash is actually king, it’s perplexing why T isn’t held in higher regard. I think T is a strong buy here as the coming years should work out well for them.

Be the first to comment