Justin Sullivan

(Note: This article appeared in the newsletter on July 22, 2022.)

There is a big market concern about the recent drop in the free cash flow of AT&T (NYSE:T). That is precisely the wrong thing to be concerned about because free cash flow can be easily manipulated by management. The market may not like the lower number. But it would like even less what would happen in the future should that free cash flow not be used in the business right now.

Many times, a spinoff as what just happened here is caused by a management that tried to be more things than the management expertise allows. Therefore, after the spinoff occurs, it is not unusual for a time period of management “whipping the company into shape”. That means an investment now is likely to pay-off in a far better future because management is now doing what it supposedly knows best.

It also means that management likely “got behind” during the time when acquisitions were made that led to the recent spate of divestitures. In fact, management “losing its way” is probably the leading reason for divestitures and simplification. To criticize lower free cash flow at this point is to impede management in the process of fixing everything that got out of line during the acquisition binge. If anything, the market should applaud the lower cash flow because such a step provides a clear pathway back to market leadership and adequate competition in the remaining business.

AT&T – What To Look For

Management already has the business growing.

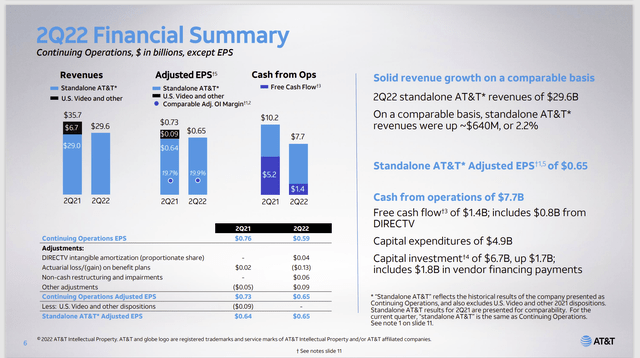

AT&T Second Quarter 2022, Operational Summary (AT&T Second Quarter 2022, Earnings Conference Call Slides Delivered To Seeking Alpha Website)

The first consideration should be that earnings “held their own”. Sometimes the remaining company is in such bad shape that earnings decline, and it takes time to “turn the ship around”. Clearly that is not the case here.

But growth carries its own requirements. Specifically, growth will require more working capital as the company business enlarges. That effect was magnified by an average slower pay. Slower pay is something to be concerned about should it continue to that “concerning” extent. However, right now, it may well be nothing to worry about with recession worries on the horizon. Shareholders should expect a company of this size to be able to deal with accounts receivable issues. This is another reason that the market reaction to the free cash flow makes little long-term sense.

A company this large will take some time to re-establish growth that is proportional to its position in any of the businesses and of course the businesses in which it competes. Generally, investors need to consider that management should have a goal to be either number one or two in any of the main business in which it competes. The other way to successfully compete would be to find profitable niches to dominate. These strategies are covered by authors Michael Porter (Competitive Strategies) or any of the books by Kathryn Ruddie Harrigan. But none of this will change “overnight” for a company the size of AT&T.

The market should have expected that costs will come first as management has clearly outlined with the benefits coming later. There is always an execution risk in a situation like this. But that execution risk should be reduced because management knows the remaining business far better than the businesses that were divested.

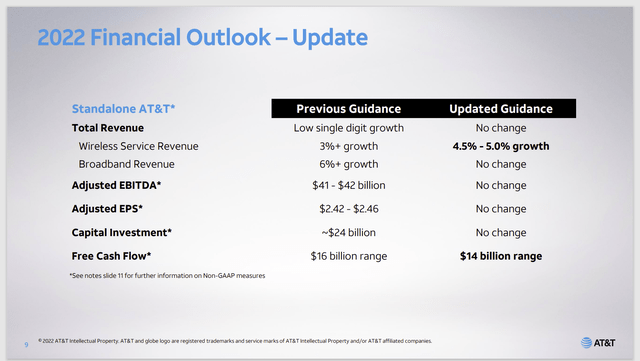

AT&T Financial Update (Earnings Conference Call Slides Delivered To Seeking Alpha Website)

The growth in wireless service should be a long term plus for the company. That is exactly what is needed for the new configuration of remaining company businesses to succeed.

Now it is certainly possible that management is looking into expanding the services to business. The brand of the company business alone likely gives it an edge in the marketplace. This part of the business likely needs some investment to achieve adequate competition levels that ensure the future success the market desires. Businesses are far more sophisticated customers with specific requirements. Management is probably doing just that (and more) when they announced lower free cash flow.

There is of course market concern about the debt levels. That really should be relegated to the debt rating agencies. Generally, a company of the stature of AT&T will be given time to “whip the businesses into shape” by the debt markets. The divestitures alone marked a big step in the right direction for this company. The next logical step is to determine what it takes for a successful future in the remaining businesses.

The debt market will be looking for a plan that makes some logical long-term sense. That logical long-term sense will likely develop as management now deals with the task at hand. Again, there is always execution risk that results in an inability to repay debt. But it is far too soon to determine that. Large companies often take some time to get where they are going. The debt market is usually a lot more patient about this than is the stock market because the debt market has a higher claim to the business assets.

But in this case, the market probably needs to pay attention to any debt market reactions. That “pay attention” part means long-term sustained and significant moves. Normal price fluctuations are just that.

What This All Means

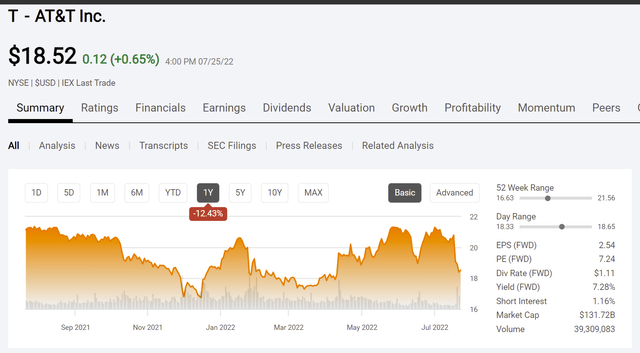

Basically, the market worries at this point make this a consideration to “buy on the pullback”.

AT&T Common Stock Price History And Key Valuation Measures (Seeking Alpha Website July 25, 2022)

Management is doing what it can to make the business valuable enough to provide decent future returns for shareholders. The market clearly does not like the initial costs. But there is every chance that the market will very much like the outcome.

It is far too early in the process to decide that less free cash flow is bad. If anything, this is probably the time to invest wisely in the business now that the remaining business will be the focus of management.

Companies that do spin-offs like AT&T along with the other divestitures tend to do better in the long run than they did in the past. Now, admittedly, that past is not a real high bar. So, the research results often show large percentages of improvement. But that is good news for income investors because there is likely to be income improvements as well as some capital gains as management refocuses the company on the remaining business lines.

Total compounded total returns likely remain in the teens for the foreseeable future from the current price. Despite market worries, management is clearly following a very traditional recovery path.

Be the first to comment