Ronald Martinez/Getty Images News

On the morning of April 21st, 2022, before the market opens, the management team at entertainment and telecommunications conglomerate AT&T (NYSE:T) is due to report financial performance for the first quarter of its 2022 fiscal year. This is a particularly interesting time because it marks the final quarter in which the company still had control over WarnerMedia before that business was ultimately spun off and merged with Discovery to create Warner Bros. Discovery (WBD). As we near this time, there are some important things that investors in both firms should watch, particularly those who are interested in AT&T and its prospects.

AT&T Q1 Earnings – Watch out for some growth areas

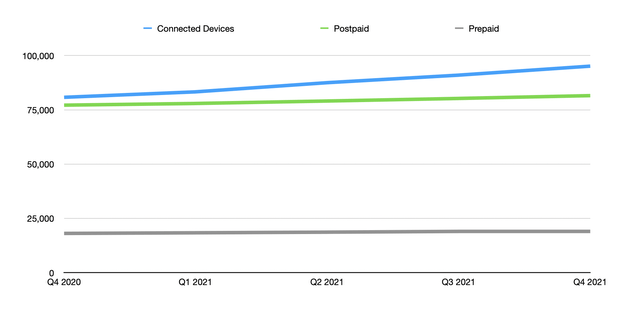

More likely than not, the management team at AT&T will take the opportunity to both describe how the broader business performed, as well as to discuss key points of matter for the business now that the aforementioned transaction has been completed. One example of a data point that management likely stress will be the connected devices and postpaid subscribers who are with the company. For years, the connected devices portion of the company has been a tremendous growth area for shareholders. This involves IoT (Internet of Things) technologies the company has such as devices that make vehicles connected to the Internet.

During the final quarter of the company’s 2021 fiscal year, the number of connected devices on its platform totaled 95.12 million. That represented a high point for the company, and was 4.5%, or 4.14 million, subscribers more than the 90.98 million the company reported just one quarter earlier. Although this sequential growth was impressive for the company, it pales in comparison to what investors should likely anticipate for the company’s latest quarter. There are no estimates on how many connected devices the company will mark. But we do know that, in the first quarter of its 2021 fiscal year, the company had just 83.29 million devices outstanding. From that timeframe through the end of last year, the growth amounted to 14.2%. So long as the company continues to grow this part of the business at a nice clip, investors should be happy.

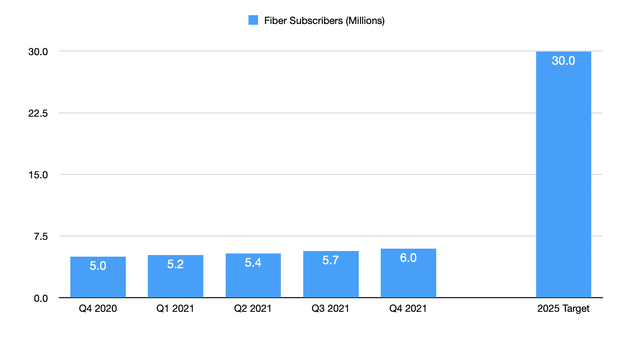

Though not necessarily a rapidly growing part of the company anymore, the postpaid portion of the company’s Mobility unit is likely to grow as well. At the end of the 2021 fiscal year, the company had 81.53 million postpaid subscribers. That was up just 1.6% compared to one quarter earlier and it’s a modest 5.7% above the 77.15 million reported one year earlier. In the first quarter of the company’s 2021 fiscal year, the number of postpaid subscribers totaled 77.93 million. Though not as vital to the company, the prepaid portion of the business should also grow. That number has increased over time, with the number of prepaid subscribers rising from 18.10 million at the end of the company’s 2020 fiscal year to 19.03 million at the end of last year. Naturally, another growth area for the business will involve 5G and fiber, areas that management stressed as being key for the enterprise moving forward. At the end of the company’s 2021 fiscal year, for instance, it boasted nearly 6 million fiber customers. That was up roughly 1 million over the course of a year. However, the company still has a long way to go if it is to reach its target of 30 million by the end of its 2025 fiscal year.

AT&T’s cash flow and debt

One of the reasons why AT&T decided to spin off WarnerMedia was so that management could focus on its core operations. The other big reason, however, was to reduce leverage at the business. As part of the transaction, the business received cash and debt securities worth approximately $43 billion. The management later sold these securities to third-party investors in exchange for the cash payments. As of the end of its 2021 fiscal year, the company had net debt of $157.53 billion. After making certain adjustments, I had forecasted, in a prior article, that net leverage would be around $114.83 billion after the completion of the spinoff. Naturally, none of this transpired during the quarter that is being reported. But it’s probable that management will have a ‘subsequent events’ update and its filings to show what its new financial position looks like.

My projections never did account for an extra quarter worth of cash flow. At the end of the day, it will also be interesting to see what kind of cash flow the company generates and whether the firm will change its stance on what cash flow will be like for AT&T as a standalone business. Prior expectations called for operating cash flow up around $40 billion for 2022. And EBITDA should be around $41.5 billion. Any deviation from this expectation could have a significant impact, not only on the company’s leverage situation, but on investor sentiment toward the business. The first indication, besides management’s own statements on the matter, that will give an idea as to what the future holds will likely come in the form of the operating cash flow of the company generated during this quarter.

Don’t ignore HBO and HBO Max

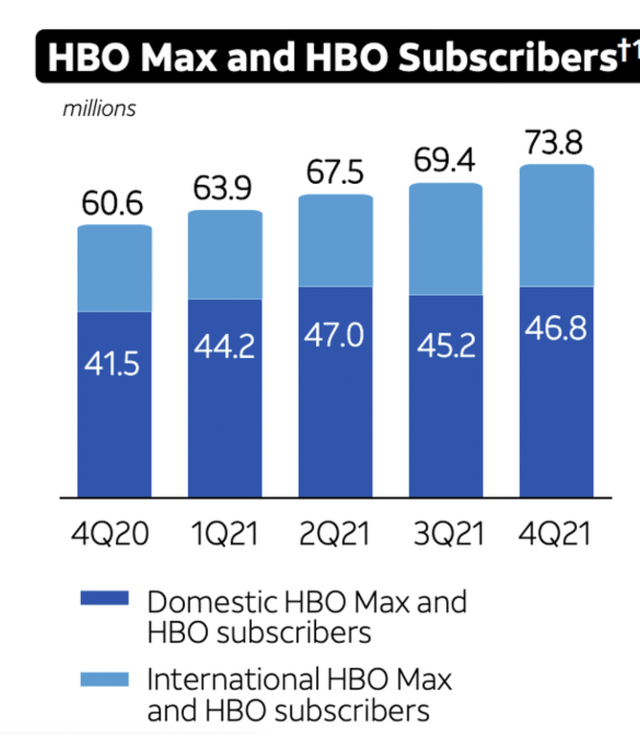

Though my focus today is on AT&T and not on its recently spun-off WarnerMedia unit, management likely will discuss performance covering the number of subscribers on the HBO and HBO Max platform. At the end of the final quarter of the company’s 2021 fiscal year, it boasted 73.8 million subscribers globally. Of these, 46.8 million were domestic subscribers. By comparison, the number reported one year earlier was 60.6 million, with the number of domestic subscribers during that time frame totaling 41.5 million. Generally speaking, I believe that HBO and HBO Max are inferior offerings compared to some other streaming services. However, management maintains that they can hit between 120 million and 150 million global subscribers by the end of the 2025 fiscal year. Though this won’t matter for AT&T moving forward, it certainly will matter for investors in Warner Bros. Discovery.

Takeaway

At this point in time, AT&T remains my highest conviction prospect. Though there are other attractive companies in my portfolio. I ended up selling my shares of Warner Bros. Discovery and, instead, allocated that extra cash to buy additional shares of AT&T. So far, I am happy with that decision. After all, shares of AT&T are up 8.7% compared to when the transaction was made official. I still believe that the company is cheap and is a high-quality prospect. But it’s important to keep a close eye on what management reports from quarter to quarter. The aforementioned items that I listed are the most vital, in my opinion, when it comes to determining how the company is progressing or not progressing. And at the end of the day, it’s likely that these metrics would determine whether this makes for a successful investment on my end or not, as well as on the end of many other investors.

Be the first to comment