Justin Sullivan/Getty Images News

AT&T (NYSE:T) stock is not able to catch a break and is again showing signs of a major correction. The main reason behind the bearish trend since early May 2021 could be the announcement about the dividends. In that announcement, the management locked itself in by announcing a limited range within which future dividends will be paid. Recently, it has again touted the attraction of its “safe” dividends. By mentioning that they would be paying dividends in the range of 40% to 43% of the free cash flow of the new AT&T, they have limited their own breathing space. Depending on the stock price, the dividend yield for the new AT&T could be between 6% to 8% after the spinoff which does not show much faith in the company or its future prospects.

During the announcement of the spinoff, the management should have left its options open on future dividends or could have given a wider range for dividends as a percent of free cash flow. There is a massive negative feedback loop where Wall Street does not trust the ability of management to deliver future growth and to tackle the new 5G era. Investors need to be prepared for a strong bearish sentiment towards the stock as the market analyses the future direction that the management will take.

Managing expectations

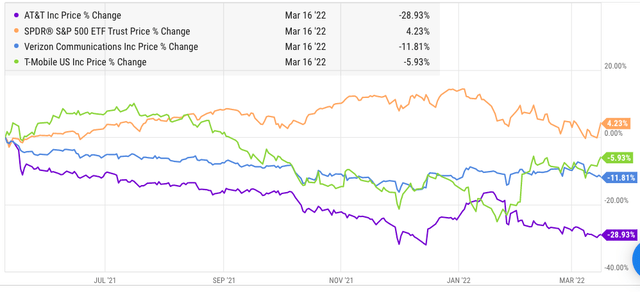

One of the key roles of the management is to manage the expectations of Wall Street. It seems that AT&T’s management has not been able to do that during the entire spinoff process. The result has been close to one-third erosion in the stock value of AT&T which would test the patience of all kinds of investors. Compared to the bearish trend in AT&T stock since the announcement, both Verizon (VZ) and T-Mobile (TMUS) have performed much better.

Figure 1: Performance of AT&T compared to other peers. Source: Ycharts

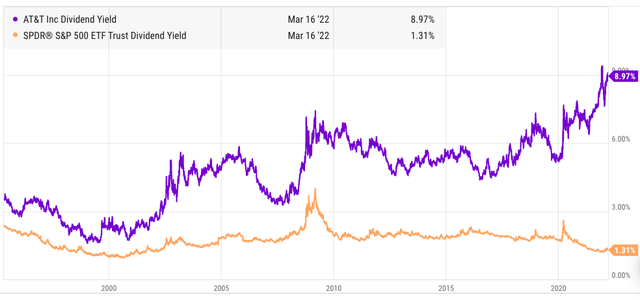

The management has promised dividends in the range of 40% to 43% of FCF after spinoff. This would be equal to $8 billion to $8.6 billion annual dividends, down from $15 billion dividends given by AT&T currently. Despite repeated assurances of a “safe” dividend, the stock has continued on the bearish trend and the current yield is again close to 9%.

Figure 2: Dividends have not been able to provide a floor to the falling stock price of AT&T. Source: Ycharts

Even at the peak of the Great Recession, AT&T’s dividend was barely over 7%. Currently, it is close to 9%. Management has already mentioned that they think the new Warner Bros. Discovery could be worth $6 to $8 of AT&T share. The new dividend will be $1.11 according to the recent announcement. This is already close to an 8% dividend yield for the new company which shows a complete lack of faith in the company by Wall Street.

Investors should be more flexible in terms of their expectations after the spinoff. A faster debt reduction timeline or higher capex might also be welcomed by Wall Street as it would show the long-term vision of the management.

Strong company facing headwinds

The financials of the core telecommunications service are quite strong. The company produces massive free cash flow which can be used in many ways to build the long-term growth runway. However, it should also be noted that the company is facing several headwinds. The debt load is already too high and a big focus would be on reducing it to a manageable level over the next few years.

AT&T is also facing challenges in the rollout of its 5G services. It is now trying to lock in subscribers by offering heavy discounts. If the discounts continue over the next few months, the total cost to the company could be very high. Already, analysts have pointed out that the discounts on the new iPhone total a staggering $4 billion for the company.

Negative feedback loop and future outlook

The recent bear run in the stock has already brought the price to a very low level. We could see this negative sentiment continue till we get close to the spinoff stage when more clarity is available about all the metrics involved in the company.

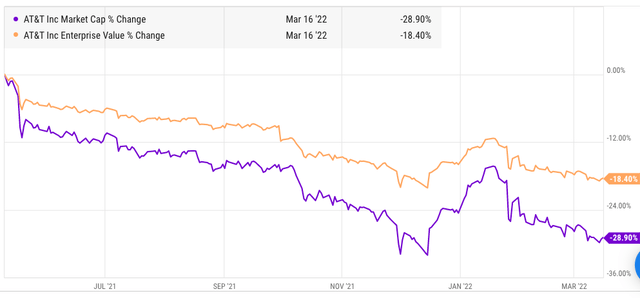

Figure 3: Difference in market cap and enterprise value decline since the announcement for spinoff. Source: Ycharts

Another point to consider is that the price decline is bigger than the decline in enterprise value over the last few months. This is because of the massive debt load of the company. Hence, a 30% price decline might seem unwarranted but in terms of enterprise value, the decline has been less than 20%.

The future price level of the stock price will depend on the management’s ability to communicate their plans effectively to Wall Street. If the market feels that AT&T is losing in the 5G race or the streaming business does not hold the potential advertised by the company then we could see another major bearish rally in the near term.

Some of the recent steps by the management do not give great confidence in the trajectory of its 5G efforts. The company asked FCC to have “spectrum guardrails”. AT&T has also prevented T-Mobile from advertising its 5G network as the most reliable by involving National Advertising Division. T-Mobile (TMUS) has already reached 200 million people in US with its 5G network which covers 80% of the customer base. This number is expected to reach 300 million by 2023. It is likely that AT&T will fall behind T-Mobile’s aggressive network expansion which can increase the bearish sentiment towards the stock.

Hence, although the stock price decline has been massive in AT&T and it is trading at a very low multiple, we could still see a negative sentiment towards the stock till the spinoff. An ideal approach at this time could be to wait on the sidelines and let the management give more clarity on the future roadmap for the company.

Investor Takeaway

AT&T’s management has limited itself by announcing future dividend range for the stock. We could see the management allocate more funds to buybacks, capex, and debt reduction instead of merely giving higher dividends.

Investors should also look at the 5G roadmap of the company to gauge the future subscriber base and churn rate. T-Mobile has already gone ahead of AT&T in terms of ramping up its network. If T-Mobile continues to build upon the strength of its spectrum and network availability, we could see AT&T’s stock face greater headwinds in the next few quarters.

Be the first to comment