undefined undefined/iStock via Getty Images

Investment Thesis

Atlassian (NASDAQ:TEAM) is a collaboration meets business platform. This story has a lot of excitement, with customers migrating away from on-premise to the platformization of Jira.

Not only does this migration lead to more stable revenue growth rates, but huge potential for margin expansion too.

The problem though is that everyone knows that, and has already priced Atlassian fully for that narrative.

But there’s a new narrative now underway. One that’s going to see Atlassian’s revenue growth rates substantially slowdown in the near term. Those two drivers are Europe and a strong dollar.

With that in mind, I don’t believe that investors will be positively rewarded from buying this dip in Atlassian’s share price.

Unbreakable Egg?

[…] the human mind is a lot like the human egg, and the human egg has a shut-off device. When one sperm gets in, it shuts down so the next one can’t get in. The human mind has a big tendency of the same sort. (Charlie Munger)

Above lies the reality of this situation. We became enamored with the pace of the digital revolution. A brand new world was going to take over. The pandemic brought about a rapid change in the pace of digital transformation. Well, as it turns out, it wasn’t so much a rapid change. Rather it was a pull forward in revenues.

What this means is that Atlassian saw strong gains as its platform was rapidly adopted by developers around the world, as enterprises sought to embrace increases in productivity. So what looked like a secular growth story, was actually not.

Here was the general thinking. If the world was to slow down, enterprises would turn defensive, and the only way to survive would be double down on productivity-enhancing technologies.

But isn’t this just an echo of what we told ourselves in the 2000s? Thus, what investors now realize is that Atlassian saw a pull forward in its growth potential. However, this left a lull in its future revenues.

And to be absolutely clear, I too fell for that narrative. I thought that this time was different. But luckily, I managed to learn some new ideas and push back against my own shut-off device.

Analysts Are Upwards Revising Estimates

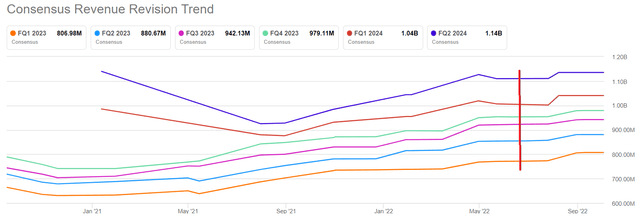

The illustration that follows is Atlassian’s revenue estimates.

TEAM revenue estimates

What you see above, is that even though there’s been consistent evidence since the summer that the global economies are slowing down, analysts have fully disregarded these insights.

Indeed, analysts have continued to upwards revise Atlassian’s revenue estimates. On what drivers? It’s as if analysts are not opening up a newspaper, or just reading the writing on the wall. The economic environment is slowing down.

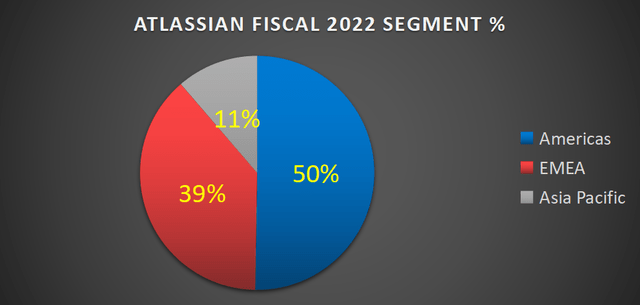

Atlassian, author’s work

What you see above is a disaggregation of Atlassian’s revenues.

You can see that 50% of Atlassian’s revenues have non-US sources. In fact, slightly over that, since Americas also includes some non-US revenue. Nevertheless, more than half of Atlassian’s revenues are going to be showing some weakness in the coming year. Why?

Because there’s no way that with Europe’s economy spiraling out of control, with households and businesses potentially rationing heating, and cutting back on all unnecessary expenses, businesses will thrive in this environment. This is not the setup for business prosperity. That’s not going to happen, in my opinion.

What Atlassian is sure to see is an echo that other enterprise software companies have recently stated, that there’s an elongation in the sales cycle.

Secondly, we know that the USD is substantially outpacing other currencies around the world. How is it that analysts are not factoring in this when projecting Atlassian’s near-term revenue estimates?

One could make the case that investors will only consider companies on an FX-adjusted basis. And while that may be the case when currencies are moving up and down 2% to 3%, it’s very different when we are talking about north of 5% headwinds, that are consistent.

TEAM Stock Valuation – 17x Forward Sales

What we’ve discussed up to this point should at least make one ponder whether Atlassian will indeed succeed in growing at 30% CAGR over the coming year.

Even though I don’t believe that to be the case, I must leave some room for doubt.

In this event, if Atlassian were to grow by 30% to $3.6 billion by the end of fiscal 2023, that would leave this stock priced at 17x forward sales.

How are investors willing to find value in a company that is not growing above 30% while paying 17x forward sales? It simply doesn’t appear to be anywhere near fair value.

The Bottom Line

During 2020-2021, investors were seduced by platforms that delivered companies with enhanced productivity tools. Companies that were rapidly growing, and we were all too quick to consider non-GAAP (or non-IFRS in Atlassian’s case) operating margins as a fair representation of profitability.

And that thesis worked a charm while the share price was moving up. While interest rates were at 0%.

After all, everyone was happy to be a buy-and-hold investor. Today, the landscape has changed. And businesses that can’t grow by more than 30% will need to show investors that they are seriously considering a clean path to profitability. Particularly, if their stock is already priced 17x forward sales.

Be the first to comment