Prompilove/iStock via Getty Images

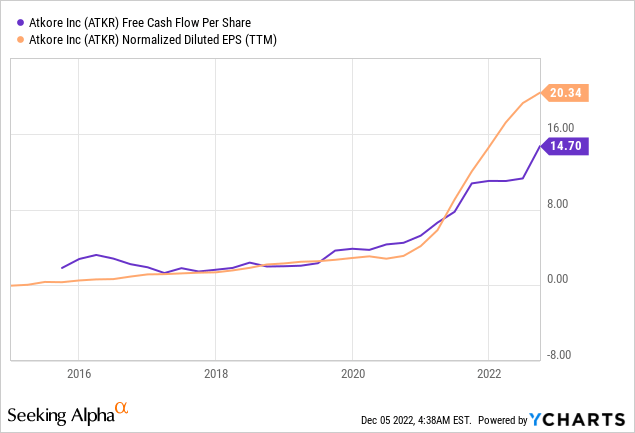

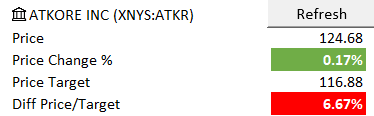

Atkore (NYSE:ATKR) has benefited dramatically from COVID-19-related consequences, with income and cash flow doubling in 2021, results should soon revert to more normal values as competition catches up. I believe the big question lies in how well the company positions itself for the medium to long future, tough comps are hard to lap and could translate into negative price movements.

Q4 solid results showed an interesting outlook for normalized earnings and what investors should expect from the future. If the management team can pull this off, I think there’s still some (not much) room to grow despite near-term economic slowdown fears. Nonetheless, those headwinds might bring better entry points, so I believe it should be best to take a “watch and see” approach and wait for a more suitable momentum.

A Boring Business

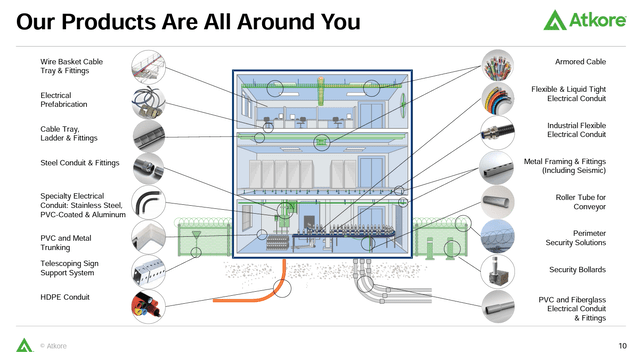

Atkore produces and distributes construction products, more specifically electrical cables and conduits (PVC, metal, fiberglass, HDPE), framings, tubes, and similar related products. It divides itself into two segments: Electrical which is seeing the big COVID-19 boom with very generous margins and Safety & Infrastructure with much more modest margins. A truly “boring” business.

Atkore’s Q4 Results Presentation (Atkore)

More than 90% of the products they sell are for the US market, having increased after some international disinvestment, making them highly exposed to a single geography. On the good end, they can benefit from the new infrastructure and inflation acts, but might also struggle with the predicted economic slowdown and recent interest rate hikes.

Recent Path and Future Potential Economic Slowdown

Management

I’m a fan of Mr. Waltz’s path since his enrollment as the CEO, he and his team have been focusing on the areas where they have some competitive advantages and cutting areas and geographies with lesser returns. Besides being reflected in the stock price, management’s work is visible in the way they were capable of profiting from the pandemic and from unprepared competitors. One of the disadvantages of recent years is that volumes have been decreasing for a while and I need to see a path toward future growth not only with pricing since that approach shouldn’t be viable long-term.

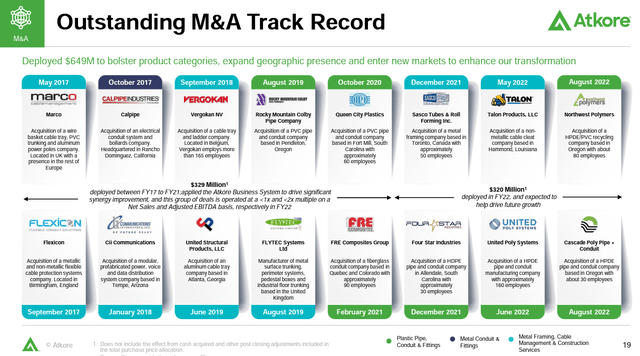

Cash Deployment

Recent times have provided a great opportunity for the company to execute its plan, the large cash inflow is being used for bolt-on acquisitions (the best kind of acquisitions) and share repurchases. While I would like to see share buybacks at lower price levels, the past track record of the management allows me to believe that these actions are value-added and it will allow Atkore to grow.

Atkore’s Q4 Results Presentation (Atkore)

Coming Years

Rate hikes together with an already slowing construction sector will no doubt hurt coming quarters and the very tough comps, generated in the pandemic highs, will pressure, even more, the team. On the other hand, the business appears to be more resilient than expected with a significant part of their sales exposed to data centers and renewables, both of which have seen acts (Infrastructure and Inflation reduction) boosting the investments. They point that the total addressable market opportunity is $40B, leaving them with roughly 10% of the pie.

I also consider the competition risk of foreign companies underpricing Atkore low since this is a business that needs proximity to be competitive, their scale and nationally established production footprint should provide a “moat” over some of the competition.

Intrinsic Value

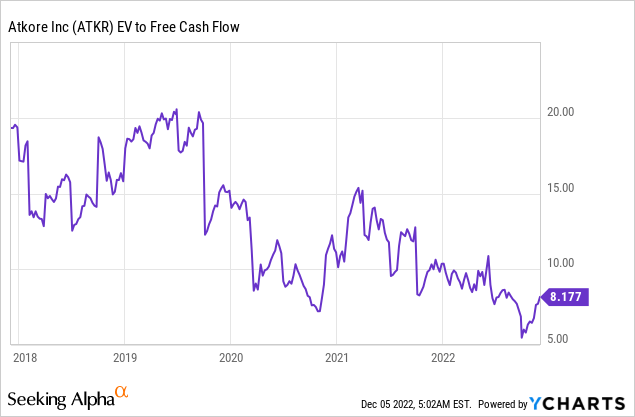

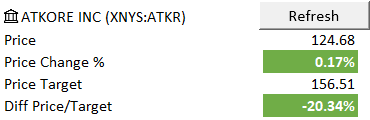

Trusting the guidance provided by the management in the last earnings report, there should be still room for stock appreciation. 1. Keeping the number of shares outstanding and debt stable; 2. 100% net income conversion into FCF, like seen in the past prior to COVID-19; 3. a 10x EV/FCF in line with historical values; 4. $18 2025 EPS guidance; we can get to a rough stock price of $168 in 2025, meaning a 10.64% CAGR appreciation.

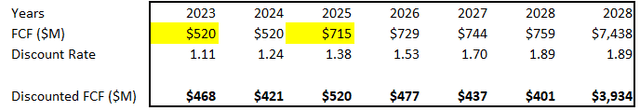

By providing a similar approach with a free cash flow model, the results are close. If we trust management guidance for 2025 and then take a conservative 2% growth afterward, we get to a price target of over $150 a share.

Scenario 1 – Management Guidance (Own Estimations) Scenario 1 – Results (Own Calculations)

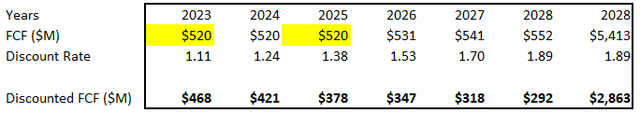

Although, a scenario where the growth path doesn’t materialize can also be an option. Considering the possibility that Atkore maintains free cash flow amounts stagnant through the next three years, despite strong inflation, then the stock price might already be above intrinsic value. The uncertainty around the future and small margin of safety leave little room for estimation mistakes.

Scenario 2 – Conservative Approach (Own Estimations) Scenario 2 – Results (Own Calculations)

Risks to Consider

- Economic Downturn – I believe this to be the most significant risk that they currently face. We are now exiting abnormal times where money has been “cheap” and easy to get for construction and investments, in general. I’m sure that the management team is already considering these macro factors in their scenarios and how will the company navigate through them, even though it’s something to pay attention to.

- Acquisitions – Despite seeing these recent buyouts as a positive move to grow, there can be issues related to the integration of these businesses, especially due to the amount done. Furthermore, acquisitions usually are worse when compared to organic growth since it’s less value added to the shareholders.

- Competition – Competitors could always initiate any price struggle, although unlikely at this stage. We can also see bigger foreign players trying to establish or expand their US foothold in search of these returns.

- Supply Chain Problems – They have been able to deal with this issue relatively well lately, but it can still be a problem ahead if the worldwide instability continues.

- US Exposure – Although this is not really a risk, a would like to see a more geographically diversified percentage of sales in order to mitigate potential country-specific risks and also to increase TAM and potential.

Main Takeaway

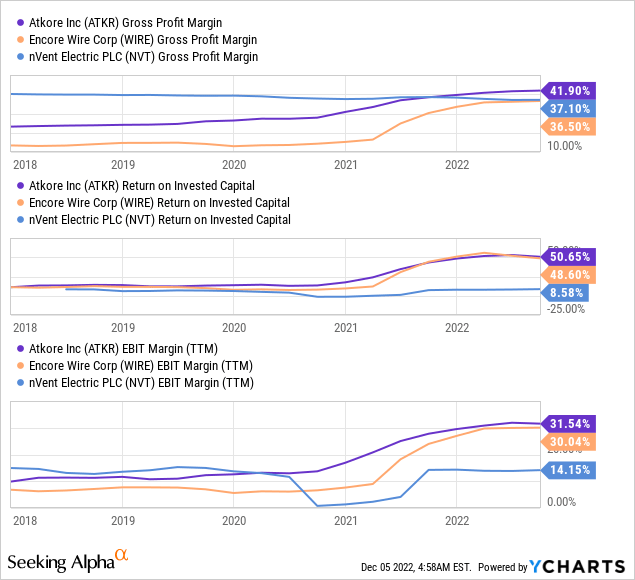

I consider Atkore to be a quality reliable business, run by a capable team with a proven track record in providing great returns to the shareholders and I see no reason for it to stop now. Returns on capital have been amazing and everyone was prepared to act and profit from recent developments, making the management 2025 guidance much more trustworthy.

Having said that, I believe that this might not be the best time to open a position simply because of the instability of next year or even next years. It has the potential to drop in price if it finds difficult quarters ahead, which is likely. Additionally, I don’t consider the current margin of safety to be enough to overcome the mentioned risks.

Be the first to comment