ablokhin/iStock Editorial via Getty Images

I last discussed Athersys (NASDAQ:ATHX) in 04/2022’s “Athersys – Hero Or Zero Opportunity”. There are still prospects for each of these two antipodal results, hero or zero; the hero is however looking less likely for Athersys.

In this article I examine its current untenable situation. I review how it got here and what I expect for its future.

Athersys is running at the end of its financial string.

Athersys’ most recent (Q4, 2021) earnings call acknowledged its dire cash situation. In response to an analyst question asking for its strategy as Athersys approached the end of its cash runway, then CFO Macleod responded:

Yes. So with a run rate — or with a cash burn of between $17 million and $20 million, of course, we do have the ability to dial it up, dial it down. But you’re correct, we have enough to get through at least the end of the second quarter [the current quarter, which as I write on 07/22/2022, already ended several weeks back].

As I had mentioned, we do have access to our equity line, which could provide financing. If the data does not lead to a successful partnership, we have explored other means of financing, which I don’t really want to give the details just yet. We have not pulled the trigger on it. But suffice to say, we have not so far accessed the debt markets. And there are other possibilities that we’re exploring. But our intention is to proceed with our discussions on the partnership. And we do anticipate the readout to be positive.

I have italicized the blue and red statements, not in a political sense but insofar as their vagueness smacks of blue sky and red flags. Athersys’ plan B as it runs out of cash is too ill-defined and uncertain to support an investment in Athersys.

Now that its Aspire equity line is no more, Athersys’ situation is ever more dire.

CFO Macleod opens the second paragraph of his above response by referring to Athersys’ equity line. As Athersys’ share price has sunk well below the $0.50 minimum price required (10-K p. 43) for use of this line, it had become less and less of a lifeboat. Nonetheless, Aspire’s decision to pull the line entirely removes the likelihood for negotiating a last ditch deal with its long time (since 2011) financing partner.

The same 07/08/2022 8-K that announced termination of this financing source, announced more unsettling news; CFO Macleod left his employment on 06/30/2022. It also advised that CEO Camardo was filling in:

…as the Company’s principal financial officer and principal accounting officer while the Company searches for a new permanent Chief Financial Officer.

Camardo is not receiving compensation for his added role.

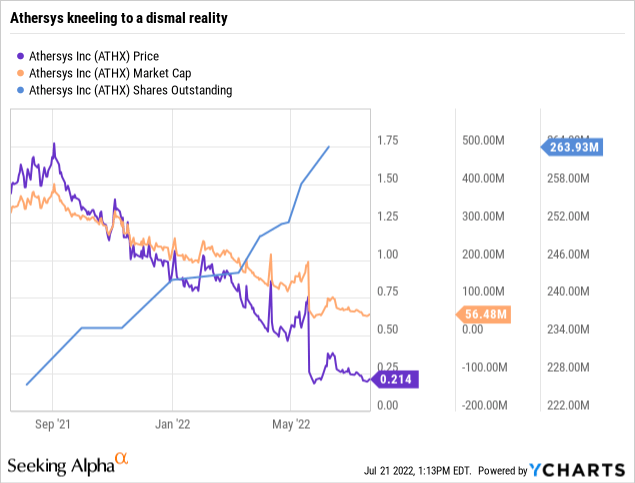

As I write midday on 07/22/2022, Athersys trades at $0.20; it carries a market cap of ~$57 million. Its trajectory has been awful as shown below:

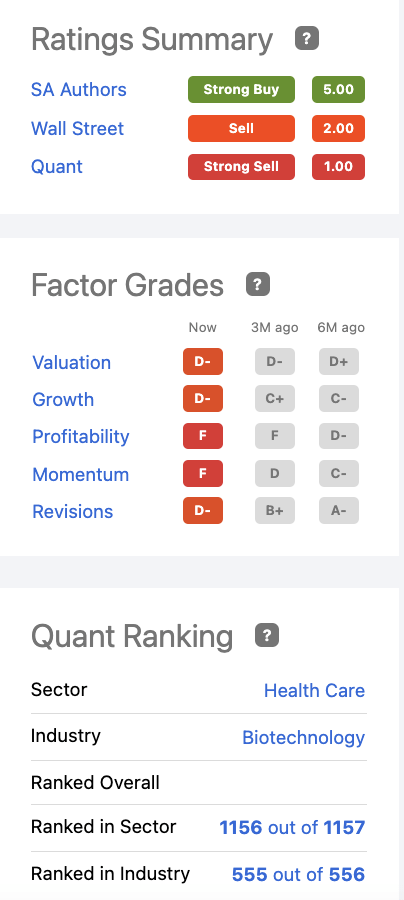

In terms of ratings on Seeking Alpha, it has only the slimmest inkling of a pulse as shown below:

Athersys’ ratings (seekingalpha.com)

Its sector ranking at 1156 out of 1157 says it all from the standpoint of financial metrics. Athersys is scraping along at the nether bottom of its sector’s barrel.

Athersys’ MultiStem tribulations have been highly frustrating and seem to be ongoing.

Athersys’ MultiStem in treatment of stroke has shown exceptional promise in a most frustrating series of clinical trials. Athersys has proven itself to be a serial bungler. “Athersys: Stem Cell Opportunity For Risk Tolerant Investors” (“Opportunity”) describes its travails in considerable detail.

As described in Opportunity, its 2011 MASTERS ischemic stroke trial “NCT01436487” missed its primary endpoint. However Athersys determined that this was because of a design flaw in the study which included patients up to 2 days following the onset of a stroke. A 2015 study data review showed that patients who were treated within a narrower window had better outcomes.

Athersys was unable to act on this insight until 2018 when it initiated MASTERS-2. The pandemic intervened causing enrollment delays. It was struggling to complete enrollment by close of 2021. In its Q2, 2022 corporate fact sheet, it reported that enrollment in MASTERS-2 was ongoing, expected to complete by the end of 2022 or “soon thereafter”.

Sadly as I write on 07/22/2022, the story moves to Japan. Athersys’ partner Healios as discussed in Opportunity, has now leapt to the front of the story having completed its TREASURE trial while MASTERS-2 is still enrolling patients. Athersys has issued an 05/26/2022 slide deck overview of TREASURE results.

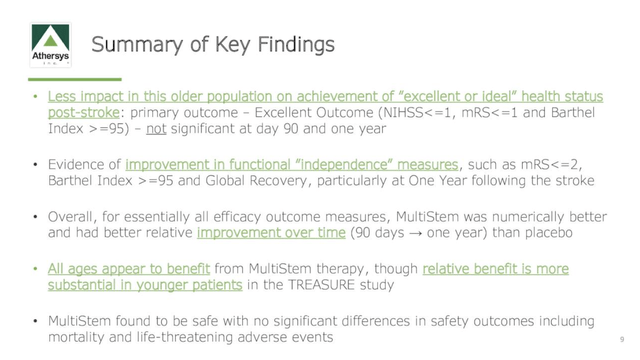

The news is mixed. The trial showed substantial benefits for stroke victims; however it fell short of its primary outcome measure of “excellent outcomes”. The slide below summarizes the situation:

MultiStem TREASURE trial (seekingalpha.com)

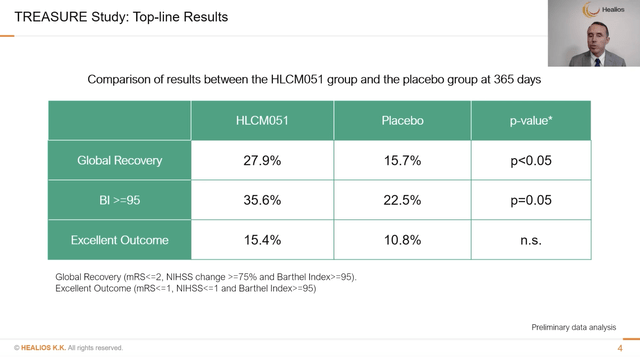

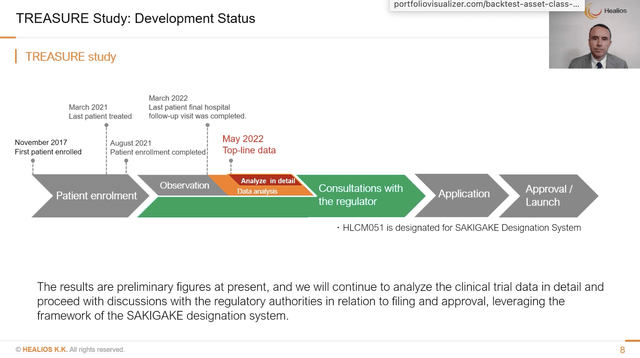

Healios’ CFO Richard Kincaid is featured in an informative 8:25 presentation with its own slide deck including the following slide (discussed from 2:15-3:00/8:25):

TREASURE showed as statistically significant in 2 of 3 outcome measures, the Global Recovery and Barthel Index; the Excellent Outcome measure showed an improvement but it was not statistically significant.

Healios’ final slide (discussed from 6:10-7:26/8:25) gives a glimpse of MultiStem’s path towards regulatory approval in Japan:

This slide shows that MultiStem has potential in Japan; it does not satisfy Athersys’ urgent need for instant cash.

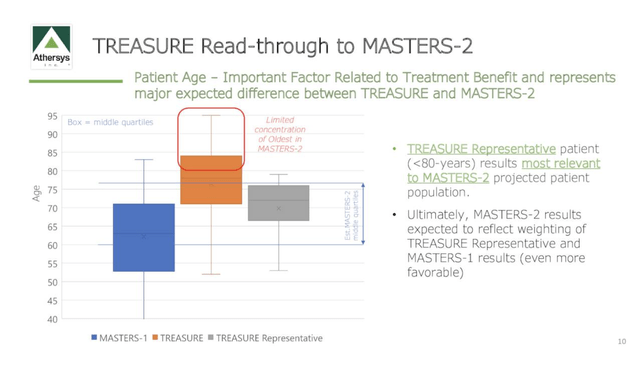

The TREASURE results are disappointing; they do not, however, spell doom for MASTERS-2. Athersys expects a favorable outcome for its MASTERS-2 trial based on the read through below from the TREASURE trial:

Athersys is relying on its expectation that the median age of 63 for MASTERS-2 participants compared to the median age of 78 for TREASURE participants will be significant. Younger patients have a better prognosis of recovery than do older, allowing more potential for MultiStem to show a treatment effect.

Conclusion

I have been an Athersys bull for a long time. My thesis underlying this positive outlook was based upon its MultiStem regenerative cell therapy, in advanced trials in the US and Japan for stroke. Unfortunately MultiStem’s development has been, and continues to be, so long and drawn out that Athersys is running out of cash.

As a result Athersys is possibly a dead man walking. It is now in its quiet period prior to its annual shareholders’ meeting. Athersys postponed this meeting from 06/16/2022 to 07/28/2022 to provide time to submit a plan for a reverse split to its shareholders.

I have previously described in some detail how reverse splits can occur for many reasons. One common reason is to boost a stock’s share price to comply with NASDAQ listing rules. Athersys has yet to report the ratio of its planned split. I, for one, hope it goes big, with say a 1 for 50 split whereby a shareholder with 5,000 $0.20 shares would end up with 100 shares trading $10.00.

The size of a reverse split is far from the biggest question currently facing Athersys shareholders. With Athersys running out of cash, the big question is how will Athersys move ahead? Its MultiStem has sufficient potential that it could attract new money. The question is what will the cost be to shareholders?

There are any number of options, ranging from draconian to confiscatory. In today’s market where things are tight for struggling biotechs, one dare not hope for too much. The worst would be some type of prepackaged bankruptcy that took out shareholders entirely.

Preferable for shareholders would be a loan where Athersys borrowed funds straight out, likely at a high interest rate with lots of cheap warrants as a lender inducement. With Athersys shares trading for two dimes apiece, the market is not very optimistic.

Anybody with any money at risk in Athersys has a real potential for a total loss. The upside is limited by the risk that management will do a deal to save the company, and some jobs, while selling out shareholders.

On a more positive note, as Jim Carrey’s character so poignantly expressed in “Dumb and Dumber” there is always hope, the one in a million shot is always lurking. For Athersys shareholders, the Jim Carrey outcome would be if Athersys could get a new partnership with an out-front payment sufficient to get it through its current cash crunch. It could happen; it really could.

In any case, we are in for an interesting period over the next few months and quarters for Athersys and its shareholders. I welcome insights from Seeking Alpha readers in the comment section below. GLTA

Be the first to comment