Kimberly White/Getty Images News

Introduction To Asana

For an in-depth exploration of Asana (NYSE:ASAN) from me/us, we invite you to read the following note from a little over a year ago:

With the cataclysmic valuation re-rating of Asana likely behind us (though no one can be sure), we’re content to let the remainder of our position ride (we sold a good bit at ~$140/share and again at $45/share recently), especially considering that Asana’s most recent report served to further confirm our thesis for the company.

Today, we will explore Asana’s most recent report together, and, at the end of this note, we will discuss our overarching strategy in owning Asana.

Without further ado, let’s begin!

Just Getting Started

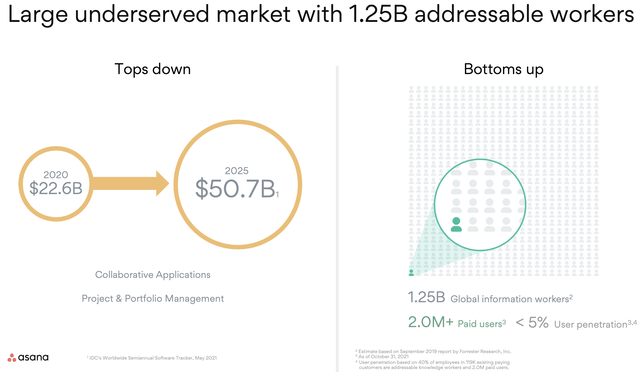

As we illustrated in our original note on Asana, and as we’ve illustrated in subsequent updates, Asana has a significant greenfield opportunity ahead of it, meaning that there are many organizations that do not have an incumbent product (or at least not a real incumbent product) embedded into their workflows/operations.

This idea can be understood by way of the following chart, which Asana shares often:

Asana Investor relations Q4 2022 presentation

And I would say this is a very fair characterization of the opportunity that lies ahead for Asana. This idea is further substantiated by this ongoing statement (as in they keep repeating it) from Monday (MNDY). The following quote is long, but quite important in understanding the above TAM chart from Asana, as well as Monday’s investment thesis:

Analyst On Recent Monday.com Call: I want to touch a little bit on the 50k plus cohort. Growth there is really, really strong. I guess, I would love to understand a little bit about sort of who you are replacing as you are expanding or landing these large accounts. Like, is there an incumbent or is it still pretty much manual work process that you are replacing? And sort of how sophisticated are these workflows when you get above 50k? Is it sort of replacing very sophisticated workflows? How should we think about what’s being done with Monday that was not able to do or poorly done with the other products? How is that space? I would love to talk about that for a minute.

Eran Zinman: Sure, so, thank you, Bhavan for the question. This is Eran. So, basically as we scale into the enterprise, and again this is right for small businesses, but also for the larger companies. We see that 70% of the deals, we see literally no competition. People use spreadsheets and emails and PowerPoint, and usually we replace those. So it’s very basic tools and using that and replacing that with Monday. So it’s not exactly replacing, but it’s filling a lot of vacuum that exists within the organization.

Asana has echoed identical ideas in the past, and the company shared on their most recent call that nothing has changed in this regard:

Anne Raimondi: Yes, I’ll take that one. We’re not really seeing a material change in competition, but rather an overall increase in awareness of and interest in work management, so I think what we’re seeing also is like our dedicated focus on innovating specifically in work management, the caliber of our customers and our ability to deliver and measure value quickly is what’s kind of contributing to us being able to attract new customers, win those customers and then expand with the ones that we have.

With these ideas as our backdrop/foundation, let’s explore the recent Asana quarter together.

Overview Of The Recent Asana Quarter

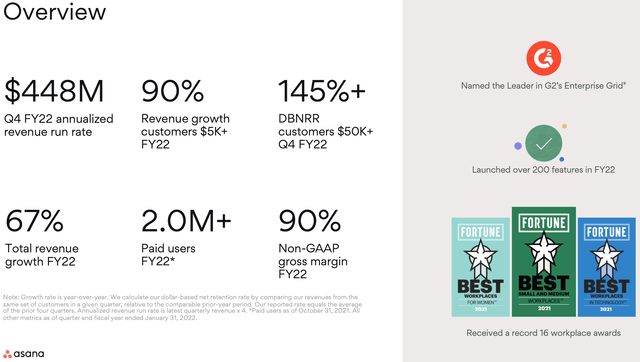

As can be seen below, Asana grew total revenue in 2021 at 67%; however, they grew revenue for customers with $5K+ in spend at 90% and their NRR (which we discussed here recently) was a staggeringly good 145%+ for their customers spending over $50K+. At an annual revenue run rate of ~$450M, Asana is crossing the chasm from small, niche platform to “the next Atlassian (TEAM)” quickly.

Asana investor relations Q4 2022 presentation

As I listened to the call recently and this morning, I was struck by a few of their “Customer Wins”. Let’s explore those for a moment before returning to Asana’s quantitative performance from its last quarter.

Customer Wins

We cannot be 100% sure, but it appears that Netflix recently expanded their usage of Asana significantly.

Annie Raimondi, Chief Operating Officer, remarked on the call the following idea:

Next, I’m sure many of you have binge-watched a show or two over these past two years. I definitely did. This quarter, one of the world’s leading streaming services upgraded from our business to Enterprise Solution. Their studio and production divisions rely on Asana to help with real-time team support so they can hit their production deadlines and ambitious subscriber goals. With this upgrade, their corporate teams will now also be able to utilize Asana to manage their work.

She went on to share…

T-Mobile, the industry leader in 5G, is known for their unwavering obsession with offering the best possible service experience. To do this, teams need to be on the same page, which is why they chose to expand their use of Asana’s enterprise solution last quarter. Now their emerging products and digital teams can collaborate cross-functionally in one platform to develop strategies and business plans for consumer markets, co-create digital products for emerging markets, and deliver digital technology programs for business and government.

And…

We also saw success with channel partners in some of our fastest-growing international geography. PC Home is now the leading integrated e-commerce service group in Taiwan, providing e-commerce, fintech and web portal services. They chose Asana’s business solution this quarter to manage product development. They were initially looking for a tool for their IT and engineering teams to manage their fast-paced product development cycle. But with the help of our local partner, Master Concept, they decided to also bring in their marketing, customer service and operations teams into Asana as well so everyone would have a system of record for the development process to help launch products faster.

And…

As Dustin said, the major fiscal 2022 wins we had with customers like Warner Music, Viacom CBS, and the largest automotive manufacturer in the world…

Annie went on to illustrate how Asana plans to further scale…

Not only are we adding big customers, but we are also helping customers serve their own customers faster. This quarter, we’re launching a strategic partnership with one of our existing customers, a major global medical device company, to bring a new, HIPAA-compliant workflow solution to the healthcare industry. Instead of relying on manual processes and disconnected systems across their vast network, they are using Asana to power a workflow that connects processes and teams to real-time updates to improve operational efficiency and customer care. With Asana, they seek to serve more customers, support them in growing their business, and create consistent experiences for those receiving treatment. By solving this pain point for their global network of organizations, we have the opportunity to reach hundreds of thousands of offices worldwide over the life of this partnership.

This partnership is just the beginning and one example of how the Asana platform can support coordination at scale across many industries and organization types from franchises to supply chains and much more. We’re also excited to announce that to further support Asana’s enterprise advancements, a broader HIPAA offering will soon expand to other customers in the healthcare industry later this year.

I found these ideas to be exceptionally heartening in illustrating 1) Asana’s ability to win big customers and 2) continue to aggressively scale into its 1.3B knowledge/information worker TAM. Now, let’s return to our exploration of Asana’s financial & quantitative performance:

Quantitative Performance

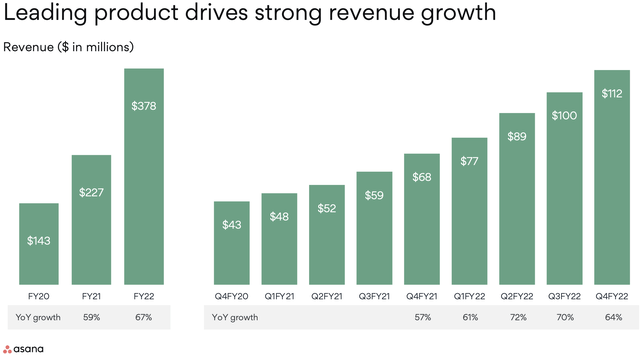

Asana reported a fantastic quarter, accelerating its sequential revenue add from the prior quarter, as can be seen below.

Asana investor relations Q4 2022 presentation

That said, from a revenue growth percentage basis, Asana’s growth decelerated from 70% to 64%, which, while it’s not what we want to see, is not bad. It’s, in fact, quite good.

Moreover, Asana closed 2021 with ~$380M in total revenue, which equates to an annual run rate of $450M.

Asana guided for ~50% growth in Calendar Year Q1 2022 and for 40% annualized growth for the full Calendar Year 2022.

This represents ~$115M for CY Q1, and we believe this will come in at $120M+, which implies a healthy, sustained rate of revenue growth in accordance with the trends illustrated in the chart above.

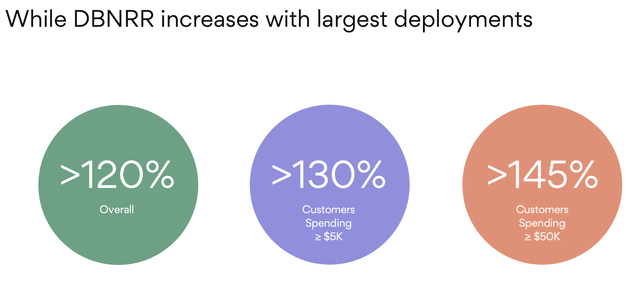

Net Retention Rate

As mentioned earlier in this note, we explore Net Retention Rate and the importance thereof in our recent SentinelOne note. As can be seen below, Asana’s NRR continues to be extremely healthy, especially for its larger customers.

Asana investor relations Q4 2022 presentation

A 120% overall NRR for Asana is actually pretty brilliantly good, considering it serves many small-medium sized businesses, which create a drag on NRR, as you can infer from the screenshot above.

For instance, HubSpot (HUBS) had an ~110% NRR for much of its lifetime as a public company because it served small to medium sized businesses.

For Asana to have a 120%+ NRR while serving this segment, and for Asana to have this NRR so early in its product’s adoption curve, is actually quite exceptional.

Obviously 130%+ and 145%+ are exceptional NRRs, and to me, they illustrate:

- Asana actually has a pretty significant network effect moat. The elevated NRRs for customers spending $5K+ and $50K+ indicate that when one team within an organization adopts Asana, it often leads to more teams adopting it. That is, Asana’s value grows within an organization as more teams adopt it, which is the quintessential definition of network effects. Network Effects defined: “a phenomenon whereby a product or service gains additional value as more people use it.”

As an aside, the four most prominent moats include:

- Network Effects (Asana has this moat.)

- Embedding (Asana has this moat in spades, and I am quite confident that Dustin understands this moat and is working to further lock customers into the Asana ecosystem.)

- Scale (Asana and Monday will benefit from this over time, if they do not to some extent already.)

- Brand (As can be seen below, Asana believes in the value of this moat.)

Asana investor relations Q4 2022 presentation

As can be seen above, it’s quite evident that Asana continues to focus on the vectors of their business that will construct their moat over the long run.

An Interesting Perspective

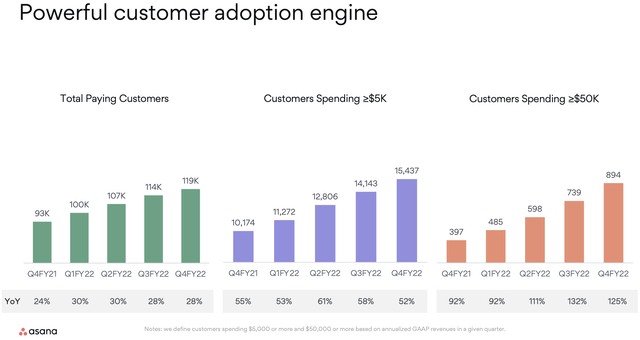

It’s worth considering that, sans total customer count and Asana’s service to very small businesses, the most recent quarter was unbelievably good.

As can be seen below, while total customer growth only came in at 28% year over year, growth in $5K+ and $50K+ customers came in at 52% and 125%, respectively.

Asana investor relations Q4 2022 presentation

This is, as mentioned, unbelievably good!

Alright, with all of this in mind, let’s turn to the “bad” from the report.

Profligacy Or Strategy?

At the heart of Asana’s principal bear thesis at this juncture is its persistent losses, which… in a vacuum might be fine. But when placed alongside the financials of Monday, Asana’s financials begin to look less “aggressive and logical” and more “outright disastrous.”

We explored this recently in this note, and I will briefly share those metrics below:

We have become smitten with Monday as of late for many reasons, not least of which is the fact that it’s free cash flow positive (it’s generating cash) while growing at 90%+.

Monday has the following financial characteristics:

- 90%+ growth; sustainable 50%+ growth for the next 3-5 years

- Free cash flow positive

- $900M (and growing because it’s free cash flow positive) in net cash; $0 in debt

- Visionary co-founders at the helm driving growth

- 70% of deals have no competition; massive global TAM into which it can sell its product

And for all of this, the market is currently paying ~16x sales or 11x EV/2022 sales.

So, if we consider Asana through this lens, it will very, very likely re-rate lower this afternoon completely irrespective of what it reports!

To substantiate this idea, let’s consider Asana’s financial characteristics:

- 70%+ growth; sustainable 40%+ growth 3-5 years

- Free cash flow negative

- $95M net cash; $248M in long term debt. Not adding to this each quarter because it’s not free cash flow positive

- Visionary founder at the helm driving growth

- 70% of deals have no competition; massive global TAM into which it can sell its product

While we acknowledge how great Asana is, as we illustrated earlier today, and while we acknowledge their strategy, Monday’s financials and growth are so compelling that we feel good about our decision to reduce Asana to 2-3%, having realized significant gains from our ownership of the company, and boost Monday to 6-7% as of today.

Let’s now turn to Dustin and management’s commentary on Asana’s aggressive spend. Annie Raimonde introduced Asana in the following fashion (basically preemptively striking on the aggressive spend questions from analysts):

As Dustin said, the major fiscal 2022 wins we had with customers like Warner Music, Viacom CBS, and the largest automotive manufacturer in the world, give us increased confidence to invest further in the enterprise.

[The following is an illustration of where all Asana’s money is going, i.e., why they’re burning so much cash]:

In Fiscal 2023, this will include: Making our biggest investment increase ever in pipeline build to support lead generation, sales development reps, account based marketing and customer engagement programs. We will be focusing on our sales infrastructure, solution selling, customer success and everything that supports customer expansions, all major levers for adoption and expansion. Our global Enterprise go-to-market sales organization, especially quota carrying sales headcount, will grow faster than overall headcount. And we will be expanding our ecosystem of technology partners, channel partners and co-selling networks. Another example of a successful partnership has been Vimeo. In fact, just yesterday Asana and Vimeo were named a Top 3 Joint Venture among Fast Company’s annual list of the World’s Most Innovative Companies. In conclusion, we are investing to win, especially in the enterprise. We are growing adoption and expansion with our product led strategy and we are going to market focused on customer success and adoption.

Now, this is fine, but if Asana is not profitable as a company, it will not be a good investment. For further light on this subject, Dustin shared the following:

Importantly, our unit economics remained strong throughout the year [As in Asana is profitable already but choosing to aggressively reinvest]. Our net expansion rate across all segments increased. Sales and marketing payback was less than 15 months at the end of fiscal year ’22. Please refer to our SEC filings for the calculation. With strong gross margins and compelling unit economics, we feel confident in our ability to continue to invest further in durable long-term growth.

Concluding Thoughts

In summary,

- Asana’ strategy is this: spend aggressively to acquire as many customers a possible, while also spending aggressively to fully expand within its largest customers like (what we believe to be) Netflix (NFLX) and Toyota.

- At some level of scale, Asana will be able to keep SG&A flat, while revenue continues to grow, thereby creating free cash flow.

- So the thesis goes.

- I/BTM believes that this is logical and completely plausible. Asana is profitable (just as Affirm, Twilio, and Amazon are; despite none of these companies being free cash flow positive at present). It’s just a matter of “When will Asana begin allowing profits to fall to the bottom line?”

- While Asana’s TAM is quite large, Asana is not operating in isolation. We believe Monday and Asana are, effectively, the only two real players in this space, and Asana must spend aggressively to capture land while Monday does the same. Curiously, Monday is much more effective at this, growing its customers faster and at larger scale with less spend.

With this final idea in mind, as of today, we feel quite good about our heavier weighting in Monday and our sustained position in Asana.

One hypothesis we have on Asana’s aggressive spend is the following:

As we illustrated in our recent note on Asana, Dustin Moskovitz has billions of dollars (though he’s eating into it quite rapidly) that he’s been using and will use to keep buying Asana stock. This will keep shorts out of the stock, while allowing the company to basically say “F U” to Wall Street and its demands for near term profitability.

That is, sans Dustin’s aggressive purchasing of shares of Asana, the company would likely not be able to spend in the way that it is. It would put too much pressure on the share price.

But, because Dustin can keep driving the share price meaningfully higher (he’s worth more than 99.9% of Hedge Funds have in AUM), I believe Asana believes that they can do whatever they want and it will not hurt the share price materially.

Whether this is a good strategy… only time will tell.

I could see the argument for both sides of whether it’s good or bad, and, to be sure, Asana is not “outgrowing” Monday as a result of this incredible cash burn/reinvestment. Were it outgrowing Monday, I would unequivocally state, “This strategy is great.” But it’s not.

So I think the case could be made for Asana hurting itself through the “profligacy” (again, it’s all in how you perceive it) of Dustin.

With all of this in mind, I do believe Asana will go on to be one of the largest and most important software companies in the world, akin to Atlassian (TEAM) or Workday (WDAY) or Salesforce (CRM). Dustin has 2+ decades left at the helm of his creation, and (from a positive perspective), his massive stock purchases are powerfully aligning his incentive with building Asana into a generational software platform.

As always, happy investing!

Be the first to comment