dtephoto/E+ via Getty Images

Assertio (ASRT) has an interesting history (see SA contributor Edmund Ingham for a detailed description) as it was mostly involved in selling opioids, a business which it had to sell at a steep loss and with lawsuits following.

Yet management has done a remarkable job turning the company around, having paid off some $900M in debt in four years, slashing cost and most of the lawsuits are in the rearview mirror.

With the restructuring complete, it can now focus on growth again, and central to that is the business model which was actually helped by the pandemic.

Reasons to buy

- The company has concluded a tremendous restructuring and deleveraging from $900M in debt in four years.

- Most of the litigation is in the rearview mirror, with only the broad opioid litigation remaining.

- The business model provides a competitive advantage and is leverageable.

- Acquired Otrexup in December and management is looking for additional acquisitions.

- The company is generating cash already.

- The shares are cheap on any valuation metric, even if one assumes no revenue growth.

Business Model

As the company made its complete 107 people strong salesforce redundant in December 2020 it has shifted to a digital sales model only. This was at least in part a response to the pandemic, but with hindsight, it might well turn out to be a very fortuitous change in direction.

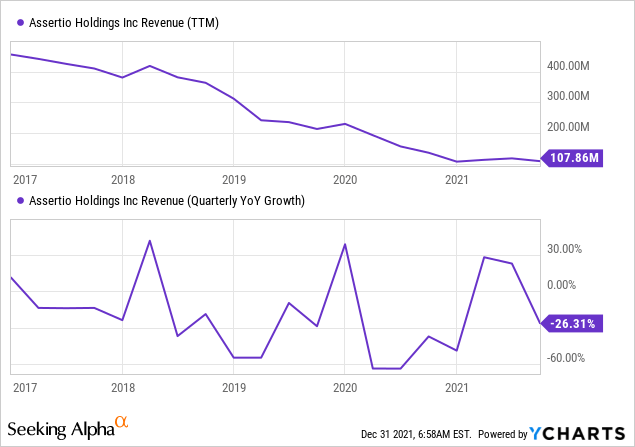

While a significant decline in sales was expected, this actually didn’t materialize in the first nine months of 2021, sales are actually up a little (2%, see below).

FinViz

Growth

YCharts

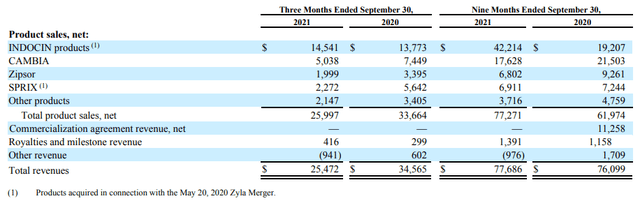

Here is a useful disaggregation with their selling drugs:

ASRT 10-Q

For the first 9 months of the year, drug sales were actually up significantly, from $62M to $77.2M. Who needs a sales force anyway?!

ASRT 10-K

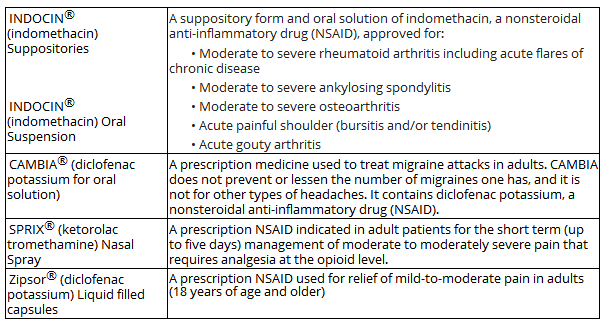

INDOCIN is the company’s main drug, responsible for over half the revenue in the first nine months and sold in two forms. It’s a generic NSAID (nonsteroidal anti-inflammatory drug) mostly used for moderate to severe Rheumatoid Arthritis and a few other indications.

At first sight, it doesn’t seem to be all that promising as there are quite a number of NSAIDs and INDOCIN itself is marketed under some 12 different brand names, but the Rheumatoid Arthritis market alone is enormous ($25B, growing to $36B in 2026) so there is clearly room to run.

Sequentially, INDOCIN sales were up $1.5M over Q2 sales that (Q2CC):

INDOCIN net sales in the second quarter reflected channel inventory adjustment related to a change in distribution strategy that will drive increased profitability in the future. The impact of this change was $1.5 million.

So that adjustment effect is already gone and the company can now benefit from that increased profitability. Sales of their combined other drugs was down though (Q3CC):

Net sales for the remainder of the portfolio are down 5.8% versus the prior quarter, primarily due to unfavorable price mix during the quarter.

The company expanded its alliance with Cove, a leading migraine telemedicine platform for CAMBIA and SPRIX (Q3CC):

What’s new now is that we’ve worked with them to build a broader set of DTC resources and engage with drivers for patients tailored to both CAMBIA and SPRIX.

And this seems to be working as their sales to Cove, although still small, are up 207% in dollar terms with CAMBIA up 77% in Q3 alone and SPRIX, which started late in the quarter already seeing first prescriptions. A digital strategy seems promising here (Q3CC):

Another unique aspect is that 47% of Cove’s patients don’t have a single headache specialist in the country – in the county they live in and might otherwise consult a primary care physician who’s not overly familiar with innovative migraine or pain treatments for the CAMBIA and SPRIX.

Cove is growing rapidly and has tens of thousands of patients and this is for cash payments only, at present. The company is in the process of getting payer coverage for migraine care next year.

The company hopes to establish many more similar relations as they have with Cove. The company also signed an agreement with a large regional IDN (Integrated delivery network, basically a multihospital regional system) for SPRIX, so things are moving positively since the payer setback last year.

Acquisitions

Now that their digital-only strategy seems to be delivering and with the company’s finances sufficiently improved, management is on the prowl for acquisitions to leverage their digital platform.

They found a target in acquiring Otrexup from Antares Pharma in December, for $44M payable in three installments (the first $18M has already been paid).

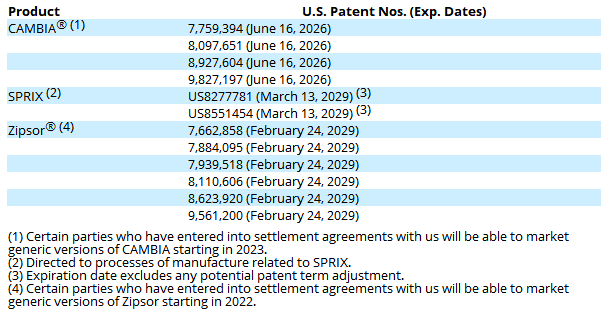

Otrexup has 10 years of patent protection remaining, delivered $15.5M in sales the last 12 months and its gross margin profile is in the low 70s.

Litigation

The company took an $11.3M charge to resolve two separate legal matters in Q2CC without providing much detail, but perhaps as amazing is that despite that charge (which wasn’t projected previously), they maintained their adjusted EBITDA guidance for the year.

In Q3 there is further news on those two remaining cases mentioned in Q2 (Q3CC):

Our operating cash flow results are even more impressive when you factor in that this quarter reflects the cash payments of $7 million to resolve our federal claims in the Glumetza antitrust matter. The class portion of the plaintiffs is still pending final court approval, but our belief is that it will become final early in the New Year…

we’ve entered into a settlement agreement to resolve our securities class action litigation, and its related derivative suits. The total is $1.2 million, but will be net against $750,000 to be covered by our insurer.

The 10-Q lists a number of other litigation cases:

- Opioid-Related Request and Subpoenas for information related to their opioid sales and marketing (Lazanda, NUCYNTA, and NUCYNTA ER) and in one case also related to Gralise, a non-opioid product formerly in their portfolio.

- Multidistrict Opioid Litigation

- State Opioid Litigation

- Insurance Litigation

- CAMBIA ANDA Litigation (settled)

There are hundreds of Multidistrict and State Opioid Litigation cases brought on by hundreds of different groups and states and Assertio is only involved in a subset.

It’s unclear to us what the potential exposure is here, the only comment in the 10-Q with respect to this is that the company intends to “defend itself rigorously.”

The Insurance Litigation with Navigators is settled (the company received $5M in insurance reimbursement for previous opioid-related expenses) but the other case with Newline it’s still in discovery phase (10-Q):

The Company is seeking a declaratory judgment that Newline has a duty to defend the Company or, alternatively, to reimburse the Company’s attorneys’ fees and other defense costs for opioid litigation claims noticed by the Company.

The CAMBIA ANDA ( Abbreviated New Drug Application) Litigation was filed last year to avoid approval of Patrin’s ANDA for a generic version of CAMBIA 50mg before the expiration of the US patents in June 2026. The case has been settled in March.

We’re no legal experts but it seems that the most important remaining cases (2 & 3 above) will drag on for years to come (here is a settlement tracker). The company has sold its opioid businesses

Patents

ASRT 10-K

Guidance

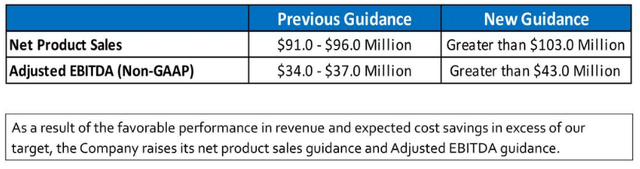

ASRT earnings deck

That was at the Q3CC where the guidance was increased from the guidance given at the Q1CC, but it has increased again after the $44M acquisition of Otrexup in December 2021:

Due to strong sales of its existing portfolio of products, the Company announces it has further raised its full-year net product sales and non-GAAP adjusted EBITDA guidance:

11/4/21 Guidance Updated Guidance Net Product Sales (GAAP) Greater than $103.0 Million Greater Than $108.0 Million Adjusted EBITDA (Non-GAAP) (1) Greater than $43.0 Million Greater Than $48.0 Million

(1) See “Non-GAAP Financial Measures” below for additional information.

So from $35.5M at the Q1CC to $48M+ in adjusted EBITDA guidance now, that’s a substantial 35% improvement in guidance.

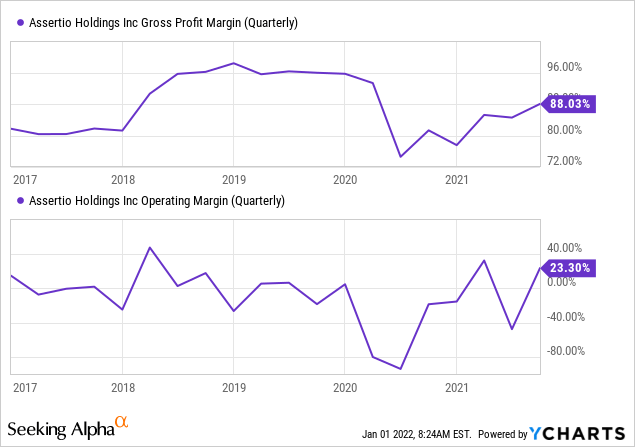

Margins

YCharts

These are GAAP figures, and OpEx has big swings mostly on reservations like the $11.3M in Q2 2021, but it shows that the underlying business is healthy financially. The y/y improvement is a result of phasing out drugs with a lower margin profile (like SoluMatrix).

The OpEx run rate will be $45M lower from the beginning of 2022, that’s less than half the run rate in 2020.

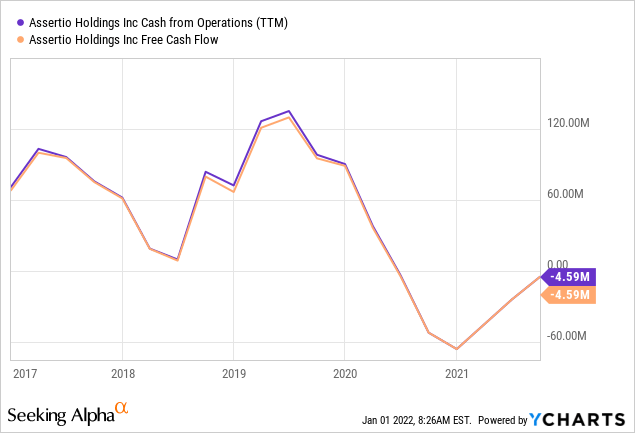

Cash

YCharts

All the restructuring has been bad for cash flow, but things have improved last year. The company had $58.7M in cash at the end of Q3, an increase of $4.3M in the quarter which would have been $11.3M bar for a $7M legal settlement payment in Q3.

Management is expecting an $8.3M tax refund in Q4 but slow processing might tilt this to 2022.

The company had $75.5M in senior secured debt outstanding at the end of Q3 which was further reduced to $70.8M on November 1, 2021 after a $9.7M payment in principal and interest.

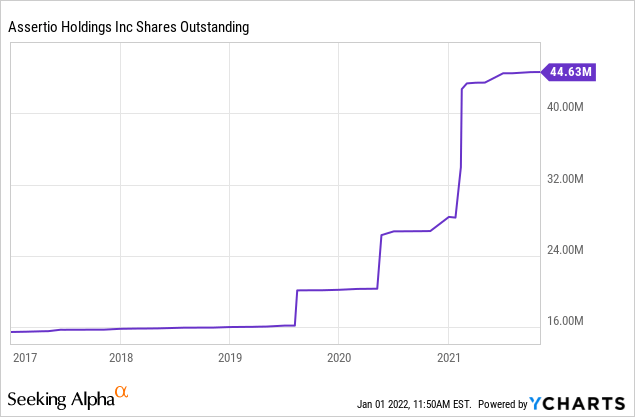

YCharts

The company embarked on a $34.3M share sale in February 2021.

Valuation

Parameters:

- 44.6M shares at $2.2 = $98M market cap

- $70.8M in debt (expiring in 2024)

- $39.3M in cash for an EV of $130M

- $108M+ in 2021 revenue 2021

- $48M+ in adjusted EBITDA in 2021

- 2021 EPS of $0.45

For 2021 the company sells at just 2.5x EV/EBITDA, 1.2x EV/S, and with a P/E of just 4.8x. The stock is downright cheap and will likely get considerably cheaper on 2022 metrics, considering:

- The acquisition of Otrexup will likely add at least $15.5M in sales even assuming no growth

- The company needs to make another $26M in cash payments for the Otrexup acquisition ($16M on May 31 and $10M on December 15)

- Given the gross margin profile of Otrexup (high 70s), it’s likely to add substantially to adjusted EBITDA, which will already by higher in 2022 as the full OpEx savings apply from the start of the year.

So even if we don’t assume any growth for the company’s existing business nor its latest acquisition, adjusted EBITDA will likely be similar or better in 2022, let alone if there is revenue growth. Here is another way of looking at it:

- 2022 revenue of $120M

- Gross profit (at 85% gross margin) of $102M

- OpEx $65M (Q3 2021 run-rate of $16M)

- Operating profit of $37M

- Interest cost $10M

- Net income before tax: $27M or an EPS of $0.60

Conclusion

There is quite a bit to like:

- The company is in the tail-end of an impressive turnaround, having revamped its business away from opioids and paying off $900M in debt in four years.

- The digital-only sales strategy was born out of necessity, but the early indications not only show it can work, but it’s also highly leverageable. Adding new drugs to the lineup (like the recently acquired Otrexup) is likely to add substantially to the bottom line.

- Financially, the company is on much sounder footing, having increased its revenue and adjusted EBITDA guidance three times last year with the latter well into positive territory at $48M+, nearly half of revenues.

- Cash flow is likely to be positive.

Concerns/Risks

- Most of their drugs are fairly generic as numerous alternatives exist, although they sell in huge markets.

- Although the early signs are very encouraging, it’s still early innings for their digital strategy.

- We have no good grip on the company’s litigation risks but the company wasn’t a major player in the opioid industry and sold off all of its opioid businesses. These cases are also years from conclusion.

Be the first to comment