Sundry Photography

Thesis

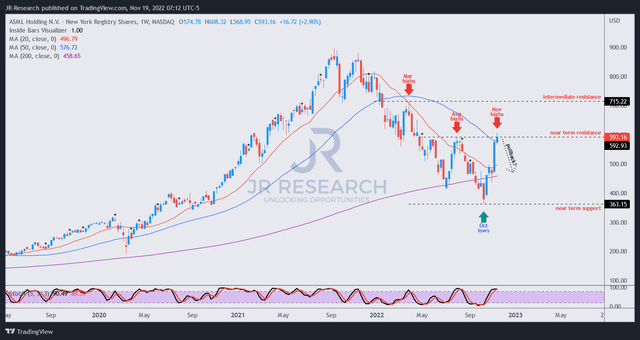

In our early October article, we highlighted that ASML Holding N.V. (NASDAQ:ASML) stock likely formed a significant bottom with a positively-skewed reward/risk profile. As such, we upgraded our rating to Strong Buy, urging investors to capitalize on substantial market pessimism.

ASML has been battered by multitudinous headwinds, including US export restrictions, downstream inventory digestion, and reduced wafer starts at its foundry customers. As such, the market forced buyers who picked the summer rally toward its August highs to flee.

Accordingly, ASML has significantly outperformed the S&P 500 (SPX) (SP500), posting a total return of 33% since our article, compared to SPX’s 7% gain. In addition, buyers’ sentiments were lifted by management’s confidence in its long-term roadmap at its recent Investor Day, as it raised its medium-term guidance markedly, coupled with visibility toward 2030.

However, ASML’s valuation premium behooves the company to continue leveraging its strong competitive moat in EUV and DUV lithography systems to deliver robust earnings growth. Therefore, the company’s confidence in its long-term growth drivers is highly constructive to justify its growth premium, even as the headwinds continue to beset the semiconductor equipment industry.

However, our analysis suggests that ASML’s valuation is no longer attractive at the current levels. Furthermore, we gleaned that its price action also suggests significant caution, as a pullback is looking increasingly likely to digest its recent sharp spike.

Revising from Strong Buy to Hold as we urge investors to bide their time before considering adding more positions.

Management Confident Of Overcoming US Chip Export Restrictions

The US government ratcheted up geopolitical tensions with China over the past few months, as the Biden Administration widened its chip export restrictions to China, creating significant uncertainties among US semiconductor companies.

However, ASML was confident that it didn’t expect to be impacted materially in the near term, given its European roots and limited application of US semiconductor technology. However, we believe that the saga has yet to conclude, as ASML’s US rivals have highlighted that the export curbs would disadvantage their competitive position against their European counterparts.

As such, the US government was reportedly in talks with its European counterparts to reach an accord “aimed at leveling the playing field, [but] could take six to nine months.” However, we believe both sides appear to be a distance away from an agreement, as Dutch Foreign Trade Minister Liesje Schreinemacher articulated:

The Netherlands will not copy the American measures one-to-one. We make our own assessment — and we do this in consultation with partner countries such as Japan and the US.

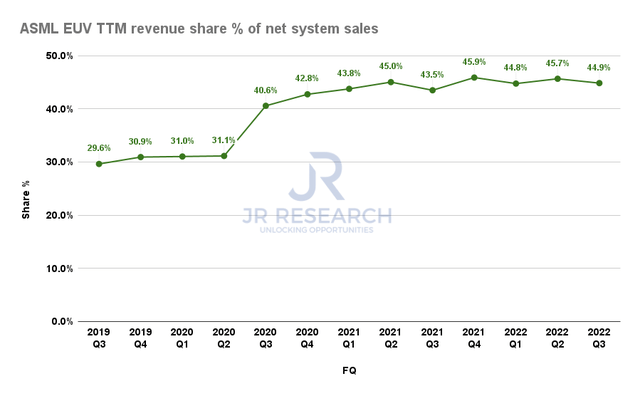

ASML EUV TTM revenue share % of net system sales (Company filings)

Furthermore, ASML’s TTM EUV share of its net system sales of 45% in FQ3 has already been banned from exports to China. Moreover, given the Biden Administration’s focus on AI-based high-performance computing (HPC) chips, the export curbs have no impact on its EUV revenue.

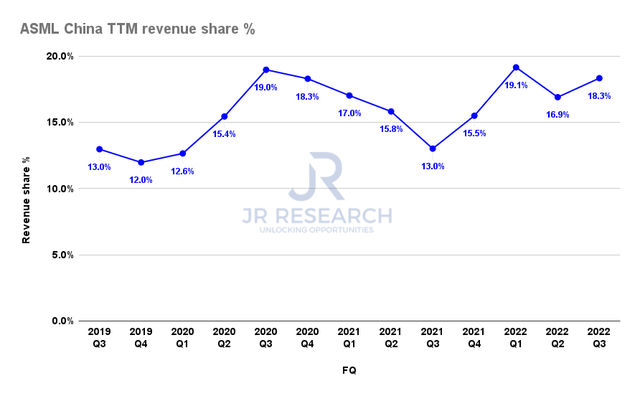

ASML China TTM revenue share % (Company filings)

Notwithstanding, China accounted for 18.3% of ASML’s total revenue on a TTM basis in FQ3. As such, investors cannot ignore the impact on its DUV systems. However, management was confident that its technological leadership should help mitigate the impact of further export controls over time, as CEO Peter Wennink accentuated:

So those fabs will be built somewhere else. So it could mean that there could be a temporary hiccup. But ultimately, those chips need to be made. And then you could argue, it is still as inefficient or perhaps even more inefficient than not less inefficient. So chips will be needed to the levels that we talked about, and where they’re being made is going to be a matter of time. And so it doesn’t change the, let’s say, the 2030 picture that much. (ASML Investor Day)

Significant Upgrade To Its Previous Guidance

As such, management lifted investors’ sentiments about the company’s clear revenue runway through 2030. Notably, ASML revised its 2025 revenue guidance from €27B (midpoint) to €35B (midpoint), demonstrating tremendous confidence in its execution.

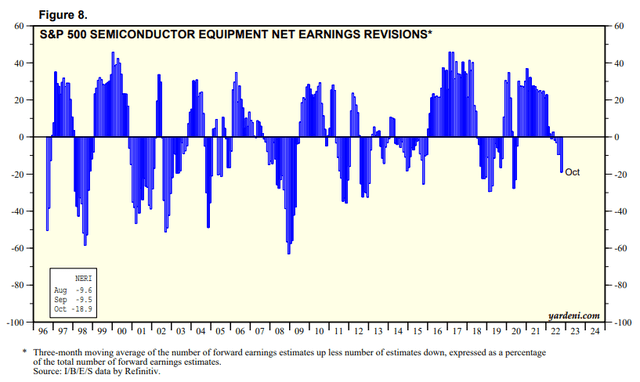

S&P 500 Semiconductor equipment industry net earnings revisions % (Yardeni Research, Refinitiv)

The Street consensus has also been revised upward to €33.7B (below the midpoint), suggesting that analysts remain tentative over the company’s visibility. However, investors should note that analysts have turned even more pessimistic through October, as their bullish thesis in FY22 was demolished by the semi industry downturn.

Hence, it forebodes well for ASML to outperform Wall Street’s less optimistic projections moving forward.

But ASML Is No Longer Undervalued

The market has consistently ascribed ASML a much higher valuation than its peers’ median. In addition, the company’s EUV and DUV leadership has given the market tremendous confidence in its long-term growth drivers that have continued to be expanded.

Furthermore, the reshoring of “technological sovereignty” is a significant driver for more foundries to be constructed as governments look to re-establish critical foundry leadership.

Coupled with the fast-growing industrial and automotive markets bolstering the HPC segment, ASML is likely a prime beneficiary of these secular growth drivers.

But the market knows it too.

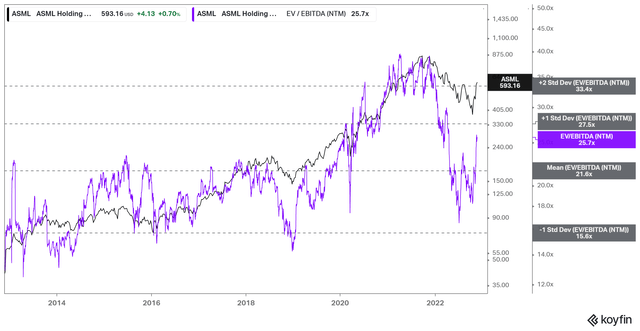

ASML NTM EBITDA multiples valuation trend (koyfin)

With the recent momentum spike, ASML last traded at an NTM EBITDA multiple of 25.7x, well above its 10Y mean of 21.6x. It’s also markedly higher than its peers’ median of 11.9x (according to S&P Cap IQ data).

While we understand that ASML has consistently traded at a premium against its peers, we urge investors to avoid the mistake of overpaying for leadership.

Is ASML Stock A Buy, Sell, Or Hold?

ASML price chart (weekly) (TradingView)

With the momentum spike re-testing its August highs, we urge investors to be wary about adding more positions at the current levels.

We believe the market has reflected the optimism from ASML’s recent Investor Day at the current level, given its current valuation.

Furthermore, its price action suggests significant caution, with a pullback looking increasingly likely. Hence, we encourage investors to bide their time and don’t rush to add more positions now.

Revising from Strong Buy to Hold.

Be the first to comment