BYD Auto (OTCMKTS:OTCPK:BYDDF) has a wide-ranging suite of new energy products. This includes cars, e-buses, e-trucks, batteries, energy storage, phone components and mono-rails. They are the ultimate vertically integrated new energy company. Long-term this should stand them in good stead as my recent article detailed. In recent days they have even ramped up whole new product lines to cope with the COVID-19 crisis. For instance, they are producing on a daily basis 5 million masks and 300,000 bottles of hand sanitizer.

The opportunities I propounded in that thesis has been illustrated by recent news out of Singapore. This continues the somewhat unheralded importance of small countries to the EV and renewables revolution. For instance Tesla (NASDAQ:TSLA) now has a stable wide-ranging base for its worldwide EV sales. In its early development though small nations such as Norway, the Netherlands and Hong Kong were key to its growth and perhaps even survival.

Singapore is likely to follow this same pattern although BYD should be more of a mainstream suppler.

BYD’s Overseas Auto Markets

The worldwide long-term growth of BYD’s e-buses and e-trucks looks very secure. My article in May last year detailed much of this. It is predicated on a superior range to its competitors and a worldwide network of manufacturing facilities for a secular growth market.

The car market is more complicated as it depends upon consumer acceptance of the product. This is very limited still in the mass high-end markets of North America and Europe. Chinese cars there are likely to be regarded as of inferior quality. The company did sign an MOU for a factory in Morocco last year. It is thought this might be to manufacture cars for the European market.

Worldwide some progress has been made by BYD through the supply of taxis. That is probably a good way to access markets gradually. Countries where this is being tried include Canada, Ecuador, Indonesia, India, the Philippines and Singapore. The company has operations in 20 countries around Asia.

A further complication is that, unlike buses and trucks, huge investment in scaling up manufacturing for cars is required for economical production. BYD has shown no sign of scaling up its bus plants in California, France and Hungary for instance into becoming car assembly plants. BYD already has quite a high debt load and has recently invested substantial sums in ramping up its battery manufacturing facilities in China.

In China the company has a couple of agreement with overseas manufacturers. My article last year detailed these. Increased capital has been put into the “Denza” brand which is a joint venture with Daimler (OTCPK:OTCPK:DDAIF). So far this joint venture has not been meaningful in revenue terms. The more recent 50/50 agreement with Toyota (NYSE:TM) might be more significant. In both cases exports elsewhere to Asia from the Chinese base seem likely.

Tesla is well advanced in its manufacturing plant plans. Shanghai will be key to increasing market share in Asia. The continent has many impatient buyers awaiting their vehicles on long lead times all the way from California.

China Auto Market

My article in February detailed the decline so I will not repeat that here. This was caused in part by last year’s temporary decline in EV incentives. It has been accelerated now by COVID-19. The stunning fall in sales was shown by figures released to the Stock Exchange by BYD for February. They showed the company’s total auto sales declined year-on-year by 79% to 5561 units. NEV’s (new energy vehicles) declined 81% year-on-year to 2807 units. This marked the eighth month in a row of declining NEV sales in China for the company.

Two possible positives can be considered. Firstly, that these are not long-term lost sales. When the situation improves, customers will still go out and buy their long-planned for car. This is unlike the crisis a company like Starbucks (NASDAQ:SBUX) faces in China. A lost cup of coffee remains a lost cup of coffee. Secondly, the shock to the Chinese auto sector is likely to encourage still further Chinese government plans to stimulate the economy and to ramp up EV incentives.

At the beginning of this month, BYD announced it had received 1.34 billion yuan (US$191 million) as a subsidy payment from the Chinese government for sales for the year of 2017.

For Tesla the COVID-19 crisis obviously came at a bad time for their ramp-up of Chinese revenues. However unconfirmed reports suggest that about 30% of the much reduced plug-in EV sales in China in February were Tesla Model 3’s. The second best selling model was the BMW 530Le. That again proved that luxury sedans do indeed sell well in China, even in these straitened times.

In January Tesla surprised the market by getting the Model 3 to be the best-selling EV in the country. Its 3183 units made it the first non-Chinese company to achieve this. Of these 3183 units, 578 were imports from the USA. The second best-selling vehicle was the local SAIC Roewe Ei5 station wagon.

Going forward the picture looks rosy for Tesla there. The company’s confidence is shown by its recent application to produce more parts at its Shanghai plant. This includes battery packs, electric motors, motor controllers and cooling pipes.

The Singapore Auto Market

The recent Budget in Singapore surprised the markets by the ambition of its proposals. The government announced it will make Singapore a totally EV market by 2040. By 2030 there will be at least 28,000 public charging points in place. Singapore is almost certainly the most expensive country in the world to buy and run a car. It is calculated that the government will be losing over S$1 billion per annum on lost fuel duty. This would be partially off-set by reduced health costs due to less air pollution from ICE vehicles.

Cynics have often doubted the government’s keenness to go with EV’s due to the substantial investments there by the oil and gas sector. It seems that this is not a factor after all. After previously looking at hydrogen fuel cell options and compressed natural gas options, the authorities have wisely plumped for the EV road to sustainability and cleaner air. In another area where BYD can offer solutions, the government plans substantial smart charging and energy storage solutions for the increase in electricity use that will result.

Cars are amazingly expensive in Singapore. The rather basic BYD e6 has a sales price of S$134,000 (US$91,000). It is likely that BYD will be bringing their full extensive range of EV models to Singapore quite soon.

The BYD pricing pales in comparison with Tesla. For instance a recent enquiry I made with the Tesla dealer gave me the choice of a standard Model 3 at S$276,000 (US$187,000), a Dual Motor Performance at S$345,000 (US$234,000) or a Model S at S$440,000 (US$316,0000). This puts it in a price bracket with best-selling ICE models in Singapore such as the BMW 3 series and the Mercedes C Class. A few Teslas can be seen on the road, such as this Model S spotted at a high end club in Singapore:

Photo By Author

Despite these costs, the roads in Singapore are full of high-end brands such as Mercedes, BMW and Audi. BYD could get a substantial market share in the country. There should be quite a strong niche market for Tesla as well in an all-EV Singapore. The company’s new facility in Shanghai will be an ideal supply point into Singapore and other Asian markets. I had previously reported rumors that there were orders for 130 Model 3s in Singapore but these are yet to be verified. Some years ago the company closed down its office in Singapore following a spat between the company and the government over calculation of road tax for EV’s.

BYD stands to gain bulk sales. An early adoption tax scheme is being rolled out by the government to start in 2021. So revenue benefits for BYD can start quite rapidly.

There have already been some experimental EV projects in Singapore. One that has been gaining ground is the BlueSG from French company Bollore. Cars can be picked up and dropped off through a smartphone app. Vehicles are pictured at charging points in a residential area of the city:

U.K. company Dyson Ltd had planned to build a new EV in Singapore but their plans were shelved last year.

It is calculated (paywalled) that the new government measures will mean 50,000 to 60,000 EV sales per annum up to 2040. That provides quite substantial revenues for EV manufacturers quite quickly.

Taxis will probably be one short-term boost for BYD. There are about 19,000 taxis in Singapore of which 7,259 are petrol-electric hybrids and 133 full EV’s from BYD supplied to new taxi operator HDTT. The hybrids are mainly Hyundai Ioniq and Toyota Prius models. So taxis alone are an addressable market for BYD of 19,000 vehicles although it is uncertain what percentage will be hybrids or full EV’s long-term.

BYD is already supplying e-taxis on a small scale to various countries in Asia. These include to Indonesia’s largest taxi fleet operator Blue Bird, to India and in the Philippines. In Singapore the taxis supplied are of their rather old model, the e6. The benefits of its vertical integration are shown by, for example, the fact they have recently supplied 200 of their T3 e-trucks to Indonesia.

The Singapore Bus Market

It is not just in cars that Singapore is going green. Trials for e-buses have been under way for a while. There will be 60 e-buses on Singapore’s roads this year. BYD is one of the suppliers, along with its Chinese rival Yutong and local player ST Engineering Land Systems. BYD e-buses are pictured below at their charging garage:

The recent Budget in Singapore declared that all future bus purchases would be for either electric buses or diesel hybrid buses.

There are about 5,800 buses on Singapore’s roads. So that is BYD’s addressable market in Singapore. A reasonable idea is that they would get about 1,800 e-bus orders over the next decade. That would probably amount to US$900 million depending upon many price and type variables.

BYD is working on trialing autonomous e-buses in Singapore in conjunction with local government-linked company ST Engineering. It also has an MOU for the development of autonomous forklifts and pallet trucks in Singapore. The country is well advanced in its plans for vehicle autonomy in a number of areas.

The Small Country Enigma

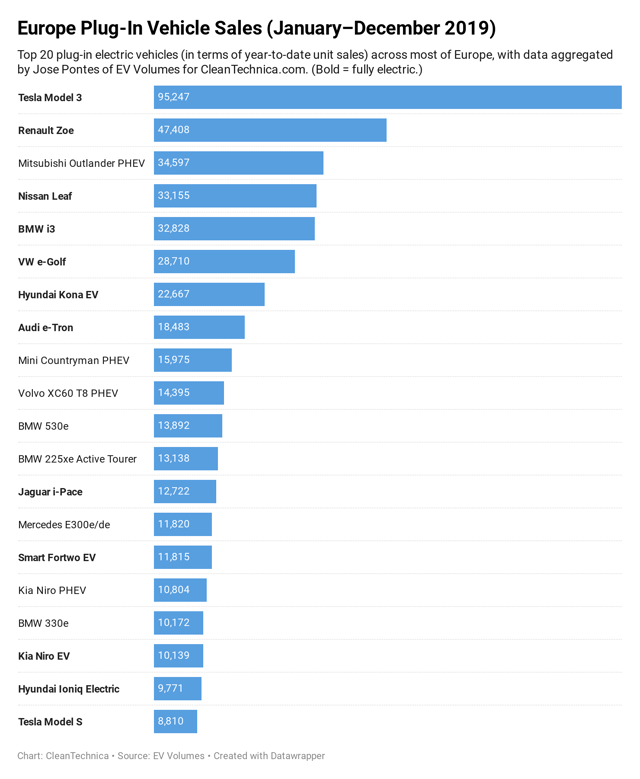

The chart for EV sales in Europe as produced by the European Automobile Manufacturers Association is illustrated below:

ACEA

The countries in Europe which have really boosted EV sales as a proportion of total sales in Europe last year were small countries such as Norway, the Netherlands, Denmark, Ireland and Sweden. Like Singapore, they are small affluent countries with a strong environmental drive and progressive governments. About 14 countries have committed so far to all EV fleets by set dates in the near future. They are mainly small countries. Others, such as China and the U.K. are committed but on a longer time-frame. Because the markets are smaller, there is also a less strong lobbying power from fossil fuel companies than in the larger countries.

Larger countries have recently been showing signs of following suit. Germany was a notable example last year. A similar pattern is expected to emerge in Asia, the world’s largest car market by a long way.

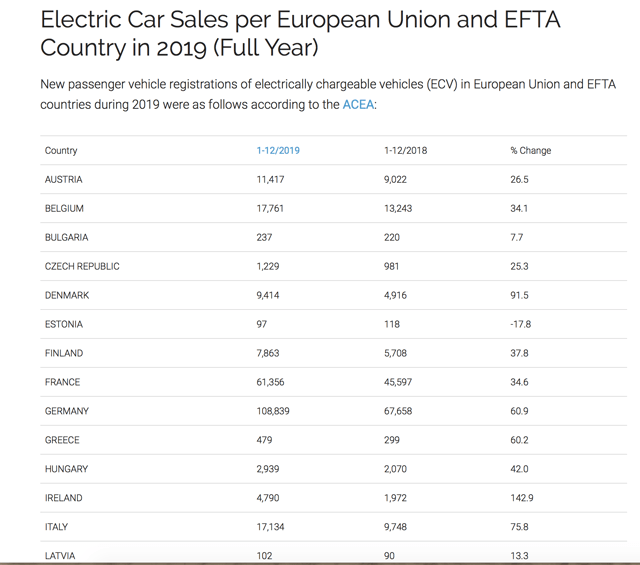

The EV market in Europe last year was of course dominated by Tesla’s Model 3 as the chart below illustrates:

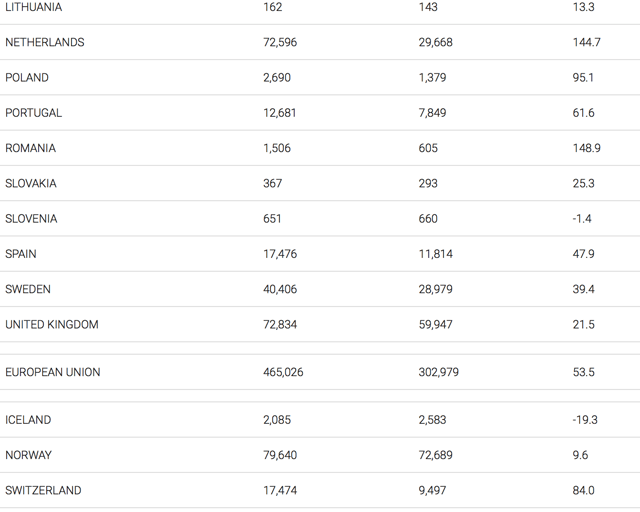

Tesla’s leading position in Europe’s EV business is evidenced across a range of countries as illustrated below:

Tesla’s leading position in Europe’s EV business is evidenced across a range of countries as illustrated below:

I would not expect such a percentage domination by Tesla around Asia, but a meaningful revenue stream is likely to emerge. My article in September last year gave details of the very promising markets around Asia for Tesla so I will not repeat that here. There have been further interesting development since then though.

Recent postings on customer bulletin boards show several shipments of Model 3’s arriving in New Zealand. This may be an interesting market. It has a similar car population to that of Norway, a similarly environmental government, and is similarly affluent, so 15,000 units per annum would be possible there.

Similar messages on the Hong Kong bulletin board show 320 Model 3’s and 32 Model 3’s arriving for Hong Kong and Macau respectively in March, from the USA. The Hong Kong government has announced that all ICE vehicles will be phased out in the next 10 to 20 years. It is thought that EV registrations are running at about 20 per day.

Taiwan has recently announced it expects to phase out all ICE vehicles by 2040. Japan looks to be more receptive to the Model 3 as the previous Tesla models were criticized for being too large for narrow city streets and parking lots.

Supply of Model 3’s and Model Y’s from Shanghai in the future should help Tesla in Asia a great deal. In Asia in general BYD, the world’s largest EV manufacturer behind Tesla, is more likely to dominate but with Tesla a strong secondary player.

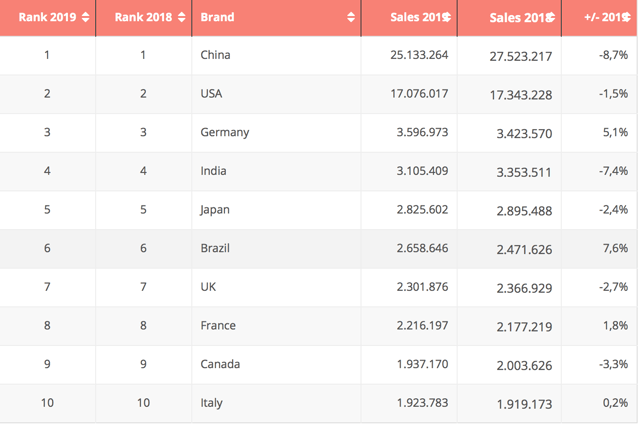

Asia, along with Europe, will be the key area in coming years. The continent’s economies are growing faster than those in North America or Europe. Asia is by far the largest auto market with 3 of the 5 biggest auto market countries being Asian, as illustrated below:

Focus To Move

Apart from the top ten, South Korea is the 12th largest, Australia the 15th largest, Indonesia the 16th largest and Thailand the 17th largest.

Conclusion

BYD is a wide-ranging company with substantial revenues in a growing number of products. Their addressable markets can all be regarded as secular growth areas. Its long-term prognosis is very good. Short-term prospects are of course dependent upon COVID-19 which no-one can accurately predict.

Tesla is the world’s leading EV manufacturer and has the brand equity that Asians love. It will not be able to match the depth of product that BYD can muster, but no doubt its Shanghai base will enable it to challenge BYD in China and in Asian markets.

Short to medium term BYD needs increased revenue streams to make up for what is arguably an over-reliance on its car business in China. Broadening the car business to more overseas markets may be a key element to boost revenues from this over-reliance on its domestic market. That could re-assure investors and give a boost to the stock price while other product revenues kick in to the bottom line.

Disclosure: I am/we are long BYDDF TSLA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment