5./15 WEST

Overview

Ascendis Pharma (ASND) is now a commercial stage company with a revenue stream. Management has flawlessly executed in the clinic and on the regulatory front. The company recently submitted an NDA for TransCon PTH to the FDA after presenting excellent data from their phase 3 trial. If approved, a mid 2023 launch for TransCon PTH will provide an additional very significant revenue stream. In addition, Takeda (TAK) has encountered manufacturing issues with competitive product Natpara which is only available through an access program to current patients. (Takeda received a CRL and has not been able to sell commercially in the US.) Ph1/2 oncology data for TransCon TLR7/8 and TransCon IL-2 β/γ are on track for Q322 and Q422, respectively, which may help to establish Ascendis as a platform company with validated technology that can be applied to other indications. Longer term, Ascendis has a clear line of sight to profitability and sufficient cash to reach breakeven without significant further dilution. This article is focused on achondroplasia, TransCon CNP, the competitive landscape and the significant commercial opportunity.

Achondroplasia (ACH)

Achondroplasia is a genetic skeletal dysplasia that causes the most common form of dwarfism. In patients with this genetic disease, a protein that is involved in converting cartilage to bone is altered resulting in disordered bone growth. This protein is growth factor receptor 3 (FGFR3).

ACH occurs in an estimated ~4 per 100K births and is usually diagnosed before age 1. Some estimates suggest a global market of 13,000 patients with open growth plates who would be eligible for treatment for ACH. There are multiple complications patients may experience including bowing of the legs, shortened limbs, spinal deformities, sleep apnea, and frequent ear infections which can result in hearing loss. Some patients also experience back pain and require spinal fusions. Addressing these co-morbidities in addition to the short stature is an important goal of treatment.

Treatments for ACH

Standard of care includes monitoring bone growth and the spine and legs. In some cases, surgical intervention is utilized to mitigate complications. Limb-lengthening procedures are sometimes recommended but pain and complications limit the utility. Until the recent approval of Voxzogo, which was developed by BioMarin Pharmaceutical (BMRN), there were no pharmacological treatments approved in the US and EU.

Voxzogo

Voxzogo (vosoritide) is an analogue of C-type natriuretic peptide (CNP) that is a synthetic version of the natural hormone. This drug was approved in November of 2021 for the treatment of children ages 5-18 although an ongoing study may expand the label to include younger children. Treatment is chronic until a child is no longer growing. SVB Leerink has projected $1B in peak sales and Goldman Sachs (GS report) estimates $1.1B. Pricing is approximately 240K/per patient/per year net of discounts. BioMarin booked $54 million in the first half of the year and guided for $130-$160 m in 2022 sales suggesting the launch has gone very well and there is strong demand for treatment.

BioMarin was granted accelerated approval on the basis of data from a trial that enrolled patients ages 5+. The primary endpoint was met and a 1.6cm/yr improvement in placebo-adjusted change from baseline in growth velocity (p=<0.0001) was noted. The safety profile was generally favorable but there is a warning in the prescribing information about the risk of low blood pressure and 8/60 patients experiencing a transient decrease in blood pressure.

Unpublished follow up data shows growth was sustained into the second year of treatment. Full approval is contingent on post-marketing studies confirming clinical benefit.

While use for years may add just 4-6 inches to height, it may allow for an improved quality of life. It is unknown whether there will be an impact on comorbidities. This is a critical question which can only be properly answered after years of accumulated clinical data.

The biggest limitation of Voxzogo may be the difficulty of administration which is required on a daily basis for years. Many subcutaneous drugs are administered via an easy to use pen injector device. (Skytrofa, a TransCon product is very simple to administer with an autoinjector and does not require refrigeration.) Voxzogo requires refrigeration, mixing, measuring and the use of multiple syringes. To illustrate the extraordinary complexity of administering Voxzogo for parents, below are the instructions.

Reconstitution Instructions:

- Select the correct Voxzogo strength and prefilled diluent syringe co-pack based on the patient’s actual body weight [see Dosage and Administration (2.2)].

- Remove Voxzogo vial and prefilled diluent syringe (Sterile Water for Injection, USP) from the refrigerator and allow the vial and prefilled diluent syringe to reach room temperature before reconstituting Voxzogo.

• Attach the diluent needle provided with ancillary supplies to the diluent prefilled syringe.

• Inject the entire diluent prefilled syringe volume into the vial.

• Gently swirl the diluent in the vial until the white powder is completely dissolved. Do not shake.

• Parenteral drug products should be inspected visually for particulate matter and discoloration.

- After reconstitution, Voxzogo can be held in the vial at a room temperature 20°C to 25°C (68°F to 77°F) for a maximum of 3 hours.

- For administration, extract the required dose volume from the vial using the supplied administration syringe [see Dosage and Administration (2.2)].

Infigratinib

Infigratinib is being developed for the treatment of achondroplasia. BridgeBio (BBIO) announced data from the low dose infigratinib in achondroplasia from the Phase 2 PROPEL 2 study. The average height velocity was 1.52 cm/year and the safety profile appears favorable with no SAEs reported. BridgeBio will be enrolling patients in Cohort 5 using double (0.25 mg/kg once daily) the dose to assess whether there is improved efficacy. It is notable that BioMarin did not see added benefit with the highest dose tested.

One significant advantage of infigratinib is that it is an oral medicine which many families may prefer over an injection, especially given the complicated administration protocol for Voxzogo.

Recifercept

Pfizer (PFE) is conducting a phase 2 trial with 63 subjects to evaluate recifercept in the treatment of children with achondroplasia. This drug came from the acquisition of Therachon and the trial is scheduled to be completed in the fall of 2023.

TransCon CNP

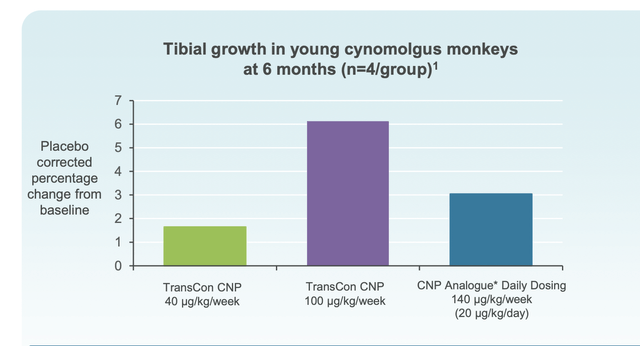

The TransCon technology enables the short half-life of CNP to be extended and patients only require an injection weekly. In addition, penetration into the growth plate occurs. Below, data from animal studies notes dose dependent tibial growth which is superior to daily dosing with a higher weekly dose. Results of clinical studies will determine if this trend is also observed in humans.

The phase 2 ACcomplisH study is underway which has enrolled 57 subjects ages 2-10 and will be testing various doses vs placebo. (Tested doses are 6, 20, 50 and 100 μg/kg/week.) The primary endpoint is height velocity at one year. Secondary endpoints will measure body proportionality and quality of life measures. Ascendis is on track to read out topline data from the ACcomplisH trial in Q4. Interim blinded data led to the 50 and 100 k μg/kg doses being chosen for a study in China so these may be the cohorts for investors to monitor closely. Data from an open label extension trial using higher doses should also give investors information about efficacy.

A key question is whether the sustained release profile and continuous exposure will result in improved efficacy as measured by AHV. Below is a comment on my last article on Ascendis by Dr. Karpf, who was VP of Clinical Development at Ascendis. His comment was extremely helpful in that it brought into focus what differentiates TransCon CNP from Voxzogo.

“Regarding TransCon CNP, what may have been lost in otherwise excellent summary is that BioMarin’s vosoritide, which has a PDUFA date this November, as a once-daily SC dose at 15 mcg/kg, only provides CNP in the physiological range for about 2 hrs out every 24 hr day. Yet still managed to eke out a statistically significant increase in AHV of just under 2 cm/year. Despite an enormous peak-to-trough ratio based on its half-life of about 20-23 minutes, which seems to cause some hypotension with tachycardia at Cmax in some patients. TransCon CNP, in contrast, provides CNP levels within the physiological or pharmacological range over 24 hrs with once weekly dosing, and with a flat profile with a very low peak-to-trough level.”

Investors will be able to assess whether this product feature translates into better efficacy and less hypotension. Longer term, an additional data point investors may wish to watch is the results of radiological studies of the foramen magnum and the proportionality of the long bones in addition to measures of impact on comorbidities.

The company plans to submit regulatory filings in Q4 for a new randomized, controlled Phase 2b trial in achondroplasia, which is expected to read out in 2024. Ascendis has indicated that this trial will enroll a larger cohort at a single dose. This will be the second randomized controlled trial and could potentially be registrational.

Financials

Ascendis Pharma had cash, cash equivalents, and marketable securities totaling €994.9 million. For the second quarter of 2022, Ascendis Pharma reported a net loss of €81.3 million suggesting a very significant cash runway. Current funds may be sufficient to reach breakeven assuming FDA approval of TransCon PTH occurs in 2023. It is notable that marketing products in rare diseases in endocrinology requires a small sales force with synergies due to a representative selling multiple products for Ascendis.

Risks

Phase 3 data for TransCon PTH was excellent but regulatory setbacks due to manufacturing or data omissions are possible. An additional risk is whether the label will position TransCon PTH as a replacement therapy rather than as an adjunctive treatment which may result in a larger market opportunity. If approved, uptake of TransCon PTH may be brisk due to the favorable profile. Longer term, given hormone replacement is a new treatment paradigm, it is unknown whether it will replace SoC treatments and be used to treat most PTH patients. There is significant clinical risk for TransCon TLR7/8, TransCon IL-2 β/γ and TransCon CNP in terms of the efficacy and safety profiles. However, by year end data on all three of these programs should provide meaningful derisking, if positive.

Conclusions

While cross trial comparisons are difficult and the population enrolled in the Voxzogo trial differs, this data readout will give investors an indication as to whether TransCon CNP has a best in class profile. Ascendis reports a 100% retention in the open label trial suggesting patients have been very satisfied with treatment.

Good data would reflect a dose response and AHV data that exceeds 1.6cm/yr vs. placebo with a clean safety profile. Investors should also follow the plans for the 2b trial and how it is designed to further differentiate the product based on the impact on comorbidities. In addition, some patients in the TransCon ACcomplisH trial are younger and the impact on their growth trajectory in comparison to older children should also be monitored.

ACH is likely a $1B+ market and demand has been robust for the first marketed product. Parents and physicians will likely preferentially use the treatment with the best efficacy and safety profile. Generally speaking, superior drugs, even if they are not first to market, often capture significant market share especially in indications where a small number of highly informed endocrinologists are the prescribers.

The second half of 2022 will be a pivotal time for Ascendis where clinical data will better clarify the profile of assets. If data is positive, Ascendis will emerge as a diversified company with a portfolio of high margin differentiated products in rare endocrinology as well early stage assets in oncology with a path to profitability. While there is clinical risk, if Ascendis Pharma produces best in class data, the company’s $5.9 B market cap could be well justified based solely on the endocrinology franchise.

Be the first to comment