marrio31/E+ via Getty Images

We cannot be certain what will happen with SAFE this year, however, by all accounts, there is a better chance that the legislation will pass before year-end than ever before. As previously stated, we are confident that at least a 2-3x immediate upside for US cannabis stocks is warranted on passage and the ensuing institutional investment. We expect those gains would be just the beginning and importantly, beyond legislation uncertainty, we see limited risk of further downside in valuations for the space in the near term, even if Q3 earnings reporting next month proves disappointing as it may on inflation driven reduced consumer spending and wholesale pricing pressure in key markets. With potential gains and limited downside risk in mind, it is a good time to invest in the space in case legislation is happening.

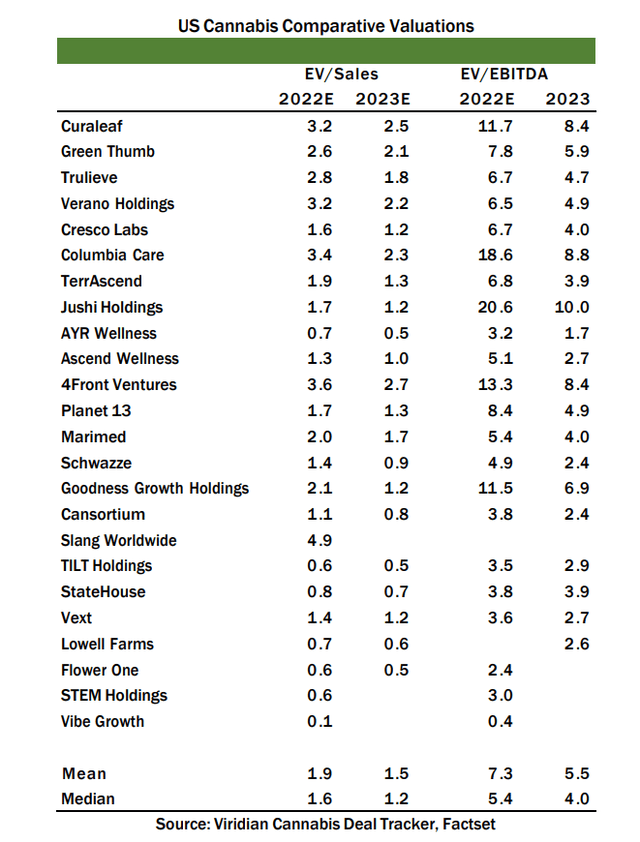

With passage, we expect the stocks of the largest MSOs will outperform as new institutional investors initially seek out more known commodities and bigger market caps. Within that group, we believe investments in Ascend (OTCQX:AAWH) and AYR (OTCQX:AYRWF) offer the greatest potential for upside. Ascend and AYR are the cheapest large MSOs with ’23E EV/EBITDA valuation discounts relative to larger peers of nearly 60% and more than 70%, respectively. The discounted valuations come despite each, in our view, being as well or better positioned for near and long-term success as any operator in all of US cannabis following meaningful fundamental progress in recent months. Furthermore, we believe each is positioned to lead future consolidation of the industry whether SAFE occurs or not. We maintain strong Buy ratings for each and feel that Ascend and AYR should be considered for new investment or as a trade out of existing holdings particularly in larger, more expensive MSO stocks with less attractive growth profiles.

Meanwhile, before potential broader gains on SAFE passage later this year, a near-term trend we are watching is a looming increase in M&A. The perception of further progress on SAFE before year-end could drive enhanced M&A activity with large MSOs jockeying to best position themselves to attract institutional investors with scale and the broadest geographic presence. Increased M&A activity or even the perception thereof should drive outperforming stock returns for smaller- and medium-sized operators for the remainder of this year. Viable takeout candidates amongst names we follow closely which could provide immediately beneficial assets to a larger MSO include: 4Front (OTCQX:FFNTF), Body and Mind (OTCQB:BMMJ), C21 (OTCQX:CXXIF), CLS Holdings (OTCPK:CLIHF), Cansortium (OTCQX:CNTMF), Greenrose (OTC:GNRS), Lowell Farms (OTCQX:LOWLF), Marimed (OTCQX:MRMD), Planet 13 (OTCQX:PLNHF), Schwazze (OTCQX:SHWZ), and Vext (OTCQX:VEXTF) Significant Progress in Recent Months Enhances Investment Opportunity for Ascend and AYR.

Ascend and AYR made significant progress this Spring to enhance future growth opportunities and eliminate key factors that historically dragged on stock returns. Neither has gotten credit and each stock has underperformed the market despite progress.

Both Ascend and AYR became early rec license recipients in New Jersey and are now poised to become long term winners in the state on initial mover benefits. In New Jersey, both Ascend and AYR are positioned to benefit from strong retail demand and inflated wholesale prices as vertically integrated players with growing cultivation capacity. In our view, only TerrAscend (OTCQX:TRSSF) is better positioned in the state. In the near term, we expect each to benefit from strong New Jersey contributions (inclusive of meaningful revenues and high margins) with Q3 results, which will offset any weakness elsewhere in their businesses on reduced consumer spending on inflation and wholesale pricing weakness.

Meanwhile, following the MedMen (OTCQB:MMNFF) settlement this winter, Ascend is set to become one of the just ten future vertically integrated operators in New York, and in April, the company quietly completed an acquisition to enter Pennsylvania, the company’s sixth state. We expect further expansion in Pennsylvania to come through M&A and investment.

For AYR, in addition to New Jersey, the company opened two Greater Boston dispensaries this month, including a Back Bay location, which along with Ascend’s store near Fanuel Hall, is set to be the top dispensary in the state.

Anticipate M&A Uptick on Legislation Hope

In order to attract the greatest amount of institutional investment and distinguish themselves from peers, we expect some large MSOs will seek out the addition of plug-and-play assets in the form of existing operators and look to acquire well-positioned single-state and concentrated multi-state operators. Enhanced M&A activity, or the perception thereof is likely to drive outperforming stock returns for small and medium-sized US cannabis companies in the coming months.

This type of jockeying was the genesis of Cresco’s (OTCQX:CRLBF) interest in Columbia Care this winter and that was before a finite catalyst in the form of institutional investment through legislation was provided. Smaller companies, even the well-positioned ones trade at a steep discount to larger MSOs, so cost should not be prohibitive if the acquired entity can bring greater initial interest from institutional investors. We believe that the possibility of upcoming financing access and enhanced valuations in the near term on SAFE’s passage are likely to make even a premium price required to complete a transaction (whether in the form of cash or equity) palatable. For sellers meanwhile, an understanding that large MSOs will disproportionately benefit from initial gains for the space if legislation occurs will likely drive acceptance of sales. If cannot beat them, might as well join them.

In our view, the grouping of most likely takeout candidates in US cannabis that could provide a large MSO with a valuable asset to market includes: 4Front, Body and Mind, C21, CLS Holdings, Cansortium, Greenrose, Lowell Farms, Marimed, Planet 13, Schwazze and Vext.

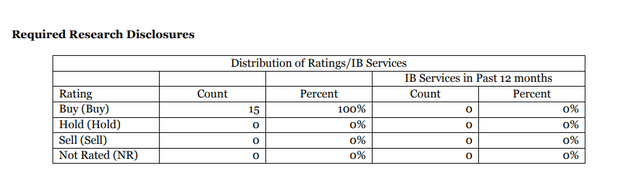

Analyst Certification

The research analyst responsible for the content of this research report, in whole or in part, certifies that with respect to each security or issuer that the analyst covered in this report: (1) all of the views expressed accurately reflect his or her personal views about those securities or issuers and were prepared in an independent manner, including with respect to Bradley Woods & Co. Ltd.; and (2) no part of his or her compensation was, is, or will be, directly or indirectly, related to the specific recommendations or views expressed by the research analyst in this report.

Meaning of Ratings

Bradley Woods & Co. Ltd.’s rating system of Buy, Hold, Sell, Not Rated reflects the analyst’s best judgment of risk-adjusted assessment of a security’s 24-month performance.

Buy: A Buy recommendation is assigned to stocks with low risk and approximately 10% expected return or stocks with high risk and approximately 25% expected return. The analyst recommends investors add to their position.

Hold: A Hold recommendation is assigned to stocks with low risk and less than 10% upside or less than 15% downside or to stock with high risk and less than 25% upside or less than 15% downside.

Sell: A Sell recommendation is assigned to stocks with an expected negative return of approximately 15%. The analyst recommends investors reduce their position.

Not Rated: A Not Rated recommendation makes no specific Buy, Hold or Sell recommendation.

Compensation or Securities Ownership

The analyst(S) responsible for covering the securities in this report receives compensation based upon, among other factors, the overall profitability of Bradley Woods & Co. Ltd. including profits derived from investment banking revenue and securities trading and market-making revenue. Unless noted in the Company-Specific Disclosures section above, the analyst(S) that prepared the research report did not receive any compensation from the Company or any other companies mentioned in this report in the previous 12 months, or in connection with the preparation of this report. Unless noted in the Company Specific Disclosures section above, neither the analyst(S) responsible for covering the securities in this report, nor members of the analyst(s’) household, has a financial interest in the Company, but in the future may from time to time engage in transactions with respect to the Company or other companies mentioned in the report.

For compendium reports (a research report covering six or more subject companies) please see the latest published research to view company-specific disclosures.

Other Important Disclosures

This report is provided for informational purposes only. It is not to be construed as an offer to buy or sell a solicitation of an offer to buy or sell any financial instruments or to particular trading strategy in any jurisdiction. The information and opinions in this report were prepared by registered employees of Bradley Woods & Co. Ltd. The information herein is believed by Bradley Woods & Co. Ltd. to be reliable and has been obtained from public sources believed to be reliable, but Bradley Woods & Co. Ltd. makes no representation as to the accuracy or completeness of such information.

Bradley Woods & Co. Ltd. is regulated by the United States Securities and Exchange Commission, FINRA, and various other self-regulatory organizations. This report has been prepared in accordance with the laws and regulations governing United States broker-dealers.

Opinions, estimates, and projections in this report constitute the current judgment of the author as of the date of this report. They do not necessarily reflect the opinions of Bradley Woods & Co. Ltd. and are subject to change without notice. In addition, opinions, estimates and projections in this report may differ from or be contrary to those expressed by other business areas or group of Bradley Woods & Co. Ltd. and its affiliates. Bradley Woods & Co. Ltd. has no obligation to update, modify or amend this report or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

Bradley Woods & Co. Ltd. does not provide individually tailored investment advice in research reports. This report has been prepared without regard to the particular investments and circumstances of the recipient. The securities discussed in this report may not suitable for all investors and investors must make their own investment decisions using their own independent advisors as they believe necessary and based upon their specific financial situations and investment objectives. Estimates of future performance are based on assumptions that may not be realized. Furthermore, past performance is not necessarily indicative of future performance. Investment involves risk. You are advised to exercise caution in relation to the research report. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice.

Bradley Woods & Co. Ltd. salespeople, traders and other professionals may provide oral or written market commentary or trading strategies to our clients that reflect opinions that are contrary to the opinions expressed in this research. Bradley Woods & Co. Ltd. may seek to offer investment banking services to all companies under research coverage. Bradley Woods & Co. Ltd. and/or its affiliates expect to receive or intend to seek investment-banking related compensation from the company or companies mentioned in this report within the next three months.

This research report (the “Report”) is investment research, which has been prepared on an independent basis by Bradley Woods & Co. Ltd., a member of FINRA and SIPC, with offices at 805 Third Avenue, 18th Floor, New York, NY USA, 10022. Electronic research is simultaneously available to all clients. This research report is provided to Bradley Woods & Co. Ltd. clients and may not be redistributed, retransmitted, disclosed, copied, photocopied, or duplicated, in whole or in part, or in any form or manner, without the express written consent of Bradley Woods & Co. Ltd. Receipt and review of this research report constituted your agreement not to redistribute, retransmit, or disclose to others the contents, opinions, conclusion or information contained in this report (including any investment recommendations, estimates, or target prices) without first obtaining express permission from Bradley Woods & Co. Ltd. In the event that this research report is sent to you by a party other than Bradley Woods & Co. Ltd., please note that the contents may have been altered from the original, or comments may have been added, which may not be the opinions of Bradley Woods & Co. Ltd. In such case, neither Bradley Woods & Co. Ltd., nor its affiliates or associated persons, are responsible for the altered research report.

This report and any recommendation contained herein speak only as of the date of this report and are subject to change without notice. Bradley Woods & Co. Ltd. and its affiliated companies and employees shall have no obligation to update or amend any information or opinion contained in this report, and the frequency of subsequent reports, if any, remain in the discretion of the author and Bradley Woods & Co. Ltd.

Bradley Woods & Co. Ltd. may affect transactions in the securities of companies discussed in this research report on a riskless principal or agency basis. Bradley Woods & Co. Ltd.’s affiliated entities may, at any time, hold a trading position (long or short) in the securities of the companies discussed in this report. Bradley Woods & Co. Ltd. and its affiliates may engage in such trading in a manner inconsistent with this research report. All intellectual property rights in the research report belong to Bradley Woods & Co. Ltd. Any and all matters related to this research report shall be governed by and construed in accordance with the laws of the State of New York.

This report is not directed at, or intended for distribution to or use by, any person or entity who is a citizen or resident of, or located in any locality, state, country, or other jurisdiction where such distribution, publication, availability, or use would be contrary to law or regulation or which would subject Bradley Woods & Co. Ltd. and its affiliates to any registration or licensing requirements within such jurisdictions.

The Bradley Woods Form CRS, Client Relationship Summary, can be accessed here.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment