AndreyPopov/iStock via Getty Images

Introduction

Since 2022, Asana, Inc. (NYSE:ASAN) has fallen over 63% as growth has been slowing and losses have been increasing. This decline was in line with the broader market sell-off of unprofitable software as a service (“SaaS”) companies. However, despite these short-term macroeconomic trends and their recent losses, Asana’s massive growth potential and resilience to the recession make the stock a great long-term investment.

Huge Opportunity

According to Grandview Research, Asana’s market is set to grow to $102 Bn at a 13.4% CAGR through 2027. With only a 2.4% market share today, Asana no doubt has much room for growth.

Unlike other sectors of the economy, the way we work has been fundamentally altered by the pandemic. The increase in work from home, combined with the broad acceptance of hybrid work, are key tailwinds for Asana. Even prior to COVID-19, Asana had been growing rapidly because of the immense value it provides to companies. McKinley reported that “Improved communication and collaboration through social technologies could raise the productivity of interaction workers by 20 to 25 percent.” Numerous internal surveys have also shown the value that Asana provides to its customers. Not to mention its impressive 120% dollar-based net retention rate which solidifies the fact that customers find Asana valuable.

In a hybrid or remote working environment, companies have no choice but to invest in cloud-based tools to effectively manage employees across different teams and locations. Currently, 73% of employees want a flexible work environment. But, remote work is beneficial to employers as well–helping to cut overhead costs and having the ability to access talent across the globe.

Overall, there is no doubt that Asana has huge growth potential, and I believe that it’s firmly supported by the microeconomic trends of remote/hybrid work.

Asana is resilient to recession

A couple of factors help defend Asana against the recession. First, Asana is primed for secular growth as there is a fundamental shift in companies towards cloud-based solutions. Second, Asana has been able to successfully shift its revenue upstream. With customers spending over $50k and $100k growing by 91% and 105% YoY respectively. Better yet, these enterprise customers are incredibly sticky, with a dollar-based net retention rate being over 145% in Q2. During a recession, these big customers will ensure a steady flow of revenue for the company. Lastly, Asana has a key asset that many of its peers lack, its CEO Dustin Moskovitz. Moskovitz has shown time and time again that he truly believes in the company, continually increasing his stake even amidst tough economic times. With a net worth of $8Bn, investors can feel safer because Moskovitz can always pour in additional funding during hard times. If push comes to shove, he even has the capacity to buy out the company and bail out investors.

Valuation

To value the company, I will be estimating its future revenue and use the median SaaS P/S ratio of 5.7x–down from its current ratio of 10.18x. To estimate its revenue, I will assume that it maintains the same amount of market share in 2027, this yields roughly $2.47 Bn in revenue in 2027. Applying the 5.7x P/S ratio would mean a $14.08 Bn market cap in 2027. Discounting that back to today with a 10% discount rate yields a market cap of $8.74Bn or a 71.54% upside.

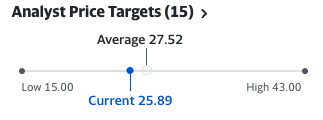

This price target is around the range of other Wall St analysts. But even if my assumptions are too optimistic, it at least shows that there is a wide margin of safety for investors.

Yahoo Finance

Risk

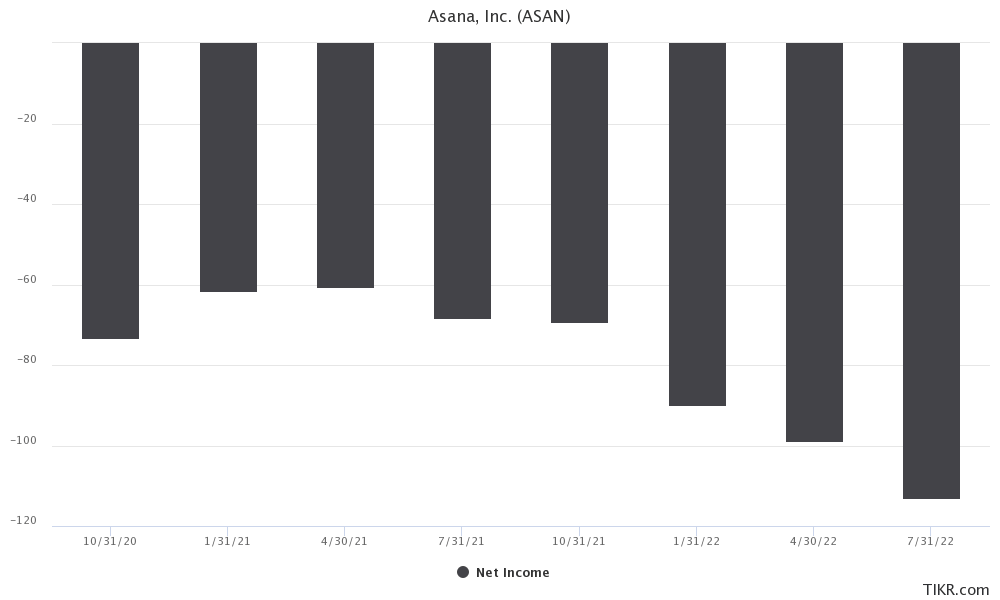

Asana’s losses have widened recently. Its GAAP net loss was $113M compared to $68.4M last year. Asana has been affected by the pandemic just like other companies and has been spending more to acquire customers-who are more cash-tight than ever before.

TIKR Terminal

Growth companies have already become out of favor for investors in this environment, widening losses will only attract more negative sentiment. As the Federal Reserve sticks to its inflation target, rising interest rates will remain the norm for at least another year.

In the short to medium term, I believe the stock will remain volatile and could even continue to decline on any slight disappointments with the company’s financial results.

Conclusion

Asana is a company with huge growth potential and microeconomic trends that will continue to serve as tailwinds. Its capacity for secular growth, ability to move revenue upstream, and supportive CEO serve as great assurances to investors amidst this bear market. For these reasons, I recommend Asana as a buy-and-hold investment with massive long-term potential. However, investors seeking to make short to mid-term gains should still be careful as the company’s operations remain loss-heavy.

Be the first to comment