Aguus

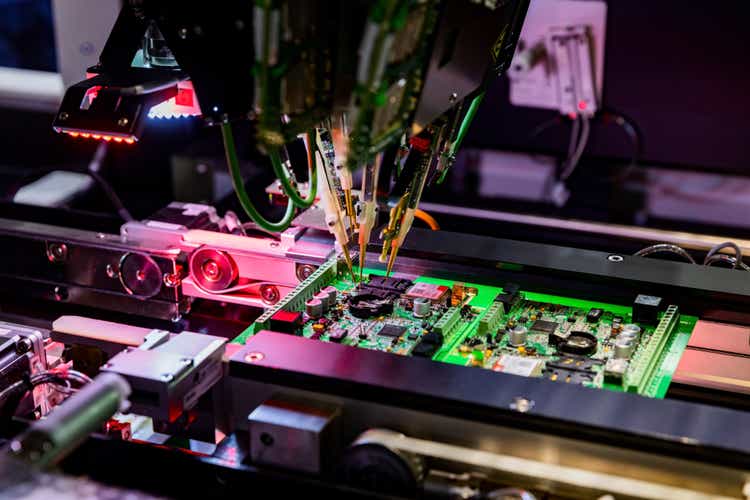

The global chip shortage may finally be showing signs of easing, but the semiconductor industry still faces challenges, including slowing demand. Greg Bonnell speaks with Julien Nono-Womdim, Semiconductor Analyst, TD Asset Management, about the outlook for chipmakers.

Transcript

Greg Bonnell: Constant headlines about computer chip shortages during the pandemic might make you think that the boom times were here for semiconductor stocks. But this week, we’ve heard several of the big names in the sector warning about slowing demand, and many of the stocks are down more than 30% this year. Joining us now for his outlook on the space, Julien Nono-Womdim, Semiconductor Analyst with TD Asset Management. Julian, welcome to the show. This is a fascinating topic. I know we’re going to have a great conversation. Let’s dive right in. Let’s talk about this underperformance we’ve seen in the chip stocks. What’s going on?

Julien Nono-Womdim: Hey, Greg. Thank you for having me. You are right. The semiconductor industry has underperformed. If we take the SOX Index, which is a basket of leading semiconductor companies, it’s trailing the S&P 500 by about 11% and the NASDAQ 100 by about 6% on a year-to-date basis, and I’ve brought some charts–

Greg Bonnell: Let’s take a look at the graph of it, and you’re showing us the SOX Index, which tracks the semiconductors, in terms, I believe, some of the sales in the space too and their relationship with each other.

Julien Nono-Womdim: Absolutely. So on the green line, what you’ll see is the year-over-year change in the SOX Index, effectively what the market is telling us. And the gray line, you’ll see the year-over-year change in semiconductor production sales. And what you’ll observe is that the peaks and troughs in the green line tend to precede the peaks and troughs of the gray line. What I mean by that is the market tends to be forward looking, and so which brings me to my first point. The underperformance we’ve seen has been a result partly of the deteriorating macroeconomic conditions we’ve seen — very high inflation, as you alluded to, but also slowing economic growth. And in semiconductor world, a slow economy never really bodes well for semiconductor demand.

The second point, which is also very important, is that the pandemic was an unusually high time for semiconductor demand. If you think about PC demand, let’s take that market, pre-pandemic we were averaging about 270 million units of PCs a year. In 2021, we peaked at 340 million units, so a big step in PC demand.

And obviously, in the months and quarters ahead, as you’ve alluded to, companies have suggested that there’s going to be a normalization, which is obviously natural, given the fact that consumers are now shifting consumption away from goods and back to services, the reopening if you will.

And lastly, I’d say part of the underperformance has been driven by the geopolitical environment we’re currently living. Geopolitical tensions are rising, and the semiconductor industry is quite vulnerable to geopolitical shocks. If you take a company like Nvidia (NVDA), they don’t manufacture any of their chips. They are reliant on third-party partners, like TSMC (TSM), who are predominantly domiciled in Asia. And to the extent that we’re entering a bifurcated world, then the equity risk premium to own semiconductor companies has likely gone up, and I think it’s probably gone up meaningfully.

Greg Bonnell: So it’s interesting that we’re seeing these market dynamics shift from what we were told during the pandemic, about no one can get their hands on chips, including the automakers. And so then, of course, you get political solutions, but they take a while to come to the fore. So we had some news this week of the Biden administration. A little too late on this front, or preparing us more for the future demands of chips?

Julien Nono-Womdim: Yeah. So the CHIPS Act, which will be providing about $50 billion in subsidies for US semiconductor production, that represents about 10% of semiconductor sales. So it’s not a meaningful amount from the grand scheme of things, but what I think it does is that, over the long term, it will offer added capacity to the industry, add resilience to the industry by way of having manufacturing capacity in the US. And there are other governments as well that are providing subsidies to the semiconductor industry, notably Europe and Japan. I’d say in the short term, however, the addition of capacity in a slowing demand environment poses the risk of oversupply, and I think that’s what the market is also contending with.

Greg Bonnell: It’s interesting to see, obviously, and this was a big discussion during the pandemic, about the re-onshoring of certain production, in certain sectors, including semis, because people started worrying about the global supply chain getting all snarled up.

Julien Nono-Womdim: Yes.

Greg Bonnell: Going forward, is this going to mean a higher price environment? The general consensus was the reason why we offshored so much production over the past several decades, because it was cheaper to build things overseas.

Julien Nono-Womdim: Correct. Correct. It was cheaper to build things overseas, but what I’d like to highlight — and this is a study that the Semiconductor Industry Association has done in conjunction with a number of consultancy companies — is that part of the cost differential between manufacturing in Asia and manufacturing in the US or Europe, a good chunk of that is driven by government subsidies. So the fact that we’re seeing governments actually step in and provide subsidies for building manufacturing plants, subsidies for the production, all these things at bode well, and structurally, we may not see the price inflation that people are suggesting.

Greg Bonnell: Now, a phrase I haven’t heard for a while, perhaps because we’re living in it now, was the Internet of Things, right? That eventually, we get to a point where everything would need microchips in it, because that would just be the future we are living in. Does that thesis still hold? And then going forward then, what’s the overall picture for chips 5, 10, 20 years down the road?

Julien Nono-Womdim: Well, let’s take a step back. If we think about the last 20, 30 years in semiconductor production — and I brought a chart to illustrate that — we’ve had a steady growth, which has been about 1 1/2 to 2 times the rate of global GDP growth. And today, we have a $550 billion annual production market. Well, what’s driving that? I’d say smartphones, PCs. Literally, everything we consume on a day-to-day basis has some kind of semiconductor component to it. On a go-forward basis, I think that that trend is mostly unchanged. It’s going to continue.

Going back to your comment on autos, an electric vehicle has about two to three times the semiconductor content of an equivalent internal combustion engine vehicle, and so that’s a driver of growth for the future. Another area of growth is cloud computing, and we’re seeing the adoption of artificial intelligence, machine learning. All these different technologies, they’re going to bode well for structural semiconductor demand.

Addressing climate change, that’s a driver of semiconductor demand with solar panels and wind farms and whatnot. But obviously, I think that the biggest change pre-pandemic versus now has to do with the geopolitical landscape. Obviously, the semiconductor industry is very geographically decentralized. I gave the example of Nvidia. But also, you have companies like ASML that have more than 4,000 suppliers globally. And so when you have a global web of companies that operate in unison, any disintegration of this global unity poses a structural threat.

Greg Bonnell: What’s very fascinating about the space to me as well is just the technological leaps and bounds that it makes over the years. I know. When it comes to apples and oranges and stuff about traditional crops, they do different kinds of cross-pollination. But an apple’s an apple, and an orange is and orange over time. But a semiconductor, the power of this thing, what has the growth trajectory been like in terms of unlocking the potential of what they can do in the future as well? Because a chip, I assume, five years from now will be a lot more powerful than a chip that’s running this machine right now.

Julien Nono-Womdim: Well, that’s partly true. I’d say, we’ve certainly seen that historically. Actually, innovation in the industry has been guided by an axiom known as Moore’s law, which effectively states that the number of transistors — which are these little switches that are invisible to the naked eye that enable the flow of electrical current to and from devices — that’s doubled every two years or so. So every two years, the number of transistors on a chip is doubled, and doubling every two years for 50 years is a very, very transformative change.

What we’re reaching today is a bit of a technological inflection point, where at the physical scale, we are starting to approach physical limits. Now, you’re hearing about chips that are made at 5 nanometers, and we’re headed towards 3 nanometers, 2 nanometers, et cetera. So the pace of innovation will slow, but there’s certainly continued innovation ahead of us, for sure.

Be the first to comment