sankai

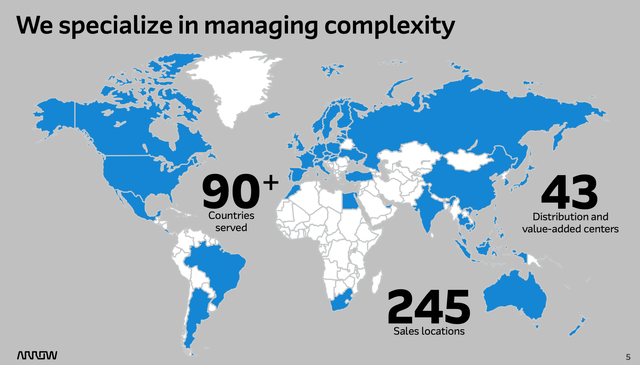

Arrow Electronics (NYSE:ARW) is a leading global value-added distributor of semiconductors and electronic components. Arrow benefits from economies of scale (purchasing over $25 billion of components, mainly semiconductors) and scope. The company sells tens of thousands of different products in over 90 different countries.

Overview (Arrow Investor Presentation)

Well positioned in the Value Chain

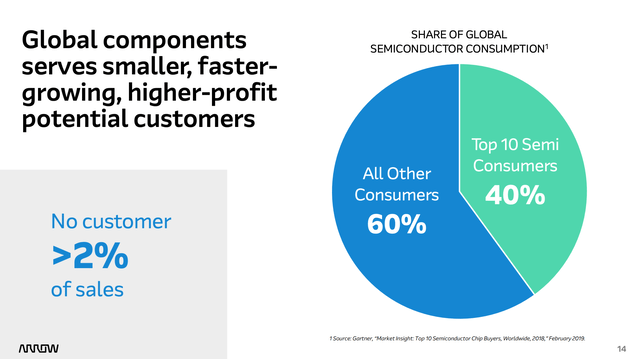

Arrow is reasonably well positioned within the value chain – it is not overly dependent on any one supplier (biggest supplier is ~10% of revenue) or customer (has over 220,000 customers -no customer is greater than 2% of revenue).

Arrow provides value to suppliers by ensuring a cost-effective route to a fragmented market. The value to the customer includes expertise design assistance, scale purchasing power, financing, and inventory management.

While semiconductor manufacturers will sell directly to large, volume customers like Apple (AAPL) or Dell (DELL), it is impractical and would be uneconomical to have sales and logistics to serve small volume customers globally. I see Arrow as being well positioned to provide a valuable service to suppliers and customers.

Share of Global Semiconductor Consumption (Investor Presentation)

Current Above-trend Results

Arrow’s current results are benefiting from:

- A shortage of semiconductors during 2021 and into 1H22 – this lead to stronger pricing and higher gross margins (until recently inventory has appreciated in value)

- Because of the global supply chain shortage, 2022 is benefiting from fulfilling some of 2021’s unmet demand

- Robust economic conditions in 2021 and 1H22.

These conditions have helped Arrow to achieve its highest margins in at least the past decade. While Arrow is expected to earn nearly $22 per share in 2022, EPS (consensus) is for ~$16 per share in 2023 as the economy weakens and the global supply chain normalizes.

Estimating Normal Earnings & Valuation

As mentioned above, current results are above trend. Both revenue and operating profitability are benefiting from the semiconductor shortage which has significantly increased gross margins.

To estimate normalized revenue, I use 2019 as my starting point. 2019 didn’t have the negative pandemic impact or the positive impact supply chain shortage which had increased semiconductor pricing and bolstered Arrow’s top line. From 2019, I grow revenue 5% annually for five years to estimate 2024 normalized revenue of ~$37 billion.

Because Arrow operates in a cyclical business which is macro-sensitive, I have decided to use long-term historical operating margins to estimate normalized earnings power for the business. Arrow has averaged 3.8% operating margin over the past decade (ranging from 3% to 2022’s 5.4%).

This brings me to an operating profit of $1.4 billion and after deducting interest and taxes I estimate normalized EPS of $15.50.

I value ARW at 12x EPS which gets me to an estimated fair value of $186/share which represents 66% upside. My 12x P/E multiple is a discount to the overall market, reflective of:

- Greater cyclicality (both overall macro-sensitivity and semiconductor cycle)

- Relatively weak free cash flow generation (business has significant working capital requirements).

- Takes into account where Arrow has traded historically over the last decade (range of 7-14x P/E).

Conclusion

While current results are above normal, Arrow trades at a low (7.3x) multiple of normal earnings power. I view this as an attractive valuation for a business with a strong competitive position and solid long term growth prospects.

Be the first to comment